A Big Mac is more than just the all-American burger. The mystery-meat riddled, artery-clogging extravaganza we’ve all had (at least) once in our lives, in addition to being America’s cheapest method of stuffing every “food” group into our flavor snouts, is actually a way to measure the buying power of currencies around the world. Known as the “Big Mac Index” our friends over at The Economist publish a yearly study to make testing which market exchange rates result in goods costing the same in different countries much more digestible (all puns intended). Let’s dive into the griddle of global economics and see how price localization can create a bit of a pickle for your business’s pricing strategy.

What exactly is the Big Mac index?

Taking advantage of Mcdonald’s global reach, the Big Mac Index seeks to measure the purchasing power-parity (PPP) of currencies across states. PPP is an economic theory that determines the relative value of different currencies and what adjustments should be made to the exchange rate to achieve equilibrium. Essentially, the idea is based on the law of one price: a bundle of goods should cost the same in any two countries if they are evaluated with the same legal tender.

To put it simply, if I go to McDonald’s in Boston and buy $50 worth of Big Macs (Don’t judge me...I’m hungry) and then I go to a McDonald’s in Tokyo and buy $50 worth of Big Macs (exchanged into Japanese Yen), then I should have the same number of Big Macs. According to the law of one price, if I ended up getting more Big Macs in Japan for my $50, more consumers would purchase Big Macs there, because of the lower price tag. The increased demand in Japan and the decreased demand in the US would drive prices toward equilibrium.

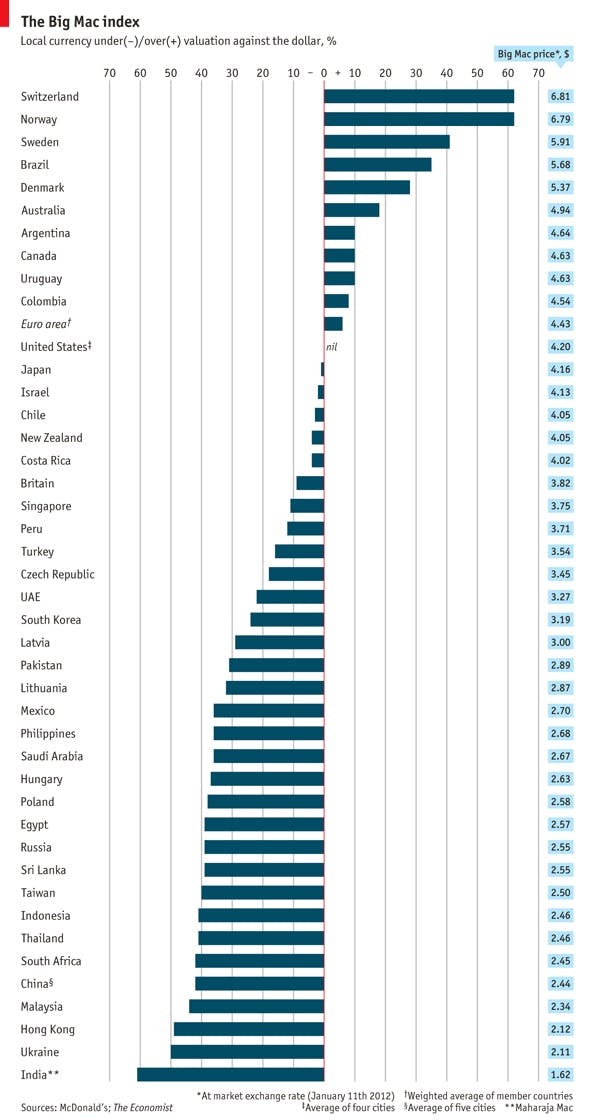

The Economist runs this index over a handful of countries, buying $50 buckets of Big Macs left and right. Unsurprisingly, few buckets have the same number of Big Macs. For instance, as explained in a 2012 price economics article from The Economist, a McDonald’s Big Mac in the US costs approximately 4 dollars and 20 cents, compared to $6.81 in Switzerland. This suggests that the Swiss franc was 62% overvalued in comparison to the dollar. The more important issue, however: who would pay seven bucks for something that is to food what jeggings are to real pants?

Here's the full breakdown from The Economist:

Consumer value: why Big Macs are not priced the same (and your products shouldn’t be either)

Why are the Big Macs priced so differently? Well, differing tax, labor, and transportation costs can all distort prices. In fact, a new study by the National Bureau of Economic Research injected real wages into the price management equation utilized by the Big Mac Index.

Yet, different marketing and pricing strategies point to a more interesting difference that is not reflective of the value of said country’s currency. If you were inundated with how wonderful McDonald’s was via pop culture and then one magically popped up, do you think you’d pay a premium for that first ever Golden Arched sandwich? Or, if McDonald’s positioned itself as a luxury offering with swanky digs and swankier service, would you pay premium pricing?

Essentially, every population values the Big Mac differently. For some, those all beef patties and special sauce are a luxury item. For others, the sesame seed bun is a cocoon only reserved for cheap 3am, “I drank so much and can’t remember where my cell phone is...” food.

This is all great, but why should I care?

From an economics perspective, the PPP shown by the Big Mac Index suggests where exchange rates should be moving in the long run. A country’s exchange rate in comparison to other monies is how much the international community values that currency (i.e. how many people are buying it). In the case of Switzerland, the index indicates the franc is overvalued, meaning that private demand is lower than private supply. An overvalued currency can make exports more expensive to other countries, and often results in a trade deficit. It does, however, lower the cost of production abroad and can be an effective means to control inflation.

From a business perspective, the PPP shown by the Big Mac Index suggests two things:

- You Must Understand Your Value Across Different Demographics. Our kindergarten teachers taught us that everyone is different. Even in the technology space your product or service may be valued drastically differently to different customers. Therefore, work to understand your value in every potential customer segment.

- Price Localization Works to Capture the Cash You’re Leaving on the Table. You should never simply run with the same prices from country to country. In a saturated market, you may be a dime a dozen, but in a sparse market you may be the bee’s knees within your industry. If your prices are the same in each, then you’re losing out considerably in both markets.

For more on pricing strategy, download our Pricing Strategy ebook or check out what we have to say about our pricing software. We promise to limit the Big Mac references