Monday.com: Does their pricing end or drive their week?

This episode might reference ProfitWell and ProfitWell Recur, which following the acquisition by Paddle is now Paddle Studios. Some information may be out of date.

Please message us at studios@paddle.com if you have any questions or comments!

Monday.com is a behemoth in the project management space. They've got probably some of the best YouTube and video advertising I've seen from SaaS companies. You almost don't mind having to watch them—they're just so well put together. They've been using these video platforms as a marketing and re-marketing channel to find success in a huge, competitive area: project management. There are so many different apps out there. It's overwhelming and, frankly, a bit annoying. You're inundated with options, no matter your segment or desired features.

So today, we're doing ourselves a favor by focusing exclusively on the practices of Monday.com. We're going to explore what this company is getting right, especially in such a hardcore space. We'll also examine what they're not doing well, and wrap everything up in a nice little case study for you to apply within your own business and monetization strategy.

Monday.com has managed to differentiate itself in such a saturated market with great branding and marketing. They now have a $1.9B valuation and are on a path to IPO. But is Monday.com’s positioning and pricing good enough to drive them forward?

Below are some valuable takeaways you can implement in your own business.

- Understand value differential in fragmented markets

When you have a lot of competition and niches, your packaging and positioning is incredibly important. It’s crucial to conduct research to really understand why people buy from you and what they’re really looking for. Identify the value propositions that drive willingness to pay, and which detract from it. - Know willingness to pay to ensure you don’t under- or over-price

Here again, understanding your customers’ willingness to pay is key to arriving at the right price point. Each band of users has different values, needs, and budgets. Price your packages accordingly. A little research can go a long way. - Understand where features change and don’t change based on size

When you're in a fragmented market, you're going to build a lot of features. Conduct an audit of your different feature set. There will be features in your core that people aren't using—these could be made differentiable. And there are probably features you're including in tiers that should be add-ons. As more and more product gets shipped, you’ll need to be better about differentiating your products in order to monetize effectively.

A million project and workflow management products exist. Ok, not a million, but there’s Redbooth, Trello, Wrike, Notion, basecamp, clickup, airtable, teamwork, and I’m not going to name them all. So many exist because we all have projects that need managing and tracking whether we’re working solo or together, but we also all work differently.

This is why it seems kind of wild that Monday.com would enter the ring, especially without any massive funding in their early years. Founded by Roy Mann, he wanted to create something that helped team members be happy and productive. In 2014 he teamed up with Erin Zinman to officially found their team management platform dapulse—a name they’d later regret as many mocked it as sounding like the name of a hip-hop artist.

I don’t know about you, but keeping dapulse of the team sounds pretty good. Yet, not wanting more tweets about the name they switched to Monday.com, a name to take back the first day of the week for a broad market of work. So many apps for this exist though, so what did Monday.com focus on to be successful?

Well, their mission squarely focused on the collaboration and transparency piece of work and project management. Other apps had these features, but they weren’t the primary focus and Monday.com tapped into these specifically. Monday also used their easy to remember name, as well as really good video and ad creative to bring people into the fun and collaborative nature of the product. When you’re ina saturated market, proper branding and marketing is an enormous differentiator. These two pieces have lead to Monday.com growing to 100,000 teams in 200 different verticals across the world. They also now have a hefty 1.9B valuation and are on a path to IPO.

Monday.com's success

Success normally breeds more competition, but in Monday.com’s case they’ve been steeped in competition since the beginning, leading some to believe that their success may decline as new apps come into the market like fads. Teamwork.com has focused on being multi-product for different leads within an organization—sales, product, marketing, etc.—to appeal to those who don’t want a bunch of different apps. ClickUp has gone down a similar route but more focused on having everything they could think of in the product. Asana went upmarket with all the upmarket features.

The question becomes: Does Monday.com have what it takes to sustain their growth or will they end their week because of many products eating at their market share over time? Alternatively, is the market big enough that it doesn’t really matter since they’ll gain enough lock-in? How can they use their positioning and pricing to propel them forward in the context of this market?

We’ll reveal all the data and answers to these questions, so keep reading.

Management mash-up: Choosing a software

You might be rightfully wondering, what project management apps do we use at ProfitWell? Quite frankly, which ones we don't use might be a more efficient question. We've dabbled in Trello, Notion, Redbooth, Asana, Basecamp... I think a team is even still using Monday.com. Google Spreadsheets and Reich have made appearances. Just right there, there are eight programs that we have used or are still using.

