Do More with Less: Maximizing Revenue Per Employee

The theme of the year has been to “do more with less”, which in turn has us all targeting efficient growth. Cutting back on internal software and squeezing every last drop out of the last funding round... Many have also been forced to reduce teams. Nearly 1,000 companies enacting over 200,000 layoffs so far. But layoffs are more than just numbers; they represent people. A reduction in force is a difficult business decision that leaves these people justifiably unhappy, but it's often necessary to set a company on the right path.

There’s one metric that reveals an honest picture of what is really going on in your company: revenue per employee. This underrated metric may seem simple, but understanding it can set your business up for hypergrowth and the spoils that come with it. We’re going to explore this metric in detail. We’ll speak with industry experts, uncover benchmarks that show you where your company stands, and discuss some tactical approaches other than layoffs to start doing more with less.

But first, if you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

Revenue Per Employee Benchmarks

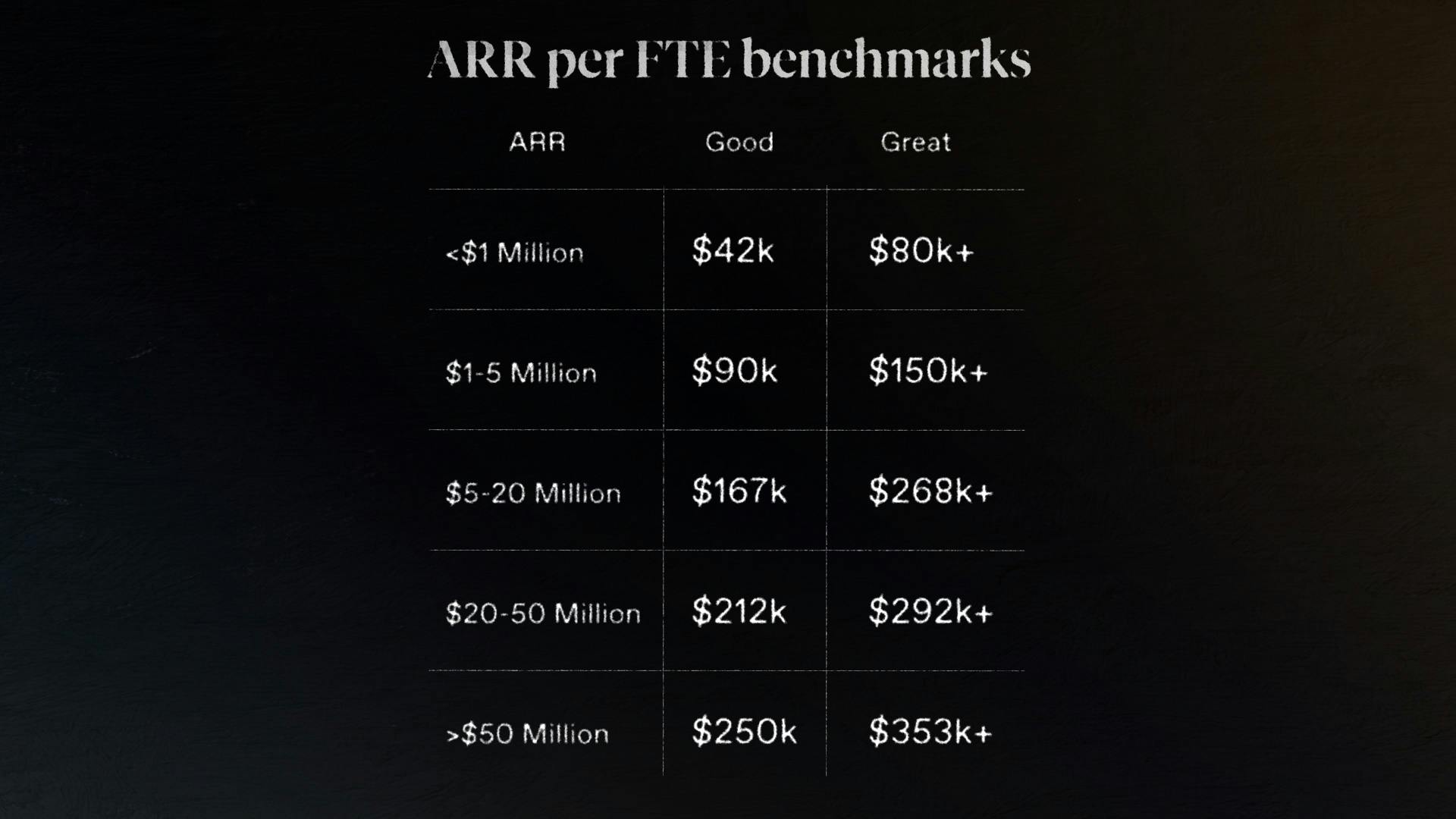

Revenue per employee. It’s a pretty straight forward calculation, you take your annual recurring revenue and divide it by the full-time employee count. By adding this dimension to your revenue numbers, you get a clear look into efficiency. Operational Efficiency is the blueprint to scale whether the goal is to become the next unicorn, IPO, or get acquired.

This piece was completed in tandem with our partner, OpenView. They've surveyed over 700 SaaS companies in order to bring these benchmarks to you. Sign up and get the full breakdown. What constitutes a good benchmark is going to fluctuate depending on where your ARR falls.

You’ll want to start tracking this metric once you’ve reached the $2.5m ARR mark. As your ARR increases, so should your ARR per employee. Once your ARR is more than $50m, a great place to be is $300,000 per full time employee. At that point, you’re well positioned to IPO.

Make sure you check out the full benchmark breakdown from OpenView to see where you stack up with other high-margin software companies.

How it Relates to Layoffs

So if your revenue per employee is in good standing you can avoid layoffs, right? Well, not historically speaking.

Expensify - the expense automation software founded in 2008 - has nothing to worry about with their ARR/FTE numbers. They currently sit atop the leaderboards - making over $1 million in ARR per employee. That's $700k more than what we consider a great place to be. They managed to go through this year without any layoffs and famously have only laid off 20 people since they were founded.

However, Dropbox, tells a different story. Despite making over $750K in ARR per employee, they laid off 500 people in April. Like most companies who go through layoffs, slowing growth was a big factor in the decision. CEO Drew Houston points to AI as a factor stating “The AI era of computing has finally arrived.”

