It’s no secret that the huge variation of tax jurisdictions around the world is a bit (a lot) of a pain for software businesses. It means more regulations to comply with, more ever-changing rules to keep on top of, and more penalties to be wary about.

International sales tax definitely has its complexities.

However, selling internationally isn’t only complex due to different locations with different jurisdictions.

Whilst SaaS businesses make a huge effort to ensure their localization and payment processes are up to scratch for selling across borders or territories, some aren’t realizing that what they’re selling has an impact on sales tax, too.

Yes, that’s right. Another complication: the software product category you’re in.

What are the different software product categories?

Software products can be divided into 5 main categories, all of which will be considered in various ways by different locations and territories, sometimes with radically different tax laws applied to each.

Here are the 5 different categories of software products:

- Standard digital goods : These are software products that are pre-written or ‘canned’ for download or installation on local machines. An example might be Excel or downloadable software to organize files on a computer.

- Digital goods: These are non-customizable digital files or media acquired with an upfront payment that can be accessed digitally without any physical product being delivered. An example might be digital artwork or online video tutorials.

- eBooks : Digital books and educational material sold with permanent rights for use by the buyer.

- SaaS : Software hosted in one place - such as online/in the cloud - where continuing access is usually paid for by customers with recurring payments. Most SaaS products also aim to continuously improve their product over time as well.

- Web hosting : A cloud storage service for personal or corporate information, assets, or intellectual property.

Software product categories and sales tax

So, how exactly do software product categories impact sales tax?

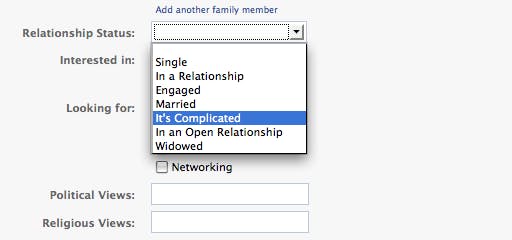

If this question had Facebook, it would set its relationship status as “It’s complicated” because, as per usual in the realm of sales tax, there is no simple answer.

The problem is, these categories came in after certain sales tax jurisdictions were created so they don’t fit neatly into a ‘standard’ of sales tax definitions or laws - if there is such a thing.

Whether or not your software product or service is taxed is all down to how different countries, states, and cities perceive each distinct category.

In some places, software isn’t taxable. In some, software is only part taxable or only some of the categories are taxable. And in others, software is entirely taxable.

Sales tax in the US

Let’s take the US as an example - it’s always a good one to show just how complicated sales tax can get.

So, all states with a sales tax will apply it to most ‘tangible’ products. But you’d be surprised at how this holds up across the states.

The eBook of Harry Potter and the Philosopher’s Stone isn’t the same as holding the physical book, is it? And streaming the film isn’t the same as placing the DVD in the DVD player, right?

Well, throughout the US you’ll find a number of opinions:

- The Harry Potter eBook is not considered a tangible product

- The Harry Potter eBook is a tangible product because it can be seen

- The standard Harry Potter book would be subject to sales tax, so an intangible version should be too

On top of that, within each opinion is an abundance of sales tax regulations and rules to go by.

The moral of the story? Do not think that selling software into the US is an easy feat.

Rewarding? Absolutely. Easy? Definitely not.

To find out just how painful it can be, and to cover everything you need to be aware of, we made this:

Find out just how painful it is dealing with sales tax in the US here.

How Paddle can help

As a revenue delivery platform, Paddle offers a number of solutions to help SaaS businesses grow and drive revenue.

We take away the headaches of the billing and payment processes, including the - rather large - headache of sales tax, too. It’s all part of what we do.

Our Paddle Comply solution does all the hard work for you when it comes to sales tax and tax compliance. With the new selectable tax categories , you can simply choose the type of each product or subscription from a drop-down. Once our team authorizes the category for use, Paddle will then automatically charge the correct amount of tax on all purchases from every country and territory.

We take full responsibility for tax compliance too, meaning any penalties are on our backs.