Churn reduction is a game of inches. Many small improvements add up to a better monthly performance. But the laws of compounding work in your favor by focusing on churn:

Just moving from 3% monthly churn to 2% monthly churn (calculated as (1-0.02)^12 - (1-0.03)^12) can translate into 9% less ARR churn in 12 months — or in other words, give you another month’s worth of revenue.

Here we intend to equip you with a clear, easy-to-prioritize set of options for tackling customer churn that can and should deliver a quantifiable lift for your team within just 45 days.

In this guide:

- The 4 parts to every churn reduction strategy

- Should you optimize leading or lagging indicators of churn?

- Strategy #1: Cancellation surveys & offers (5% less ARR churn)

- Strategy #2: Dunning campaigns (10% less ARR churn)

- Strategy #3: User activation campaigns (15% less ARR churn)

- Strategy #4: “Upgrade to Annual” campaign (25% less ARR churn)

- Strategy #5: Improve subscription payment acceptance (30% less ARR churn)

- Prioritizing the right strategy for you

- Putting it all together

- Churn reduction strategies FAQ

The 4 parts to every churn reduction strategy

Before diving into a list of tactics and to-dos, here's a quick overview of the problem we're trying to solve. Customer churn happens for different reasons, and no one method will stamp it all out (however perfect).