AI might have arrived, but automation is not a new concept. It’s been a factor going all the way back to at least the 16th century, with the mechanization of textiles. There isn’t a 100% guarantee that layoffs can and should be avoided. In fact, Dropbox found itself in a better financial position since this move. As automation improves, technical founders have more tools than ever before to improve their efficiency. But as CJ Gustafson alludes to, company value is a factor of growth rates and you can’t cut your way to growth.

How to Improve Operational Efficiency

So what are some other strategies that you can utilize in order to shore up your operational efficiency? Well, the first thing is to tighten operational processes to reduce costs. By taking an audit of the tools that your team uses, you can figure out where some might be redundant.

Next, look towards expansion revenue. In the past four recessions, expansion revenue has stayed consistent. While it may seem counterintuitive to ask for more money during a slowdown, there are many different ways to provide value so that an upgrade seems like a no brainer. Run a multi-product strategy, add upsell tiers to your pricing, create an add-on… As long as you are meeting the needs of your customers, reach out to them to see if they’re willing to pay more.

And finally, ensure you’re not letting customers walk out the door so easily. Don’t prevent them from leaving, but set up systems that add the right amount of friction to at least gather some data as to why they are leaving. Churn might elevate during times of turmoil, but addressing things like payment failures can be a good start as well This can amount to up to 40% of your churn.

For more, we’ve got plenty of documentation on all sorts of ways to improve your efficiency, as well as a multitude of products that do this work for you.

Reach out if you have any questions, and make sure to check out the OpenView benchmark report. I’ll see you in the next one!

If you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

00:00:00:08 - 00:00:19:01

Ben Hillman

Do more with less. We will have to do more with less, do more with less. Do more, much more with less. Which in turn has us all targeting efficient growth, cutting back on internal software and squeezing every last drop out of the last funding round. Many have also been forced to reduce teams. The tech giant scaling back, slashing its global workforce.

00:00:19:02 - 00:00:43:13

Ben Hillman

Second round of layoffs, nearly 1000 companies enacting over 200,000 layoffs so far. But layoffs are more than just numbers. They represent real people. A reduction in force is a difficult business decision that leaves these people justifiably unhappy. But it's often necessary to set a company on the right path. There's one metric, though, that reveals an honest picture of what this growth actually looks like.