I think that shows that 80% of these services are going to be pretty comparable in terms of features and usability. You'll see things like task management, assigning, commenting, and all of those great things. The struggle is, no product can completely dominate that last 20%, which differs for every consumer.

My biggest advice for finding your perfect software match is figuring out your ideal flow. Once you figure out how you best operate, you can find a product that meets your needs. You shouldn't be having to match your project to your software—after all, there's so many options that the one you're looking for is probably out there.

I think this is a lesson from a business perspective. When you're in a giant, fragmented market, you can make your niche just comically small. I think that right now, Monday.com is targeting more of a mass market. They've gotten a lot of traction, so that's good, but could maybe be missing the opportunity to be the perfect fit for a certain crowd. In the end, project management is destined for a very fragmented market, where a bunch of different players just cover specific niches. The mass market is inevitable, but it's very different to start off in.

Rome has tried out bi-directional linking, which initially attracted many people to the product. They're doing a lot of interesting things but, in the end, consumers ditch them, saying, "Yeah, but I need these seven features." That's when they turn to something like Notion, which is a bit more of an enterprise solution.

Long story short, you've got to understand what you're going after and what you're coming up against. If you're in a fragmented market, don't fight it. Lean into it.

Let's take a look at the pricing page and unpack some of the data on their current and prospective customers.

Pricing Page

First up, their user scale is really cool. I like that you're not worried about adding one user at a time. Instead, you get fit into a bucket with a predetermined price. It eliminates a lot of the pushback from potential customers as they're going through their sales conversation. It also gives you the ability to see, at a glance, what the price would be for your team. That's key for an SMB type buyer—they'll want to know the flat rate.

Here's a critique, though. They have many different bands—20, 25, 30. I don't know if that's the right move. If you force a client into a fifty user group, you can re-contextualize this upsell as a positive: up to 50. That means that agencies with external or infrequent viewers aren't having to shell out cash for users that aren't worth the cost. Many apps neglect to think about that, so offering those "lurkers" for free could be a huge selling point. Offering unlimited, free viewers is huge.

Another annoying point with that, though, is that every single plan offers these free viewers. That's great, but they waste space placing that feature in the description of every tier. Instead, that information could be represented in saying, "Hey! Everyone gets these things. Everyone gets an awesome product." That's an appealing pitch and frees up space and attention for the truly differentiated pieces.

As we take a look at the more traditional, enterprise-type features, I would also make some changes. Explaining everything that comes with enterprise takes up a page's worth of information. It could be better anchored by simply prompting visitors to "contact us." Even better would be linking enterprise out to its own landing page. It's a more immersive experience for your potentially big clients without annoying the rest of your viewers.

We'll end on a positive. I love how they optimize for monthly cost, versus looking at it annually. I would maybe tweak that "18%" figure to what it really means: two months. Human beings understand percentages, but why make us do the conversion? We like physical things—and the data shows that. And speaking of the data, let's check it out.

Where does our data come from?

Here at Paddle, our Price Intelligently software combines proprietary algorithms and methodologies with a team of pricing experts who think about this stuff more than anyone else to help companies optimize their monetization strategy. We do this by going out into the market and collecting data from current and prospective customers, having the ability to collect data from everyone, from a soccer mom or dad in the middle of Kansas, all the way to a fortune 500 CIO in South Africa. We then take that data and run it through our algorithms and analyze it in every direction to determine a company's ideal customer profiles, as well as which segments value, which features and which segments are willing to pay more, all in the spirit of determining how a company can use monetization for growth.

Understand value differential in fragmented markets

It's important to understand value differential fragmented markets, and what it means for your product. We mentioned earlier how fragmented the project management market is. When you have such competition and many niches, your packaging is incredibly important. Your positioning is perhaps most important of all. When someone comes to Monday.com, there are many reasons why they might want to use a project management tool. But why might they convert, or be ready to defend your product's value?

We took a bunch of different value propositions and asked participants, "Is this the number one reason you're buying this product?" Then, we compared and contrasted their individual willingness to pay with the overall median. What we found is that things like keeping clients in the loop and enabling collaboration boosted willingness to pay, or at least value perception, by about 10-15%.

On the flip side, the stereotypical "project management" tools—like gain visibility and timeline management—actually detracted about 15%. Ultimately, these value props can change how conversions look, as well as what willingness to pay looks like. We don't do enough experimentation with that. Advertising these "table stakes" features doesn't do much for clients - it's something that they're already expecting from everyone. Cross-team sharing and strong communication is where the big competition and value comes in.

