Take a look at what Apple got wrong, as well as some major takeaways for your business so you don’t make the same mistakes.

Apple’s “one more thing...” at WWDC 2015 yesterday was the launch of their new Apple Music service, which provides streaming music and radio access to Apple's already behomith music downloads business. This move has been heralded as a “fiiiiiinallllly” moment as Apple continues to trail streaming music companies like Spotify and Pandora.

Yet, as Business Insider’s Dave Smith put so elegantly, the launch was “easily one of the sloppiest debuts for any new product or service from the company.” With off script moments that didn’t pan out well to broken demos and incoherent feature demonstrations, the Apple fan boy in me was pretty disappointed.

What’s worse: Apple’s pricing strategy for Apple Music is one of the worst we’ve seen from such an innovative company (and we see a lot of pricing strategies).

With essentially no segmentation, a race to the bottom price, and disconnected differentiation, we don’t think Spotify should be too worried - at least in the short term. We were so distraught with what we saw from a pricing perspective that we even hustled from late yesterday afternoon to collect some data using our software to show you just how wrong Apple is miscalculating the market. Let’s walk through what Apple got so wrong, as well as some major takeaways for your business so you don’t make the same mistakes.

The Pricing Challenges Apple Faces (you probably do, too)

To bring you up to speed on what exactly Apple Music is and how it’s priced, let’s walk through the current pricing strategy, as well as the major challenges Apple faces in the streaming market. As alluded to above, Apple Music is Apple’s answer to Spotify, Pandora, and other streaming music services out there that allow users to listen to essentially every song ever recorded in the world for a monthly subscription.

