Ancestry's pricing lacking monetary DNA

This episode might reference ProfitWell and ProfitWell Recur, which following the acquisition by Paddle is now Paddle Studios. Some information may be out of date.

Please message us at studios@paddle.com if you have any questions or comments!

Ancestry.com's embrace of technology, a widening pool of products, including DNA health data, military records, and news databases, combined with a subscription model to keep your family tree locked in, has pushed them to over $1 billion per year with the market cap around $1.3 billion. But are their technological achievements too advanced? Does Ancestry have the ability to embrace their technology for the next echelon of growth?

Below are some valuable takeaways you can implement in your own business.

Segment willingness to pay to understand which segments value the product most.

Aligning your pricing with customer segments increases both revenue and profit, keeping customers happy and helping reduce churn.You need to know what kind of customer demographic or attribute is the leading indicator of higher willingness to pay versus lower.

In Ancestry.com’s case, we see an evident differentiation between under 40 and over 40. Ancestry.com has a lot of opportunity to figure this out across these two categories.

- Segment willingness-to-pay data and your customer base to expose different opportunities for growth.

- Understand your segments in order to know where you should be priced to create better pricing tiers.

Understand why the purchase is happening to adjust packaging.Having the right feature mix is key to optimizing value for customers and ensuring future growth. Tailor your packaging to specific kinds of users, so that customers can get the most value out of your product

- Examine the difference in willingness to pay.

- Ensure there's an upgrade path to take advantage of higher willingness to pay.

Understand feature preference to determine upgrade paths and bridge the gift path.

Targeting the features that are most valuable to particular customers is what drives potential customers to convert and current customers to upgrade to higher plans. Optimizing this path is where there's much to be gained, at least in the monetization growth lever.

- Features that aren't really a proxy for the company size or maturity, should definitely be offered to everyone and allow them to build them onto the subscription that they're on.

- Don’t give away too much value.

- Features that you're selling, bundled in different tiers, are used or valued by less than 40% of the people within that tier.

The history of Ancestry.com

Genealogy fills the need in our humanity to understand who we are through the lens of where we came from, so we can fix the sins, and build on the lessons of the past.

This is the central mission Ancestry.com took on all the way back in 1983.

Before Ancestry, genealogy was a laborious task of trudging through bureaucracies for physical birth and death certificates. Ancestry wanted to make this discovery easier, so their first products in the 1980s were physical books that outlined all the genealogical data they could get their hands on—mostly for large families.

Their core thesis was to use technology to get as much genealogical data into the hands of family sleuths to automate the production of their family tree. With this in mind they embraced every technological revolution. Floppy Discs in 1990 brought more data and searchability. CD-roms in 1996 brought even more data and the ability to document your tree in a more automated fashion. In 2000 they went online with more census data added every month, and then in 2002 they launched the first DNA service, so you could discover that second cousin, twice removed, Ralph, even if no paper or digital records existed.

Ancestry's success

Ancestry.com focused on the customer need for data, but also the need for building the tree in as automated a way as possible. Thus, they moved the experience from compiling to compiling and exploring, widening their market from just family sleuths to those who were also curious about if all those stories told around the holidays were true, or where those characters came from.

Their embrace of technology, a widening pool of products including DNA health data, military records, and news databases combined with a subscription model to keep your family tree locked in, has pushed Ancestry.com to $400M per year with a market cap well over $1BN.

Not everything is amazing though. While their technological edge got them here, technology also allowed for the market leader to get challenged by niche and new-age solutions. 23andMe is making their play in the DNA health and ancestry space. My Heritage and FindMy Past are claiming to offer not as good of databases as Ancestry, but a much cheaper price.

Critics also point out that the market for DNA testing is souring over privacy concerns and a loss of novelty. After all, it's pretty cool that DNA sleuths have solved numerous crimes using DNA databases, but does that give a company like Ancestry too much power? Ancestry’s calmed these concerns, but the amazing technological achievement Ancestry made mainstream may end up being just too advanced.

The questions then become: Does ancestry have the ability to embrace their technology for their next echelon of growth? Is there another market they could enter to widen their target customer segments? Is there more revenue to squeeze out of optimizing their current base further? It seems this market is Ancestry’s to lose and they’re in a good position, but we’re going to answer these questions and more by collecting data from 10,542 current and prospective Ancestry.com customers. We’ll reveal all the data and answers to these questions, so keep reading.

A data product

Unlike other data products, with Ancestry, you're looking up information, and you're getting the data around this little leaf. The next leaf might tell you who your next relative is. But where they get this right—and this is a big lesson for many people—they tap into the actual action and actual recording of a living document or a living app essentially. And it's evolving.