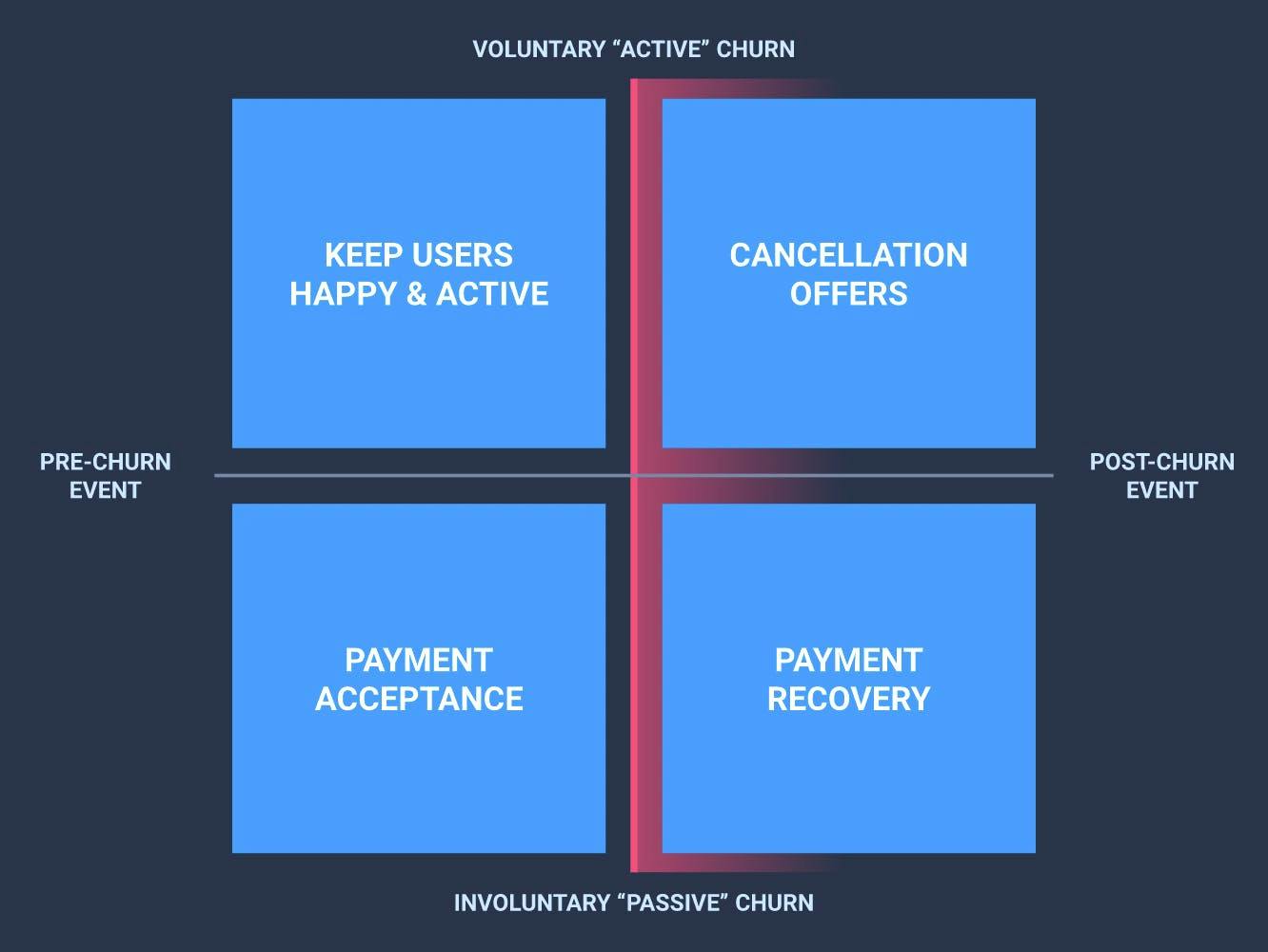

You need to classify your churn strategies by:

- Voluntary, active churn (customer’s actively choosing to cancel their subscriptions)

- Involuntary, passive “delinquent” churn (customer’s subscriptions canceling due to failed payments)

It can be surprising to learn that typically 20-40% of churn is involuntary (particularly if you take payments through cards). This proportion will probably vary wildly from month-to-month. This chart shows a sample Paddle seller’s churn breakdown over a 12-month period, with involuntary churn as high as 38% to as low as 19%, averaging ~30%.

You also need to classify your churn strategies by:

- Pre-churn event (before the subscription renewal is due)

- Post-churn event (after the subscription renewal is cancelled or has failed)

It can help to think of this as a 2x2 matrix with different strategies.

With the four quadrants, you can broadly group your churn reduction strategies together (and spot where you’re missing out).

- Keep users happy & active - Nurture users to new feature adoption and annual plans.

- Cancellation offers - When customers click to cancel, find out why and make offers to deflect the cancellation request.

- Payment acceptance - Stop subscription payments from failing (and churn from happening accidentally).

- Payment recovery Recover failed credit card payments and fraudulent chargebacks

Your goal should be to build a complete churn reduction strategy across all four quadrants. That way, you’ll maximize your chances of reducing churn and improve revenue retention.

Should you optimize leading indicators or lagging indicators of churn?

The matrix helps you prioritize the fastest strategies you can prioritize to reduce churn quickly.

You can split it into leading and lagging indicators.

The top-left quadrant is most likely to impact new customer cohorts and make an impact over the long run. For instance, happy and active users are a leading indicator of lower churn. It’s important to optimize but it’s harder to quantify their direct impact on revenue — particularly in a short time frame.

The other three quadrants are lagging indicators. You can quantify past performance across cancellation requests, failed subscription payments, and payment recovery. These lagging indicators are also strong predictors of future performance (unless something significant changes).

Unless you’re already very strong across all three “lagging” quadrants, we recommend you start optimizing your churn reduction strategy by focusing on lagging indicators. What’s already directly dragging down churn?

With that in mind, here are the top five churn reduction strategies. These estimates are based on evidence from benchmark data at Paddle and other providers. Your mileage may (will) vary, but this ought to give you some benchmark guidance to prioritize with.

Key takeaway: Focus on optimizing lagging indicators of churn first

Strategy #1: Cancellation surveys & offers (5% less ARR churn)

How and why it works:

Instead of letting customers unsubscribe immediately after clicking “cancel,” route them through a flow to restate your value proposition, capture cancellation reasons, and even make an offer to stay.

Your customer needs to feel in control still, but you get to engage and learn from them through this parting exchange. Adding just a little friction also gives a chance to learn (and maybe second guess the decision to cancel).

Exit surveys also enable you to learn and objection-handle common reasons for cancellation instead of losing that insight and flying blind to churn reasons in the future. If those reasons revolve around budget or reduced value, then make an offer.

