Expansion Revenue is Your Lifeblood

This episode might reference ProfitWell and ProfitWell Recur, which following the acquisition by Paddle is now Paddle Studios. Some information may be out of date.

Originally published: March 28th, 2018

Expansion revenue is the lifeblood of a successful subscription business, particularly when it comes to looking at growth.

On this episode of the ProfitWell Report, Fred Stevens-Smith, CEO and Co-founder of Rainforest QA asks us to dive into the data around expansion revenue. To answer Fred's question, let’s look at the data from over 5,000 companies and 300,000 subscription consumers.

But first, if you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

The Fuel for Efficient Companies

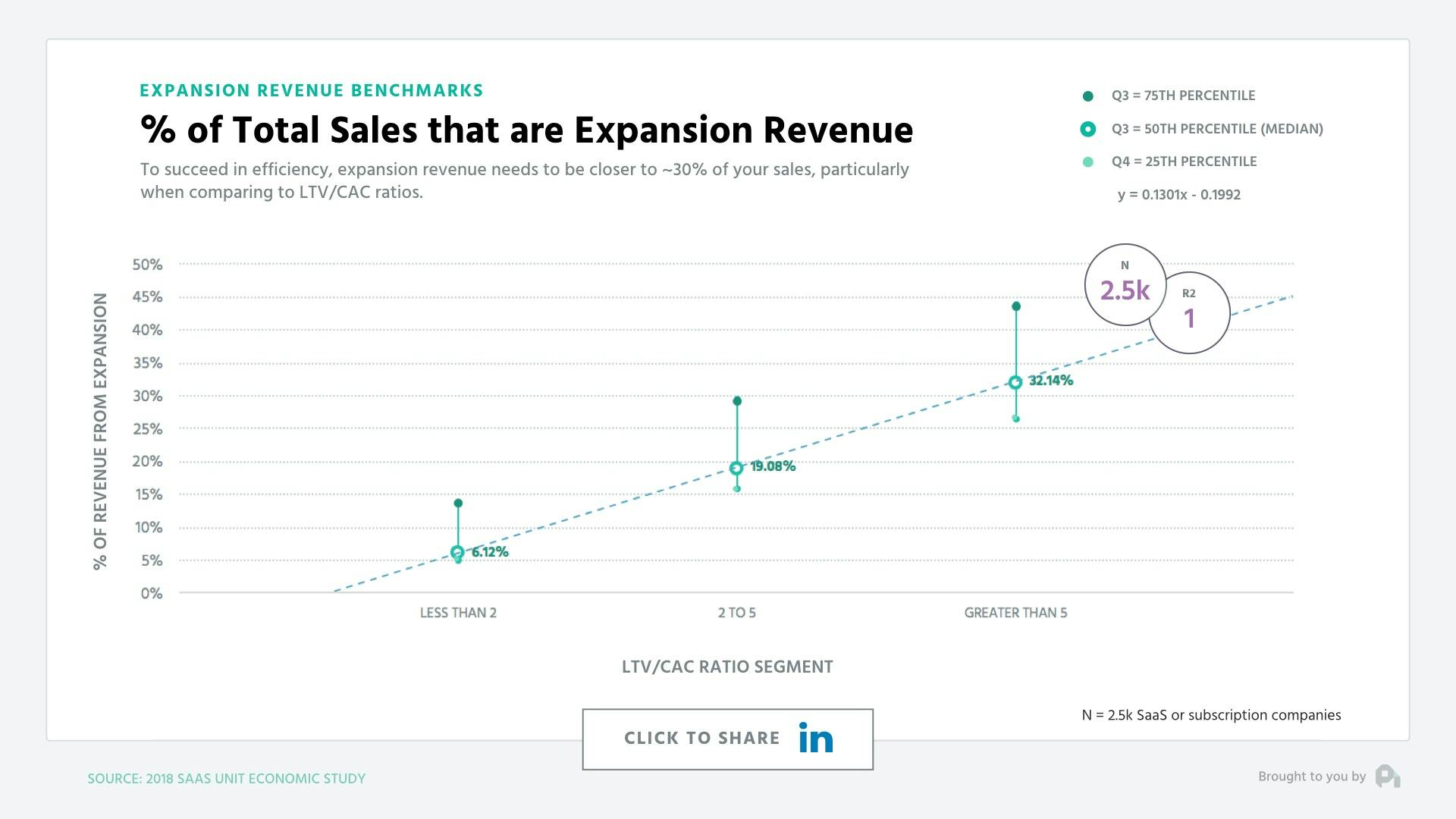

The most efficient companies when looking at LTV to CAC ratios are fueling that efficiency mainly off expansion revenue. Note that companies who have an LTV to CAC between three and five are seeing a median of just under 20% expansion revenue as a proportion of their total revenue. Those with an LTV to CAC above five are pushing above 30% in terms of expansion revenue.

