Salesforce was founded in 1999. That means the last platform for sales technology was built 25 years ago—built for technology, not built for the world of AI.

Established SaaS giants like Salesforce and HubSpot—the architects of foundational platforms built for a pre-AI world—face a reckoning, driven by AI's relentless advance and changing customer demands.

Noah Sturm, Senior Vice President of Sales & Revenue at Augment AI, says these incumbents now find their core architectures strained, creating what he calls a "huge gap in their business." As their once-mighty technology moats shrink, and with a history of sometimes failing to deliver clear ROI, they stand at a crossroads where nimble, AI-native challengers are ready to rewrite the SaaS playbook.

Aging architecture: Sturm pinpoints the foundational problem: "Salesforce was founded in 1999. That means the last platform for sales technology was built 25 years ago—built for technology, not built for the world of AI." This mismatch, he argues, means "AI native technology companies are going to be able to catch up quicker than they've ever caught up before. No feature is safe."

Moats under siege: While companies like Salesforce and HubSpot are deeply integrated" into customer workflows, giving them a current advantage, analysts warn this traditional moat could weaken as AI could fundamentally reimagine CRM. Sturm believes the "technology moat that SaaS companies have existed in for the last 10 years is getting too thin."

Value on trial: Customer perceptions around value amplify this vulnerability. Sturm contends some SaaS players have been "consistently under delivering on ROI, and then consistently overcharging their customers." Research supports this, showing that ambiguity in ROI measurement can lead to customer dissatisfaction and perceptions of being overcharged when value isn't obvious.

Features fade fast: In this new AI-powered arena, "if you're selling feature function, you're f*cked," Sturm declares bluntly. With AI speeding up development, competing on features alone is a dead end. "People are catching up in days and weeks now," he warns.

AI native technology companies are going to be able to catch up quicker than they've ever caught up before. No feature is safe.

Bloat signals breakdown: This pressure contributes to what Sturm terms "SaaS bloat," where legacy systems are bogged down by "tech debt on all these acquisitions" and a surplus of unused features. He foresees this potentially leading to "the downfall of SaaS as we know it."

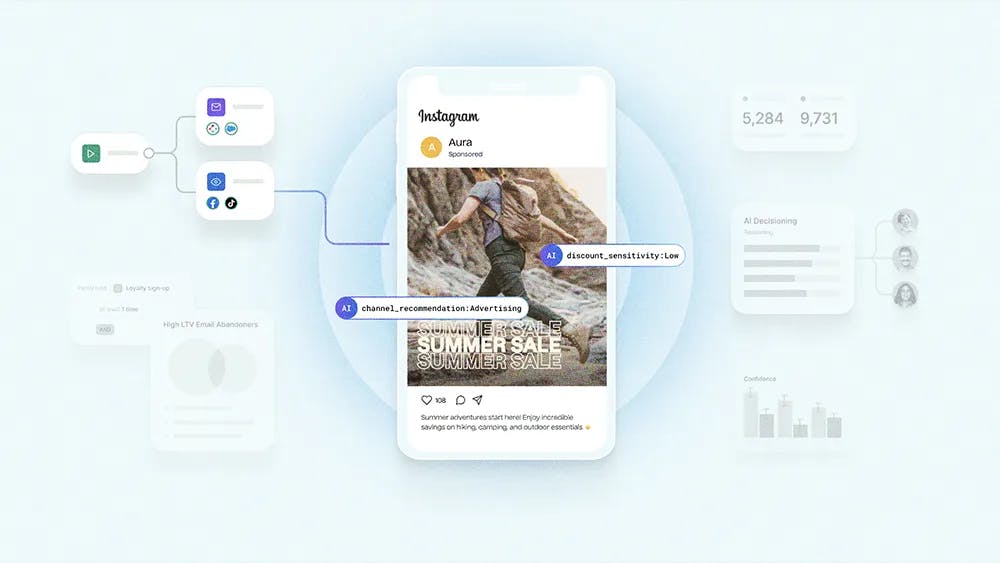

Market analysis lends support to this view, indicating the "SaaS sector is not vanishing, but its core model is being redefined" by AI, with "AI agents emerging" as the next major disruptor and new "AI Agents as a Service (AIAaaS)" offerings on the horizon, all while "pressure on technology investments" grows.