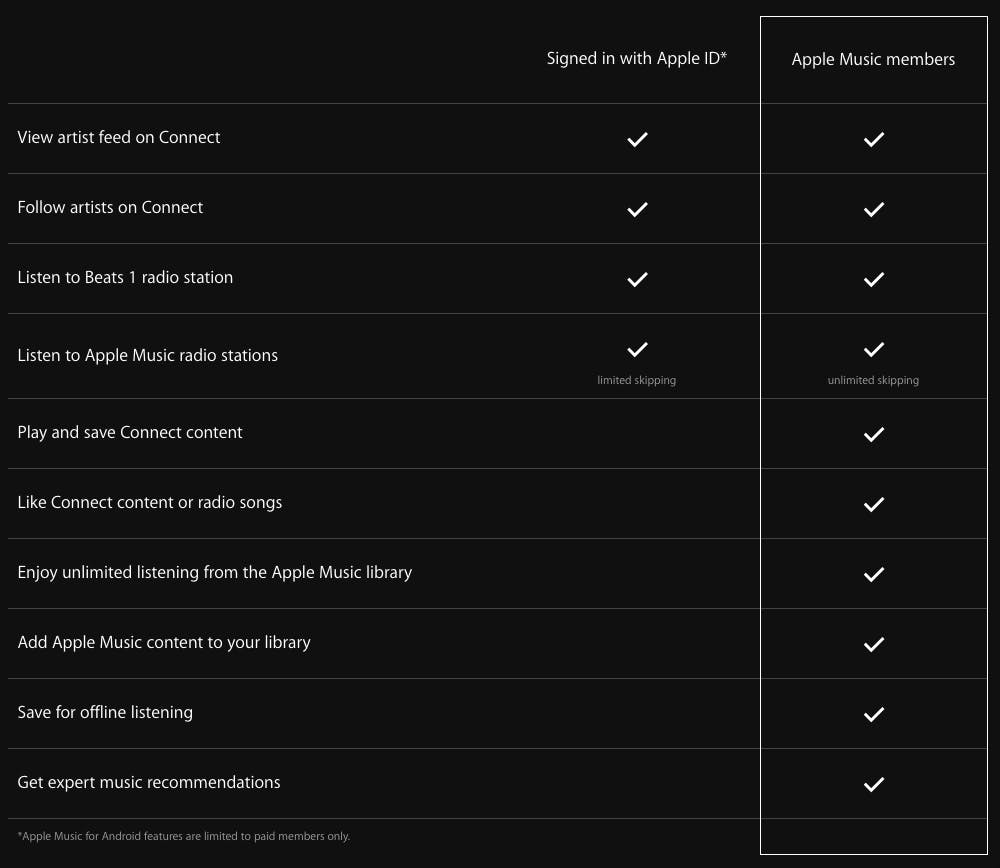

Apple takes these services a step further with a feature they’re calling “Connect”, which essentially acts like the artist MySpace pages of yore, allowing artists to post premium content, such as behind the scenes footage, messages to fans, etc. Specifically though, free users can listen to Apple Music radio stations with limited skipping and view and follow artists using Connect. Premium users (paying either $9.99 per month for a solo membership or $14.99 per month for a family membership with up to 6 people) can do everything free users can, but can put together their own music playlists that can be played offline or on any device, and do some extra interactions with Connect. Here’s the full breakdown:

The very nature of the product presents a few problems though:

- Many different buyer personas to target: Music is one of the few things that connects almost every human being on the face of the Earth in some way. Yet, the fabric of music listeners is exceptionally multi-colored. You have the casual music listener, the audiophile, the artist, and even dozens of striations of each of those. Creating a mass consumer service for the multitude of potential buyer personas is exceptionally tasking from a product perspective, but even worse from a pricing perspective when looking to monetize properly in a digital market where you’re lagging.

- Millenials (their core target market) are the only generation that don’t want to pay for music: To make matters worse, Apple is trying to shift the purchasing behavior of a generation that just constantly rejects paying for music. We’re napster babies fueled by the world of free and torrents. The generation that came before us barely learned to buy songs and albums digitally (many still don’t), and the generation after us will be just fine. Yet, the heart of their target market at this very moment and for the foreseeable future continues to yearn for free. True, the market is trainable, but that’s where Customer Acquisition Cost (CAC) will continue rise.

- The music industry is probably screwing Apple on costs: Apple can’t afford high marketing contribution to CAC either, because they’re likely suffering under intense costs from the major labels. In our review of Spotify’s pricing last year, we learned that Spotify is essentially taxed 70% on every dollar they make through costs paid out to artists and the major labels. Apple’s consistently been a phenomenal negotiator, but it’s hard to imagine them not paying out at least half of every dollar they’re making in fees to the industry.

Where Apple Screws Up Royally (things you should avoid/learn from)

The problems above are absolutely tough to weather, even for a company as innovative as Apple. Yet, given their scope and Apple’s position in the market, Apple essentially punted on doing anything innovative or intelligent with their pricing. Instead, they opted for a road similar to their streaming competitors, but executed in a much poorer manner, particularly when it comes to leaving money on the table through a mono-price mindset and abandoning a clear freemium strategy

1. Apple’s leaving an exceptional amount of money on the table through a mono-price mindset

There’s no doubt that Apple’s going to sell subscriptions here. An aggressive three month free trial, killer acquisition experience, and the knowledge from selling over 25 Billion songs through iTunes since it’s inception means there isn’t a question. Yet, they sadly could be selling so much more with the platform they’ve built.

Take a look at the price sensitivity data below that we collected using our software from 300 music lovers regarding a music service that provided the premium features of Apple Music (more detail on the process and methodology in this article we did on Groupon's pricing). You’ll notice that Apple's $9.99 per month falls fairly close to the rock bottom price point of around $8 per month that captures the majority of the market (Point A). Yet, you’ll also notice that between points A and B, a good number of folks were willing to pay much more than the $8 per month price with about 10% of the sample willing to pay about $25/month (point B).

This doesn’t mean that Apple should have an entry level price for the service above the $9.99 per month price point (and there's an argument to be made to make it even lower), but it does mean that they’re leaving an enormous amount of money on the table from the majority of the market that’s willing to pay much more than $9.99 per month.

