Pricing has always been an issue for Evernote. The notes app was one of the first incredibly successful freemium products, growing to 75 million users and a valuation of $1 billion in its first five years. But the company always struggled with converting and monetizing those users—the free version was just too good.

After years of different monetization strategies that included partnerships with Post-it Notes and Moleskine, Evernote got back to basics in 2016 when they overhauled their pricing and started charging customers for the value they used.

In this edition of Pricing Page Teardown, Peter and I look at where Evernote is on the path to pricing success and the changes the company could make to start truly using freemium as an acquisition channel and monetizing their core users.

Evernote's pricing is still way too low

Many complained in 2016 when Evernote restricted devices and storage on the Basic plan. But these users are still getting a bargain:

Evernote's pricing has three tiers. The Basic plan is free. It is for the casual user but still lets you use Evernote on two devices (as well as the web), has a 60MB upload limit per month (you could upload ten of our Freemium Manifestos in that limit), as well as clipping, searching, sharing, and the passcode lock for mobile devices. You can do a lot with Evernote Basic.

The Premium plan is $7.99/month ($5.83/month if you pay annually). Unlimited syncing and 10GB uploads per month (about 60 Pricing Page Teardown videos). All the same features as Basic, but you can also search in PDFs and other docs, not just text, and there's access offline. The Business plan gives even more storage along with business support and the ability to digitize business cards.