The two most common ways we see this working include:

- Route cancellation requests to your customer support team

- Route cancellation requests through to a dedicated cancellation page (similar to how you’d have a full-screen signup flow to capture their preferred payment method).

In the context of why a loyal customer is cancelling, it can make sense to make a specific offer or discount. The most common incentive we see is to pause the subscription (saving the customer account, payment method, and contact details for possibly reactivating in the future) for 30 days or indefinitely.

Other offers we’ve seen in the context of exit offers and churn discounts:

- Annual upsell (at a discount)

- Free access to the next plan

- % off a monthly subscription (for the next billing period)

Evidence in the market

Some Paddle sellers use our subscription support team to proactively offer discounts to stay when cancellation requests come in. For larger customer accounts, offering 50% discounts if they move to an annual plan has resulted in a 2% “deflection” rate on cancellations.

Paddle Retain's Cancellation Flows help you save more customers by providing a customized and curated offboarding and salvage user experience.

When customers go to cancel, Retain analyzes dozens of data points — from their cancellation reason to customer engagement data — to target the optimal salvage offer that gets them to stay. Data shows their cancellation flows save 25%-30% of at-risk customers that would’ve cancelled.

Calculating the value to your business

Exit surveys and offers will impact voluntary churn, reducing the post-event churn rate. You should model this based on the proportion of your churn that is voluntary, and the expected “deflection” rate. For example:

- 5% total monthly churn

- 60% of churn as voluntary (3%)

- 15% deflection rate (voluntary churn saved)

5% * 60% * 15% = 0.45% decrease in MRR churn

Estimate annual impact = 5.3% decrease in year-end ARR churn

Compound the monthly impact as 1 - (1-0.0045)^12

With churn prevention offers, it’s important to calculate this in the context of revenue retention, not customer retention. You need to factor in the costs of any discounts in terms of revenue churn (e.g., 20% discount = 20% revenue churn if accepted).

Consider the volume of cancellation requests too. You need to be seeing at least three figure customer cancellations per month to realize significant uptick here in the near-term. This is most impactful to high-volume self-serve SaaS businesses.

Finally, consider the cost of cancellation page tooling or the additional support rep time to manage additional ticket volume.

Best Practice: Setup a cancellation flow

Steps to go live in the next two weeks:

If you assess the impact to be worthwhile for your business, the first version of this should add some sort of step between the “cancel” button and your customer subscription ending.

Two options to explore:

- Redirect the “cancellation” button link to a form that issues a “cancellation request” to customer support

- Redirect the “cancellation” button link to a cancellation page or another landing page customized for cancellations.

Key Takeaway: Reduce churn with cancellation flows and offers

Strategy #2: Dunning campaigns (10% less ARR churn)

How and why it works

Subscription payments can fail when a card expires, lacks funds, gets flagged for fraud, and many other reasons. This means happily-subscribed customers churn without meaning to (involuntarily) because their payment method goes delinquent.

This is most common with card payments which act in between your company’s bank and your customer’s bank — there is no back-up source of funds. This is common among US-based or US-focused self-serve SaaS businesses, which have most of their revenue run through card payments.

In contrast, digital wallets like PayPal can have multiple payment methods and act as a source of funds themselves (i.e., your PayPal balance). Similarly, bank wire transfers are directly linked to the source of funds and would only decline if the account being debited was itself delinquent. Both of these lead to higher authorization rates and payment acceptance.

“To dun” literally means “to make persistent demands.” Dunning programs are designed to recapture failed subscription payments. Generally, these split into two sides to help “resurrect” a customer account and reduce churn:

- Payment automation (automatically retrying payments)

- Customer campaigns (through emails and in-app notifications to a form to update their payment method).

Evidence in the market

Dunning programs break into multiple tactics and can be spread across multiple and different services. This can include in-app tools, email providers, and subscription billing tools.

Some dunning providers will touch on multiple parts of this process like Churnbuster, Baremetrics Recover, and Paddle Retain suggest figures around different steps in their processes they touch. At Paddle, we see similar numbers for leftover failed payments with our own dunning programs.