What’s worse is that audiophiles are willing to pay even more. We surveyed another 100 music lovers who were hardcore audiophiles, identifying themselves as individuals who listen to music constantly as a passionate hobby, not just as a means to shaking their bum on the weekend. These individuals fell into two groups - one that’s willing to pay roughly around where the main group is (point C below) and another that’s willing to pay 6-8x what the casual listeners are willing to pay.

Without doing even an ounce more analysis, this data is compelling enough to suggest at least two tiers of service that captures revenue from both the casual entry-level listener and the audiophile. This is a basic tenet of proper pricing - you need to align your tiers to your personas, giving them an entry point and a place to grow.

Naysayers out there may be thinking, “well Apple wanted to keep things simple as Apple is prone to do.” Having multiple tiers of service doesn’t mean things need to be super complicated, particularly in the consumer space. Additionally, Apple's roll out is already super confusing with two versions of their single tier ($9.99 solo and $14.99 for up to 6 people), a free version that offers some limited functionality, and very unclear language around what you exactly get with the premium versus free tier.

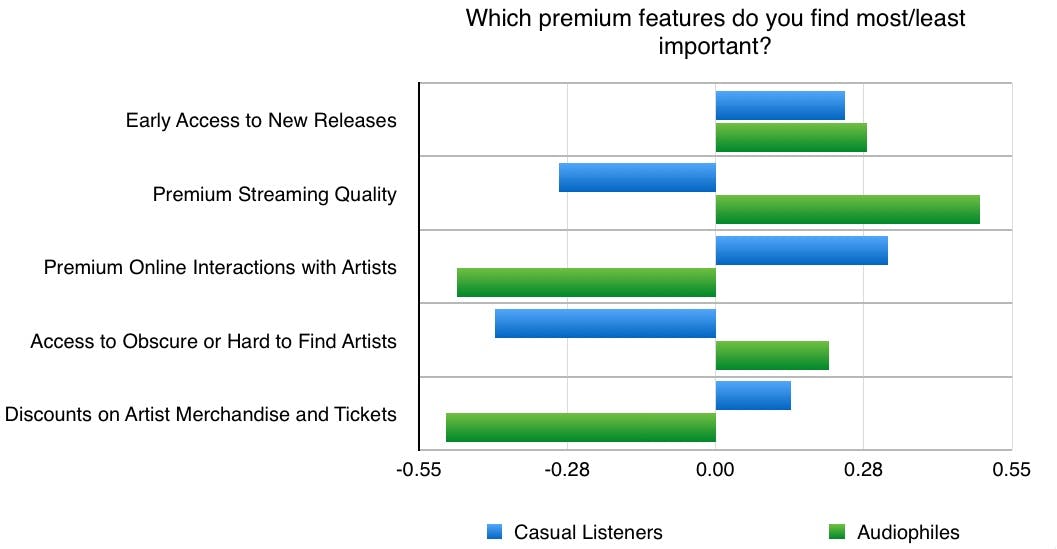

Netflix does multiple tiers in consumer SaaS exceptionally well by differentiating streaming quality and number of concurrent streaming locations. In an additional analysis you can see below we ran amongst the audiophiles, the most basic differentiating factor was sound quality. Simply offering a premium bitrate would be enough to hook those premium users to upgrade to a higher level of service. Mixing in a few additional perks would convert and retain even more (here's more information on running feature value analyses).

The bottom line how we’d make changes: Apple needs better persona-pricing alignment and to not crush themselves under the mono-price mindset. We’d have a tier at $10/month and a tier at $25/month+ for the premium audiophiles. All this allows them to sweep up much more of the cash out there for services like these, especially considering our look at the market showed audiophiles could be as much as 15% of buyers. Having 1 or more out of every 10 customers giving you 2.5x+ Monthly Recurring Revenue (MRR) does amazing things to your Lifetime Value (LTV) to CAC ratio. We’d need to do some more analysis to truly know where that premium price point should be and which features to differentiate on, although bitrate looks exceptionally promising.