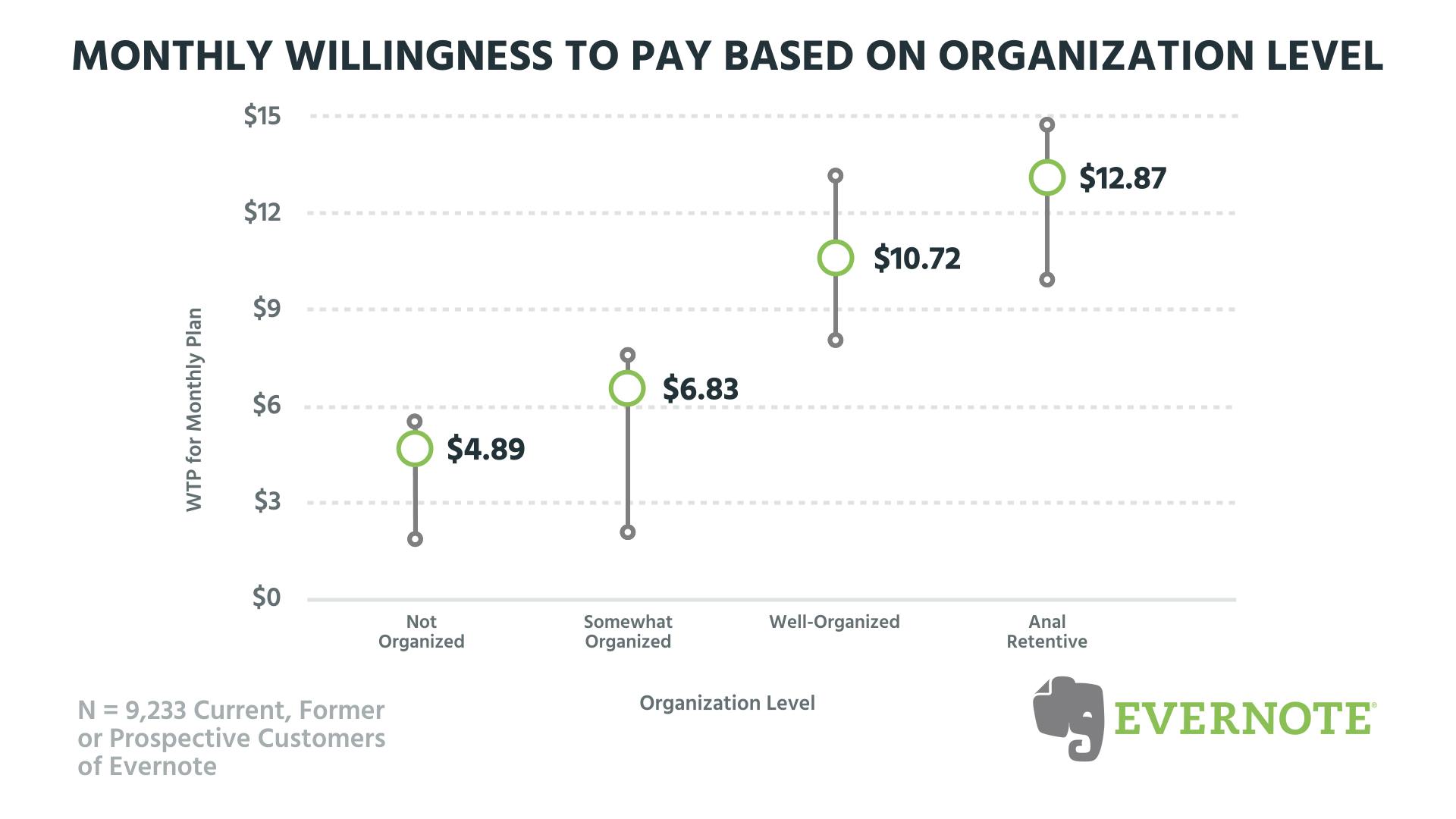

When we surveyed 9,233 current, former or prospective Evernote customers, we found that these tiers are way off:

Segmenting by organization level, we can see that even at the lower end, there are people who are willing to pay for Evernote. As part of a freemium-for-acquisition model, Evernote might be willing to forgo revenue from these users with the idea of hooking them, turning them into “Well-Organized” and “Anal-Retentive” note-takers, and getting them to upgrade to premium. But then Evernote is setting their pricing way below what the market could bear.

The premium plan is $7.99/month, but the median willingness to pay (for customers who aren't even in the highest category of organizational acumen) is $10.72. That's almost $3.00/month/customer lost by Evernote. The problem is exacerbated with the most organized cohort. For Anal-Retentive customers, the median willingness to pay is $12.87, a difference of almost $5.00. Evernote's pricing comes in below that of power users.

