How to Price a SaaS Offer

This episode might reference ProfitWell and ProfitWell Recur, which following the acquisition by Paddle is now Paddle Studios. Some information may be out of date.

Originally published: April 4th, 2018

Value metrics are what you charge for, where it could be some measure of usage, some per user pricing, or even a cut of cash made from a product. So to answer Zeal's question, we looked at over 6,000 companies and data from nearly 600,000 subscriber buyers, and here's what we found.

But first, if you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

Deeper insights into value metrics

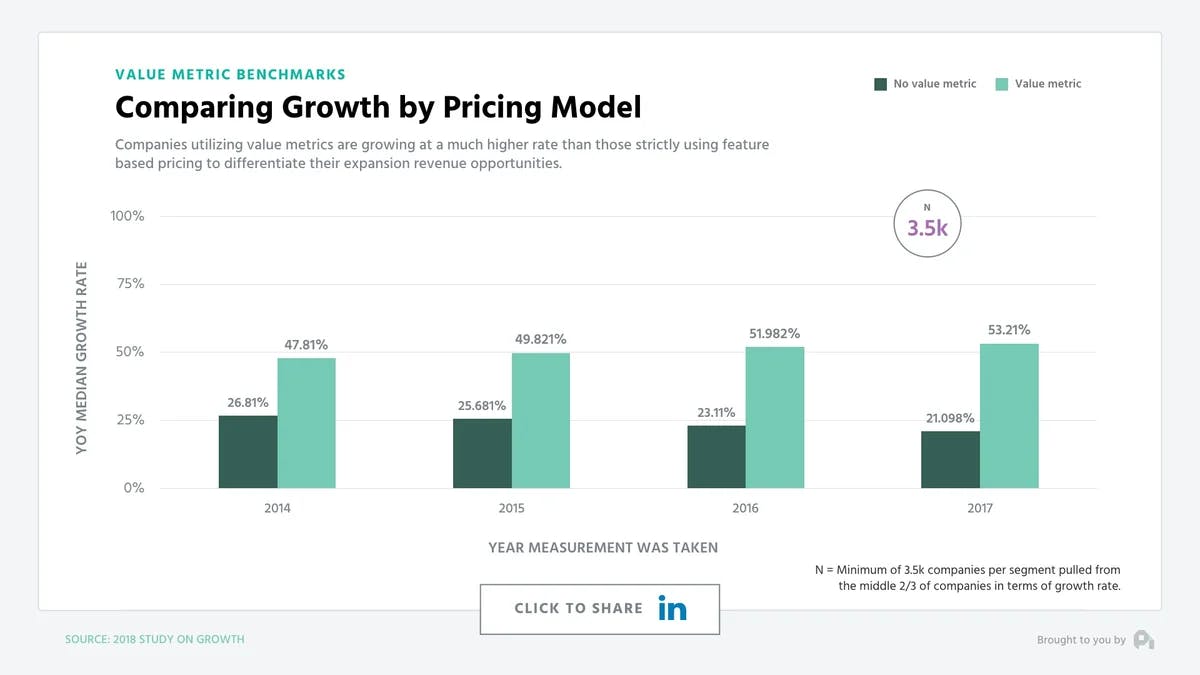

For one, it’s hard to deny the impact of value metrics on a business, particularly when it comes to growth. When we compare companies utilizing some sort of value metric versus those who are strictly utilizing feature differentiation, those who have value metric based pricing are growing at nearly double the rate as their feature differentiated counterparts - and the gap is widening.

Growth Differential

This growth differential for value metric companies is because you’re baking expansion revenue directly into your pricing model. If you’ve aligned your value metric correctly with your target customer base, then as they use more of that metric, they’ll naturally be inclined to pay more, because they’re getting more value. Plus, you won’t have to fight tooth and nail to convince them to upgrade for a feature they probably don’t need.