When you think about data products. This is going to be a hard left turn to B2B products. I think where many folks get things wrong with Mattermark, or some of these other products where you're looking up data, this is where Ancestry.com can provide a big lesson to both consumer products and other B2B products.

Some level of engagement is super important. If you're not a workflow product—meaning customers aren't using it every single day—and you're not an anti-active usage product, meaning the customer only needs to turn it on. If you're in the middle here, you need a work product the customer wants to save and retain. If they want to retain it, they'll keep paying you, even if they're not necessarily engaged. And I think that's an enormous lesson for many people.

Ancestry's pricing page

The Amex effect

One thing I love about their pricing page is the six-month membership—they're taking advantage of the Amex effect. They're pricing the product right at that $100, $150, $200 mark, that we've found people are just so willing to swipe their credit card for.

This is key because people aren't great with percentages in terms of decision-making. When I look at save $100, save $90, that's a physical amount of money. Customers think, "Oh, it costs me $150, and I'm saving $90? Oh, great! Let's make that conversion. I'm buying it for grandma. I'm buying it for grandpa."

The other key point here is how Ancestry.com bifurcated their product in terms of the different tiers: US Discovery, World Explorer, All Access.

There are a bunch of other features we'll talk about in a second relating to data. But the thing you need to understand when you have a data product is they're looking at data is they're basically using location as the primary as the primary kind of segmentation on that data. And here in the US, we are all immigrants on some level. It depends on how many generations you've been here. But eventually, you'll need an upgrade path to World Explorer.

It's fascinating how they do this. I think it's super smart. And it creates a path inside the product. You might think you're starting with just US Discovery. Well, you're probably very quickly going to upgrade to World.

Another thing we're not going to get into too much, but it's important to note: If you scroll to the bottom here, you can see "visit other sites." They have different centric sites: A French site, Australian site, Australian site, Canada... and more. They have many other sites.

Now, someone in Canada might not care about the US data base at all. So you want to make sure you tailor that site to those different use cases. What Ancestry does really well, and others should mimick, is they're in a position where they are localizing their pricing. They've been able to localize not only the experience and the language, but the actual pricing. In some places, customers are less interested in these databases. So they're selling the DNA testing kit.

In other places, they might have enough databases, and people want to explore these memberships. Ancestry puts that price in Euros or British pounds, etc. That's a key point we need to make. It's a theme from this season, and it's one of those things that should keep in mind.

Where does our data come from?

Here at Paddle, our Price Intelligently software combines proprietary algorithms and methodologies with a team of pricing experts who think about this stuff more than anyone else to help companies optimize their monetization strategy. We do this by going out into the market and collecting data from current and prospective customers, having the ability to collect data from everyone, from a soccer mom or dad in the middle of Kansas, all the way to a fortune 500 CIO in South Africa. We then take that data and run it through our algorithms and analyze it in every direction to determine a company's ideal customer profiles, as well as which segments value, which features and which segments are willing to pay more, all in the spirit of determining how a company can use monetization for growth.

