Partnering with a merchant of record like Paddle frees your team from the distraction of building a global payments infrastructure, so you can focus on building your customer base.

Land & expand customers with modern SaaS experiences

No slowdowns to build, maintain, and fix your payment stack

Avoid add-on fees, overcharges, and wasted resource

De-risk your payments with a more reliable infrastructure

An MoR is paid by your end customer and handles all of the payment infrastructure and tax liability related to each transaction.

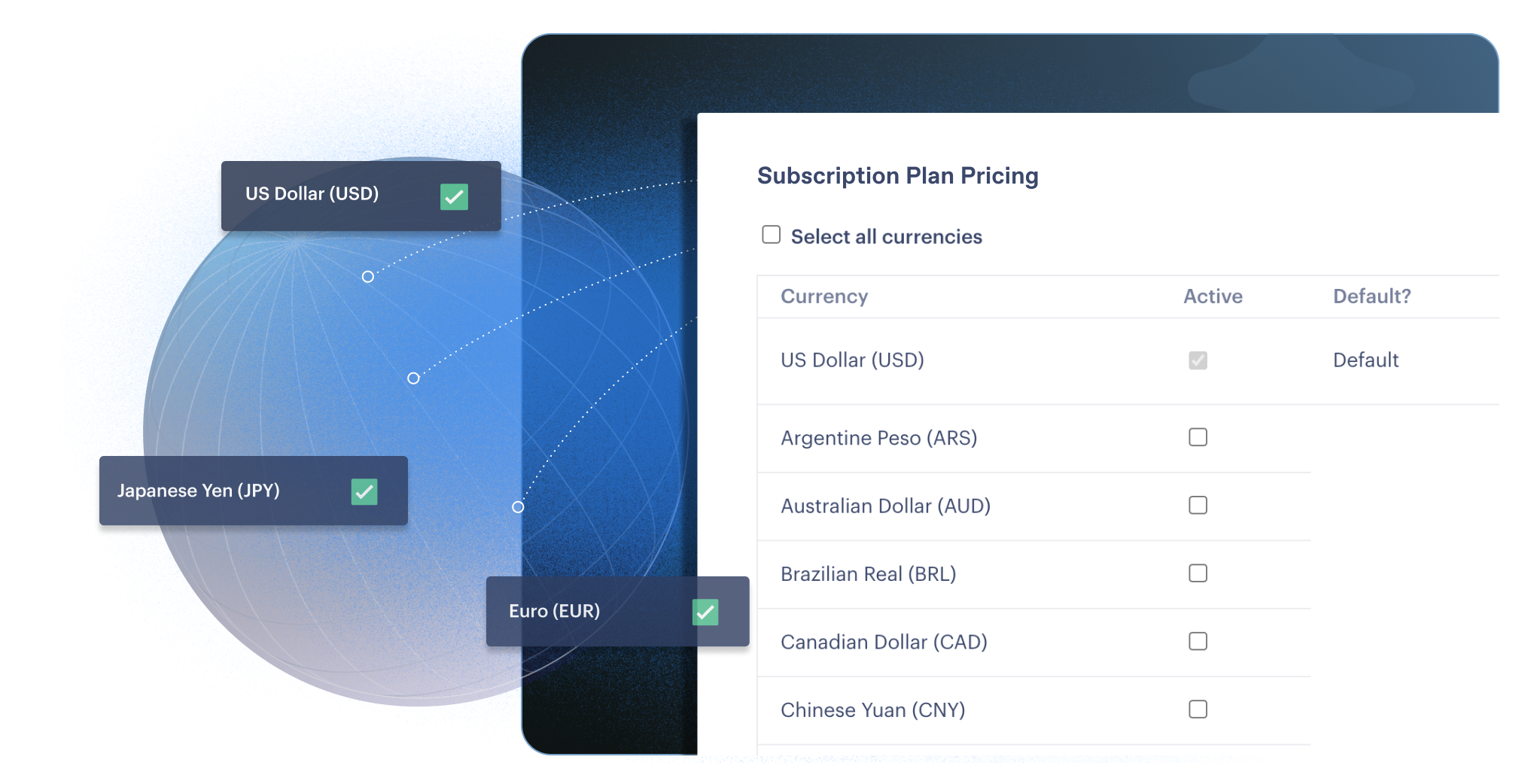

We’re incorporated and have a local bank account wherever you need one. We’re registered to collect and remit taxes. We’re integrated with all the popular local payment gateways.

