The world's largest study on churn

This episode might reference ProfitWell and ProfitWell Recur, which following the acquisition by Paddle is now Paddle Studios. Some information may be out of date.

Originally published: Jan 29th, 2018

Churn is one of the most painful aspects of building a subscription business. You work incredibly hard to acquire customers, prime them with the right value proposition, do everything you can to make them happy, only to be left with a non-descript reason as to why they're leaving and will never be seen again.

To help, here's the first episode of our new series, the PW Report, where each week we go into the subscription economy benchmarks that you can't get anywhere else. This week we heard from David Cancel, CEO and Founder of Drift who wanted to know the state of churn in the subscription economy.

To understand the current state of retention, we pulled data from over three thousand subscription companies of all shapes, sizes, and verticals. We'll initially break down where churn stands overall, and then dig into some actionable trends for you to take advantage of for your business.

But first, if you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

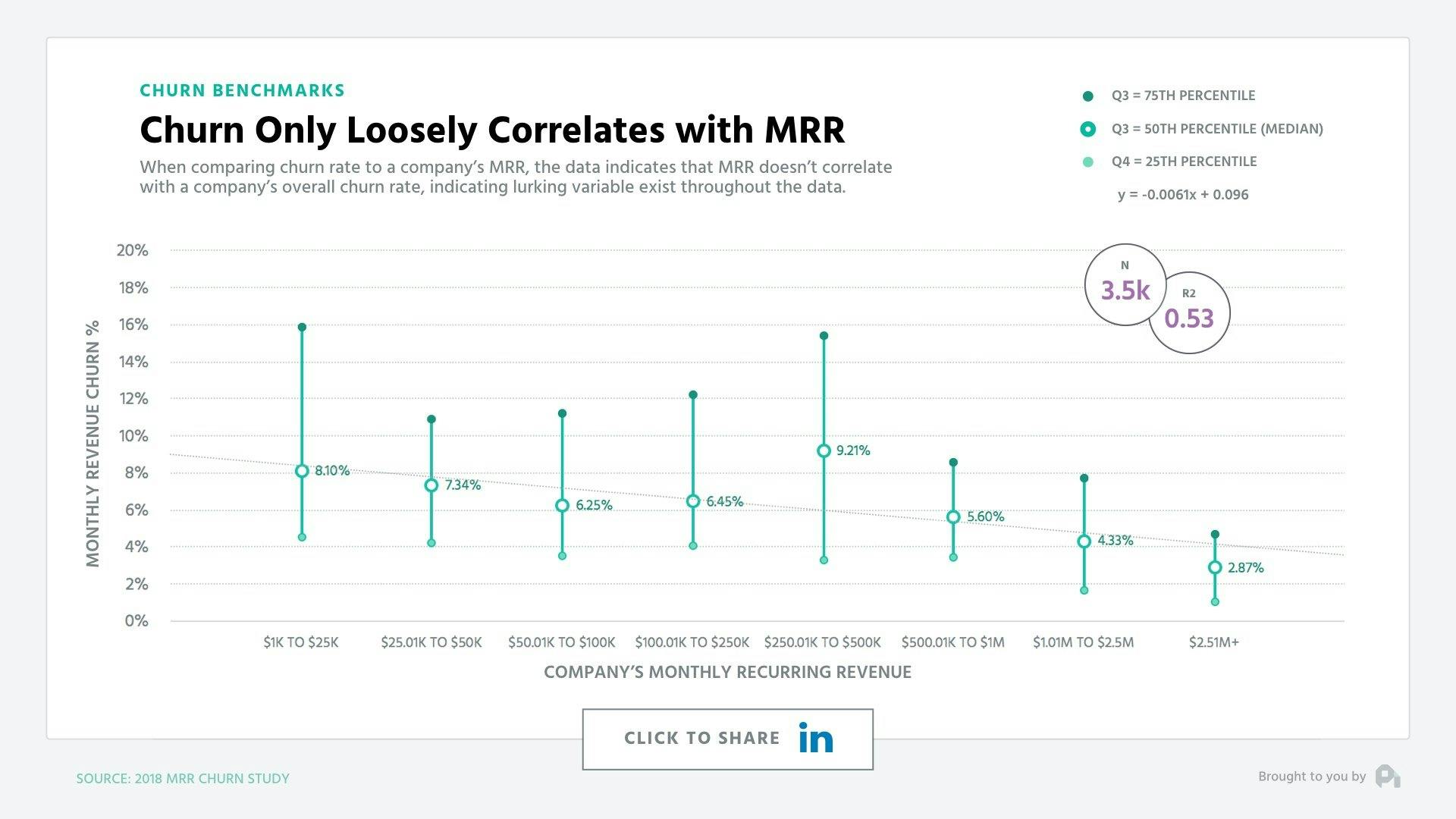

Churn vs. MRR: Churn only loosely correlates with MRR

First up - While we love to click and retweet articles about lowering our churn, it turns out churn is actually much higher than most companies are willing to admit and only loosely correlates with a company’s size, meaning as a company gets bigger churn tends to get smaller, but only slightly. What's especially interesting is the wide interquartile range that fluctuates between 5% to 16% gross revenue churn on the low end, and 2% to 8% on the high end.