Data and analysis

Segment willingness to pay

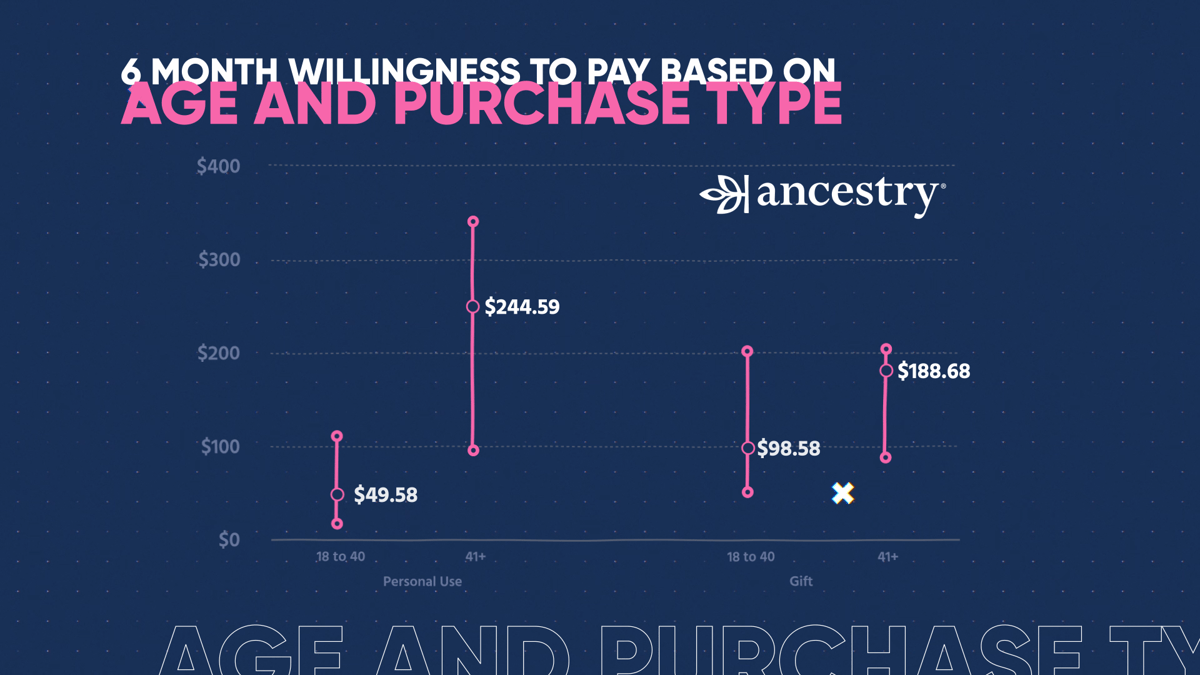

Segment willingness to pay by the cohorts of your customers that value the product most.This is crucial. And we got crazy results for Ancestry.com. You can see in the data here, the willingness to pay, once you jump over 40 years old, is astronomically higher than below 40. It's almost troubling. Here's this giant cliff between people under 40 in their willingness to pa, and people over 40. But Ancestry.com is pricing pretty much for people under 40.

I would want to look at the demographics. I would argue that most Ancestry.com folks are probably older. When you're older, you get a fascination with where you come from. When you're young, you don't care because you're young and stupid.

What's interesting and want to explore more and have some data on this—is that the older people get gifted a lot. Like, "Hey, let's give grandma or grandpa something to do, exploring their history, the family, these types of things." Ancestry has chosen to price based on the people giving the gifts, hoping that it also includes the people who are over 40 because they're willing to pay more.

And that brings us to our second point.

Understand why the purchase is happening to adjust your packaging

This gets to the heart of the actual gift aspect. We tested the willingness to pay amongst prospective and current customers. We asked "Hey, is this for personal use or is this a gift?" And what you'll notice here in the data, interestingly enough, someone under 40, their willingness to pay for personal use was half of what they were willing to pay for it as a gift. They're priced for the gift.

When you look at the folks over 40, personal use is much higher in terms of the willingness to pay for six months. For the folks who are essentially on the gift side, is still pretty hot, about 30% higher in some cases.

So, what I think Ancestry.com should do, is average things out.That means average things down. It's essential for most businesses. If you have a gift purchasing motion or a champion purchasing, but not a decision-maker purchasing, you need to adjust the packaging for when the actual user who has a higher willingness to pay, ends up using the product.

Ancestry.com has a gift-type packaging. That gift should probably have some limits. Maybe it's time-based, and then the price jumps back up. Maybe it's, "Hey, you don't get all-access. You only get US based."

I would reconsider their gifting strategy to not just be all-inclusive. The giver of this gift doesn't care about all the idiosyncrasies of the gift because it's not for them. They just want to make sure it's good. So you can kind of take advantage of that in a couple of different places in a good way. Once the actual or power user who cares about the product and willingness to pay is higher—you need to have a trigger to push them into the upgraded plan.

Now, Ancestry.com may be doing something like this already. We don't have any insider information. But based on their price points and even their gifts price points, I don't think this is happening. They're leaving a considerable amount of money on the table. We're talking probably at least 20 to 30% ARPU, depending on how they would tinker to put this.

These prices are too low. And it's insane that they're not doing anything about it. Maybe there's something that we're not seeing, but even the prices top out pretty high. And there's some work to be done to adjust this and get the pricing in order. Because with three million subscribers, you get a fraction of those to upgrade and we're all buying yachts.

So to close this out and make it applicable for everyone, I think it's crucial to understand that one: who's willing to pay more than you're currently selling to. If you have one group willing to spend less, and another group willing to pay more, but you don't have a way to differentiate them, you need to make a decision. The worst thing to do is put the price in the middle. The second worst thing to do is just go with the lower price. What you should be asking is, "How do I get the lower price and then get to an upgrade path?" Especially if you can't offer up two different packages up front.

Now, the other thing to keep in mind is understanding what the purchase path. If someone is gifting it, if someone is a champion buying the product to test it out, you must understand what that path looks like. Then, you can hop in and take advantage of that path to get that ARPU expansion.