If you're taking notes for your business, you'll want to make sure you test your value propositions from a willingness to pay perspective. It's a much cleaner environment than trying to A-B test, which is hard to do without high levels of traffic. Take the time to truly understand what is going to boost willingness to pay, then lean into those segments and value props.

Know willingness to pay to ensure you don’t under-or over-price

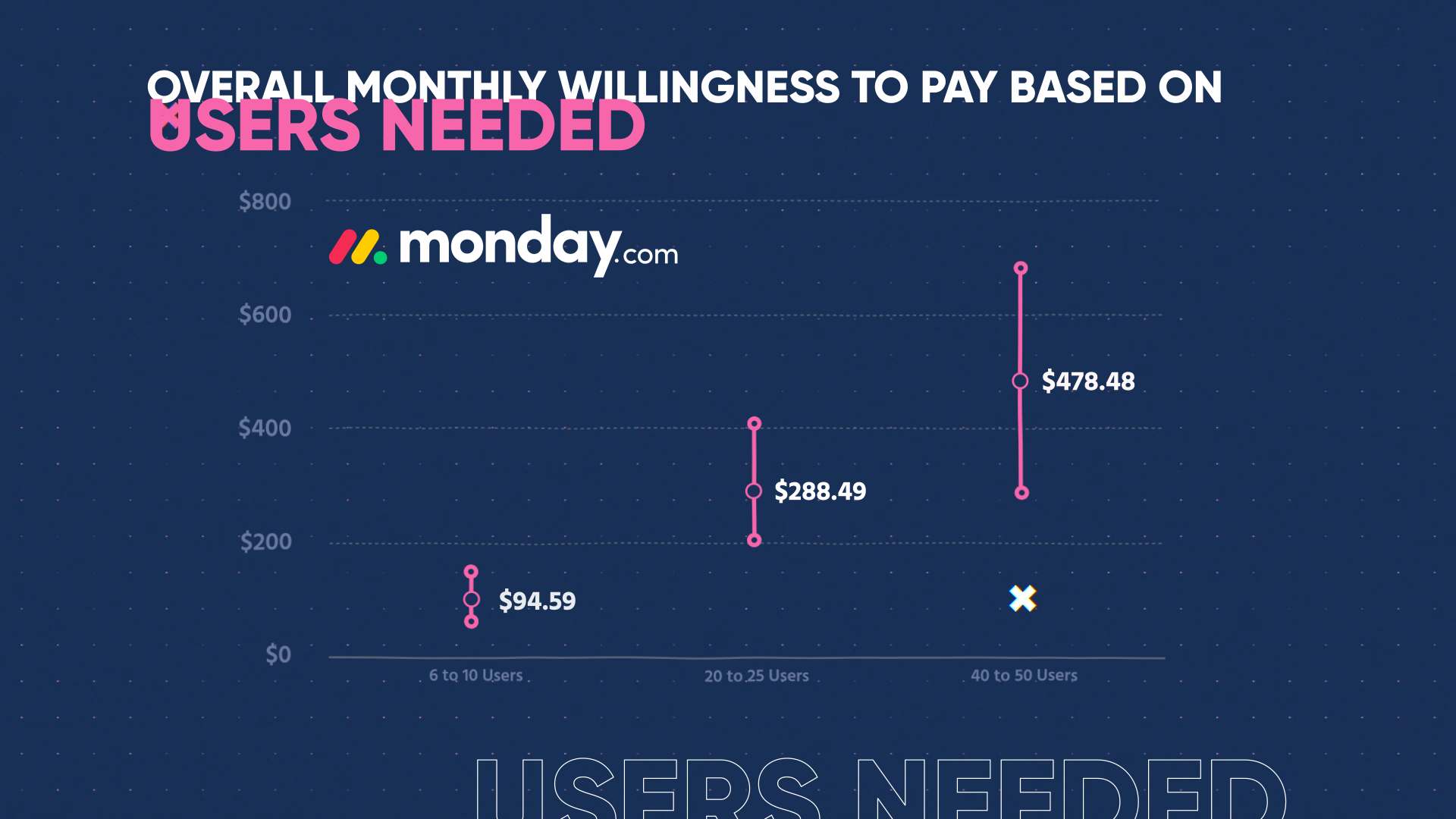

An awareness of willingness to pay can also help make sure you're not under- or over-pricing. This is critical. Understand where those drop-offs are and make sure you know exactly how that willingness varies within each group. Monday.com absolutely nailed their downmarket price points. I want to give them all the credit in the world. Unfortunately, their higher tiers, which are marketed towards other groups, follow the same downmarket trend. On their price page, the middle level was about $200. But we learned their willingness to pay for that group was closer to $300. That's $100 a month, lost. By the time you get to the highest levels, they might be $200 below their ideal price.