- Automated card updaters (up to 5% improvement)

- Retry the card again (up to 10% improvement)

- Email & in-app campaigns (up to 40% improvement)

- Payment update forms (up to 15% improvement)

- Lockout users from their accounts (up to 8% improvement)

When put together, different dunning tools promise up to 78% of your involuntary churn retained with a combination of tactics (with some pre-churn event best practices to increase payment acceptance included too).

It’s important to distinguish between preventing payment failure pre-churn (like increasing payment acceptance) vs. measures after payments fail. More on that later...

Calculating the value to your business

The first step to calculating the value of dunning is to calculate the percentage of involuntary, delinquent churn from your subscription billing tool and payment processors. What is the value in play.

You can expect failed payments to be significantly worse for annual subscriptions paid by cards since cards are much more likely to expire over a 12-month period. During your analysis, try to break up your analysis by subscription billing period (you want to avoid double counting any lower annual subscription performance).

In the context of making a short-term impact on the billing process, most customers have some process to catch delinquent accounts (even if that's manually chasing just a select few) with an average performance of around 25%-30%.

Here are some baseline figures to play with.

- 5% total monthly churn

- 40% delinquent churn

- 50% improvement in dunning recovery rates

5% * 40% * 50% = 1% decrease in MRR churn

Estimate annual impact = 11.4% decrease in year-end ARR churn.

Compound the monthly impact as 1 - (1-0.01)^12

If you buy additional tools to recover revenue here, you’ll need to factor that into your monthly recurring revenue churn calculations.

Best Practice: Cut your involuntary churn

Steps to go live in the next two weeks

Since dunning breaks down into multiple parts, it’s important to prioritize where in the program to start that's going to make the biggest impact in the near term — this is likely to be your emails (and in-app) communications.

Your dunning email campaigns (if you have any) are likely to be tied to your subscription billing stack. You should review these with your marketing team to try to send more emails over a longer period of time, and review the content within each message.

- Optimize the dunning emails within the subscription billing tool you already have.

- Review triggering emails in your main email marketing automation tools where you can A/B test in more detail. You should be able to trigger email workflows & automation from these tools via webhooks from your subscription billing tool.

- Review dunning tools like Paddle Retain or Churnbuster which are generally free to get started, but charge later based on revenue recovered.

Key Takeaway: Reduce churn by recovering more failed subscription payments

Strategy #3: User activation campaigns (15% less ARR churn)

How and why it works

Given a longer-term horizon, improving your user onboarding process can have a dramatic impact on customer retention and churn performance for your future customer cohorts. Your users need to hit their “aha!” moment and realize the value of your product for yourself.

Realize value is an ongoing process. However, use the same methods for reactivating stale and poorly engaged users thats you’re using for new users. Build campaigns to engage your users, communicate the value you provide and encourage them to take action. Active users are less likely to churn from a lack of value.

Evidence in the market

Tools for in-app messaging, tutorials, and walkthroughs can decrease customer churn rate by improving new user onboarding, nurturing feature adoption, gathering customer feedback, and more.

Case studies on Appcues report doubling their user engagement rate among current customers with in-app walkthroughs and tooltips.

Calculating the value to your business

Leading indicators are very tricky to generalize, particularly in the context of near-term results. But we take the case study results from doubling user engagement and carry that impact forward to reduce voluntary churn.

- 5% total monthly churn

- 60% of churn as voluntary (3%)

- 50% improvement in user engagement (model as reducing voluntary churn by half: 1.5%)

Estimate annual impact = 16.6% decrease in year-end ARR churn

Compound the monthly impact as 1 - (1-0.015)^12

This is highly dependent on the scope of your customer base. You may have a number of customers who are stale or “dormant” that are paying, but not active or realizing value from your product. Assess your user base according to core features used, time since the last activity, and the number of key actions taken recently.

Your goal is to identify pockets of similar users who are lacking in engagement, and to develop campaigns and messaging to reactivate them. These pockets of users may be at the highest risk of voluntary churn in today’s business environment, and the highest value to reactivate.

Steps to go live in less than 2 weeks

- Identify segments of inactive users

- Create a campaign to re-engage those users around your features and use cases that they’ve used before, are popular among other users, or are new and add value.

