4 Keys to SaaS Success in 2024

Let’s talk about four ways to drive growth in 2024. In our research of over 700 companies, in partnership with OpenView, we’ve clearly seen a rise in focus on the less sexy side of SaaS growth - operational levers that don’t usually get the airtime of acronyms like AI or PLG or ABM. We are calling this ‘the rise of the operator’, and what follows are the four areas to focus on.

But first, if you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

Internationalization

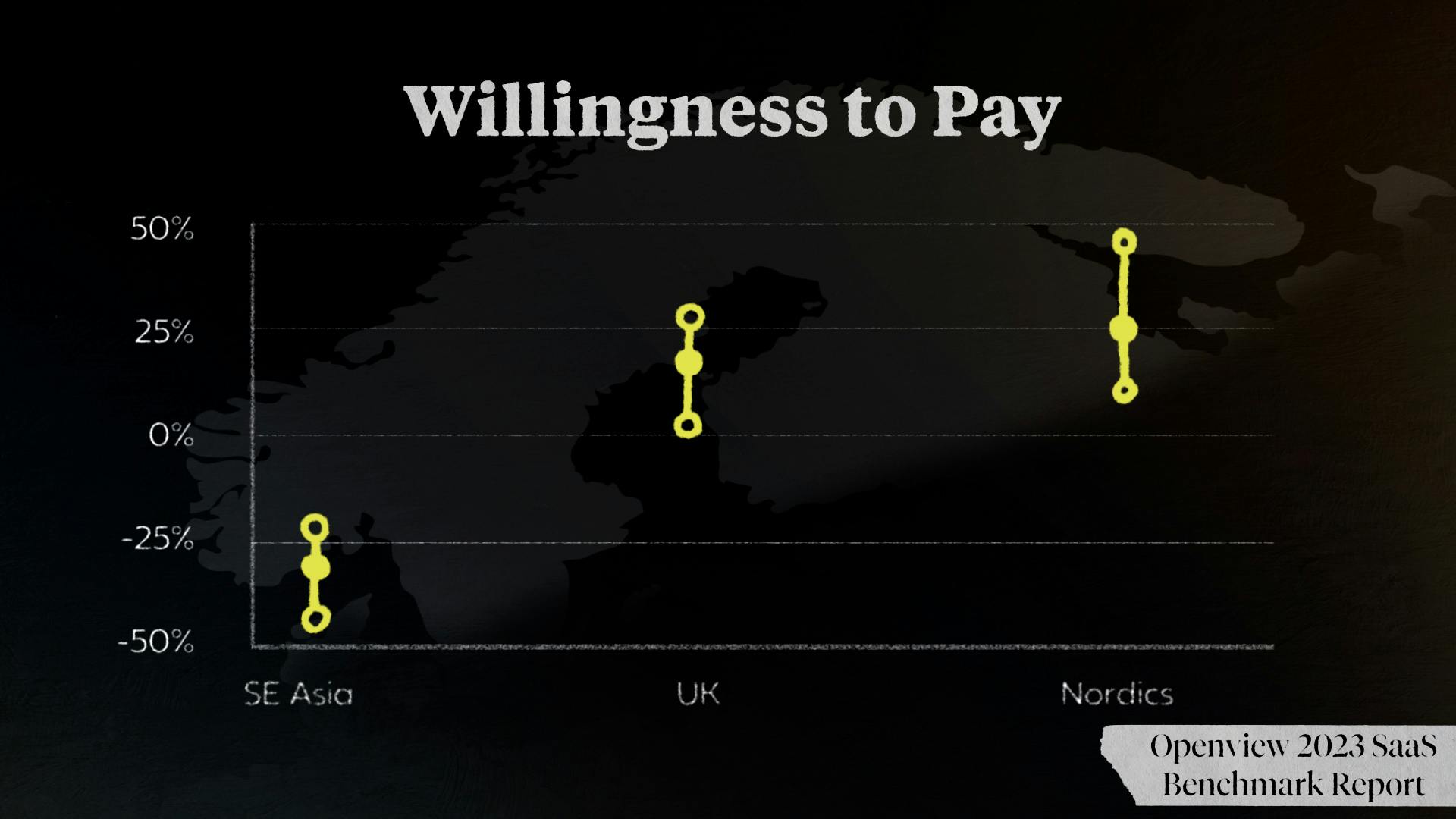

Historically, US SaaS companies have waited to expand internationally until relatively late in their lifecycle. Expanding abroad was seen as complicated and costly. That’s still the case today, but the new wave of product-led SaaS companies are international by default. And as the US market slows and international markets mature rapidly, selling internationally can give a huge boost in revenue. product-led startups are ‘always on’ for customers to discover, try, and buy - regardless of location. When it comes to internationalization, you can take different approaches. Cosmetic localization - simply changing your currency symbols to adapt to buyers from different countries. Or True localization - localizing pricing based on willingness to pay.