Growth Cohort Compared to Expansion Revenue

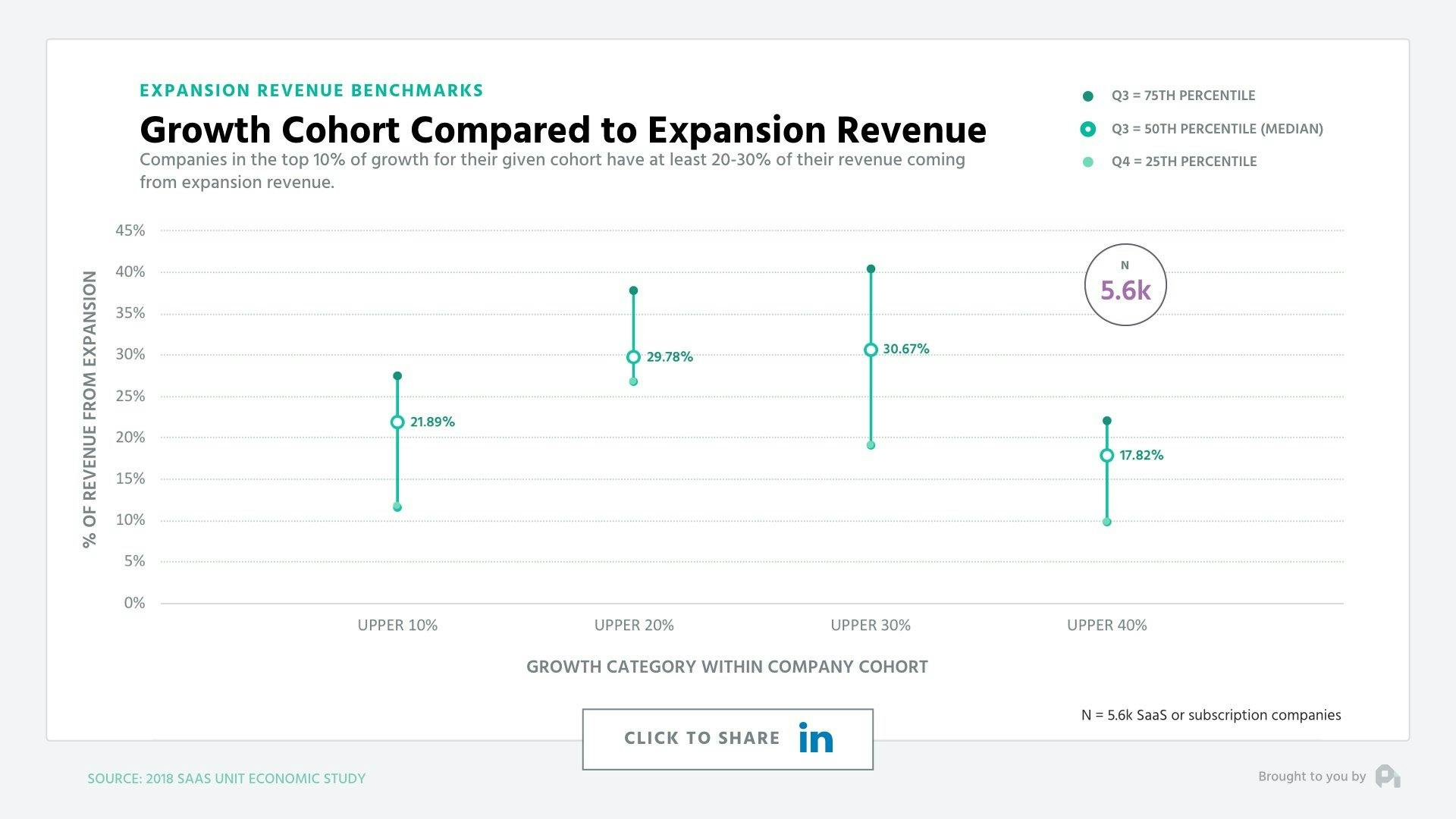

Efficiency doesn’t tell the whole story though. Growth is important, and if you’re efficient you’re not always investing in growth. Interestingly enough though, companies growing in the Top 40% of their cohorts are seeing at least roughly 20% of their revenue coming from expansion and a high end of nearly 40% expansion revenue.

How much more?

We’ve seen a good crop of externalities for companies who have cracked the 30% threshold when it comes to expansion revenue. ARPU tends to be growing at 2x the rate as those companies with expansion below that threshold. Revenue retention is typically net negative, and even gross churn is typically half.