Now, you might be thinking, "Oh great, then they'll get more volume." Unfortunately, that's not how it works with software. It doesn't have a natural, perfect demand curve. It's one of those things where, as the price goes down, some people may question the quality of the product or its efficacy in solving their problems. If prospective customers look at Wrike or even Asana, you're suddenly in an environment where Monday.com seemed very underpriced. Visitors have developed a willingness to pay $300-$400. If Monday is sitting at $200, people might get in the door... but you might not pass the sniff test.

It's even more extreme as the groups get bigger. For 40-50 users, the willingness to pay shoots up to $500-$750. Monday is only pricing these folks at about $400. It's not terrible, but there are clearly some quick wins here. Adjust those bands or adjust the price point, and they're making a lot more. I really doubt their conversions would suffer at all.

Value Matrix

You're about to see something called a value matrix. We collected data from the group comparing feature preferences and plotted those on the horizontal axis, more valued features on the right, less valued on the left. We then collected willingness to pay for the overall product and plotted that based on their number-one feature preference on the y-axis. Analyzing data in this manner allows us to determine which features are differentiable add-ons, core, or commoditized for each segment.

Understand where features change and don’t change based on size

I think that one thing Monday.com does fairly well is separating out their tiers based on features. However, the one thing you'll find here is that, when we compare clients who have 5-50 users to 51+ users, there's a big shift. Things like customer branding, integrations, time-tracking become a lot more important. For those 5-50 user groups, there's some willingness to pay, but they're within that +/-20%. Nothing's beating the bank here. When you make the jump to 51+, people are willing to pay for these things and they become truly differentiable.

Here's the key: When you're in a fragmented market, you're going to build a ton of features. You'll have a ton of product. When you do that, you have to make sure you understand where different things should be placed in terms of your tiers. Monday.com actually did a pretty good job with this. There are some little modifications I would suggest, but it's nothing to cry over.

- Understand value differential in fragmented markets. In a fragmented market like the project management space, every inch of your design, positioning, and price are incredibly important.

It’s crucial to conduct research to really understand why people buy from you and what they’re really looking for. Identify the value propositions that drive willingness to pay, and which detract from it. Many businesses think about this internally, but most under-test it. - Understand your audience's willingness to pay. We talk about this a lot, but it's critical to ensure that you're not under- or over-pricing. Each band of users has different values, needs, and budgets. Price your packages accordingly. A little research can go a long way.

- Know where features change and stay the same in terms of value, based on the size of your customer. As we saw with Monday.com's user base, the game changed as soon as they got over 50 users. It's something they can take advantage of by differentiating their tiers. Your company needs to understand what your upgrade paths look like, and the only way to do that is research.

Need help with SaaS pricing?

Price Intelligently by Paddle is revolutionizing how SaaS and subscription companies price and package their products. Founded in 2012, we believe in value-based pricing rooted in first-party research to inform your monetization strategies. We combine expertise and data to solve your unique pricing challenges and catapult growth.

(00:00):

I'm about to go Greek mythical creature on you because what project management, the space in and of itself is literally full of siren songs. It is a space that pulls you in, convinces you, oh my gosh, there's an amazing tam here, there's such a large market, it's gonna be amazing. And then just slaps you over the face with fragmented feature at differentiation.

(00:22):

Welcome to pricing page Teardown, where the profitwell Crew breaks down strategies and insights on how subscription companies from all corners of the market can win with monetization.

(00:37):

Welcome

(00:38):

To Pricing page Teardown. I'm Patrick Campbell. I'm Rob Litterst. And this week we are going to the beginning of the week with monday.com, a behemoth in the project management space with I would say, some of the best YouTube and video advertising I've seen out of most sass companies out there. I've seen them a lot. I've seen them a lot and I always enjoy watching them. Oh yeah. It's one of those things, even if I've seen them, they're just well put together. Right? And I think they've used YouTube as just a main either remarketing or just straight up marketing channel. Um, to be successful in what I would argue is a enormous space, huge space known as project management. And there are so many different apps. Go to the G2 crowd for project management and it is overwhelming. It's annoying, it's just annoying. I'm just gonna say it.

(01:19):

Yeah, it's annoying how many products are there and like which products you should really look at, even with their segmentation and filtering features. But what we're gonna do is we're gonna explore what monday.com is getting right, especially in such a fragmented, hardcore space. And also what they're not doing so well. Because I think there's some tweaks that they can use even going after what I presume their target customer is to be a lot more successful. Totally. And we're gonna wrap this all up, all these lessons into a nice little case study so that you can do better within your own business and get your monetization right on track.