00:00:43:15 - 00:01:08:05

Ben Hillman

Revenue per employee. This underrated metric may seem simple, but understanding it can set your business up for hypergrowth and the spoils that come with it. We're going to explore this metric in detail. We'll speak with industry experts, uncover benchmarks that show you where your company stands and discuss some tactical approaches other than layoffs to start doing more with less so revenue per employee.

00:01:08:05 - 00:01:28:07

Ben Hillman

It's a pretty straightforward calculation. You take your annual recurring revenue and you divide it by the full time employee count, by adding this dimension to your revenue numbers. You get a clear look into efficiency. And as we know, operational efficiency is the blueprint to scale, whether the goal is to become the next Unicorn IPO or even get acquired.

00:01:28:09 - 00:01:46:07

Ben Hillman

But being efficient also makes it possible to avoid sudden macroeconomic shifts. No number is perfect, of course, if your burn is out of control, this isn't going to show everything. So definitely keep an eye on that too. But don't just take my word for it. T.J. Gustafson, a CFO and writer behind the blog, mostly metrics breaks it down.

00:01:46:09 - 00:02:04:15

CJ Gustafson

This metric really drills into the core economics of any company because you can't really drill down any further. You have a company that's doing, say, 10 million in revenue. They've got 50 employees and they're super excited about the traction they're seeing. So they go out and raise a whole lot of money in 12 months at 14 million in revenue.

00:02:04:15 - 00:02:25:14

CJ Gustafson

But now they're at like 130 employees. You're really looking at the productivity of the entire org, how you're staffing it, because at startups, 70 to 75% of all costs walk on two legs and then the top line output that you're getting. I still think that you should look at other metrics along the way, like you shouldn't just stop at the top line because the company could be burning a ton of cash.

00:02:25:17 - 00:02:44:08

CJ Gustafson

So in addition to, say, this top line check, I would also take a look at what the company's gross margin is. You could even do gross margin per employee. So that shows the leverage of what your company has to spend after it pays the cost to serve the customer. And then I would also look at free cash flow per employee to see how much you're actually generating to put back in shareholder hands.

00:02:44:08 - 00:02:50:22

CJ Gustafson

Era per employee, I have to admit, does go out the window. If you're burning so much cash that you won't stay in business full stop.

00:02:51:00 - 00:03:14:12

Ben Hillman

Once he's calculated your revenue per employee numbers, you've got to figure out where it stacks up compared to others. Fortunately, open you calculated benchmark data by looking at thousands of software companies so that you can see where you stand with your numbers. Sign up to get the full report below to dive into all that good stuff. But for now, what constitutes a good benchmark is going to fluctuate depending on where your IRR falls.

00:03:14:13 - 00:03:32:21

Ben Hillman

You want to start tracking this metric once you've reached the $2.5 million RR mark As your RR increases, so should your RR per employee. Once your RR is more than $50 million, a great place to be is $300,000 per full time employee. At that point, you're well positioned to IPO.

00:03:32:23 - 00:03:51:06

CJ Gustafson

You're not going to be at $100,000 overnight. Like it's not that common for a series, a company to be able to generate that because you do need to, you know, add employees and believe that you're going to grow into that over time. But you do want to see that you're getting incrementally more out of each employee as you progress through the company's life cycle.

00:03:51:08 - 00:04:12:12

Ben Hillman

Make sure you check out the full benchmark breakdown from OpenView to see where you stack up with other high margin software companies. So if your revenue per employee number is in good standing, then you can avoid layoffs altogether. Right? When I, historically speaking, expensify the expense automation software founded in 2008 has nothing to worry about with their RPA FTE numbers.

00:04:12:14 - 00:04:35:01

Ben Hillman

They currently sit atop the leaderboards making over $1 million an hour per employee. That's 700 K more than what we consider a great place to be. They actually manage to go through this year without any layoffs and famously have only laid off 20 people since they were founded. However, Dropbox tells a different story, despite making over 750 K and R per employee.

00:04:35:05 - 00:04:48:14

Ben Hillman

They laid off 500 people in April. Like most companies who go through layoffs, slowing growth was a big factor in the decision. CEO Drew Houston points to air as a factor, stating the era of computing has finally arrived.