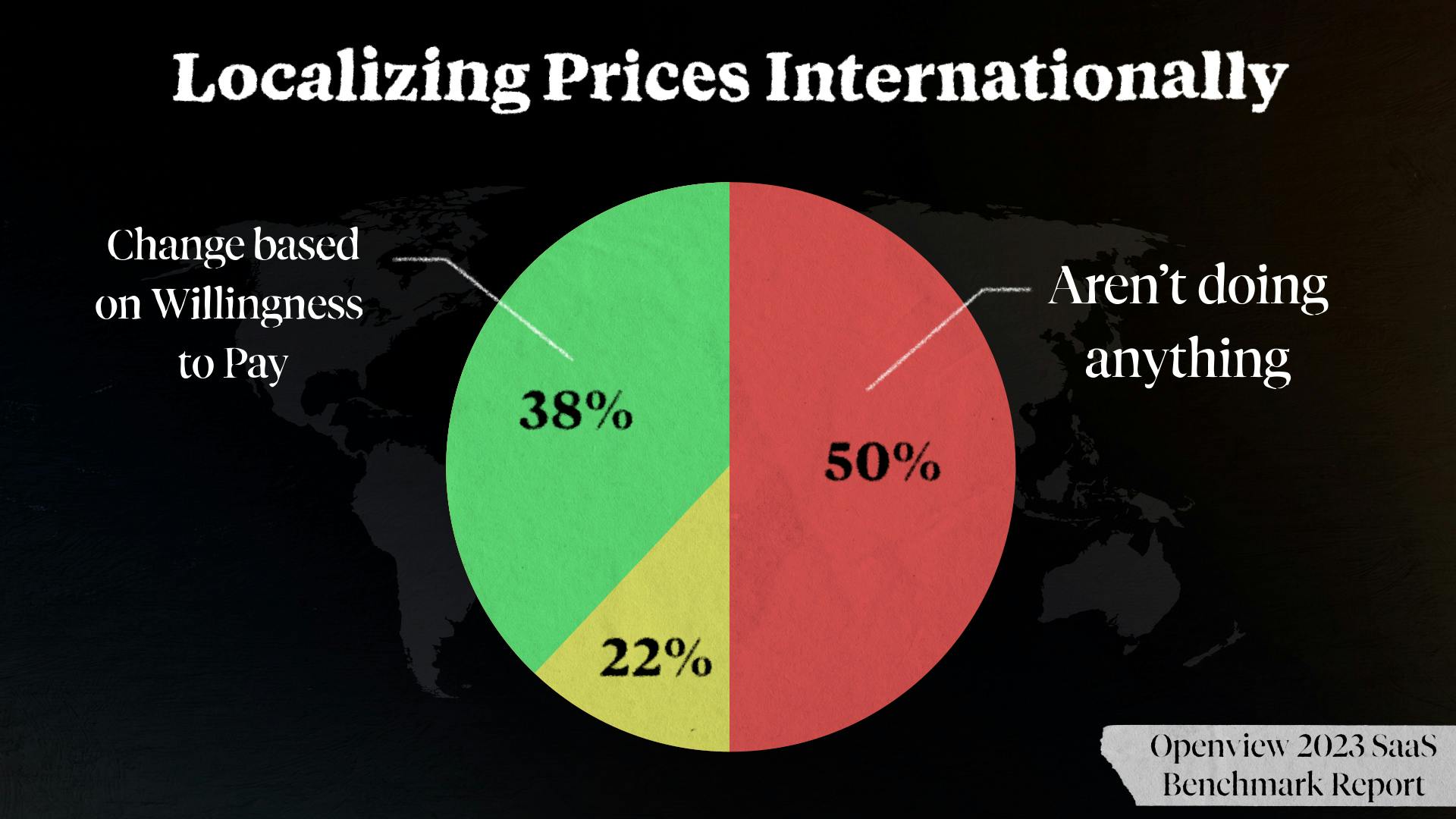

For example the Nordics are willing to spend more than South America. When we look at benchmark data, 50% of companies aren’t adjusting their prices based on location at all. And only 38% adjust based on local willingness to pay. You can be an outlier by monetising effectively, everywhere you sell.