Understand feature preference to determine upgrade paths to bridge the gift gap.

What Ancestry does so perfectly is they have a natural, organic expansion opportunity within the product. And what's beautiful about this is I'm sure there's a level of community with Ancestry.com.

We saw this with the Golden State killer. They uploaded DNA, and they found a familial match. I think it was a cousin or something, don't quote me on this. They went to the cousin and said "Hey, this is what's going on. And here's all the information we have." And I think they had an image, like a crude drawing, and they suspected he was a former law enforcement professional. And the cousin says "Oh yeah, that's my uncle." And they caught the guy! It's crazy! And I think he's on trial this year.

People are super passionate about this. I think that the limitations of data, or records, is probably the right thing to do. And I think we saw this in the value matrix.

Value Matrix

You're about to see something called a value matrix. We collected data from the group comparing feature preferences and plotted those on the horizontal axis, more valued features on the right, less valued on the left. We then collected willingness to pay for the overall product and plotted that based on their number-one feature preference on the y-axis. Analyzing data in this manner allows us to determine which features are differentiable add-ons, core, or commoditized for each segment.

So, for Ancestry, things like the US Records, those are table stakes. Showing up in the core, these were largely US respondents. And there's the world database and the differentiable feature, which is kind of like a slam dunk. And then you have the newspaper.com and military subscriptions. These are showing up more as add-ons to keep a consumer subscription easier.

Sometimes you don't want to nickel and dime and charge for these. Just include them into an all-encompassing tier, which is precisely what Ancestry.com did. And I think they need to reconsider their upgrade path, especially with those gifts, to unlock some ARPU and raise their overall prices. Let people get in on the US subscription and expand to World, or get into World and expand all of those add-ons from there. There are different levels.

Recap

- Segment willingness to pay to understand which segments value the product most. In this case, we see an evident differentiation between under 40 and over 40. Ancestry.com has a lot of opportunity to figure that out across these two categories.

I think for any business, this is just table stakes, monetization strategy. You need to know what kind of demographic or attribute of your customers or prospects is the leading indicator of higher willingness to pay versus lower. If you're B2B, it's probably going to be something like company size, team size, these types of things. If you're D2C, it's probably going to be household income, maybe it's age for a product like this. But you want to see what are things that have the biggest swings, then you want to make sure you're pricing based on those different personas. - Understand why the purchases happen to adjust packaging. If you're getting all these gift-givers, essentially you have to make sure that if you have such a high difference in the willingness to pay for people buying for personal use of the people getting the gift, yes you want to price for the person getting the gift, but you need to have an upgrade path to take advantage of higher willingness to pay of the person receiving the gift. Allow them to grow their usage of the product over time after they get the gift.

- Understand feature preference to determine upgrade, pass, and bridge that gift gap. We talked about this at length earlier. There are so many opportunities with Ancestry.com to continue diversifying their plans with different features. And we saw that huge breakdown in willingness to pay between US and World, and some of those add-ons. I'm sure there are some other options with the DNA testing kits as well.

I'm sure they're already doing that. But I think going back to the core of the three million subscribers and optimizing this path is where there's much to be gained, at least in the monetization growth lever.

Need help with your pricing?

Price Intelligently by Paddle is revolutionizing how SaaS and subscription companies price and package their products. Founded in 2012, we believe in value-based pricing rooted in first-party research to inform your monetization strategies. We combine expertise and data to solve your unique pricing challenges and catapult growth.

(00:00):

In all seriousness, find me a product I can sell to geriatric women, and I will show you a hundred million dollar company.

(00:08):

Welcome to pricing page teardown, where the ProfitWell crew breaks down strategies and insights on how subscription companies from all corners of the market can win with monetization.

(00:23):

Welcome to pricing page tear down. I'm Patrick Campbell. I'm Rob Litterst. And this week we're going back in time to study the subscription model of ancestry.com. Ooh. And before you think, oh, that's for my parents, that's for my grandpa. That's for my grandma. When they can go study what happened in the olden days, keep in mind that this is a company that has 3 million subscribers and they're not paying just 10 bucks a month. Wow. They're paying a pretty good premium on the product. And in addition to that, they have 26 million people who have taken their DNA tests. What we're gonna be focusing on are the monetization pieces of ancestry.com strategy that are doing really, really well, and those that they could really, really fix based on the mass gifting model that happens with ancestry.com subscriptions. And we're gonna bundle this all up into a nice little case study so that you can take the knowledge back to your business, whether it's B2B or a consumer business, and make sure you're getting your monetization right.