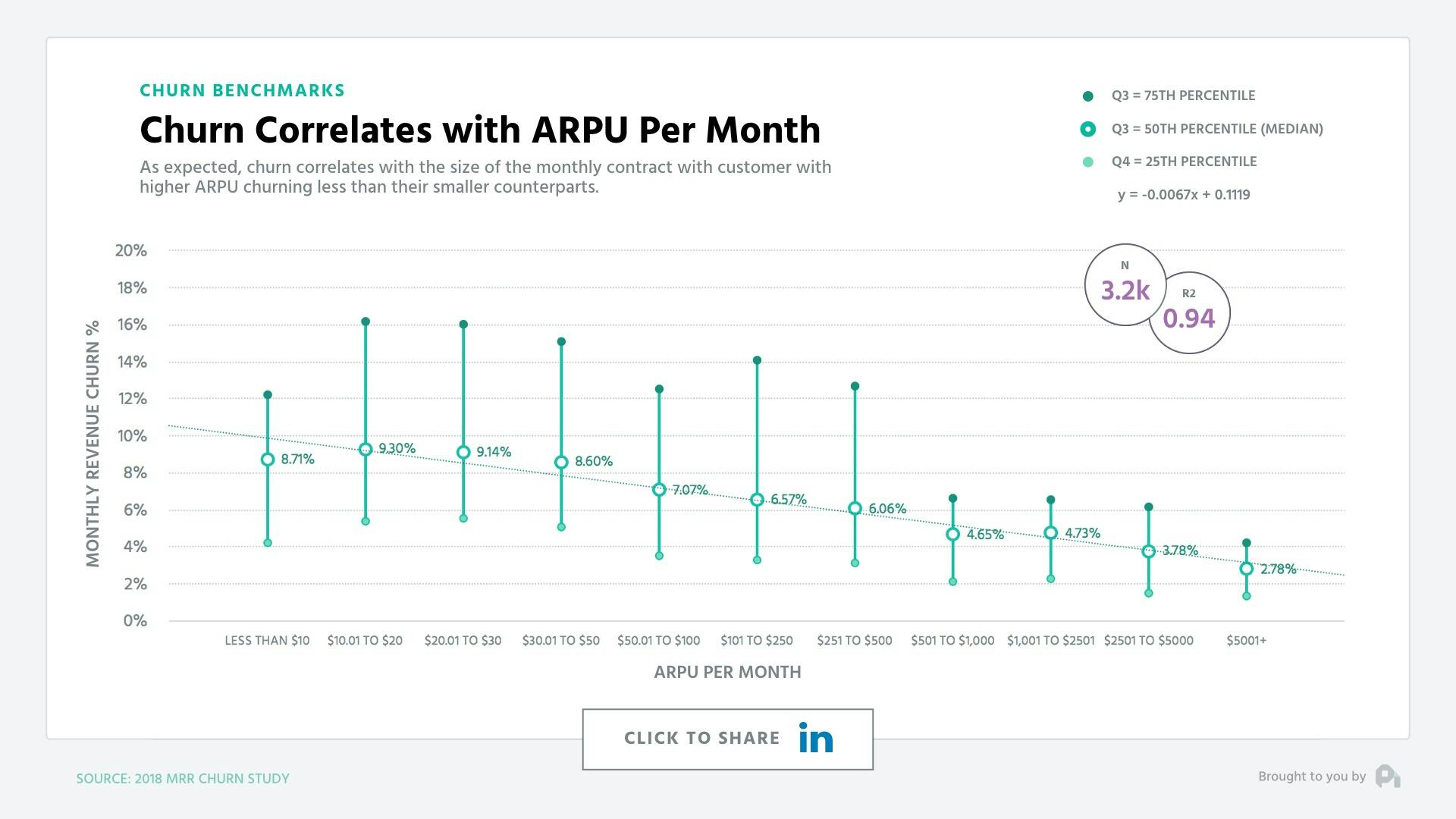

Churn vs. ARPU: Higher ARPU correlates to less churn

Perhaps most telling, there's a strong correlation when comparing ARPU (average revenue per user) and churn. Single and double digit ARPU correlated with churn between 3% and 15%, whereas four figure ARPU dropped to 1% to 5%. This is to be expected, because high ARPU tends to come with a more consultative sales team, more customer success, and more attention surface area per customer.