(01:52):

A million project and workflow management products exist. Okay, not a million, but there's red Booths, Trello, rake Notion, Basecamp clip up. Airtable Teamwork. I'm not gonna name them all. So many exist because we all have projects that need managing and tracking whether we're working solo or together. But we also all work differently. This is why it seems kind of wild that monday.com would enter the ring, especially without any massive funding. In their early years. Founded by Roy Mann, he wanted to create something that helped team members be happy and productive. In 2014, he teamed up with Aaron Ziman to officially found their team management platform, dets a name they'd later regret as many. Mocked it as sounding like the name of a hip hop artist. I don't know about you, but keeping the PTs of the team sounds pretty good, yet not wanting more tweets about the name they switched to monday.com.

(02:38):

A name to take back the first day of the week for a broad market of work. So many apps for this exist though. So what did monday.com focus on to be successful? Well, their mission squarely focused on the collaboration and transparency piece of work and project management. Other apps had these features, but they weren't the primary focus. And monday.com tapped into these specifically. Monday also used their easy to remember name as well as really good video and ad creative to bring people into the fun and collaborative nature of the product. When you're in a saturated market, proper branding and marketing is an enormous differentiator. These two pieces have led to monday.com growing to 100,000 teams and 200 different verticals across the world. They also now have a hefty 1.9 billion valuation and are on a path to i P o Success normally breeds competition, but in Monday dot com's case, they've been steeped in competition since the beginning leading some to believe that their success may decline as new apps come into the market.

(03:32):

Like fads. teamwork.com has focused on being multi-product for different leads within an organization, sales, product, marketing, et cetera, to appeal to those who don't want a bunch of different apps. Clip up has gone down a similar route, but more focus on having everything they could think of in the product. Asana went upmarket with all the upmarket features. The question becomes does monday.com have what it takes to sustain their growth or will they end their week because of many products eating at their market share over time? Alternatively, is the market big enough that it doesn't really matter since they'll gain enough lock-in? How can they use their positioning and pricing to propel them forward into the context of this market? We're gonna answer these questions and more by collecting data from current and prospective monday.com customers and will reveal all the data and answers to these questions coming up in just a bit.

(04:19):

What project management apps do we use at Profit? Well,

(04:21):

Which ones don't we use is more of the question. Trello notion, red Booth, Asana, basecamp monday.com. We've used or we, I think there's a team that's still using it. Google's it Spreadsheets. Okay. We've used those. We've tried Reich. Oh my gosh. So those are eight that we have used or are still using. And I think that this shows like 80% of your product is going to be very much the same for everybody, right. Task management, assigning commenting, these types of things. The problem is, is that none of these products can handle the last 20%. Mm-hmm. Which is literally different for every single customer out there. Exactly. I think my biggest piece of advice for, for like a user of picking project management apps, it's like figure out what is your ideal like flow. Totally. And then once you figure out your ideal flow, then go looking for the products.

(05:09):

Right. I think cuz then you're like, I need to make sure it fits this flow. Absolutely. Rather. Absolutely. Than like, oh I need to bend towards this project management app. And I think this from a lesson from a business perspective is that when you're in a giant fragmented market, you need to make your niche just comically small. Exactly. And I think that monday.com I, I don't know if they've done this, I think they've gone after more of the mass market, but they've also had like a lot of traction, which I think is good. And then Asana, I think they just played the game long enough, right. Um, in order to attract enough people and then just kill all of those different features that they needed to kill.

(05:43):

That's the end game here. I think Project management's just destined for a very fragmented market where there are a bunch of different players that just cover specific

(05:50):

Niches. Yeah. And there still will be mass markets out there, but I think when you're starting off mass market is just really, really hard. I think Rome with kind of the bi-directional linking mm-hmm. <affirmative> has attracted a bunch of people to the product. Um, and there's a bunch of other aspects of Rome that I think are really, really interesting. But ultimately people are like, yeah, but I need these seven things. Right? And that's why they use something like Notion, which is a little bit more now of an enterprise solution. Um, but I think what'll be really interesting to see how this space evolves. Like long story short, you gotta understand like where you're going after and if you're in a fragmented market, don't fight the fragmentation. Lean into the fragmentation. So

(06:23):

Let's take a look at the pricing page and then unpack some of the data on their current and prospective customers. Yeah.