You’ll get all of the above without losing control over your customers and product.

Find out more here

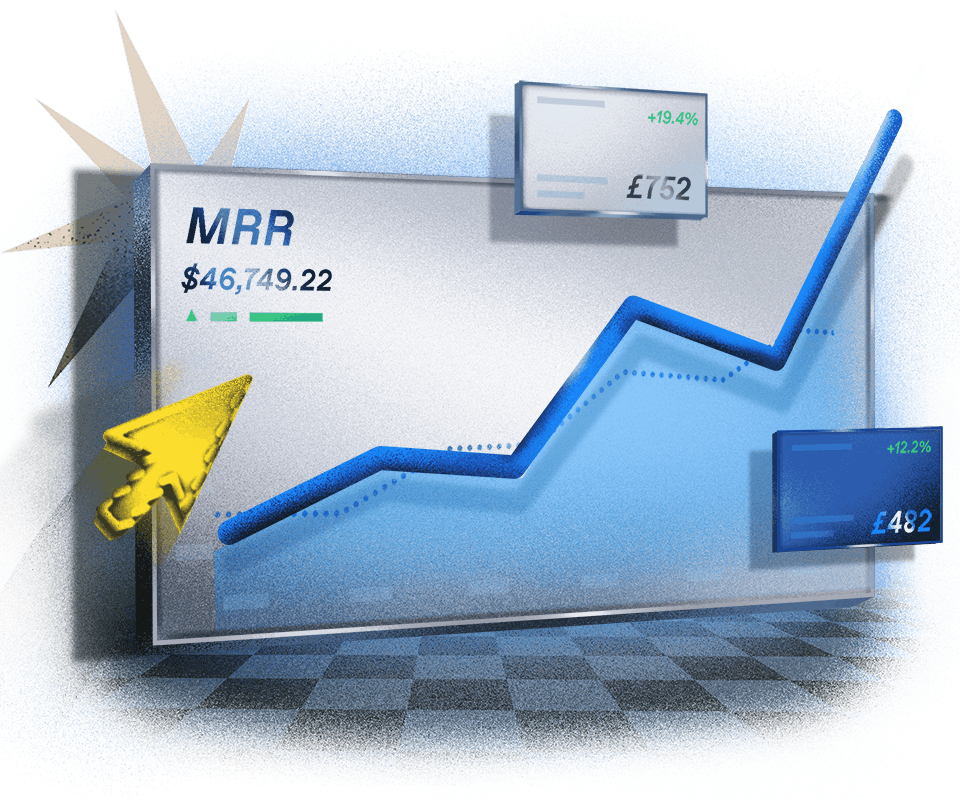

Paddle uses the proven MOR business model and applies it to a modern, fast-growing payment infrastructure. For the best of both worlds. So you can have complete confidence in your payment partner.

The bottom line: less time maintaining a legacy system, more time growing with a reliable, modern Merchant of Record.

As a merchant of record, we help you get to your end goal - whether it’s funding, acquisition or listing.

We have a portfolio of public listed companies with over 1000+ employees, as well as stories of acquisitions happening every month (including Kaleido).

And if funding is on your horizon, Paddle help you prove commercial viability and growth potential to any investor with a clean, integrated, open, and auditable platform.

As an MoR managing the payments stacks, subscriptions, sales tax, and more on behalf of over 3000 software companies, we have found that businesses who move to Paddle usually see:

We manage your payments, tax, subscriptions and more, so you can focus on growing