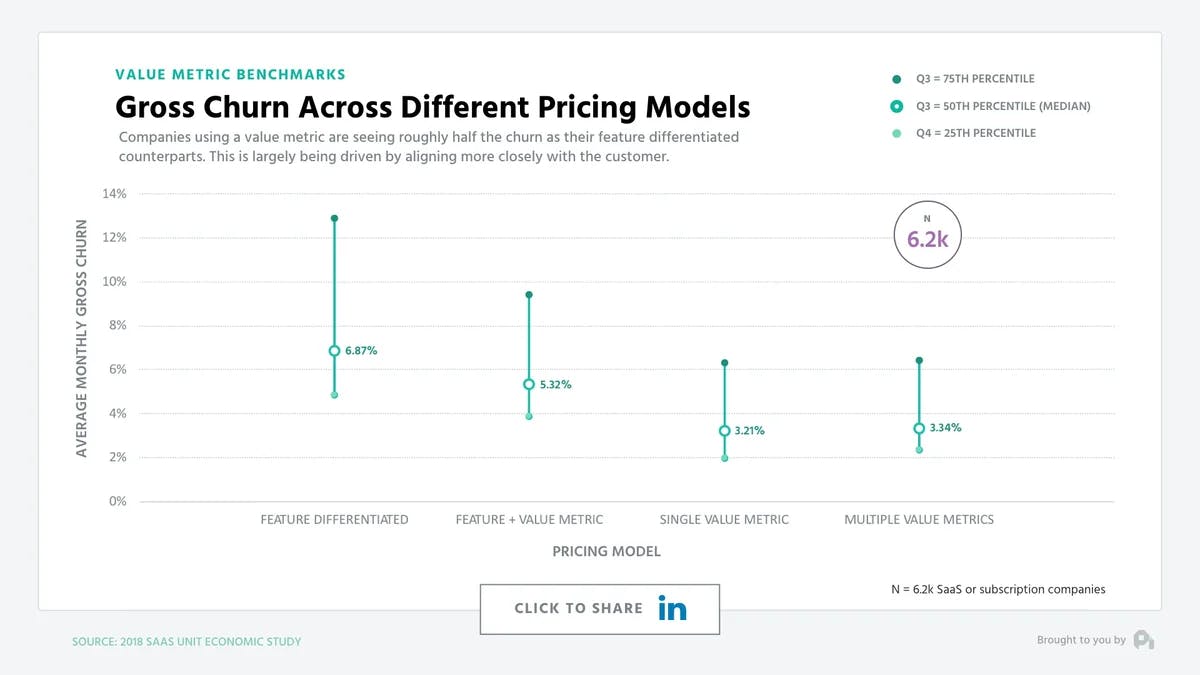

Gross logo churn rates of those companies who are utilizing a value metric are actually half those of those pricing based on feature differentiation.