Cost of Finance

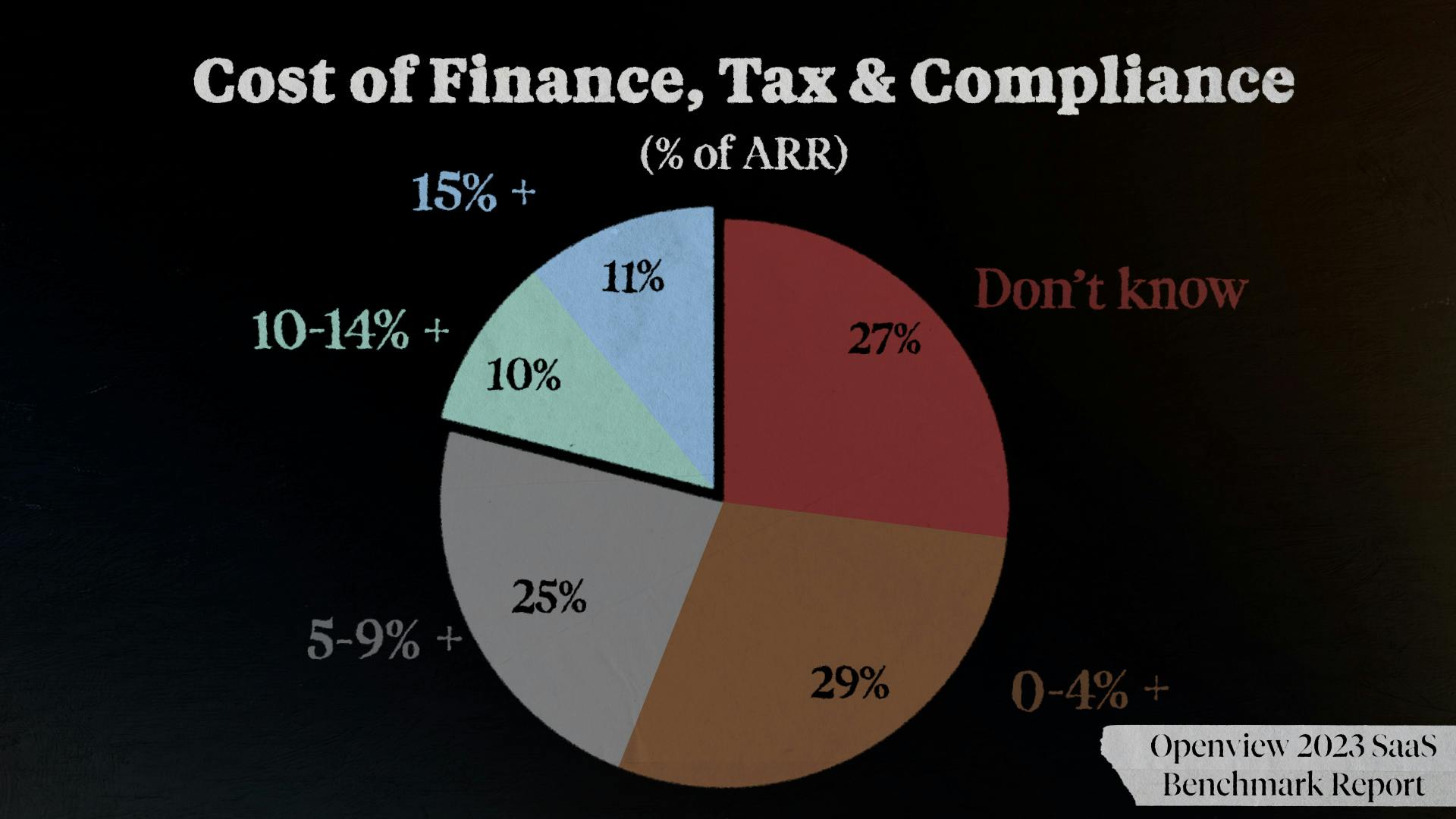

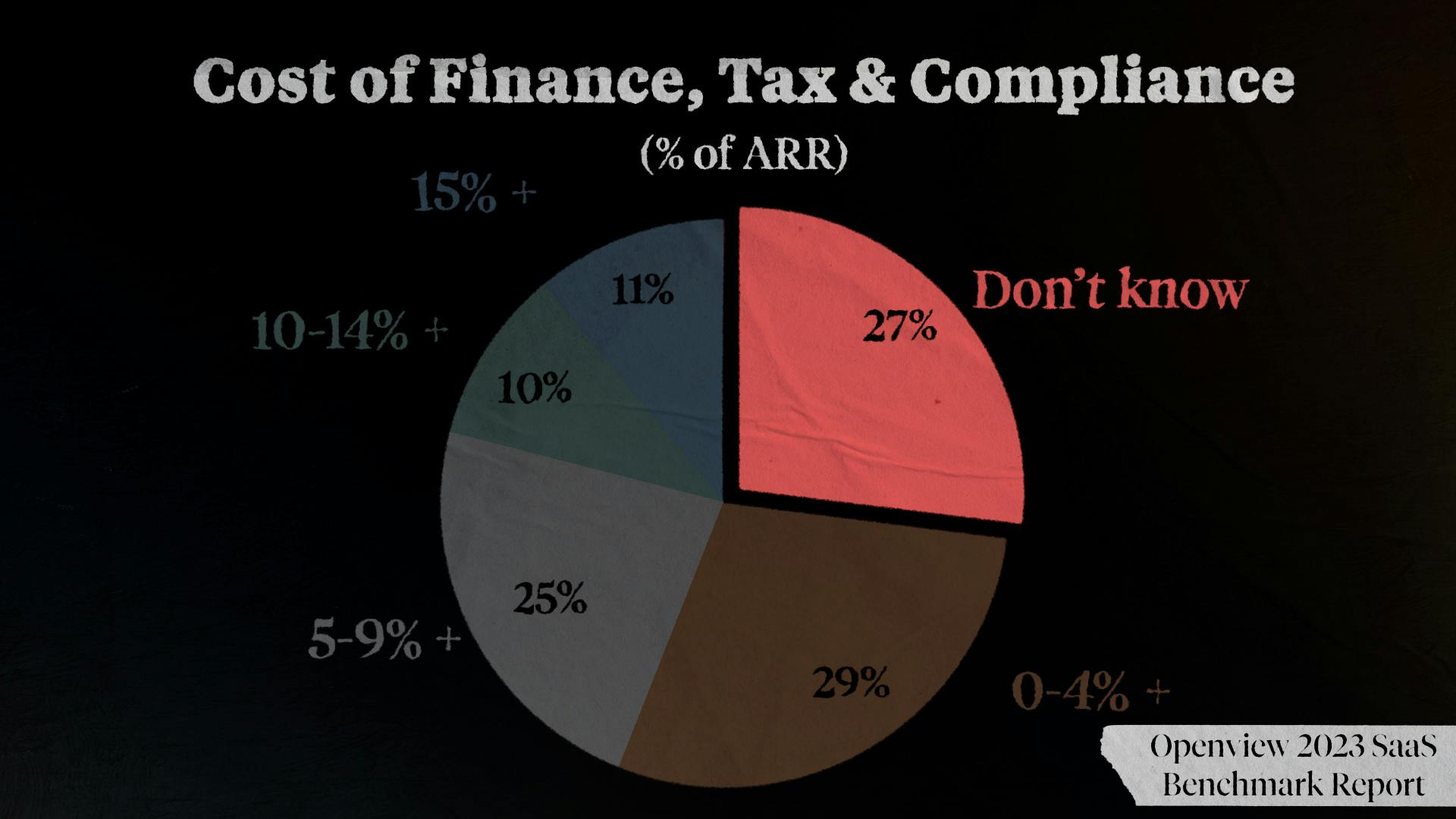

When money was cheap, overheads were not under scrutiny. But now, every cost line is subject to an efficiency imperative. One of these is the cost of finance, tax and compliance. According to our Benchmark data: We found that one out of every five companies surveyed are spending 10% or more of their ARR on finance, tax and compliance

That's an extremely high cost - often higher than the hosting infrastructure that supports your software product! On the other side of the graph, only 29% of respondents are paying under 4%. Sales tax and compliance is extremely complicated and it often results in high costs, as businesses sell across country and state lines - and PLG businesses face this complexity much earlier in their growth journey. Of course we’d say this… but using a Merchant of Record like Paddle to replace your payment infrastructure can reduce cost (our internal customer data shows by up to half).

Going back to our Benchmark data, the most alarming statistic we found is that 27% of respondents didn’t track the cost of their finance, tax and compliance. By keeping track of your overheads, you’re able to make more informed decisions about your spend and in turn, your efficiency.