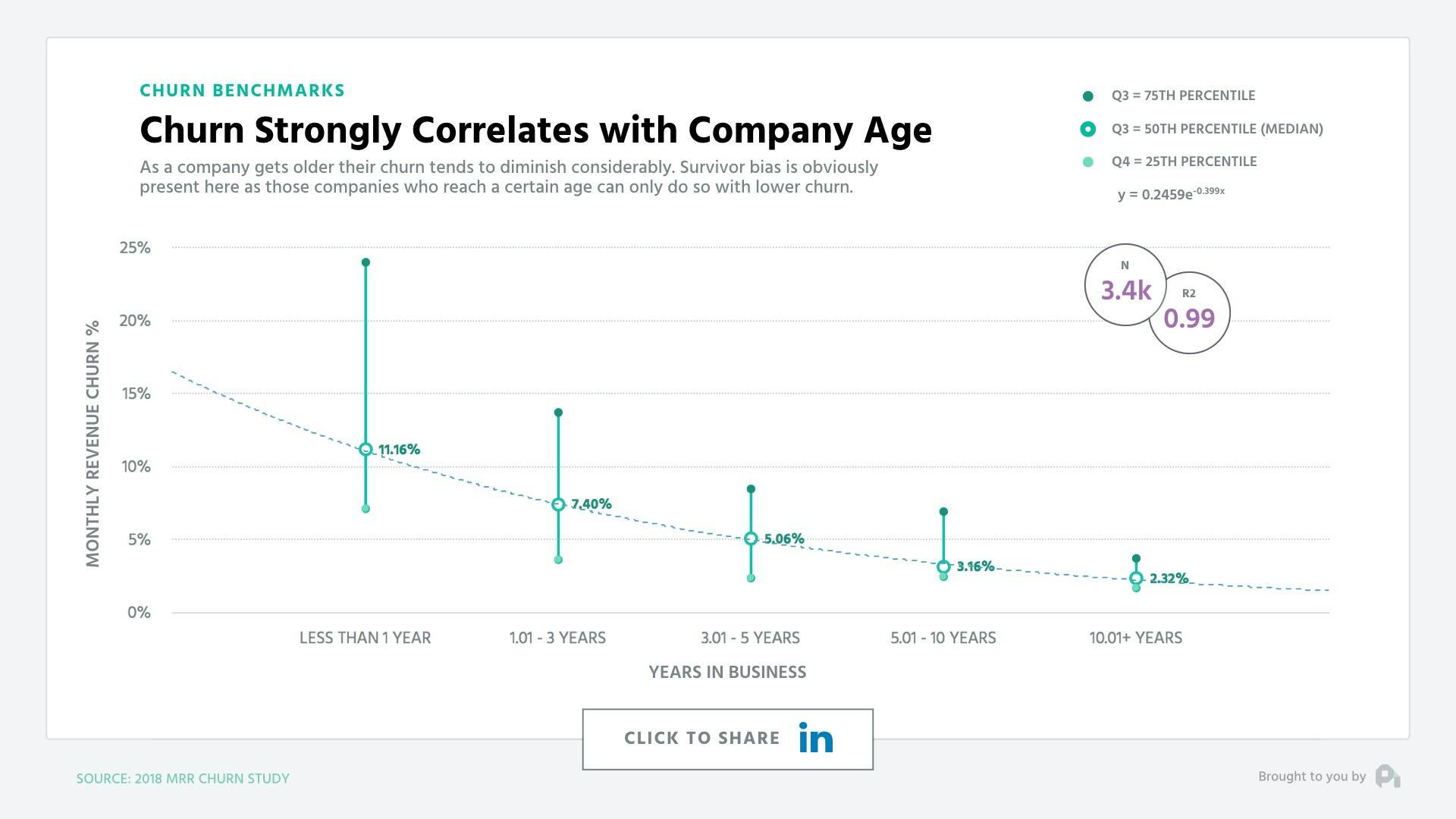

Churn vs. Age: Older company correlates to less churn

Interestingly enough, we saw a similarly strong correlation when it came to the age of the company with companies longer in the tooth seeing significantly lower churn than those who were younger. Of course there's survivor bias here, but you'd hope to see this when it comes to a growing company.