00:04:48:20 - 00:05:05:23

CJ Gustafson

It's not always just a binary decision of saying yes or no. We need head count or not. It's more nuance is that head count and then that resources is deployed in the right department, in the right place. I think that's what you're seeing with Dropbox. They cut heads, maybe it for a call center. I don't even know. And maybe that's what I is taking the job of.

00:05:06:05 - 00:05:13:04

CJ Gustafson

And then they're redeploying resources to build AI into their product, which they think is a better return for shareholders in the long run.

00:05:13:05 - 00:05:37:08

Ben Hillman

Artificial intelligence has arrived, but automation is not a new concept. It's been a factor going all the way back to at least the 16th century with the mechanization of textiles. There isn't a 100% guarantee that layoffs can and should be avoided. In fact, Dropbox found itself in a better financial position since their move. As automation improves, technical founders have more tools than ever before to improve their efficiency.

00:05:37:10 - 00:05:43:14

Ben Hillman

But as E.J. alludes to company value is a factor of growth rates, and you can't cut your way to growth.

00:05:43:15 - 00:06:13:11

CJ Gustafson

HeadCount cuts don't have an immediate impact on run rate performance. And I'll give you kind of a couple of reasons why. The first one that it doesn't immediately show up in the panel is that there are onetime costs related to severance that actually cause a temporary increase in spend. And the second reason is that the teams who have the headcount cuts still need to stabilize after If you think about like the core group of people you work with today, you're probably not going to be as efficient the next day if you cut a node out of that ecosystem.

00:06:13:12 - 00:06:35:14

CJ Gustafson

To be frank, there's also a motivation issue. You may start to think, Well, my next and you may not be working as hard. And the third, it's common for orgs to still backfill roles that they just cut just in different functional areas. So they're almost swapping one for one. If you ran this out in perpetuity, yes, there would be some sort of apex, you know, run rate adjustment, but it's just not as simple or as soon as you would think.

00:06:35:15 - 00:06:55:14

Ben Hillman

So what are some other strategies that you can utilize in order to shore up your operational efficiency? Well, the first thing is to tighten operational processes to reduce costs by taking an audit of the tools that your team uses. You can figure out where some of them might be redundant. Next, look towards expansion revenue. In the past four recessions, expansion revenue has stayed consistent.

00:06:55:15 - 00:07:13:16

Ben Hillman

While it may seem counterintuitive to to ask for more money during a slowdown, there are many different ways to provide value so that an upgrade is a no brainer. Run a multiproduct strategy. Add upsell tiers to your pricing, Create an add on. As long as you're meeting the needs of your customers, reach out to them to see if they're willing to pay more.

00:07:13:21 - 00:07:33:03

Ben Hillman

And finally, ensure you're not letting customers walk out the door so easily. Don't prevent them from leaving, but set up systems to add the right amount of friction to at least gather some data as to why they are leaving. Churn might elevate during times of turmoil, but addressing things like payment failures can be a good start as well.

00:07:33:05 - 00:07:51:17

Ben Hillman

This can amount to up to 40% of your churn for more. We've got plenty of documentation as well as other videos on all sorts of ways to improve your efficiency as well as a multitude of products that do this work for you. Tracking your revenue per employee and stacking it up against what is considered healthy can let you get out ahead of growth problems.

00:07:51:19 - 00:08:04:06

Ben Hillman

Stewarding the valuation of your software company is all about making sure your revenue grows faster than your costume. And as we can see, a reduction in force is only a temporary fix that could potentially cause problems if it's not handled with care.

00:08:04:09 - 00:08:23:08

CJ Gustafson

You always want to have the best performing people at any company. You also want to know, though, that you don't have to get rid of people who are hard working and contributing every day because you didn't make the right decisions of how much money to raise or how to run an operating plan. It shows up as a number on paper, but there is a person behind that with a family and they're trying to hold down the job too.

00:08:23:09 - 00:08:25:20

CJ Gustafson

So there's a human element to it as well that you have to consider.

00:08:25:20 - 00:08:40:03

Ben Hillman

You can't predict a downturn in the economy just like you can't force customers to stay when they have to leave due to the same problems that you're facing. You can find more information on these sorts of metrics by checking out open views, benchmark reports. Good luck out there and I'll see you next time.