(01:22):

Genealogy fills the need in our humanity to understand who we are through the lens of where we came from so we can fix the sins and build on the lessons of the past. This is the central mission ancestry.com took on all the way back in 1983 before Ancestry. Genealogy was a laborious task of trudging through bureaucracies for physical birth and death certificates. Ancestry wanted to make this discovery easier. So their first products in the 1980s were physical books that outlined all the genealogical data they could get their hands on, mostly for large families. The core thesis was to use technology to get as much genealogical data into the hands of family sleuths to automate the production of their family tree. With this in mind, they embrace every technological revolution. Floppy disc in 1990 brought more data and searchability CD ROMs in 1996 brought even more data and the ability to document your tree in a more automated fashion.

(02:13):

In 2000, they went online with more census data added every month, and then in 2002 they launched the first DNA service so you could discover that second cousin twice removed Ralph even if no paper or digital records existed. ancestry.com focused on the customer need for data, but also the need for building the tree and as automated away as possible. Thus, they moved the experience from compiling to compiling and exploring, widening their market from just family sleuths to those who were also curious about if all those stories told around the holidays were true or where those characters came from. Their embrace of technology, a widening pool of products, including dna, health data, military records, and news databases combined with a subscription model to keep your family tree locked in has pushed ancestry.com to over 1 billion per year with the market cab around 1.3 billion. Not everything's amazing, though, while their technological edge got them here.

(03:10):

Technology also allowed for the market leader to get challenged by niche and NewAge Solutions. 23 and Me is making their play in the DNA health and ancestry space. My heritage and fine my past are claiming to offer not as good of databases as ancestry, but a much cheaper price. Critics also point out that the market for DNA testing is soaring over privacy concerns and a loss of novelty. After all. It's pretty cool that DNA sleuths have solved numerous crimes using DNA databases, but does that give a company like Ancestry too much power, ancestry, calm these concerns, but the amazing technological achievement ancestry made mainstream may end up being just too advanced. The question then becomes, does Ancestry have the ability to embrace their technology for the next echelon of growth? Is there another market they could answer to widen their target customer segments? Is there more revenue to squeeze out of optimizing their current base? Further, it seems this market is Ries to lose and they're in a good position, but we're gonna answer these questions and more by collecting data from current and prospective ancestry.com customers and we'll reveal all the data and answers to these questions coming up next.

(04:21):

Have you ever looked into your genealogy, anything like that? So I personally haven't, my cousin did like a really rigorous family tree Sure. A few years ago, and he's gone the furthest I think of anybody in the family. Why do you think, why do you think people are so in, especially in the United States? I think it's a combination of curiosity, nostalgia, and just wanting to make sure we know where we're from. Yeah, I know, unlike other data products, cause ultimately that's what this is, it's a data product, right? It's like you're looking up information and you're getting the data or the information around like, you know, this little leaf and then the next leaf as their commercials say, and these types of things of like where your family tree is, but where they get this really right, and this is a really, really big lesson for a lot of people is that they tap into the actual action and the actual recording of kind of like a living document or a living, you know, app essentially an evolving totally mm-hmm.

(05:10):

<affirmative>. And when you think about data products, and this is gonna be a hard left turn to B2B products, I think where a lot of folks get things wrong with like Mattermark or some of these other products where you're literally just looking up data like PVA in town, some of these other ones. Mm-hmm. <affirmative>. And I think that's where ancestry.com can provide a really, really big lesson to both consumer products, um, as well as, you know, other B2B products is that some level of engagement is super, super important. If you're not a workflow product, meaning you're not doing something every single day mm-hmm. <affirmative> and you're not an anti active usage product where you just turn it on and does something for the customer, right? If you're in the middle here, you have to have some sort of work product that that customer wants to save and wants to retain. Right? And if they wanna retain that, then they'll keep paying you even if they're not necessarily engaged. And I think that's a really, really big lesson a lot of people need to take.

(05:59):

Definitely. All right, so let's take a look at the pricing page along with the data on their current and perspective customers to dig a little bit deeper.

(06:05):

And we're gonna find out basically what ancestry.com is doing really, really well from a data perspective and a pricing perspective as well as where they're falling short a little bit. And there's some pretty big gains that I believe answers sheet.com can make based on the data. And you're gonna be able to wrap this all together into a nice little case study so that you can take it back to your business, whether you're a B2C business, a D TOC business, a B2B business, and make sure that your pricing strategy gets back on the right track.

(06:33):

First up, one thing I love about their pricing page is for the six month membership, they're taking advantage of the Amex effect,

(06:39):

Good old Amex

(06:39):

Effect. And what I mean by that is they're pricing the product right at right at that 100, 1 50, 200 mark mm-hmm. <affirmative> that we found people are just so willing to swipe their credit card for. Totally.