- Send an email, chat, and in-app messaging to a landing page explaining the difference between their current plan and upsell.

Key Takeaway: Reduce churn by (re)activating your users

Strategy #4: Upgrade to annual campaign (25% less ARR churn)

How and why it works

To minimize friction, most self-serve signup processes sell via month subscriptions to minimize commitment and upfront risk for the buyer. The risk with this is each billing cycle is a chance to reconsider the subscription as well as payments to fail.

Moving customers to an annual plan forces more commitment of resources and internal buy-in, instead of a shallower month-to-month purchase.

Capturing an annual payment also requires a successful, upfront payment (great for cashflow and reducing the risk of delinquent churn).

Marketing to existing customers can be easier since you have established channels of communication and plenty of data to create highly contextual and relevant messaging to engage them with.

Evidence in the market:

Unbounce shared a customer marketing campaign where they moved from 2% of customers on annual plans to 21% of customers over a three-month campaign.

Paddle reports a negative correlation between the percentage of revenue on annual contracts and monthly churn. It’s not realistic to move every customer to an annual plan overnight, but it is likely that a concentrated campaign can move from one “bracket” to the next. Still, this can show a 2.4% decrease in monthly voluntary churn.

Calculating the value to your business

Assuming you can move from one “bracket” average to the next with annual contracts, you might expect to see up to a 2.5% decrease in MRR churn.

Estimate annual impact = 26.2% decrease in year-end ARR churn

Compound the monthly impact as 1 - (1-0.025)^12

Caution: The data and campaign were from “normal” times, pre-COVID-19. It might not be realistic to drive annual upgrades at the moment without more sensitive messaging and significant discounting.

On the flip side, your buyers may be looking to preserve their favorite tools and budget, so locking in at a good rate may now be preferable too.

Heavy discounting (beyond a two-month free / 20% off offer in B2B) might be needed (perhaps closer to B2C levels, where discounts can come as low as six-months free / 50% off). You need to factor in discounting in terms of revenue churn too.

Best practice: You should also consider moving annual subscriptions to a different payment method. One option could be invoiced wire transfers which can be cost-effective for higher value SaaS products, especially if you are B2B company and need to invoice for record-keeping and tax compliance. That said, invoicing is manual and can lead to payment delays.

Another option could be card payments which offers a more streamline billing process, a more predictable billing cycle and reduces churn. Add a tool for dunning and churn management and you have an effective churn management strategy. Using a billing platform that enables a hybrid billing approach, allowing you to flex between charging via card or invoice to accommodate your buyers' preferences, improves customer satisfaction while maintaining a singe source of revenue truth.

By mixing payment methods, you’ll need to set up your subscription billing and reporting tooling to unify subscription payments and avoid a “split-brain” finance team.

Steps to go live in less than 2 weeks

- Segment most active customers on monthly plans (don’t recommend offering this to inactive users)

- Create a limited-time offer (like a discount or “free” upgrade to a higher plan if they commit and pay annually upfront)

- Send an email, chat, and in-app messaging to a landing page explaining the difference between their current plan and the annual upsell offer.

Key takeaway: Consistently nurture happy monthly customers to an annual plan

Strategy #5: Improve subscription payment acceptance (30% less ARR churn)

How and why it works

Since failed payments will cause 20%-40% of your total revenue churn (our data at Paddle shows this will vary significantly for individual sellers month to month), the most effective way to save failed subscription payments is to stop subscription payments from failing in the first place .

The most effective methods we've tested to increase payment acceptance:

- Run payments through alternative payment methods which have a direct source of funds

- Charge payments in local currencies

- Increase your transaction volumes

- Route payments through local acquirers

- Prompt (and where possible, automatically update) expiring cards

Most US-based or US-focused SaaS companies focus on charging by card, which typically sees lower payment acceptance rates than digital wallets (like PayPal). This is because cards aren’t a source of funds themselves (unlike a bank or a digital wallet).

For card payments, we see big differences in payment acceptance across different geographies. This is usually because of the lack of relationships with local banks due to different countries, currencies, and card networks. It becomes harder to draw a path between the acquiring bank (your bank) and the issuing bank (of your customer’s card).