Payments

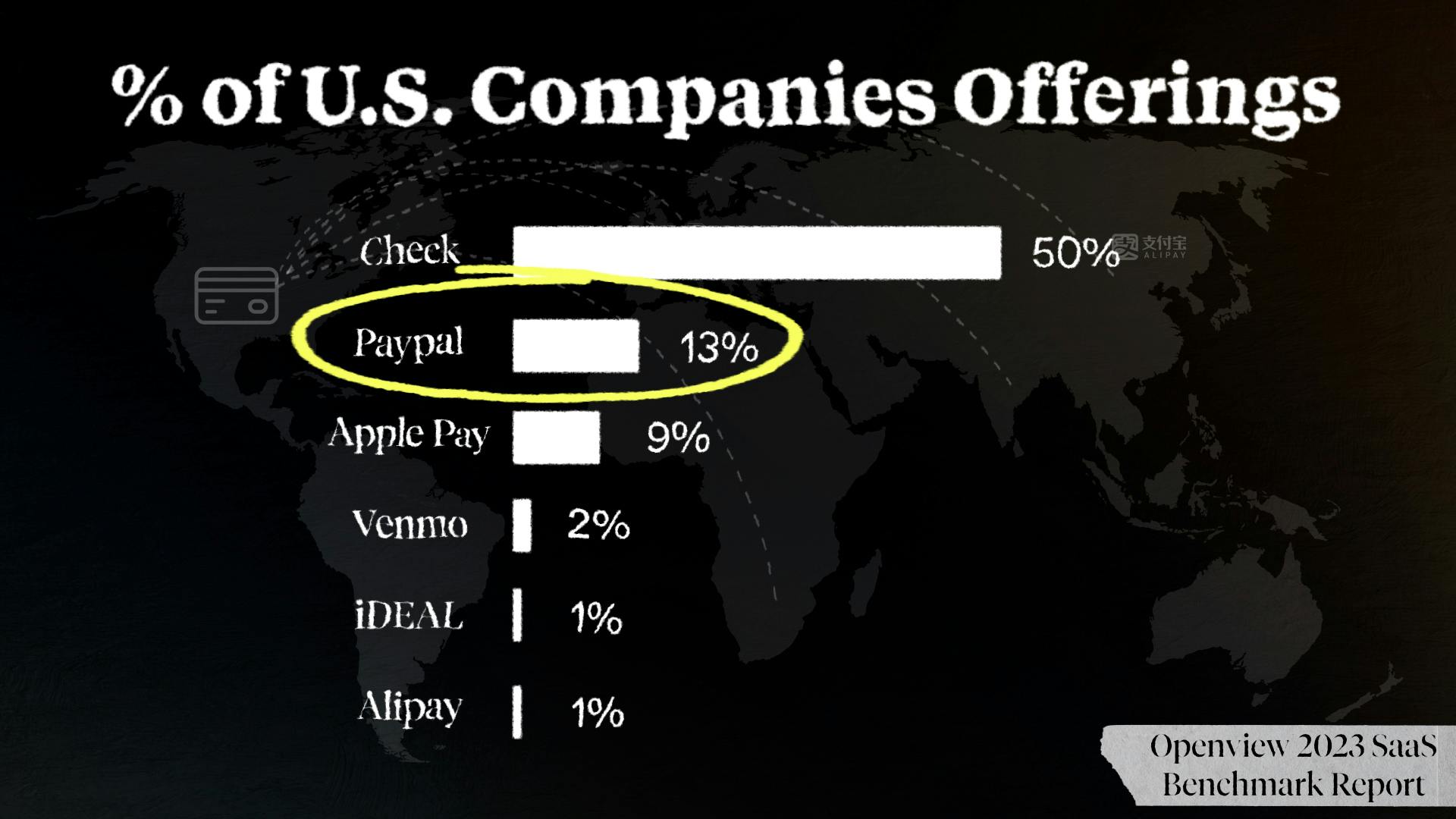

Particularly in PLG or international businesses, another overlooked lever is the impact of payment methods. Your customers will prefer various different methods - and you are suppressing your conversion rate if you don’t dive into the detail. Companies based in the US tend to expect customers from all over the world to pay the same way they do. That's just not the case. Germany loves PayPal, China loves Alipay and the Netherlands love iDEAL.

With only 4% of the Chinese market preferring credit cards trying to sell a product in China, a credit card only option would result in you leaving money on the table. It turns out only 13% of companies are offering PayPal, 9% offer Apple Pay and the international markets using iDEAL and Alipay are almost guaranteed to be left out. By including a wide range of payment methods you can satisfy your customers' individual needs and drive efficient revenue growth.

