Understanding CAC Payback: When Do Investments in Customers Pay Off?

You’ve got to spend money to make money, right? Well it’s not just about shelling out the cash for the best ads, the best social media presence, and the best sales team, you wanna know roughly when you’ll get that money back. I mean you wouldn’t pay for a cup of coffee with the idea that you’ll get it eventually, right? If your CAC payback is out of control - it could be a sign that your acquisition strategy is in dire need of attention. Don’t go anywhere, because we're about to walk through crucial CAC Payback benchmarks to help you see where you stack up and teach you tangible lessons to help you get your CAC payback under control.

But first, if you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

Calculating CAC Payback

CAC payback is as broad or as simple as you make it. You can calculate it with months, quarters, or even years. We’re going to focus on Months. Generally speaking, you’ll want to take your sales and marketing expenses in a given time-frame and divide that by the new revenue acquired multiplied by your gross margin.

Make sure you include your sales team and marketing salaries, the tools those teams use, spend on conferences and events attended, word of mouth if you can help it, you name it. All costs contributing to new business should be accounted for, not just direct ones. For revenue acquired, include upgrades, downgrades, and churn of customers during the measured interval. What’s excellent about software is that the gross margin is usually high. CAC is typically calculated based on what acquisition looks like for one customer, but by taking these factors into consideration, the picture becomes more clear.

CAC Payback Benchmarks

But what’s a good number to shoot for? Most people agree that 12 months is a good rule of thumb. But you deserve better than a ballpark guess.