(06:27):

And we're gonna take some lessons of what monday.com is doing really, really well and what they're doing not so well. And wrap up these lessons into a nice little case study to get your own monetization on the right track.

(06:40):

First up the user scale is really cool. Yeah. I

(06:43):

Thought it was cool too.

(06:44):

I like this. You know, you can't, it's, it's not the type of thing where you can just add one user at a time. It's like you kind of get fit into these buckets with predetermined prices. It eliminates a lot of the pushback from Yeah. Potential customers as they're going through their sales conversation. Also kind of gives you the ability to just see exactly what your pricing would be for your team.

(07:01):

Well and that's what's really interesting about it is when you're targeting more of an SMB type buyer, I wanna know what my flat rate is. Mm. Right? I don't want to know, oh it's $10 per user and then I have to kind of calculate, well I need 14 users and that's 114. Like I know that's not hard to do, right? But it is some extra work here. It's like how big is my team? Oh it's 15 people. Oh it's 150 bucks on basic 1 79 on standard and 2 99 on Pro. Right. And I think that's a really powerful thing to do because I need to know where I stand pretty quickly on this page. Yeah. And all of a sudden I come in and it's like, okay wait, how many users am I gonna need? Well it's just that one team, just 10 users or hey it's gonna be 30 users.

(07:40):

They have to make sure they get these bands perfect. Right. Right. And basically like, are there a lot of 12 person teams? Well then maybe put that number at 12. There's a number of bands here, 20, 25 and 30. I don't know if that's the right move. Right, right. And so maybe you force them into 50 users and maybe you recontextualize this as up to 50 users. And that gets really interesting cuz really what they're saying is, is unlimited free viewers and unlimited free users. Which with project management, especially if you're an agency or you have external like viewers or you have people like, I'm not necessarily gonna be active, but I want to view what's going on. Right. Those users that those should be free. I thinks a really, really big thing that enough apps just don't use is that if someone has to pay for a lurker user, that's really annoying.

(08:23):

Oh, a hundred percent. It's really

(08:25):

Annoying. It

(08:25):

Is weird optics to your point. Yeah. Like saying unlimited users and then going right into these kind of user totally cohorts. Right.

(08:32):

But I do like the flat right. Kind of pricing. Agreed. I think the other thing that's kind of annoying here, but I understand why they did it, is you look at these plans basically unlimited free viewers all the way down to, you know, iOS and Android apps. Mm-hmm. <affirmative>, it's like they're showing, hey, they're in every tier. Right. I think the thing is is you can pull those out and get some free up some space. Right. And basically be like, Hey, everyone gets these things and make it a little bit of like, everyone gets an awesome product. Right. Even if you don't use all the features, you get an awesome product. And I think that would give them some space then to like truly show the differentiation, which seems to be around some of these integrations and these views. And then as we get up into like the traditional more enterprise type features, um, I actually would pull out enterprise. I think what's really fascinating is enterprise is always, um, contact us. Yeah. And what I would do is I would actually pull that out into its own plan below these other plans just so you can still have the anchoring effect but you're not taking up look at all the space. Right. Look at all these things that come with enterprise. Yeah. You know, it's, it's a page worth of information that's a better way to anchor this rather than like just putting it physically on here and kind of annoying folks, if that makes sense. I

(09:41):

Totally agree. I think that's one of those things you, you put the enterprise plan kind of labeled underneath the grid and allow people to click into it and go to a landing page. It just goes through enterprise specifically.

(09:50):

Totally. The other thing I would say, just to kind of end this out is like I do like how they're optimizing for the monthly versus annual here. Same. Um, the only thing I would change when we found this time and time again is I would change that 18% of two months. Yes. Uh, human beings, we just understand physical things better than percentages. Put another way we understand percentages, but it takes us a second to be like, oh wait, is that, oh that's two months. Right? Right. Just say the two months. Um, we found a time and time again in the data. Two months always works better than a certain percentage. Um, but these are some of the things that I would change and these are some quick wins I would argue. Um, but they can test. These are like, they get enough traffic based on their advertising that they could definitely test these out to see like what the uptick is in these in these different tiers. Totally. You wanna take a look at some data. Let's

(10:32):

Dig in.

(10:33):

So where does our data come from? Here at ProfitWell, our price intelligently product combines proprietary algorithms and methodologies with a team of pricing experts who think about this stuff more than anyone else to help companies optimize their monetization strategy. We do this by going out into the market and collecting data from current and prospective customers. Having the ability to collect data from everyone from a soccer mom or dad in the middle of Kansas all the way to a Fortune 500 CIO in South Africa. We then take that data and run it through our algorithms and analyze it in every direction to determine a company's ideal customer profiles as well as which segments value which features and which segments are willing to pay more. All in the spirit of determining how a company can use monetization for growth.