Payments

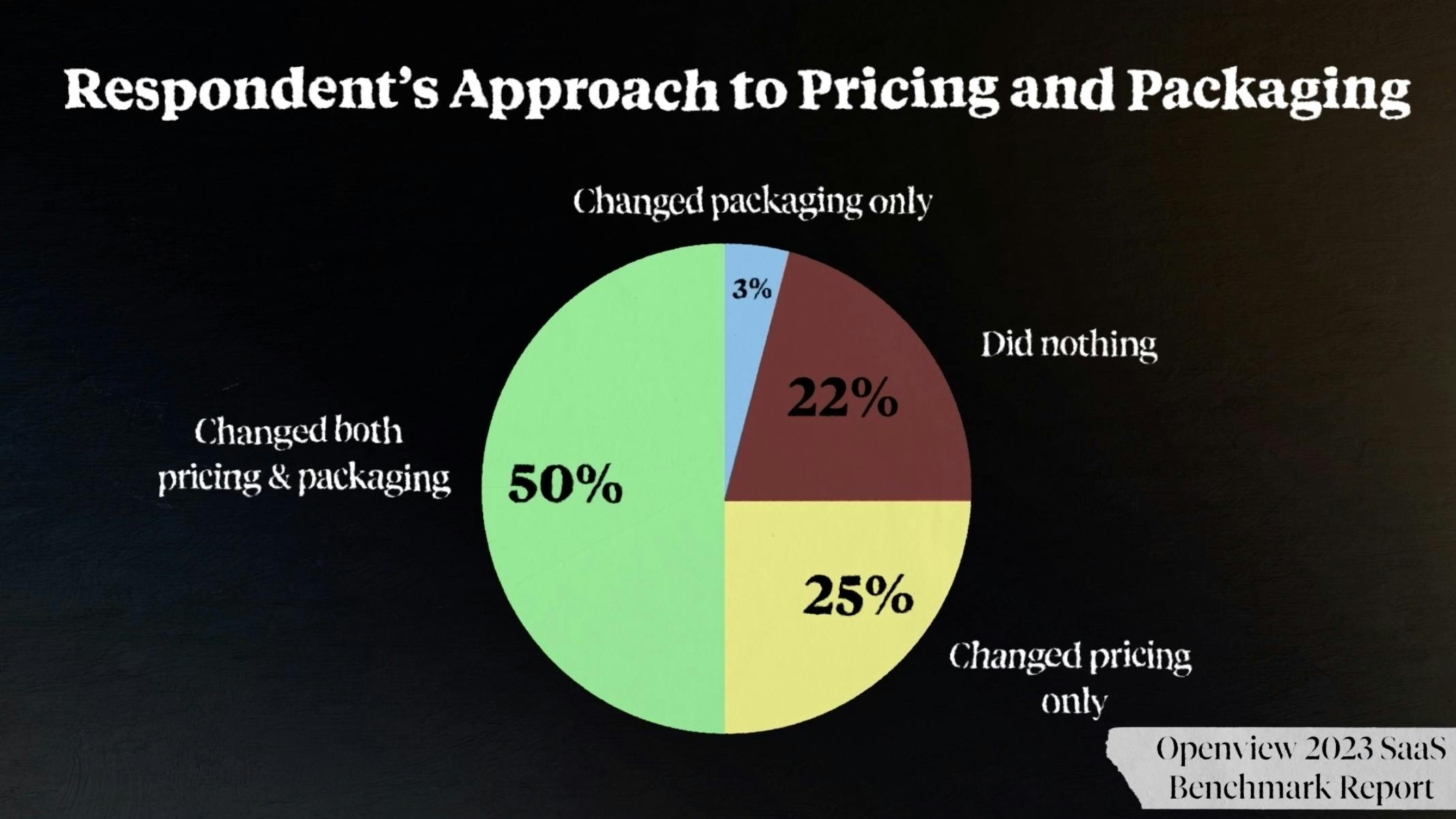

Pricing and packaging is one of the fastest and cheapest ways to impact revenue growth. The median impact from changing pricing was a 14% increase on NDR among expansion stage software companies. What’s positive is that 78% of respondents are actively changing either their pricing or packaging.

That’s a great first step. But the data shows that the majority of companies who changed their pricing, conducted a short internal analysis taking less than a month. Hit us up if you’d like to understand how simple quantitative studies can give you real customer willingness to pay data - and we can also send you our free guide to pricing strategy.

As an operator, doing more with less means making smart, data-informed decisions and knowing where you stand. This is crucial to help guide you towards efficient growth. Make sure to check out our 2023 Benchmark Report for a ton more insights on everything from AI to operational efficiency and see where you stack up as we head into 2024.

If you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

00:00:00:00 - 00:00:18:07

Andrew

Let's talk about four ways to drive growth in 2024. In our research of over 700 companies in partnership with OpenView, we've clearly seen a rise in focus on the less sexy side of SaaS growth operational levers that don't usually get the airtime of acronyms like Air or PLG or ABM.

00:00:18:09 - 00:00:25:19

Andrew

And we're calling this the rise of the operator. And what follows are the four areas to focus on as we approach next year.

00:00:25:19 - 00:00:46:21

Andrew

Historically, U.S. SAS companies have waited to expand internationally until relatively late in their lifecycle. Expanding abroad was seen as costly and complicated, and that's still the case today. But the new wave of product led SAS companies are international by default. Does the U.S. market slows and international markets mature rapidly?

00:00:46:23 - 00:01:10:18

Andrew

Selling internationally can give a huge boost in revenue. Product led startups are always on for customers to discover, try and buy regardless of location. And when it comes to internationalization, you really can take a few different approaches. Cosmetic localization, simply changing your currency symbols to adapt to buyers from different countries or true localization localizing pricing based on willingness to pay.