Gross Churn Across Different Pricing Models

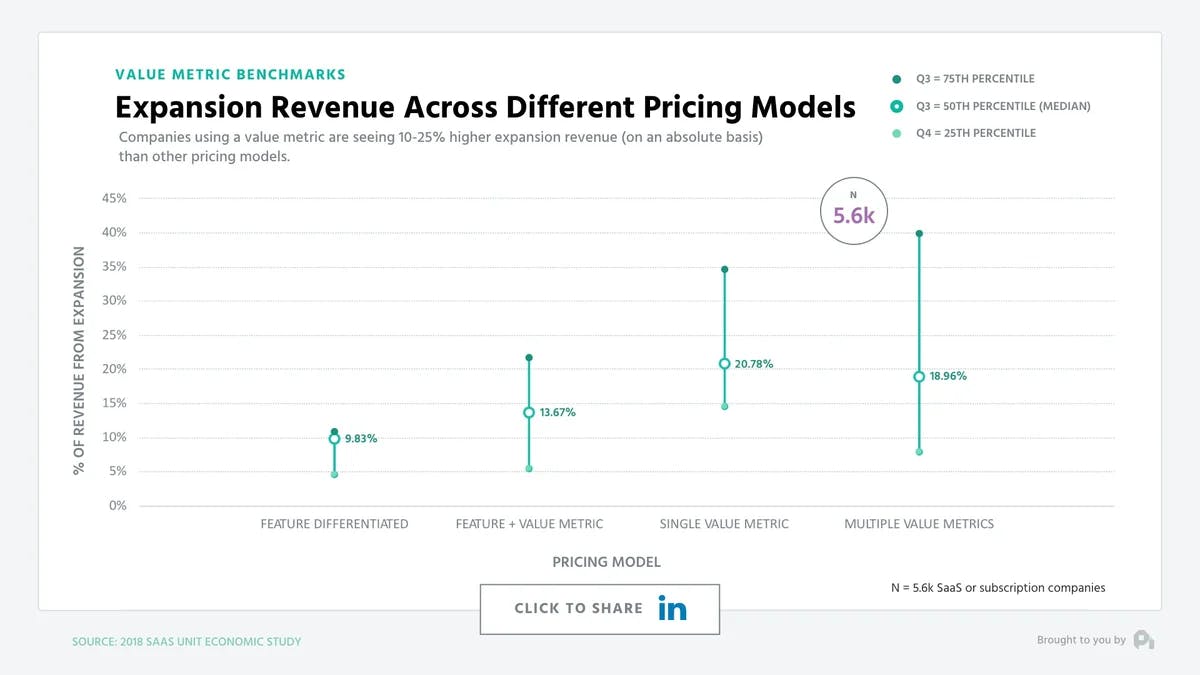

Plus, just raw expansion revenue as a proportion of overall revenue is higher - with value metric companies seeing roughly 10 to 25% higher expansion revenue on an absolute basis.

Signs You Have the Right Value Metric

Clearly a value metric is the way to go, but what are some signs you’ve hit the right one? First, I’d make sure you’re seeing this type of throughput from an expansion revenue perspective. If you’re seeing less than 15% of your revenue from expansion, you’re probably using the wrong metric.

Ultimately, the beauty of the subscription model is that with more and more technology coming into the billing mix, we now have the ability to fulfill the dream of commerce, which is to bake the relationship of our users directly into our pricing model, allowing a symbiosis to germinate and grow as that user continues to be nurtured by the value we’re providing.

Want to learn more? Check out our recent episode: How Discounts Impact Retention and subscribe to the show to get new episodes.

1

00:00:00,320 --> 00:00:03,060

You've got the questions,

and we have the data.

2

00:00:03,680 --> 00:00:04,240

Each week,

3

00:00:04,240 --> 00:00:07,440

we dive deep on benchmarks

of the subscription economy that

4

00:00:07,440 --> 00:00:09,375

you just can't get any else?

5

00:00:10,795 --> 00:00:13,375

This is the profit well report.

6

00:00:14,635 --> 00:00:17,810

Yo Patrick, it's zero

with publicity dot ai. Curious.

7

00:00:17,810 --> 00:00:21,330

What are the best practices

for pricing your SaaS offer in

8

00:00:21,330 --> 00:00:22,930

today's landscape? Zeal,

9

00:00:22,930 --> 00:00:26,050

that's an amazing backdrop

and also an amazing question

10

00:00:26,050 --> 00:00:30,195

because it gets to one of my

favorite topics of all time, value metrics.

11

00:00:30,195 --> 00:00:31,955

Value metrics are

what you charge for,

12

00:00:31,955 --> 00:00:34,435

where it could be some measure

of usage, some per user

13

00:00:34,435 --> 00:00:37,380

pricing, or even a cut of

cash made from a product.

14

00:00:37,380 --> 00:00:38,660

So to answer Zeeel's question,

15

00:00:38,660 --> 00:00:41,300

we looked at over six

thousand companies and data from nearly

16

00:00:41,300 --> 00:00:43,380

six hundred thousand

subscriber buyers,

17

00:00:43,380 --> 00:00:45,205

and here's what

we found. For one,

18

00:00:45,205 --> 00:00:48,005

it's hard to deny the impact

of value metrics on a business,

19

00:00:48,005 --> 00:00:49,845

particularly when

it comes to growth.