(11:21):

All right. First up, it's important to understand value differential and fragmented markets. So we talked about how fragmented this market is. I think that when you have a fragmented market, not only is your packaging super, super important, but your positioning is probably number one if not number two on the list here. Totally. And what I mean by that is someone coming to monday.com, there's a lot of reasons why someone might use a project management tool, but the reason that they're going to convert or the reason that they're going to defend value is gonna be very, very different. So what we did is we took a bunch of different value propositions and we basically, Hey, is this the number one reason you're buying this product? Is this the number one reason you'd be buying this product? And then we basically compared and contrasted their willingness is to pay against the overall median of willingness is to pay.

(12:05):

And what we found is that thinking things like keeping clients in the loop, enabling collaboration, those things basically boosted willingness to pay or at least value perception by about 10, maybe 15%. Whereas things like gain visibility and keep projects on time, the traditional things that you would think project management is for, they're actually detracting about 15% from value. And I think that the big thing that kind of realize and not enough B2B as well as D TOC clients understand this is that ultimately these value props can very much change how conversions look like. Um, as well as what willingness to pay looks like and we don't do enough experimentation with them.

(12:39):

Totally. It doesn't even surprise me here either. I think like keeping projects done on time and visibility, they feel like table stakes, right? It's something that all of these different, um, platforms should have and should be able to deliver. It's at collaboration and keeping clients in the loop and kind of like cross team sharing. Yeah. That's where stuff gets tough and I mean I think that's kind of a a, a really big value prop especially

(13:00):

I also think that a lot of people just don't think things will ever be on time <laugh>. Yeah. So that's true. I think here like you notice like enable collaboration and keep clients in the loop. These are like not only aspirational but things make us look good. Totally. Right? If we're using the app like oh keep 'em in the loop, they can log in and check out some things. But I think the big thing for you as a business is just make sure you test your value propositions and you can test them from a willingness to pay perspective. I'd recommend actually doing that because it's a much cleaner environment than kind of trying to AB test when most of you don't have the traffic to truly ab test value props. Uh, but do the research to understand like what is actually gonna boost willingness to pay and then lean into those segments as well as those value props.

(13:36):

Next up need to know your willingness to pay to make sure you're not under overpriced. Yeah. And this is critical and I mean you alluded to this when we were going through their pricing page, understanding where those cliffs are and making sure you know exactly how that willingness to pay differentiates within each group. Um, these guys specifically absolutely nailed their down market price points.

(13:56):

Yeah. Down market price, which I don't, I wanna give them all the credit in the world. Yeah, they do it right. So give 'em the credit but it's a hundred dollars, right? That's kind of the natural thing on the low end that, that they nailed anything but the right price even as they get into the higher tiers on the page. Mm-hmm. <affirmative>. Yeah. Like we're looking at those folks who have 20 to 25 users. Um, the, the actual price on the page, I think on the mid-end was about $200. The willingness to pay on the median side is closer to 300. Wow. So a hundred dollars a month off. Yeah. And then even on the high end, you know, it's reaching over 400. So they might be $200 off. Now you might be thinking, oh great, well they'll get more volume. That's not how it works with software.

(14:33):

Software isn't like a natural perfect demand curve. Like every demand curve doesn't look like a perfect demand curve. Sorry to break your one econ class in high school or college bubble. But it's one of those things where, you know, as the price goes down, there might be a factor where people are questioning the quality of the product or AC if it's actually gonna solve the problem. Totally. And when you look at Reich and some of these other like tools like Asana, even all of a sudden you're living in an environment where they're pretty overpriced. Oh yeah. Compared to this. And so it's one of those things where if the willingness to pay is like three, $400 and you're only pricing at 200, it's great to get people in the door, but there might be a little bit of a sniff test problem. Right. And you see this even further when you look at 40 to 50 users, the willingness to pay range there goes way up. You know, it's closer to about 500 all the way up to about seven 50 and they're only pricing these folks at about 400. And so that's not as terrible. But there's some really quick wins here that monday.com could take to basically either adjust those bands like which bands they're offering or adjust the actual price point. Right. And I doubt their conversion would suffer at all. Totally.

(15:34):

You're about to see something called a value matrix here. We collected data from the group comparing feature preferences and plotted those on the horizontal axis. More valued features on the right, less valued on the left. We then collected willingness to pay for the overall product and plotted that based on their number one feature preference on the y axis. Analyzing data in this manner allows us to determine which features are differential add-ons, poor or commoditize for each segment.