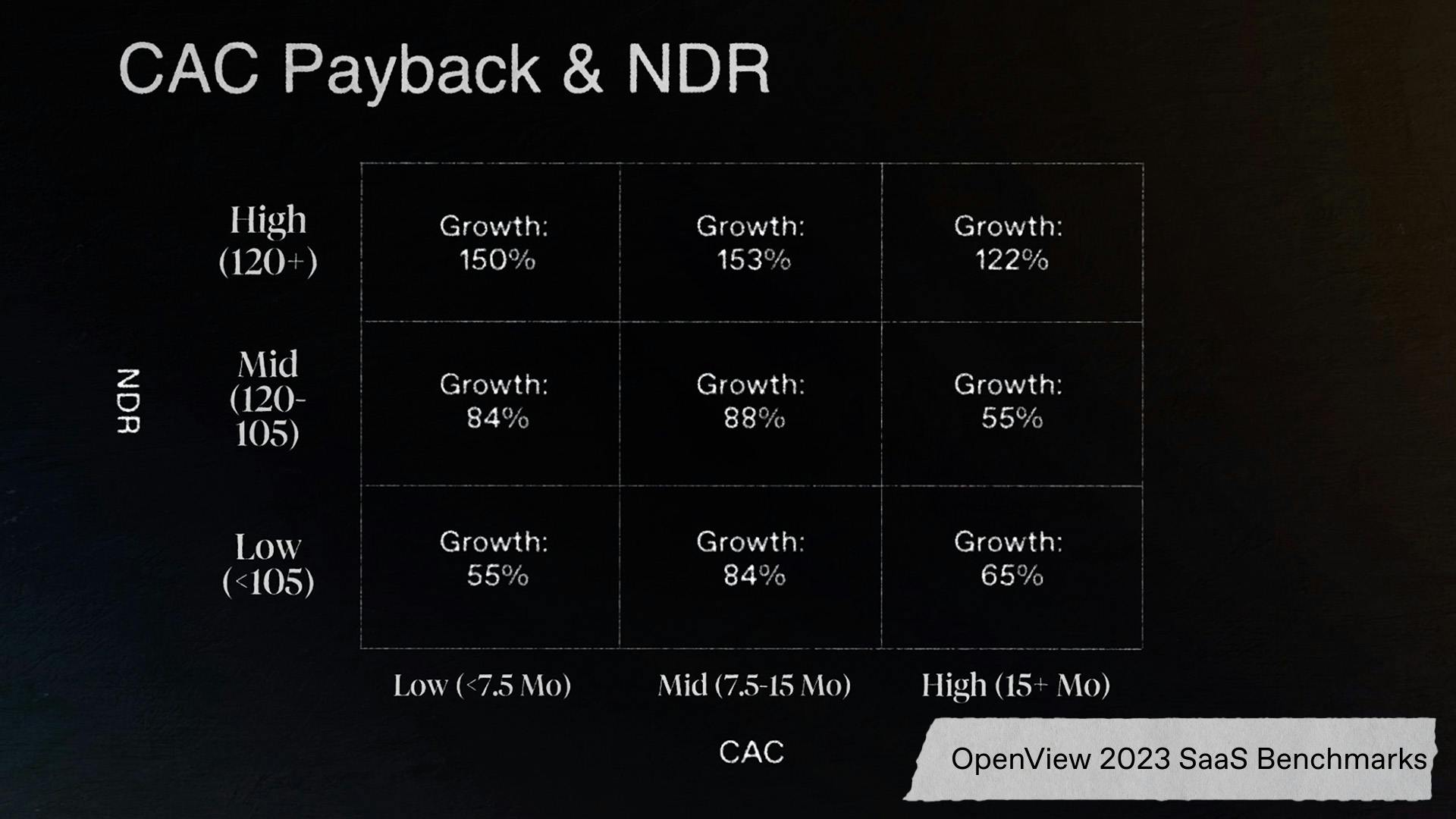

Let’s look to our partner on this video, OpenView. They’ve been surveying thousands of businesses over six years in order to give you the best idea possible of where you need to be. This data is stacked up with Net Dollar Retention, an extremely useful metric that helps you determine how durable your business is. We just did a video about Net Dollar Retention so if you have any questions after viewing this data, head over there next. But first, let’s break it down.

On the upper left of the graph, we see companies with CAC payback below 7.5 months and NDR above 120% are doing amazing with growth of 150%. If we jump over to the right hand side of the graph, companies with CAC payback above 15 months aren’t doing as well, especially if their NDR is below 105%. Growth here is only at 65%. But a big takeaway is that performing poorly in either NDR or CAC Payback will, at most, leave you in the no man's land between great and not so great.