It’s also more likely that these transactions get flagged for fraud as the path of your payment is less familiar and matches fraud patterns (less common as you hit higher transaction volumes and show a track record). In the worst-case scenarios, foreign banks can issue chargebacks that cost you money. Most payment processors will automatically deduct chargeback fees from your account balance.

Finally, anti-fraud laws mandate cards must expire within three years of being issued, which means an average of 1 in 36 cards (or 2.78%) of your customer’s cards could be expiring each month (excluding other factors like cancelling cards).

This is one reason why you can expect recurring payment acceptance to be lower than the initial payment — especially for annual subscriptions paid by card. To counter this you’ll need to have customers proactively update their card details or otherwise lookup new card details through connected bank networks (most payment processors offer this, but you can only expect a fraction of your card vault to be updated).

To improve payment acceptance, you should offer local currencies and payment methods (like digital wallets) and route payments to be processed by local acquiring banks (instead of a one-size-fits-all global account). Most SaaS businesses generally don’t optimize for any of the banking infrastructure behind their chosen payments processor.

Evidence in the market

We have a number of data points on improving payment acceptance at Paddle as we’ve built out and tested our infrastructure.

Across our volumes and purchase types (B2B/B2C, 1st checkout/monthly subscription/annual, AMEX/Visa/MasterCard), we typically see more than 2X the proportion of failed payments for card transactions than PayPal.

When we A/B tested local acquiring in the US at Paddle (i.e., running US transactions through banks and entities that were based in the US vs. generic global accounts), we saw a 3% lift in payment acceptance on subscription renewals and 20% lift in 1st-time checkout subscriptions. That translates directly into 3% less MRR churn across all of our sellers for their US-based customers, and compounds to over 30% less ARR churn within 12 months.

When payments are in international markets, we typically see payments 1%-2% more likely to be successful (although in some regions, up to 9%!) when they're charged in local currency rather than a generic currency (like USD or EUR) for checkout and subscriptions. For instance, Japanese Yen (JPY) for Japanese buyers, Polish Zloty (PLN) for Polish buyers, and so on.

With Paddle’s card updaters, we see card details updated for around 10% of cards which are due to expire (as the issuing bank issues the new cards from the same account), and so the subscription can continue as normal.

Calculating the value to your business

With your own data, first look at the proportion of payments that failed. Analyze your unique transactions. If you have payment retries (recommended), this will drag down your overall payment acceptance rate as each individual unique transaction will have multiple payment attempts. This might be alarmingly low. Failed unique transactions are a much more helpful way to view involuntary churn.

Then, look into the proportion of recurring revenue that’s most likely to fail:

- Card payments (minus 1%-2%)

- International customers (minus 1%-3%)

- International customers paying in a currency different from their own (minus 1%-9%)

Churn can be even higher for companies based outside of the US who don’t have a US bank, or if they’re based in countries with generally lower authorization rates in their home market. We see some SaaS businesses come to Paddle from other providers with more than 30% annual churn from failed subscription payments (approximately 3% monthly — in line with results from our testing).

Estimate annual impact = 30.6% decrease in year-end ARR churn

Compound the monthly impact as 1 - (1-0.03)^12

Note: Improved payment acceptance will decrease your involuntary or delinquent churn. This will decrease the revenue impact of your dunning campaigns as they’ll have a smaller volume of customer accounts to engage in. The types of reasons for payment failure (and the effectiveness of different dunning strategies) will also shift.

Best practice: Cut your involuntary churn

Steps to go live in less than 2 weeks:

Payment acceptance can be optimized in the long term with currencies, payment methods, and local entities. The fastest fix is to start routing subscription payments through local acquiring banks.

For SaaS businesses that are setup with payment processors like Stripe and Braintree, you’ll need to set up multiple accounts for each target region (if you have a local business entity registered there with a public address). You’ll also need to migrate your subscriptions from your subscription billing tool to run through your localized payment processing.