Let's dig into some truly actionable cuts answering what are the biggest influences on churn we could find.

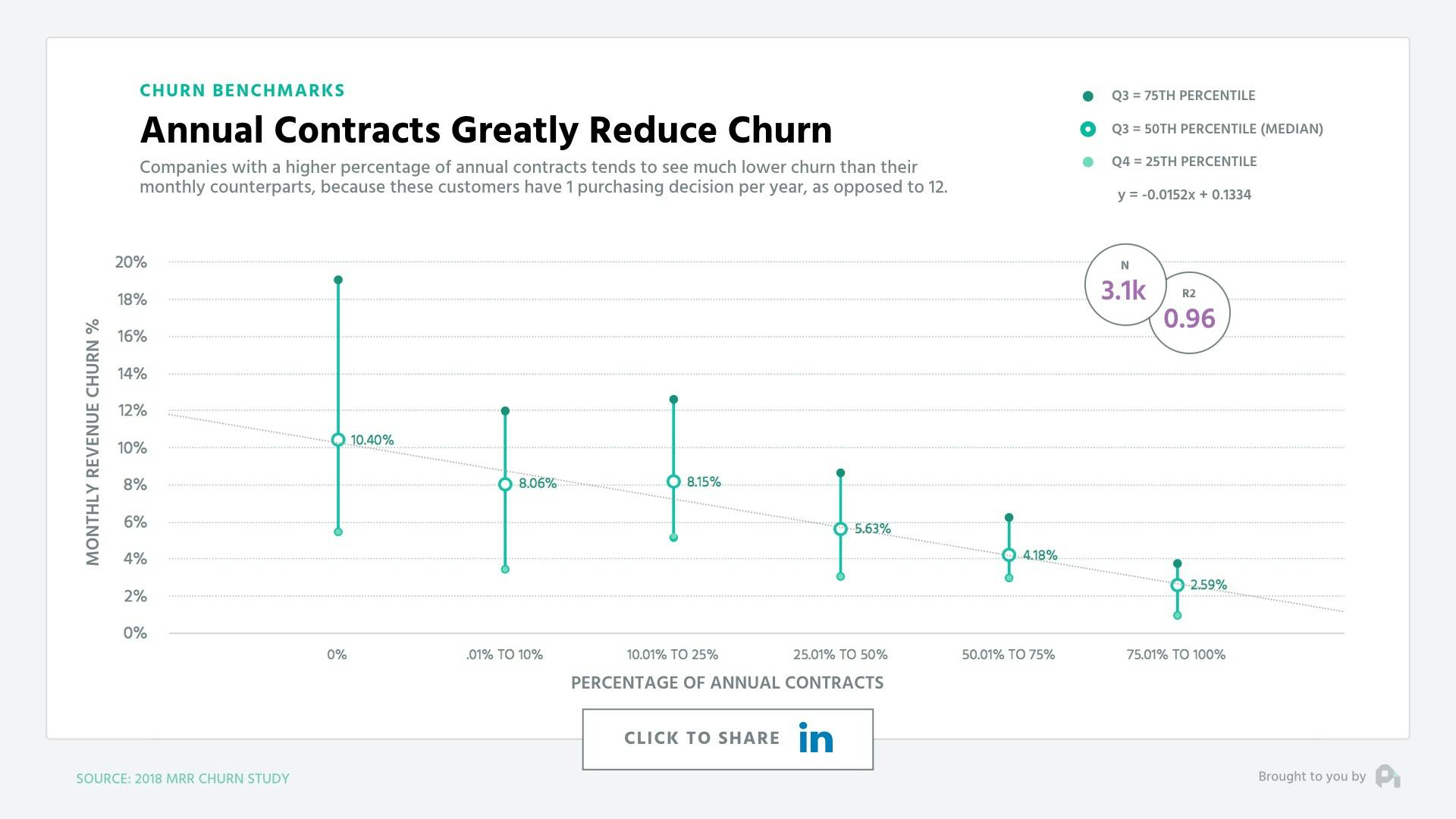

Tip: Increase proportion of annual contracts

Along this axis, the first piece was really the proportion of annual contracts in the business. Regardless of ARPU, those companies with a higher percentage of annual contracts see significantly lower churn. This is because these customers have only one purchasing decision per year (albeit a larger one) whereas their monthly counterparts have 12 purchasing decisions per year.