(16:05):

Finally, you need to understand where features change and don't change based on size, at least when it comes to like preference. Totally. I think that one thing that monday.com does fairly well is it does separate out their tiers based on features pretty smoothly. But the one thing that you'll find here is that when we compare those users who have five to 50 users, to those who have 51 plus users, what you'll notice is that all of a sudden there's this big shift that happens when it comes to things like custom branding, when it comes to integrations, time tracking, et cetera. And you'll notice here is like for five to 50 users, things like priority support, custom branding, time tracking, you know, they're valuable, they're some willingness to pay, but they're kind of within that plus or minus 20%. Yeah. So nothing's like really beating the bank here and then all of a sudden you go to 51 plus users and all of a sudden things like custom branding, integrations, these types of things, they're things that people are willing to pay for and they're differential. And totally the main point here is when you're in a fragmented market, you're gonna build a ton of features, a ton of product. And when you do that you have to make sure you understand where different things should be in terms of your tiers. And I think monday.com actually did a really, really good job with this. There are some little modifications that they could make here and there, but it's not enough to like, you know, cry over spilled milk for.

(17:15):

Yeah. They do a great job. I think they have a lot of feature-based differentiation and I think a lot of them are kind of thematically aligned with what we're seeing

(17:22):

Here. A hundred percent. And it's good, like it's a good mix. You've sort of talk about push and pull pricing. It's a pretty good mix of pole pricing, right? Where hey, you have more users, you want to jump up to a plan that works cuz you have everything in that tier is really what you want. Um, especially when you get into the enterprise side, you got things like SSO and things like that. I would say that for most businesses you need to do an audit of your different feature set. I guarantee you there's features into your core that people aren't using that should be differential. I guarantee you there's features that you're kind of including in tier right now that should be add-ons. It's just one of those things that as more and more product gets shipped, we need to be much, much better about differentiating our products in order to monetize effectively and also understand where maybe we shouldn't be differentiating because Right. You know, we're not defending our value enough.

(18:04):

Totally.

(18:09):

First up, it's important to understand your value differential in a very fragmented market. When you look at something like the project management space, the positioning and every inch that you want to gain from your design, your positioning, your price is really, really important. So you have to understand what are those value props that drive willingness to pay, and what are those value props that detract from it? And for most businesses, this is something that you probably haven't tested much, you've just kind of thought about it internally. You really should do some research on why people buy from you and what they're really looking for. And not just like, oh, the core table stakes type stuff, but really what is the value that they're going after?

(18:43):

Next up, you need to know willingness to pay to make sure you're not under or overpricing. It's critical to understand which kind of bands of users or whatever your value metric is, have those different differentials and willingness to pay so that you can make sure that your packages are priced accordingly.

(18:58):

Absolutely. And I think it's one of those things where we meet companies all the time that are com mostly underpriced. Mm-hmm. <affirmative>. Um, there are some that are overpriced and those are tougher conversations. But it's one of those things where a little bit of research can take you a long way here just to basically understand like where you should be. Um, and you can kind of look at that in the context of where you are. And finally, you have to understand where features change and don't change in terms of value based on the size of your customer. As we saw with Monday dot com's users, as soon as they get over 50 users, all of a sudden the game changes in terms of what they value and what they're really looking for. And money dot com's able to take advantage of that by differentiating their tiers. But you have to understand what those upgrade paths look like. And the only way to do it is to make sure you're measuring your relative preference from your customer's perspectives of your different features.

(19:46):

Well, let's, this week's episode of pricing page chair down, if you got some value from this, you learn something, had a little bit of a chuckle, make sure you share it on the social media channel of your choice. We wanna make sure we get this into the hands of as many people as possible to teach pricing just far and wide. And also, if you want some data like this for your own business, you're interested in our Price Intelligently software, feel free to reach out to me@patrickatprofitwell.com or rob@profitwell.com and we'll hook you up with the right pricing team internally here at ProfitWell.

(20:12):

Who do we got next week?

(20:13):

Next week we have a heartbreaker. And it's a heartbreaker in multiple different ways because it is an amazing mobile app that started monetizing way too late and got so much backlash because they started monetizing, which I believe has led them to being so wooly under price that it's hurting their business so much. And that business is Strava.

(20:36):

Strava is for the elite runners in fitness crowd, it's

(20:39):

For the elite runners, but they're pricing it for some schlub like me, which makes me so angry and so upset because there's so much potential in that product. We'll see you next week.