Of course, this data is highly correlative, because to get proper expansion revenue at these levels, you need good pricing, good product, and ultimately to be using a value metric. Yet, 20 to 30 percent can act as a solid north star to benchmark your efforts going forward. That being said, the answer is probably still more, more, and more.

Want to learn more? Check out our recent episode: How Great Support Impacts Retention and subscribe to the show to get new episodes.

1

00:00:00,099 --> 00:00:02,699

You've got the questions, and we have the data

2

00:00:03,399 --> 00:00:09,119

Each week we dive deep on benchmarks of the subscription economy that you just can't get anywhere else

3

00:00:10,480 --> 00:00:13,230

This is the ProfitWell Report

4

00:00:15,850 --> 00:00:20,010

Yo, Patrick, it's Fred. As I sit here on my morning walk

5

00:00:20,529 --> 00:00:25,379

The top of Bernal Heights I find myself wondering what portion of my revenue

6

00:00:25,680 --> 00:00:28,940

should be up sell and expansion revenue?

7

00:00:28,940 --> 00:00:34,100

You're my kind of man Fred thinking of the subscription economy amongst nature, but to answer your question

8

00:00:34,200 --> 00:00:38,900

Let's look at the data from over 5,000 companies and 300,000 subscription consumers

9

00:00:39,340 --> 00:00:43,680

As to not bury the lede the answer is just straight up more more more MORE

10

00:00:44,140 --> 00:00:47,760

Expansion revenue is the lifeblood of a successful subscription business

11

00:00:48,180 --> 00:00:50,100

particularly when it comes to looking at growth.

12

00:00:50,110 --> 00:00:57,520

The most efficient companies were looking at an LTV 2 CAC ratio are actually fueling that efficiency mainly off of expansion revenue

13

00:00:57,640 --> 00:01:04,650

note that companies who have an LTV - CAC between 3 & 5 are seeing a median of just under 20 percent expansion revenue as

14

00:01:04,650 --> 00:01:06,490

a proportion of their total revenue

15

00:01:06,490 --> 00:01:13,979

those with an LTV - CAC above 5 are actually seeing 30 percent or more of their revenue coming from expansion that being said

16

00:01:14,229 --> 00:01:16,119

Efficiency doesn't tell the whole story

17

00:01:16,119 --> 00:01:17,340

Growth is important

18

00:01:17,340 --> 00:01:19,799

And if you're efficient you're not always investing in growth

19

00:01:20,100 --> 00:01:25,160

interestingly enough though companies growing in the top 40 percent of their cohorts are seeing at least

20

00:01:25,480 --> 00:01:31,600

roughly 20% of their revenue coming from expansion and a high-end of nearly 40 percent coming from expansion

21

00:01:31,600 --> 00:01:36,180

So to be blunt, more more and more is really an answer of at least 20%

22

00:01:36,340 --> 00:01:38,800

And you really should be shooting for closer to 30%

23

00:01:39,220 --> 00:01:40,750

We've seen a good crop of

24

00:01:40,750 --> 00:01:43,439

externalities for companies who have cracked this 30 percent threshold

25

00:01:43,659 --> 00:01:50,008

When it comes to expansion revenue ARPU tends to be growing at 2x the rate as those companies with expansion below that threshold

26

00:01:50,530 --> 00:01:56,219

Revenue retention is typically net-negative and even gross churn is typically half. Of course this data

27

00:01:56,219 --> 00:02:01,829

is highly correlative because to get proper expansion revenue with these levels you need good pricing good products and

28

00:02:01,930 --> 00:02:08,669

Ultimately you need to be using a value metric yet 20 to 30 percent can act as a solid North Star to benchmark your efforts

29

00:02:08,700 --> 00:02:12,160

That being said the answer is probably still more, more, and more.

30

00:02:12,320 --> 00:02:18,430

Well, that's all for now if you have a question ship me an email or video to PC@ProfitWell.com and let's also thank

31

00:02:18,430 --> 00:02:23,440

Fred for sparking this research by clicking on the link below to share on LinkedIn to give him a nice little shout-out

32

00:02:23,780 --> 00:02:25,780

We'll see you next week

33

00:02:27,530 --> 00:02:30,100

This episode of the ProfitWell Report is brought to you by

34

00:02:30,380 --> 00:02:35,079

Pricing Page Teardown where Patrick and Peter break down the pricing pages and strategies of

35

00:02:35,360 --> 00:02:43,179

Subscription companies from all corners of the market. Sign up right now to be notified as soon as a new episode is live