Alternatively, you could migrate your subscriptions to a platform like Paddle, which manages all global acquiring and subscriptions together in one place — no extra tools or business entities to integrate. Paddle holds relationships with banks and card schemes worldwide and routes payments through entities on your behalf without any extra admin on your side.

Key Takeaway: Reduce churn by fixing sources of failed subscription payments

Prioritizing the right strategy for you (introducing the dollar retention calculator)

Based on the benchmarks you’ve seen above (plus a few others) and your own data, wouldn’t it be helpful to get the best strategies to reduce churn quantified for you?

Introducing the Dollar Retention Calculator.

In five short questions, we’ll email you a personalized report based on your current monthly churn rate and calculate how much different churn reduction strategies will decrease your monthly churn and improve your dollar retention rate.

What’s dollar retention?

Dollar retention rate is a simple metric to calculate the value of each customer cohort that you’re retaining as a percentage or as cents on the dollar.

You can calculate your gross dollar retention rate (excluding account expansion and upsells — that’s net dollar retention) by compounding your monthly churn rate over 12 months.

For instance, a 5% monthly churn rate has a 12-month dollar retention rate of just $0.54. That’s (1 - 0.05)*(1 - 0.05)*(1 - 0.05)*...*(1 - 0.05) twelve times, or in short (1 - 0.05)^12).

But a 4% monthly churn rate has a 12-month dollar retention rate of $0.61. Still not great, but a nine cents on the dollar improvement — effectively another month’s subscription revenue added.

With the Dollar Retention Calculator, you’ll get a list of which strategies to reduce churn are more effective for you, and an estimated revenue gain from all of them together.

How much is your churn costing you?

How many cents on each dollar do you retain after 12 months?

Calculate your dollar retention rate based on your monthly churn.

Putting it all together...

Each of these churn reduction methods will make an impact in isolation. But how will they come together and create a cohesive churn reduction strategy?

Since one method will impact the other (like improved payment acceptance reduces the impact of your dunning programs), you need to model what your churn reduction strategy should look like all together. Here’s an example:

In the top-left quadrant, a two-part strategy to tackle voluntary churn before they decide to cancel. For new and evaluating users, develop and refine a user activation campaign. For regular users and evangelists on monthly plans, develop an annual upgrade campaign.

In the top-right quadrant, strategies to capture reasons and make churn prevention offers as customers decide to cancel. For v1, this may look like redirecting users to a “request cancellation” landing page which restates your value proposition and lets them submit a form with their reasons for canceling. The next version might include an offer that needs to be integrated into the next plan, either manually (through your customer success team) or automatically, updating their subscription.

In the bottom-right quadrant, strategies for chasing failed subscription payments. For customers whose payments have failed, you might start by adding to and extending your dunning email campaigns.

In the bottom-left quadrant, strategies for increasing payment acceptance. In particular, this means migrating your subscriptions to tools and infrastructure that are going to deliver higher payment acceptance (and churn less upfront).

In summary

You should build your churn reduction strategy across all four quadrants — pre & post-churn for voluntary and involuntary churn.

Focus first on your lagging indicators (since past performance is a strong indicator of future performance). These will tend to be around cancellation offers, payment acceptance, and payment recovery.

Try to quantify which strategies might be most effective.

Finally, implement your v1 quickly. The returns from reducing churn compound month by month. You’ll see significantly bigger returns the sooner you implement.

Churn reduction strategies FAQs

What is customer attrition?

Customer attrition (customer churn) refers to the loss of customers in a given period. The attrition rate is the percentage of all the users who stopped using your product or services and is calculated by dividing the number of lost customers by the total number of customers a business had at the beginning of the period.

What are some of the most common reasons for customer churn?

Customers churn for a variety of reasons, but some of the most common ones include:

- Inadequate customer acquisition tactics

- Poor customer service

- Ongoing product bugs and lack of features

- High product pricing

- Payment failures

What are some of the best customer retention strategies?

The best way to reduce churn is to have a customer retention strategy.

Some of the most successful methods include: personalizing customer offers, measuring customer lifetime value to understand which customer relationships can be salvaged, re-engaging users through targeted marketing campaigns, optimizing the customer journey, creating a knowledge base for new products and features, continually improving product functionality, and more.