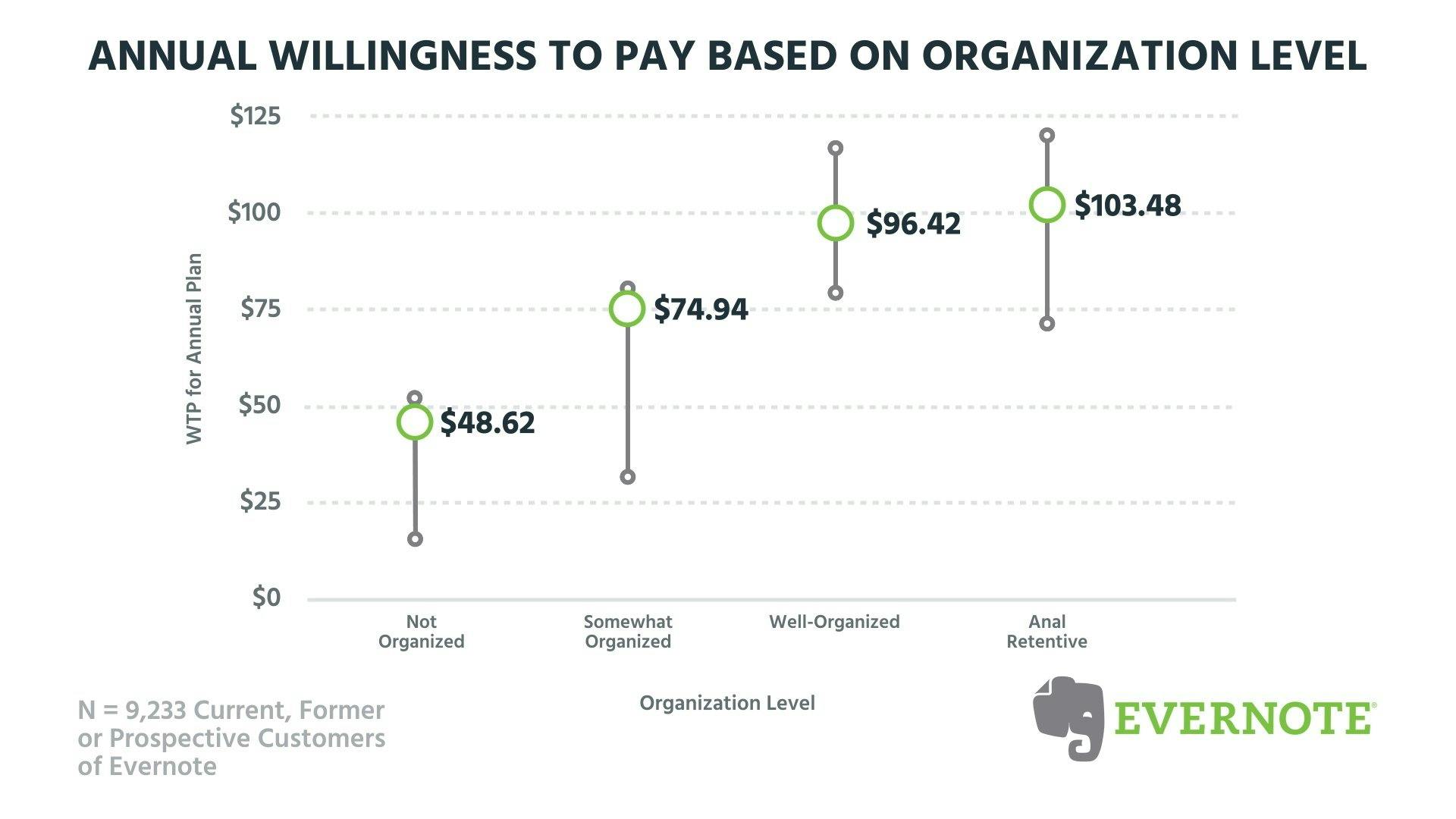

When comparing monthly to annual, there is something important to keep in mind:

$100 is a solid price point for an annual plan. Evernote appears to be optimizing for the wrong crowd, and there is room to move while maintaining simple, up-front, pricing.

They are effectively averaging out the WTP of their low-value customers, who are currently on the free plan anyway, and the people who are willing to pay much more for access to a tool they really care about. As I point out in the video, Evernote isn't alone in making this mistake. At Price Intelligently, we see this all of the time:

“This is something we find really, really often in different types of products, is that you are averaging out your price for the people who are probably not that well retained.”

Imagine Evernote converts 100 customers: 75 Well-Organized and 25 Anal Retentive. With current pricing, revenue from those customers is $799 per month. If Evernote's pricing was in sync with the willingness to pay for these customers, revenue from these customers would be $1125.75, over $3.00 more ARPU each month. Instead, they are making the averaging mistake and pulling their pricing down.

To get more in sync, Evernote needs to rethink their approach to these higher value users.

Evernote needs a double premium approach

At the moment, Evernote thinks they have two premium plans: Premium and Business. At $149.99/user/year, the Business plan actually hits the willingness to pay for the most organized cohort.

But the features present on that plan aren't features power users care about. Certainly not enough to make the jump from ~$70/year on the Premium plan to over double that for the Business plan. Additionally, though Evernote can be used in a business setting, it is still seen as a personal app. An Anal-Retentive Evernote user isn't going to walk into a new organization and get 1,000 employees to sign up.