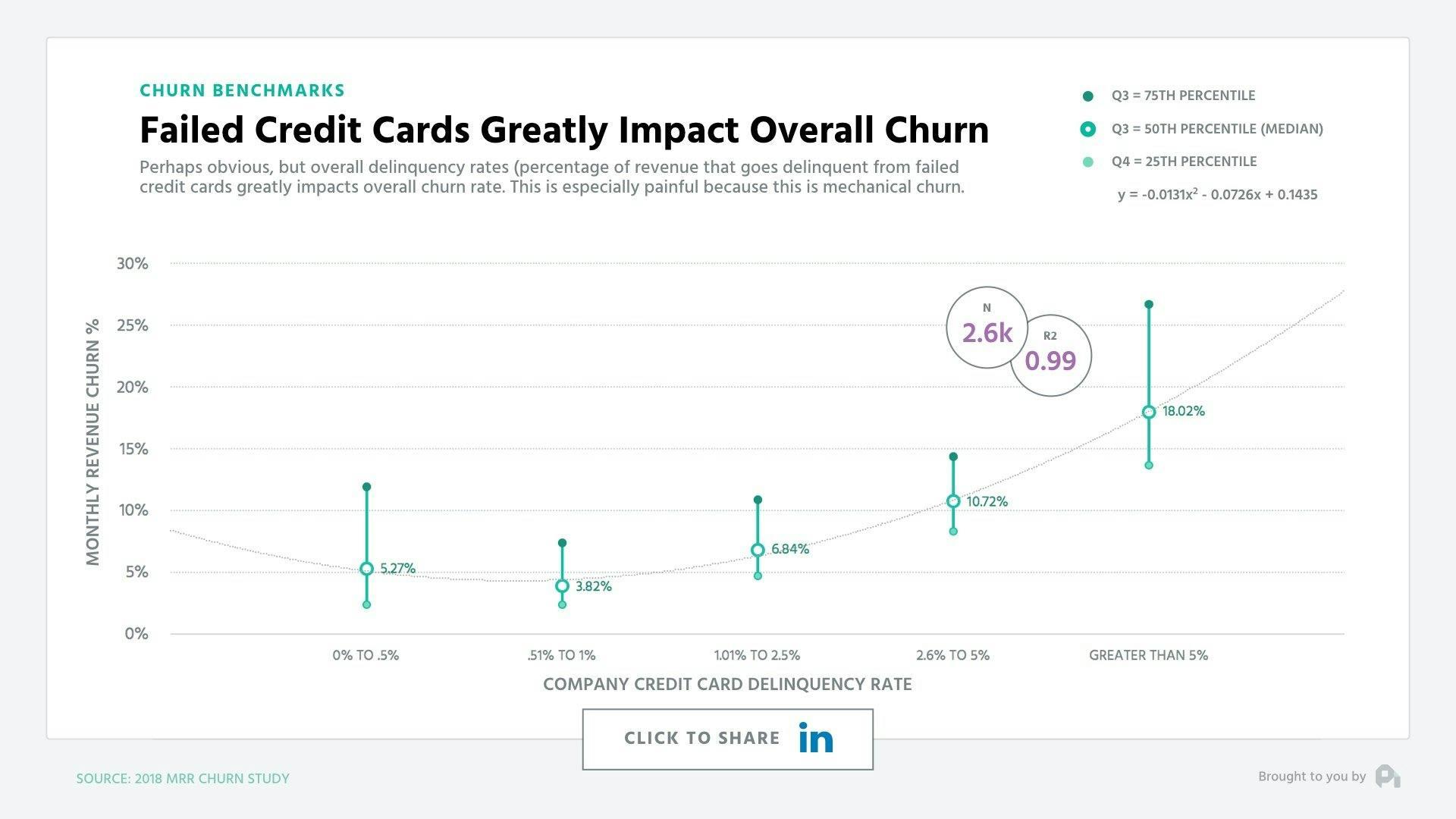

Tip: Bring down your credit card failure rate

Delinquency rate also significantly correlated with high churn. Delinquencies are credit card failures, and it turns out 20-40% of churn is typically from delinquent churn. This churn is painful because it's completely mechanical with over 130 different reasons a credit card will fail, but most companies don't have a good solution for combatting this churn.