00:01:11:00 - 00:01:12:14

Andrew

For example, the Nordics are

00:01:12:14 - 00:01:14:22

Andrew

willing to spend more than South America.

00:01:14:22 - 00:01:17:01

Andrew

And when we look at benchmark data,

00:01:17:01 - 00:01:25:15

Andrew

50% of companies aren't adjusting their prices based on location at all, and only 38% adjust based on local willingness to pay.

00:01:25:17 - 00:01:30:06

Andrew

You can be an outlier by monetizing effectively every way you sell.

00:01:30:09 - 00:01:41:20

Andrew

When money was cheap, overheads were not really under scrutiny, but now every cost line is subject to an efficiency imperative. And one of these is the cost of finance tax compliance, your payments infrastructure.

00:01:41:20 - 00:01:50:20

Andrew

According to our benchmark data, we found that one out of every five companies are spending 10% or more of the RR on finance tax compliance.

00:01:50:21 - 00:02:11:11

Andrew

That's an extremely high cost, often higher than the hosting to support your software product. And on the other side of the graph, only 29% of respondents are paying under 4% sales tax. And compliance is extremely complicated and it often results in high costs as you sell across country and state lines and product led businesses face this complexity much earlier in their growth journey.

00:02:11:13 - 00:02:30:06

Andrew

Of course we'd say this, but using a merchant of record like pothole to replace your payments infrastructure can reduce costs. Our internal customer data shows by up to half. Going back to the benchmark data, the most alarming statistic we found is that 27% of respondents just didn't track the cost of their finance tax compliance.

00:02:30:06 - 00:02:37:05

Andrew

By keeping track of your overheads, you're able to make more informed decisions about your spend and in turn your efficiency,

00:02:37:05 - 00:02:40:20

Andrew

particularly in product led growth or international businesses.

00:02:40:22 - 00:02:59:18

Andrew

Another overlooked lever is the impact of payment methods. Your customers will prefer different methods, and you're suppressing conversion rates If you don't dive into the detail. Companies based in the US tend to expect customers from all over the world to pay in the same way that they do. But that's just not the case. Germany loves PayPal,

00:03:00:00 - 00:03:00:22

Andrew

China loves Alipay.

00:03:00:22 - 00:03:06:03

Andrew

The Netherlands love ideal with only 4% of the Chinese market preferring credit cards,

00:03:06:03 - 00:03:07:09

Andrew

trying to sell a product in

00:03:07:12 - 00:03:08:01

Andrew

China,

00:03:08:03 - 00:03:24:14

Andrew

a credit card only option would result in you leaving money on the table. It turns out that only 30% of companies offering PayPal, 9% offer Apple Pay, and the international markets using ideal Alipay are almost guaranteed to be left out by including a wide range of payment methods.

00:03:24:19 - 00:03:29:16

Andrew

You can satisfy all your customers individual needs and drive efficient revenue growth.

00:03:29:16 - 00:03:48:09

Andrew

Pricing of packaging is one of the fastest and cheapest ways to impact your revenue growth. The median impact from changing pricing was a 14% increase on net dollar retention among expansion stage software companies. What's positive is that 78% of respondents are actively changing either pricing or packaging.

00:03:48:10 - 00:04:05:14

Andrew

That's a great first step. But the data shows that the majority of companies who changed their pricing just conducted a short internal analysis. Less than a month. Hit us up if you'd like to understand how simple quantitative studies can give you real customer willingness to pay data, we can also send you a free

00:04:05:14 - 00:04:07:11

Andrew

guide to pricing strategy

00:04:07:11 - 00:04:08:13

Andrew

as an operator.

00:04:08:15 - 00:04:18:03

Andrew

Doing more with less means making smart data informed decisions and knowing where you stand. This is crucial to help guide you towards efficient growth.

00:04:18:03 - 00:04:25:08

Andrew

Check out this video on the screen to get a ton more data and information to help you become an outlier and a true operator.