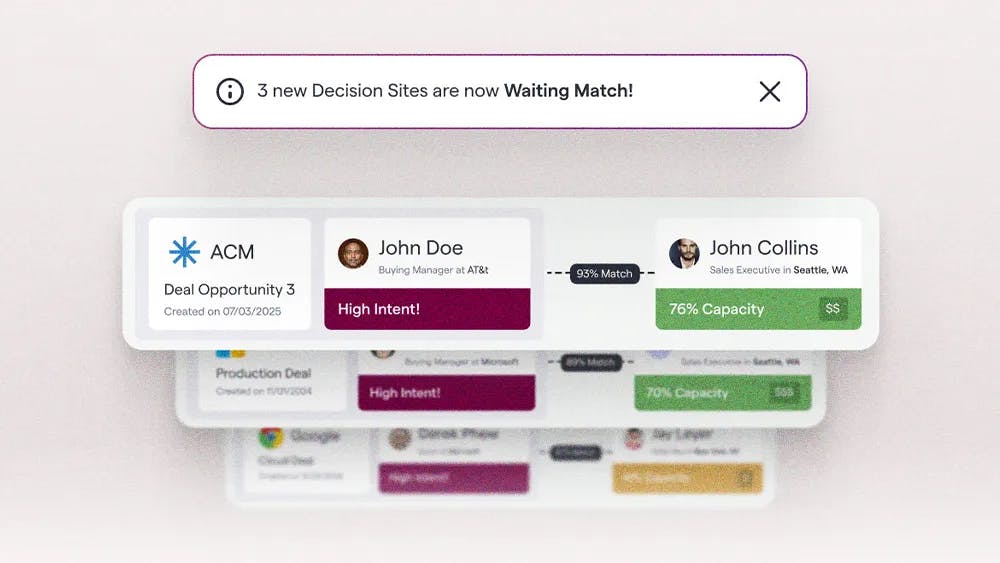

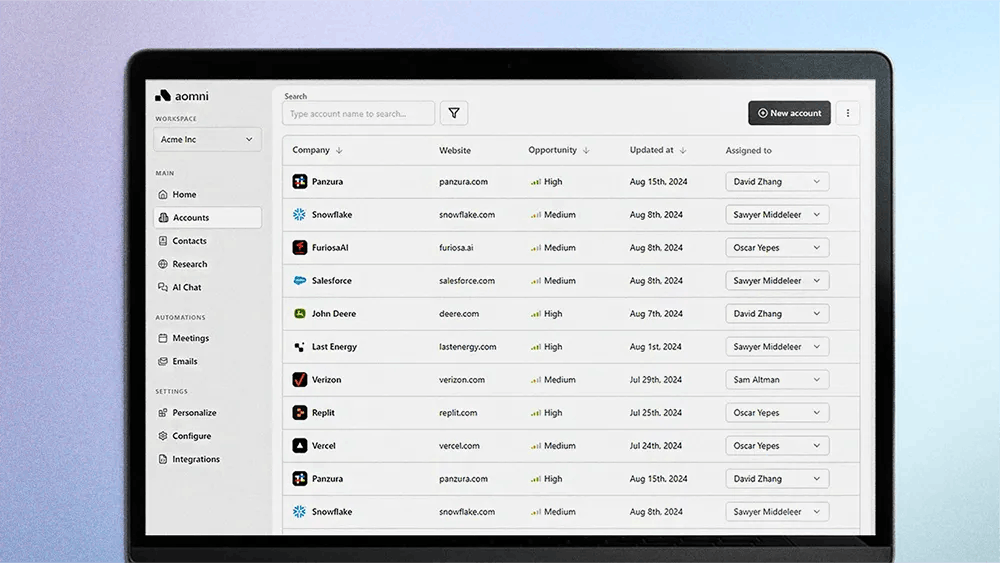

AI with a human touch: The path forward, Sturm believes, demands a strategy that's hyper-focused on keeping humans in the loop. "We believe that AI is a co-pilot not just for the seller, but for the buyer," he says, explaining that Augment AI is building "AI decision hubs to help buyers make more effective decisions." The philosophy centers on creating "durable relationships and durable revenue" through robust platforms, not fleeting point solutions.

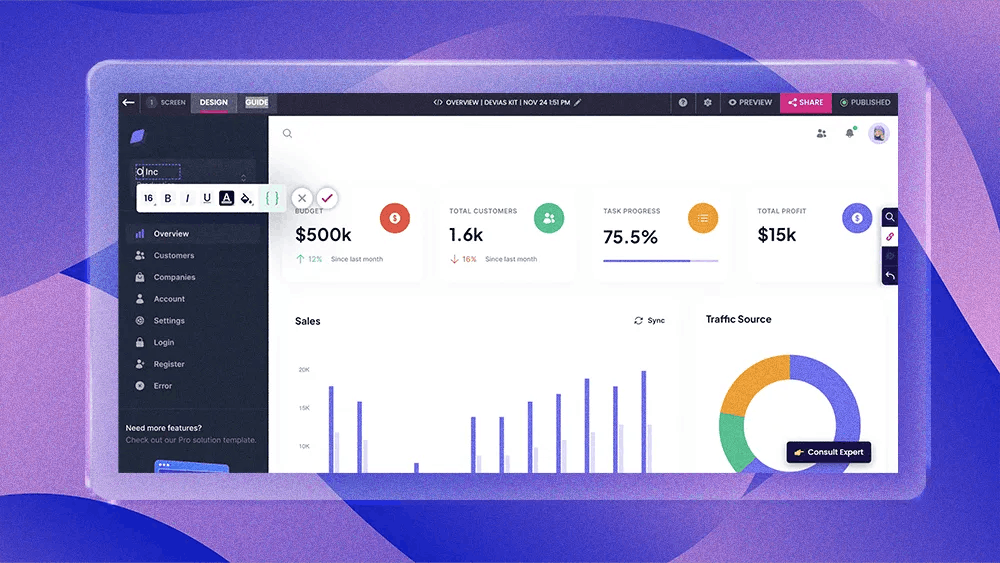

Enterprise, accelerated: AI, Sturm concludes, is also revolutionizing the speed of sophisticated software development. "AI is allowing companies to build enterprise grade technology faster than we've ever done before," he observes. "Startups are no longer restricted to running a product-led growth motion to acquire SMB customers. Today, you can start building enterprise grade products from day one."