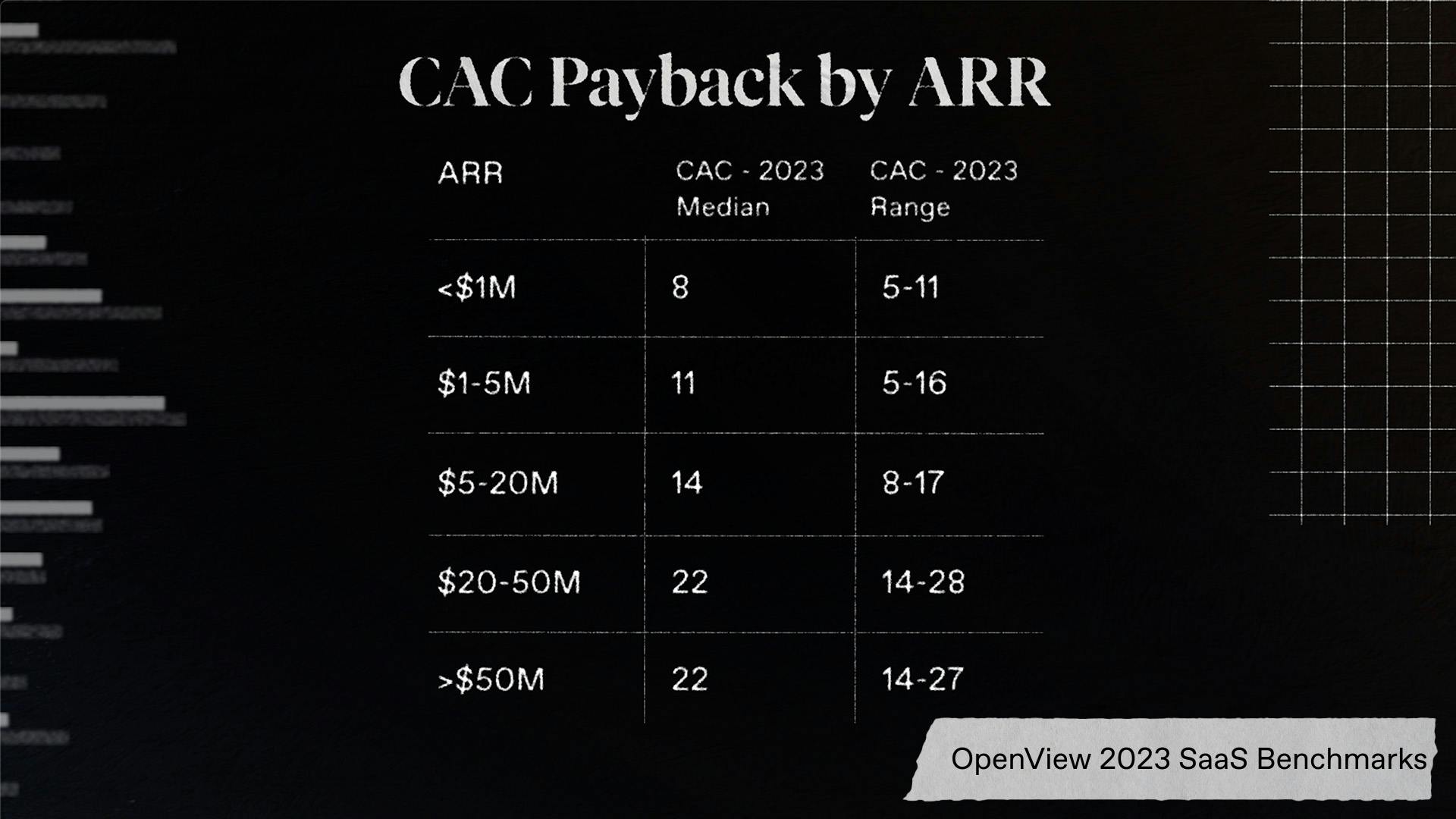

OpenView actually gets even more granular here. By breaking down the data according to your ARR, you’ll find these benchmarks. For example, if your ARR is below $1m, the median CAC payback from respondents is 8 months. If your ARR is over $50m, the median CAC payback was nearly 2 years at 22 months.

There’s a ton more on CAC Payback and more in the OpenView Benchmark report. Sign up to get it and you’ll be an outlier when the world is facing economic strife.

Strategies to Reduce CAC Payback Period

So if your company is in good standing with others, then you’re all set, right? Well, if only it were so simple. While you might be in a good range now, if you aren’t careful that number can start creeping up. Avoid this by focusing on efficiency and retention.

For example, get your sales and marketing cost in check. Of course, you have to spend money to make money, but if you’re spending money on inefficient funnels you’re not gonna get much in return. Instead, double down on your strengths. Is one channel performing multitudes better than another? Take spend from a different channel and allocate it to this one. That way you’re not increasing your total spend, but you’re acquiring more profitable and more efficient customers.

Next, look for efficiencies in the buying process. By leveraging something like product-led growth, you can take pressure off of the sales and marketing teams. On top of that, getting your pricing right in the first place will ensure folks are paying what they feel comfortable with. Consider value based pricing - by tying the value of your product to your customer, it creates an easy upgrade process or commitment to a longer term. The more value you provide, the more your customers are willing to pay.

Perhaps most importantly, get your churn under control. If your average customer is leaving before you have time to recoup their value, then it doesn’t really matter if your CAC Payback is on the low end. Subscriptions are all about the relationship you have with your customer, if you aren’t consistently delivering value period over period, then why would they stick around? If your value delivery is in check, take advantage of upsell and cross-sell. We’ve talked ad nauseam about combating churn over the years and of course we even have a tool that does the hard part for you.

Don’t just be focused on acquiring customers, make sure you understand when your customers actually pay you back. Yes, you’ve got to spend money to make money, but efficiency is important in good times and bad. Plus, when your customers finally pay you back, every penny after that is pure profit. Reach out if you have any questions, and make sure to check out the OpenView benchmark report. I’ll see you in the next one!

If you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

00:00:00:01 - 00:00:01:00

James Brown

Pay it back!

00:00:01:02 - 00:00:05:07

Tom Haverford

They say you got to spend money to make money well I don’t know where we went wrong, we spent all of our money!

00:00:05:09 - 00:00:06:00

James Brown

I’m mad!

00:00:06:02 - 00:00:19:18

Ben Hillman

You got to spend money to make money, right? Well, it's not just about shelling out cash for the best ads, the best social media presence and the best sales team. You want to know roughly when you'll get that money back? I mean, you wouldn't pay for a cup of coffee with the idea that you'd get it eventually.

00:00:19:23 - 00:00:21:08

Ben Hillman

Right.

00:00:21:10 - 00:00:24:20

Judge Smalls

Well... we're waiting.

00:00:24:22 - 00:00:42:08

Ben Hillman

If your CAC payback is out of control, it could be a sign that your acquisition strategy is in dire need of attention. Don't go anywhere, because we're about to walk through crucial CAC payback benchmarks to help you see where you stack up and teach you tangible lessons to help you get your payback under control. Hey.

00:00:42:08 - 00:01:05:08

Ben Hillman

Hey. CAC Payback is as broad or as simple as you make it. You can calculate it with months, quarters, or even years. But we're going to focus on months. Generally speaking, you'll want to take the sales and marketing expenses in a given time frame and divide that by the new revenue acquired multiplied by your gross margin. Make sure you include your sales and marketing team salaries.