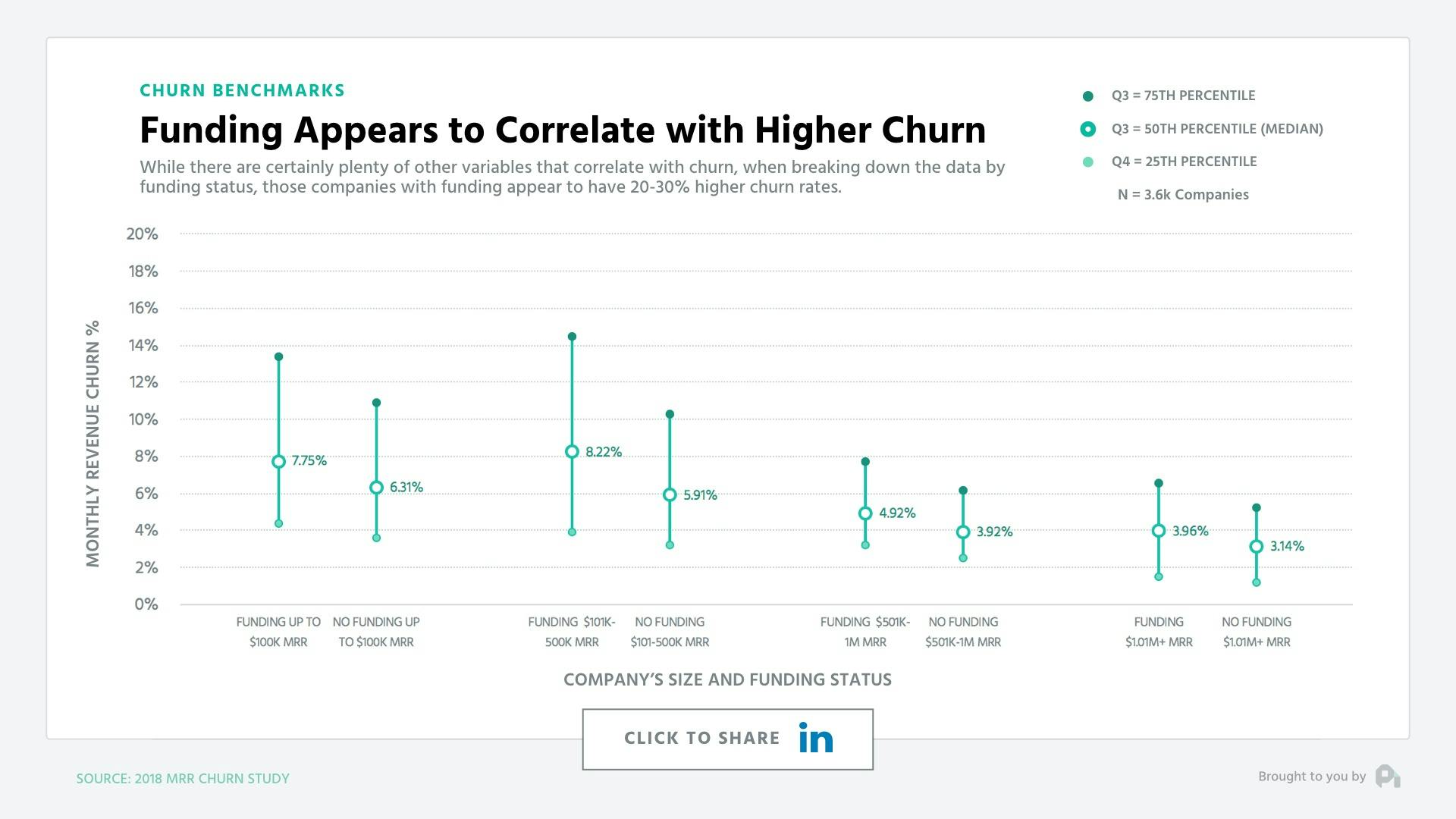

Churn vs. VC Funding: Churn 20-30% higher with funding

Finally, and likely most controversially, we found that those companies with funding saw 20-30% higher churn rates than those who didn't take on funding. There's likely a number of reasons for this, but through qualitative research we've found that a likely culprit is the false sense of security that comes with the moral hazard of being able to spend your way out of growth holes. Not saying don't raise funding, but be careful and ensure funding is a tool, not a crutch or a bandaid.