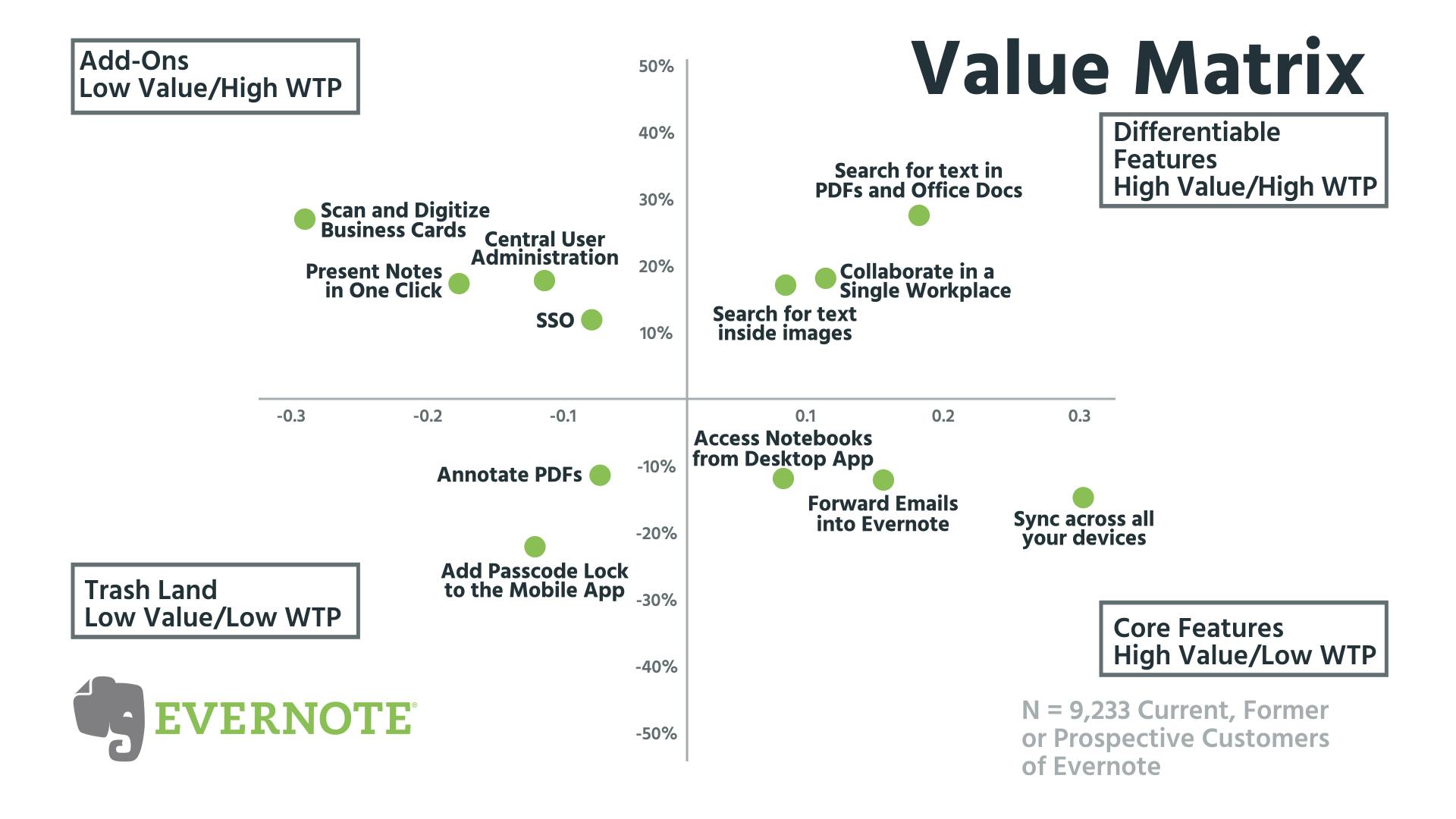

So for their true power users, they only have one paid plan. They need two. Looking through the value matrix from our research, we can see a few possibilities to differentiate tiers:

- Search. At the moment, this feature might be introduced too early in the tiers. It is a High Value/High WTP feature, so Evernote can consider shifting this feature up, allowing paying customers to search certain docs on the first tier, then more types on the second tier.

- Collaboration features. Power users don't want to work in Evernote alone. If that is their personal hub, they need to share and collaborate. Offering power users the ability to collaborate with other power users or users of their choice unlocks the value of the tool for these customers, and potentially introduces it to more users as well.

- Storage. This is always going to be an option. On the Business plan, Evernote effectively offers 22GB to a personal user. Having this as a part of a double-premium plan would allow them to segment Well-Organizeds from Anal Retentives.

An easy way to increase ARPU: Localization

Evernote has another option to increase ARPU without disrupting their pricing plan: localize their pricing. This is one of the easiest wins for any company if you have customers outside of your home country.