(06:48):

Yeah. And you're looking at like, they're saying, oh, six months save, you know, $50 $90. And this is a really important thing because I think that we're not really good with percentages in terms of decision making. When I look at save a hundred, save $90, that's a physical amount of money that I can go, oh, it costs me one 50 and I'm saving 90. Oh, great, let's, let's make that conversion. I'm buying it for grandma, I'm buying it for grandpa, I'm buying it for my mom or dad or whatever it looks like. I think the other thing that's really, really important here is that the way that they bifurcated their product in terms of the different tiers. Yeah. So US Discovery, world Explorer, all Access, and there's a bunch of different features we're gonna talk about in a second with some of the data, but the thing you gotta understand is like when you have a data product, essentially what you're looking at is they're, they're basically using location as the primary kind of segmentation on that data.

(07:36):

So us Discovery, well we're all immigrants on some level, right? Depends on how many generations you've been here. But basically what that means is, is you're absolutely gonna have an upgrade path to a world explorer. Oh sorry. Well that gets into our, you know, Western Europe database, right? You have to upgrade to the world. Um, and you get, and then all access kind of ups it even further where you get access to additional data. I think it's military records as well as like the newspaper archive. So yeah, it's just kind of fascinating how they do this. I think it's super, super smart and it creates inside the product then, you know, basically a path where, I'll just start with us. Well you're probably very quickly going to upgrade to World a hundred percent unless for some reason, you know, you've been here forever, which you know, is, is maybe Native Americans and that's about it.

(08:20):

Right? Right. The other thing that we're not gonna get into too much with the data, but I think it's important to note, um, if you scroll all the way to the bottom here, you can see visit other sites. They have different centric sites. So they have a French site and Italian site and Australian site, um, you know, a UK site Canada, they have a number of other sites. And I think that what this is really important is that someone in Canada probably doesn't care about US database at all. Right? Someone in the UK in Western Europe. So they wanna make sure that they tailor that site to those different use cases. Right. And I think the one kind of thing that they do really, really well that most people should kind of, you know, steal from a little bit is they're actually in a position where they are localizing their pricing.

(09:02):

What they've been able to do is basically localize not only the experience and the language, but also the actual pricing. So in some places they're probably not interested in these databases as much, so they're selling the DNA testing kit, right? In other places they might have enough database and people want to explore these memberships so they're basically able to put that price in Euros or put that price in British pounds or you know, wherever else that they might be selling. And I think that's a really, really important thing to kind of point out. Totally. It's a theme from this season and it's one of those things that kind of keep in mind. Yeah. Ready for the data. Let's do it. Let's get into the data.

(09:34):

So where does our data come from here at ProfitWell, our price Intelligently product combines proprietary algorithms and methodologies with a team of pricing experts who think about this stuff more than anyone else to help companies optimize their monetization strategy. We do this by going out into the market and collecting data from current and prospective customers. Having the ability to collect data from everyone from a soccer mom or dad in the middle of Kansas all the way to a Fortune 500 CIO in South Africa. We then take that data and run it through our algorithms and analyze it in every direction to determine a company's ideal customer profiles, as well as which segments value which features and which segments are willing to pay more. All in the spirit of determining how a company can use monetization for growth.

(10:23):

First up segment, willingness to pay by the cohorts of your customers that value the product most.

(10:28):

Such a crucial, crucial thing.

(10:30):

Absolutely huge. And something that really returned crazy results for ancestry.com. You can see in the data here, the willingness to pay once you jump over 40 years old is astronomically higher than below 40. Yeah.

(10:42):

It's insane. I think that this was like troubling, if that makes sense. Yeah. In a way that, okay, so you have this giant cliff between people under 40 and their willingness to pay and people over 40, but you're pricing pretty much for the people under 40, right? I would wanna look at the demographics. Like your cousin doesn't sound like they're over 40. No. But like mid twenties I would just argue that most ancestry.com folks are probably older. Totally. Right? Because it's just you get a fascination with where you come from and when you're young you kind of don't care because you know you're young and stupid, right? Yeah. And so, exactly. I think what's really interesting though that I wanna explore more, and we have some data on this, is that I think that they get gifted a lot. Yeah. Like, hey, let's give grandma or grandpa something to do exploring their history, the family, these types of things.