20

00:00:49,845 --> 00:00:53,090

When we compare companies

utilizing some value metric to

21

00:00:53,090 --> 00:00:56,210

those who are strictly

using feature differentiated pricing,

22

00:00:56,210 --> 00:00:58,770

those who use a value

metric are growing at nearly double

23

00:00:58,770 --> 00:01:01,155

the rate as their feature

differentiated counterparts.

24

00:01:01,155 --> 00:01:02,595

And the gap is widening.

25

00:01:02,595 --> 00:01:04,995

The growth differential for

value metric companies is

26

00:01:04,995 --> 00:01:08,115

because you're baking expansion

revenue directly into your

27

00:01:08,115 --> 00:01:10,950

pricing If you've aligned

your value metric correctly with

28

00:01:10,950 --> 00:01:12,310

your target customer base,

29

00:01:12,310 --> 00:01:14,230

then as they use

more of that metric,

30

00:01:14,230 --> 00:01:17,485

they're naturally inclined to

pay you more because they're

31

00:01:17,485 --> 00:01:18,925

getting more value. Plus,

32

00:01:18,925 --> 00:01:21,085

you won't have to fight tooth

and nail to convince them to

33

00:01:21,085 --> 00:01:23,645

upgrade for a feature

they probably don't need.

34

00:01:23,645 --> 00:01:26,530

Gross logo churn rates of

those companies who are utilizing a

35

00:01:26,530 --> 00:01:29,810

value metric are actually

half those of feature differentiated

36

00:01:29,810 --> 00:01:33,385

pricing models plus just

raw expansion revenue proportion of

37

00:01:33,385 --> 00:01:36,265

overall revenue was higher

with value metric companies seeing

38

00:01:36,265 --> 00:01:38,825

roughly ten to twenty

five percent higher expansion

39

00:01:38,825 --> 00:01:40,905

revenue on an absolute basis.

40

00:01:40,905 --> 00:01:43,200

Clearly, a vow you

metric is the way to go,

41

00:01:43,200 --> 00:01:46,320

but what are some signs you've

hit the right one? First,

42

00:01:46,320 --> 00:01:48,720

I'd make sure you're seeing

this type of throughput from an

43

00:01:48,720 --> 00:01:50,215

expansion revenue perspective.

44

00:01:50,215 --> 00:01:52,455

If you're seeing less than

fifteen percent of your revenue

45

00:01:52,455 --> 00:01:56,455

from expansion, you're probably using

the wrong value metric. Ultimately,

46

00:01:56,455 --> 00:01:58,920

the beauty of the subscription

model is that with more and

47

00:01:58,920 --> 00:02:01,080

more technology coming

into the billing mix,

48

00:02:01,080 --> 00:02:03,800

we now have the ability to

fulfill the dream of commerce,

49

00:02:03,800 --> 00:02:06,440

which has debate the

relationship of our users

50

00:02:06,440 --> 00:02:08,115

directly to our pricing model,

51

00:02:08,115 --> 00:02:11,075

allowing a symbiosis to

germinate and allowing those

52

00:02:11,075 --> 00:02:14,230

customers to grow as you

continue to provide them more you.

53

00:02:14,230 --> 00:02:16,390

Well, that's all for now.

If you have any questions,

54

00:02:16,390 --> 00:02:19,270

shoot me an email or video

to p c at profitable dot com.

55

00:02:19,270 --> 00:02:21,590

Let's also thank Zeal

for sparking this research by

56

00:02:21,590 --> 00:02:24,395

clicking the below to share on

LinkedIn to give him a nice

57

00:02:24,395 --> 00:02:26,655

little shout out. We'll

see you next week.

58

00:02:29,115 --> 00:02:32,500

This episode of the Proposal Report

is brought to you by GoSquared,

59

00:02:32,500 --> 00:02:36,820

intelligent software to convert

clothes and delight customers,

60

00:02:36,820 --> 00:02:38,280

GoSquared dot com.