00:01:05:09 - 00:01:27:02

Ben Hillman

The tools those teams use spend on conferences and events attended. Word of mouth, if you can help it. You name it. All costs contributing to new business should be accounted for, not just direct ones. For revenue acquired include upgrades, downgrades and churn of customers during the measured interval. Carcass is typically calculated based on what acquisition looks like for one customer.

00:01:27:06 - 00:01:51:06

Ben Hillman

But by taking all of these other factors into consideration, the picture becomes much more clear. Let's say your sales and marketing spend from last month was $18,000 and your net new revenue was 2500 at an 80% gross margin. If we punch that into our calculation here, we're looking at a CAC payback of nine months. You can see that the higher your acquisition costs, the longer the payback period and subsequently the higher your net new revenue.

00:01:51:10 - 00:02:10:14

Ben Hillman

The shorter payback period. By shortening this payback period, your customers are more likely to pay off cash and propel you out of the red. But what's a good number to shoot for? Most people agree that 12 months is a good rule of thumb, but you deserve better than a ballpark guess. Let's look to our partner on this video, OpenView.

00:02:10:16 - 00:02:29:21

Ben Hillman

They surveyed thousands of businesses over more than six years in order to give you the best idea possible of where you need to be. This data is stacked up with net dollar retention, an extremely useful metric that helps you to determine how durable your business is. We just did a video about net dollar retention, so if you have any questions after viewing this data, head over there next.

00:02:29:23 - 00:02:50:09

Ben Hillman

But first, let's break it down. On the upper left of the graph, we see companies with cash pay back below seven and a half months and they are above 120% are doing amazing with growth of 150%. If we jump over to the right hand side of the graph, companies with CAC payback above 15 months aren't doing as well, especially if their NDR is below 105% growth.

00:02:50:09 - 00:03:18:05

Ben Hillman

Here is only at 65%. But a big takeaway is that performing poorly in either NDR or CAC payback will at most leave you in no man's land between great and not so great. OpenView actually gets even more granular here by breaking down the data according to your IRR. You'll find these benchmarks. For example, if your error is below 1 million, a good range to be in is between five and 11 months, with a median being eight months.

00:03:18:07 - 00:03:40:07

Ben Hillman

If your RR is above 50 million, a good range to be in is between 14 and 27 months, with the median being 22 months. There is a ton more on payback and more in the OpenView benchmark report. Sign up to get it and you'll be an outlier when the world is facing economic strife. So if your company is in good standing with others, then you're all set right?

00:03:40:09 - 00:04:01:00

Ben Hillman

If only it were so simple. Well, you might be in a good range now. If you aren't careful, that number can start creeping up. Avoid this by focusing on efficiency and retention, for example. Get your sales and marketing costs in check. Of course, you have to spend money to make money, but if you're spending money on inefficient channels, you're not going to get much in return.

00:04:01:02 - 00:04:28:18

Ben Hillman

Instead, double down on your strengths. Is one channel performing multitudes better than another? Take spend from a different channel and allocated to this one. That way you're not increasing your total spend or you're acquiring more profitable and efficient customers. Next, look for efficiencies in the buying process itself by leveraging something like product led growth. You can take pressure off of the sales and marketing teams and on top of that, get your pricing right and sure that folks are paying what they feel comfortable with.

00:04:28:19 - 00:04:55:08

Ben Hillman

You can do this by utilizing value based pricing, which ties the value of your product to your customer. It also creates an easy upgrade process or commitment to a longer term. The more value you provide, the more your customers are willing to pay. Perhaps most importantly, get your churn under control. If your average customer is leaving before you have time to recoup their value and it doesn't really matter if pay payback is on the low end, subscriptions are all about the relationship you have with your customer.

00:04:55:09 - 00:05:18:11

Ben Hillman

If you aren't consistently delivering value, period over period, then why would they stick around? If your value delivery is in check, then take advantage of upsells and cross sales. We've talked for years about combating churn and of course we even have a tool that does the hard parts for you. Don't just be focused on acquiring customers. Make sure you understand when your customers actually pay you back.

00:05:18:13 - 00:05:35:05

Ben Hillman

Yes, you've got to spend money to make money, but efficiency is important in good times and in bad. Plus, when your customers finally pay you back, every penny after that is pure profit. Reach out if you have any questions and make sure to check out the OpenView benchmark report, and I'll see you in the next one.