(11:35):

And so what ancestry.com here has chosen to do is basically price based on the people giving the gifts, hoping that it also includes the people who are over 40, right? Because they're willing to pay more. And that brings us to our second point here. You gotta understand why the purchase is happening to adjust your packaging. And this gets to the heart of the actual gift aspect cuz we actually tested willingness to pay amongst prospective and current customers and we actually asked like, Hey, is this for personal use or is this a gift? Mm-hmm. <affirmative>. Right? And what you'll notice here in the data is that really, interestingly enough, when someone was under 40, their willingness to pay for personal use was half right than if they were buying it for a gift. Yeah. That's so interesting. Which they're priced basically for the gift. And when you look at the folks over 40 personal use, much, much higher, you know, in terms of the willingness to pay here for the six months, for the folks who are essentially on the gift side still pretty hot.

(12:33):

Yeah. Like right around where they currently are priced a bit higher mm-hmm. <affirmative>, um, about 30% higher in some cases. So what I think as.com should do is that they kind of average things out. And what that means is they average things down. Here's what I think astra street.com should do, and it's something that's really, really important for most businesses. If you have like a gift purchasing motion or let's say a champion purchasing but not a decision maker purchasing mm-hmm. <affirmative>, you need to adjust the packaging for when that actual user who has higher willingness to pay ends up using the product. Right? So for answers.com, maybe the personal or the gift that this person is giving, and I know they have gift type packaging, that gift probably should have some sort of a limit, right? Like there should be some sort of a limit on maybe like the gift, maybe it's time based and then the price jumps back up, right?

(13:25):

Maybe it's, you know, hey, you don't get all of the access, like you only get us based, but I would reconsider their gifting strategy to not just be all inclusive and basically go after, hey, like they, the user that is doing, doing the gift probably doesn't care about all the idiosyncrasies of the gift cuz it's not for them. Right? They just wanna make sure it's good. And so you can kind of take advantage of that in a couple of different places in a good way. And then all of a sudden, once that actual user who's the power user who really, really cares about the product and willingness to pay is higher, you have to have some sort of trigger to push them into the upgraded plan right now, ancestry.com, we don't have any insider information. They very well may be doing something like this, but based on their price points and even their gift price points, I don't think this is happening and they're leaving a considerable amount of money on the table.

(14:08):

Definitely. Um, we're talking probably at least, at least 20 to 30% arpu depending on how they would tinker to put this, these prices are too low, they're huge for the people who are actually using the product. The numbers for those over 40 are, are huge. Yeah. And it's insane that they're not doing anything about this. Maybe there's something that we're not seeing, but even the prices top out, you know, pretty high. Right. And I think that there's some, there's some work to be done to kind of adjust this and actually get the pricing in order because, you know, 3 million subscribers, you get, you know, a fraction of those to upgrade and we're all buying yachts Exactly. Like everything's gonna be great. So to close this out and make it applicable for everyone, I think it's really, really important to understand one who's willing to pay more mm-hmm.

(14:45):

<affirmative> that you're currently selling to. And if you notice you have one group that's willing to pay less than another group's willing to pay more and you don't have a way to differentiate that, you gotta make a decision. And I think the worst thing to do is put the price in the middle. Mm-hmm. <affirmative> second worst thing to do is just go with the lower price. Right. Really what you should be doing is really considering like, how do I get the lower price and then get to an upgrade path. Right? Especially, especially if you can't offer up two different packages right up front. Now the other thing to kind of keep in mind is really understanding what the purchase path is. And that means like if someone is gifting it, if someone is a champion buying the product to kind of test it out, you gotta understand what that path looks like so you can kind of hop in there and take advantage of that path to get that RPU expansion. Definitely.

(15:26):

Finally, you gotta understand feature preference to determine upgrade paths and bridge the gift gap. What these guys do so perfectly is they have this really natural organic expansion opportunity within the product. Right.

(15:37):

What's kind of beautiful about this is that I'm sure there's a, there's a level of community with this. Like we saw this with like the Golden State Killer. They uploaded the D N A and they found like a familial match. I think it was like a cousin or something, they'll quote me on this and basically they went to the cousin, they were like, Hey, this is what's going on and here's all the information we have. And I think they had an image, like a, a crude drawing and like a, an mo that it was like a former, you know, law enforcement person probably. And they're like, oh yeah, my uncle is that or something. And then all of a sudden they caught the guy. That's crazy. Right. And he's, you know, and I think he's on trial this year actually. People are super passionate about this. Yeah. And I think that the, the, the limitations of data or records is probably the right thing to do. And I think we saw this at the value matrix.

(16:21):

You're about to see something called a value matrix here. We collected data from the group comparing feature preferences and plotted those on the horizontal axis. More valued features on the right, less valued on the left. We then collected willingness to pay for the overall product and plotted that base on their number one feature preference on the y axis. Analyzing data in this manner allows us to determine which features are differential add-ons, core or commoditized for each segment.

