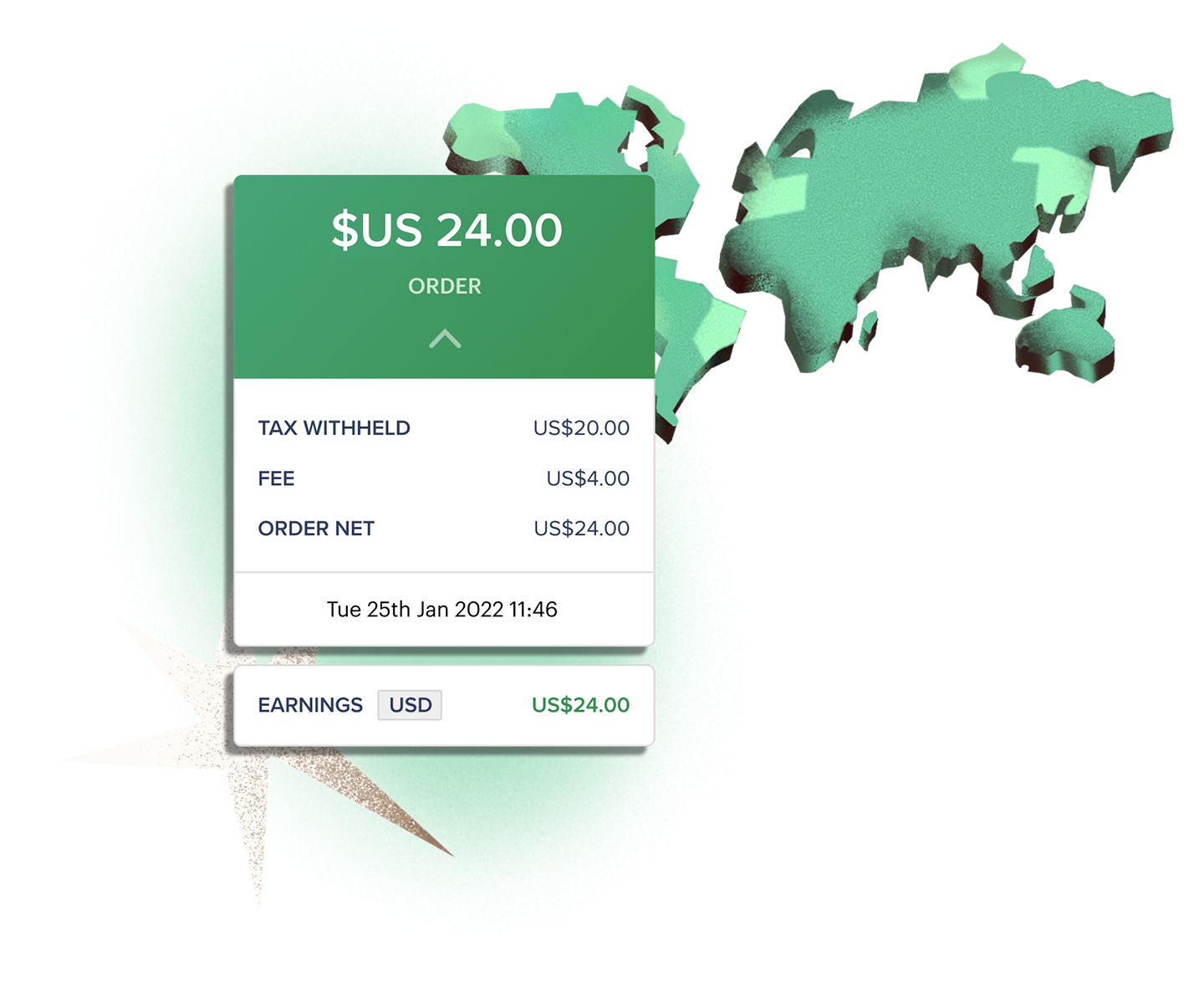

Selling software with Paddle? You never have to deal with sales taxes like VAT and GST in any jurisdiction ever again.

We act as the merchant of record (a reseller, just like the App Store). This means we calculate, file, and remit your software sales taxes on your behalf, saving you from the distraction.

Paddle is more than a tax calculator. We ensure tax compliance across your payments, subscriptions (including proration), invoices, and receipts. Tax calculators are limited to calculating, charging, and producing a report. The liability for sales tax compliance lies with you.

Paddle files and pays your sales taxes owed on your behalf, then issues a 'reverse invoice' to for your records to show taxes as paid. You don’t need to do or pay anything extra.

If a jurisdiction investigates you or changes their tax law overnight, Paddle takes liability, not you.

Why does Paddle do this for me? →

We manage your payments, tax, subscriptions and more, so you can focus on growing