Check out our other episode about content marketing: is it dead? and subscribe to the show to get new episodes.

1

00:00:00,240 --> 00:00:03,660

You've got the questions

and we have the data.

2

00:00:03,680 --> 00:00:07,360

Each week, we dive deep on benchmarks

of the subscription economy that

3

00:00:07,360 --> 00:00:09,475

you just can't get anywhere

4

00:00:10,555 --> 00:00:10,875

else.

5

00:00:10,875 --> 00:00:13,975

This is the ProfitWell Report.

6

00:00:14,555 --> 00:00:17,035

Welcome to the ProfitWell

Report. I'm Patrick Campbell.

7

00:00:17,035 --> 00:00:20,189

And this week, we have a

question from the CEO of Drift,

8

00:00:20,189 --> 00:00:20,889

David Cancel.

9

00:00:20,889 --> 00:00:24,387

Yo, Patrick. It's the uncle,

uncle DC. What's going on?

10

00:00:24,387 --> 00:00:27,885

What's the latest state and

retention in the market today?

11

00:00:27,885 --> 00:00:30,845

I know you got the data.

Stop holding on on me.

12

00:00:30,845 --> 00:00:32,685

Send it to me. I wanna know.

13

00:00:32,685 --> 00:00:33,485

Let's get it.

14

00:00:33,485 --> 00:00:34,605

Love me some DC,

15

00:00:34,605 --> 00:00:37,165

and this is a phenomenal

question that I've been wanting

16

00:00:37,165 --> 00:00:39,490

to dig in on for

quite some time.

17

00:00:39,490 --> 00:00:41,410

To understand the current

state of retention,

18

00:00:41,410 --> 00:00:44,210

we pull data from over three

thousand different subscription

19

00:00:44,210 --> 00:00:46,805

companies of all shapes,

sizes, and verticals,

20

00:00:46,805 --> 00:00:50,005

and we'll initially break down

where churn stands overall and

21

00:00:50,005 --> 00:00:52,245

then dig into some actionable

trends for you to take

22

00:00:52,245 --> 00:00:54,060

advantage of in your business.

23

00:00:54,060 --> 00:00:58,380

First up, while we love to click and

retweet articles about lowering our churn,

24

00:00:58,380 --> 00:01:01,340

it turns out churn is actually

much higher than most companies

25

00:01:01,340 --> 00:01:05,455

are willing to admit and only loosely

correlates with a company's size.

26

00:01:05,455 --> 00:01:07,695

Meaning as a company gets

bigger from a revenue

27

00:01:07,695 --> 00:01:11,520

perspective, churn tends to

get smaller, but only slightly.

28

00:01:11,520 --> 00:01:14,320

What's really interesting is

the wide interquartile range

29

00:01:14,320 --> 00:01:17,200

that fluctuates between five

and sixteen percent revenue

30

00:01:17,200 --> 00:01:21,075

churn on the low end and two to

eight percent on the high end.

31

00:01:21,075 --> 00:01:22,275

Perhaps most telling,

32

00:01:22,275 --> 00:01:26,195

there's actually a strong correlation

when comparing ARPU and churn.

33

00:01:26,195 --> 00:01:29,050

Single and double digit ARPU

correlated with with churn

34

00:01:29,050 --> 00:01:30,890

between three and

fifteen percent,

35

00:01:30,890 --> 00:01:34,890

whereas four figure ARPU actually

dropped to one to five percent.

36

00:01:34,890 --> 00:01:37,835

This is to be expected because

high ARPU tends to come with

37

00:01:37,835 --> 00:01:40,795

things like consultative

sales, customer success,

38

00:01:40,795 --> 00:01:44,020

and simply just more surface

area per customer that you can

39

00:01:44,020 --> 00:01:45,460

give attention to.

40

00:01:45,460 --> 00:01:46,420

Interestingly enough,

41

00:01:46,420 --> 00:01:49,620

we saw a similarly strong

correlation when it came to the

42

00:01:49,620 --> 00:01:51,045

age of the company.

43

00:01:51,045 --> 00:01:53,845

With companies longer in the

tooth seeing significantly

44

00:01:53,845 --> 00:01:56,165

lower churn than those

who were younger.