(16:51):

So you have things like the US records, those are kind of table stakes, totally table stakes. They're showing up in the core. I think, you know, these were largely US respondents and then all of a sudden the world database, like all of a sudden differential feature, which is kind of like a slam dunk. Totally. And then all of of a sudden you have like the newspaper.com and military subscriptions. These are showing up more as add-ons, but just to kind of keep a, a consumer subscription easier. Sometimes you don't want to kind of nickel and dime and charge for these, you wanna just kind of include them in sort of an old encompassing tier, which is exactly what ancestry.com did. And so I think they can, they need to reconsider their upgrade path, especially with those gifts. Definitely. Um, to basically unlock some ARPU and then raise their overall prices. Let

(17:30):

People either get in on us and expand a world or get into world and expand, uh, all of those add-ons that you talked about from there. There are different levels. Yeah.

(17:37):

Absolutely. Ready to recap. Let's recap, let's recap, let's recap.

(17:44):

So first up, segment willingness to pay to understand which segments value the product most. In this case, very, very clear differentiation there between under 40 and over 40. ancestry.com has a lot of opportunity to figure that out across these two categories.

(17:57):

A hundred percent. And I think for any business, this is just table stakes monetization strategy. You gotta know what kind of demographic or attribute of your, of your customers or prospects is the leading indicator of higher willing spay versus lower mm-hmm. <affirmative>. Um, if you're b2b, it's probably gonna be something like company size, team size, these types of things. If you're d toc, it's probably gonna be household income. Maybe it's age for a product particularly like this. But you wanna see what is the thing that has the biggest swings. And then you wanna make sure that you're trying to price based on those different personas. I think it's absolutely crucial. And that led us to, you gotta understand why the purchase is happening to adjust packaging. Totally. If you're getting all these gifts, you know, givers essentially, you gotta make sure that if you have such a high difference in the willingness to pay for people, for personal use of the people are getting the gift. Yeah. You gotta get the person who, you know, got a price where the person is who's giving the gift, but you have to make sure that's the upgrade path to take advantage of that extra willingness to pay of the person who's receiving the gift. Right. Right. And I think that's a really, really huge thing.

(19:01):

A hundred percent allow them to carry that out and grow their usage of the product over time. Absolutely. After they get the gift. And lastly, understand future preference to determine upgrade pass and bridge that gift gap. Totally. We talked about this at length, but there's so many opportunities with ancestry.com to continue diversifying their plans with different features. Totally. And we saw that huge breakdown in, in willingness to pay between us and world and some of those add-ons.

(19:23):

And I'm sure there's some other options too with the DNA testing kits as well. Oh, I'm sure they're already doing that. But I think that going back to the core of the 3 million subscribers and really optimizing this path is probably where there's a much to be gained, at least in the monetization growth lever.

(19:38):

Definitely.

(19:41):

Well, that's all for this week's episode of pricing page. Teardown. If you have value from this, if you enjoyed what you watched, if you got a little bit of a chuckle, hopefully learn something. Make sure to share this on your social media channel of choice, LinkedIn, Twitter, Facebook, wherever you're sharing things on social, we wanna make sure this gets into the hands as, as many people as humanly possible. And that's a good way of, you know, basically giving back to the community and making sure that people can join you on this monetization learning journey. And of course, if you're not subscribed, make sure you go to pricing page teardown.com. We can do, have new episodes every single week. And if you're a business who's looking for pricing and monetization help, you want some of this data, you just want some feedback, feel free to reach out to me@patrickprofitable.com or@robprofitable.com. We'll make sure to get your answers to your questions. Um, and ultimately we can always talk to you about our software as well,

(20:29):

Who's on deck next week?

(20:30):

Next week we have the best media company who I think in the history of humankind, Disney, they challenge Disney. All right. All right. And Disney's kind of fighting back. Yeah. If

(20:42):

That makes sense. There we go. All right. I I know who it is.

(20:44):

Netflix. It's gonna be Netflix. And I think the reason that they're the best is because Disney just has the dna mm-hmm. <affirmative> to create great media. And Disney is obviously, you know, a very, very admirable company. But Netflix in this new age has the technology and data DNA that may allow them to take on Disney. And we'll get into kind of the implications of what happens with a competitive marketplace with Disney. And obviously wrap up what they're doing well, what they're not doing so well, so that you can take this as a case study to basically help your own monetization strategy. Awesome. Sound good? Let's do it. All right. We'll see you next week.