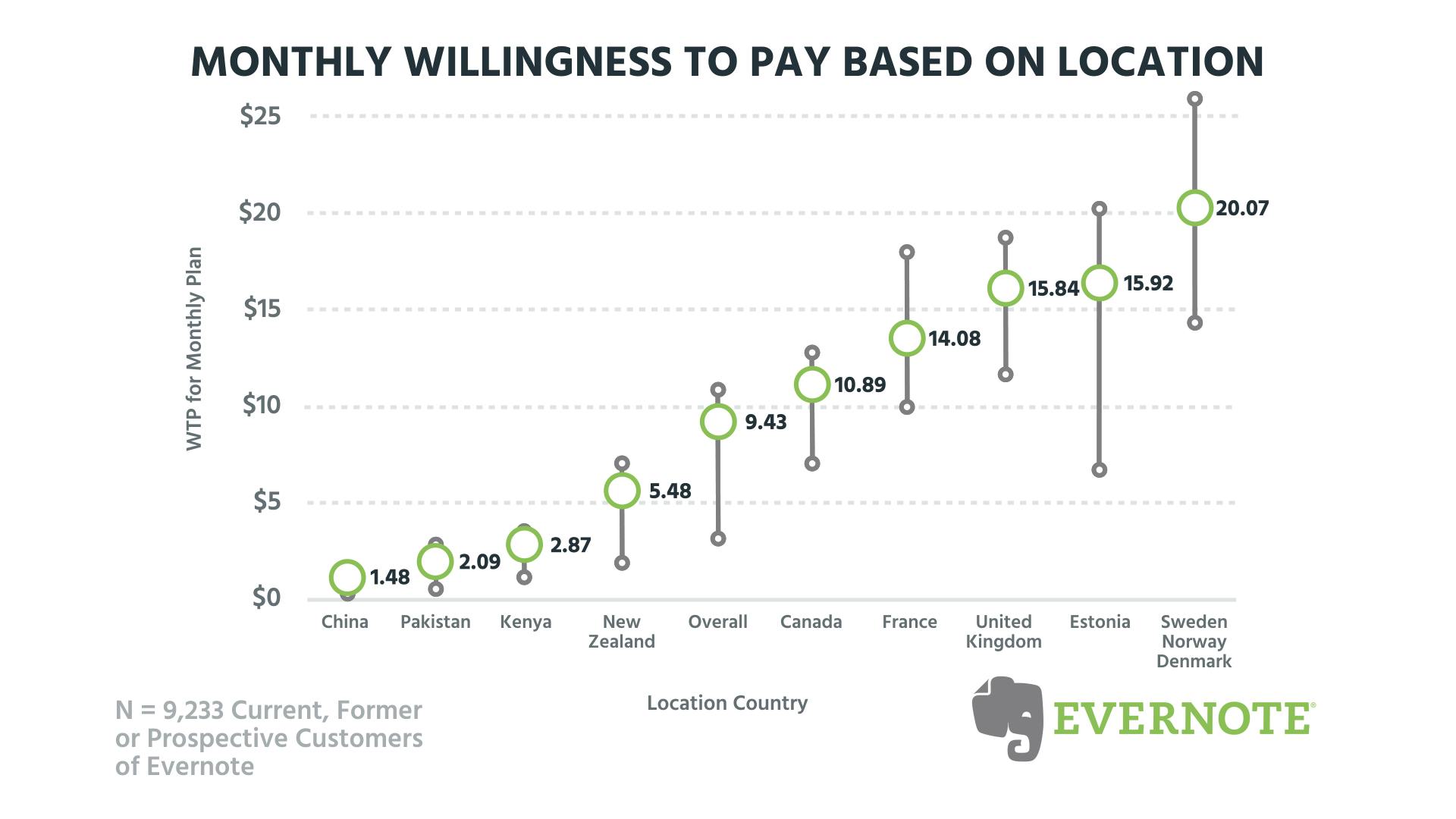

Our research shows that Evernote has an incredible opportunity here:

Scandinavians love their notes. If you consider that the overall median here is actually above Evernote's Premium plan, a lack of localization in Canada and Europe is definitely costing the company money:

- Canada: median is 36% greater than Premium price.

- France: median is 76% greater than Premium price.

- United Kingdom: median is 98% greater than Premium price.

- Estonia: median is 99% greater than Premium price.

- Sweden/Norway/Denmark: median is 151% greater than Premium price.

This is why I always say this:

“I talk about it a lot. If you have even 10% or less of your base outside of your main market, make sure you are localizing your pricing. Even if it's just cosmetic, making sure it is the right currency symbol.”

Value changes per country and per market. If you are selling to those countries and markets, you have to understand the value and pricing there just as well as your home market.

Tell us what you think and become an Evernote power user

Evernote has had a turbulent few years, pricing-wise. But I think they are on an upwards trajectory. Yes, their pricing is too low, but they have made that leap from offering too much within their free tier to understanding that precipice between free and paid. Peter is a bit more bearish on their pricing, but still sees what they are trying to achieve.