45

00:01:56,165 --> 00:01:58,165

Of course, there's

survivor bias there,

46

00:01:58,165 --> 00:02:01,230

but you'd hope to see that when

it comes to a growing company.

47

00:02:01,230 --> 00:02:04,510

You can find more cuts on a benchmarking

basis in the show notes below,

48

00:02:04,510 --> 00:02:07,790

including things like b to b

versus b to c and a breakdown

49

00:02:07,790 --> 00:02:08,990

by customer target.

50

00:02:08,990 --> 00:02:12,365

But let's dig into some fully

actionable cuts answering

51

00:02:12,365 --> 00:02:15,885

what's the biggest influences

on churn that we could find.

52

00:02:15,885 --> 00:02:18,610

Along this axis, the first

piece that was really,

53

00:02:18,610 --> 00:02:22,450

really telling was the proportion

of annual contracts in a business.

54

00:02:22,450 --> 00:02:23,570

Regardless of ARPU,

55

00:02:23,570 --> 00:02:26,435

those companies with a higher

percentage of annual contracts

56

00:02:26,435 --> 00:02:28,515

saw significantly lower churn.

57

00:02:28,515 --> 00:02:31,315

This is because these customers

have only one purchasing

58

00:02:31,315 --> 00:02:33,860

decision per year,

albeit a larger one,

59

00:02:33,860 --> 00:02:36,020

whereas their monthly

counterparts have twelve

60

00:02:36,020 --> 00:02:38,020

purchasing decisions per year.

61

00:02:38,020 --> 00:02:41,780

Delinquency rate also significantly

correlated with higher churn.

62

00:02:41,780 --> 00:02:43,460

Delinquencies, for those

of you who don't know,

63

00:02:43,460 --> 00:02:44,555

are credit card failures,

64

00:02:44,555 --> 00:02:47,675

and it turns out that twenty to

forty percent of your churn is

65

00:02:47,675 --> 00:02:50,315

actually typically from

delinquent credit cards.

66

00:02:50,315 --> 00:02:53,800

This churn is painful because

it's completely mechanical with

67

00:02:53,800 --> 00:02:57,160

over a hundred and thirty different

reasons that a credit card will fail,

68

00:02:57,160 --> 00:03:00,120

but most companies don't

have something implemented to

69

00:03:00,120 --> 00:03:01,905

actually combat this churn.

70

00:03:01,905 --> 00:03:05,005

Finally, and likely

most controversially,

71

00:03:05,265 --> 00:03:08,625

we found that those companies

with funding saw twenty to

72

00:03:08,625 --> 00:03:12,920

thirty percent higher churn rates

than those who didn't take on funding.

73

00:03:12,920 --> 00:03:15,560

There's likely a number

of reasons for this,

74

00:03:15,560 --> 00:03:17,320

but through some

qualitative research,

75

00:03:17,320 --> 00:03:20,705

we found that a likely culprit

is the false sense of security

76

00:03:20,705 --> 00:03:23,905

that comes with the moral

hazard of being able to spend

77

00:03:23,905 --> 00:03:25,540

your way out of growth holes.

78

00:03:25,540 --> 00:03:27,620

And we're not saying

don't raise funding,

79

00:03:27,620 --> 00:03:30,420

but make sure you're using

funding for what it's made for

80

00:03:30,420 --> 00:03:34,435

which is a tool and not a

crutch that you need to rely on.

81

00:03:34,435 --> 00:03:35,555

Well, that's all for now.

82

00:03:35,555 --> 00:03:36,755

Thank you, David,

for the question,

83

00:03:36,755 --> 00:03:39,875

and I trust everything is

going amazingly well at Drift.

84

00:03:39,875 --> 00:03:42,720

If you want us to research

further into this dataset or

85

00:03:42,720 --> 00:03:45,040

research an entirely

different dataset,

86

00:03:45,040 --> 00:03:48,000

feel free to reach out to me

with a video at p c at profit

87

00:03:48,000 --> 00:03:51,135

well dot com, and we'll

have more for you next week.

88

00:03:53,495 --> 00:03:55,815

This week's episode is

brought to you by Crazy Egg.

89

00:03:55,815 --> 00:03:58,855

See what makes your visitors

lead by seeing how users click

90

00:03:58,855 --> 00:04:00,343

and scroll through your website.

91

00:04:00,343 --> 00:04:02,328

Crazy egg dot com.