2. Apple’s wrongfully abandoned a clear freemium strategy

As mentioned above, Apple’s facing a potential problem with a staunch competitor with a very enticing freemium strategy (Spotify) in the context of a main target buyer generation that doesn’t like paying much, if anything, for music. As we’ve discussed previously freemium is an acquisition strategy, not a revenue model that needs to be used like a scalpel in SaaS. With Apple being behind, it’s perplexing why they aren’t buttressing their freemium offer, even if it’s not as feature rich as Spotify’s. Without it, they're forcing themselves into an upward CAC battle riddled with landmines of active usage woes.

In the consumer SaaS space, free trials are typically a weak way to convert users, as you want to constantly be nurturing a lead for as long as it takes to convert them. For instance, if I try a product on a free trial tomorrow there may not be enough hooks to get me as an active user within the first 15-30 days, let alone for me to be triggered enough to want to purchase within or after those 30 days. Plus, my attention span may distract me from interacting with your product beyond a day or two. As a result, if you’re only giving us 15-30 days to date, the liklihood that I’m going to marry you with my credit card is very low in consumer SaaS following a trial.

Freemium on the other hand keeps me warm constantly, and allows you to barrage me with messaging to make me move from "free inactive" to "free active" and then different triggers to make me "premium active."You own the lead and can refine your funnels constantly based off the free interaction, because there’s simply no end date.

Apple doesn't have free as a core competency, but leading with their free trial (even if it is 90 days) and not buttressing their free plan shows a lack of foresight around truly understanding their funnel enough out of the gate. They aren’t in a space where their powers of hardware or mass distribution can save them from proper acquisition modeling, especially with Spotify who has such a far reaching head start.

The bottom line how we’d make changes: The free trial should still exist for the premium offering, but Apple should lead with free as the gateway drug to premium. Even with the limited features, there’s enough there to keep folks hooked and even to bring some diehards over from some of the other services. Yet, this won’t work if a prospect’s conversion from another service starts with a ticking trial clock.

What Apple’s Doing Right (things you should steal)

Fortunately it’s not all fire and brimstone for the Apple Music pricing strategy. Some innovative thinking around product and brand will likely be their saving grace overall, particiularly revolving around pushing the music experience beyond a commodity and getting ahead of the innovator’s dilemna curve.

1. Apple began closing down a dwindling download market at the right time

Sure Apple has sold over 25 billion song downloads since iTunes came on the market. Yet, streaming has started to eat Apple’s lunch considerably with download sales falling 11.4% year over year from 2013 to 2014. Larger drops are likely to be expected as time goes on, because who can say no to streaming literally any song ever recorded for less than an album cost per month.

No one can deny Apple is an innovator in so many markets, but what’s beautiful with this move is they didn’t try to hold on to a profitable dying star - a move Microsoft is exceptionally adept at making. Instead, they recognized the writing on the wall, bought Beats for the hardware and software, and moved their mindset immediately to the next frontier.

Sure we may all think this is absolutely what we also would have done, it’s hard to imagine such a swing from billions of dollars to the unknown frontier of streaming. Many companies try to hold on for way too long at the hopes that on-premise software will somehow start to grow again or paper maps will be back in vogue.

Pricing Takeaway: Just because you’re making money today, doesn’t mean you’ll make money on the same product tomorrow. Pricing is a process that constantly needs to be re-evaluated for proper SaaS monetization of what you’re building out. Additionally, your user does not care about what you think is cool or valuable; they care about what they find valuable.

2. Making music more of an experience again, beyond the commodification of access

When looking at Apple Music’s “Connect” features one can easily become cynical, because how much can an artist’s feed of videos, thoughts, etc. in Apple Music really do beyond their presences on facebook, twitter, soundcloud, etc. Well, what’s fascinating about Apple Music’s move is that Connect points to something potentially much bigger in the future of music streaming.

Music streaming as an industry right now is exceptionally commoditized. With the exception of a platform’s features and functionality, each service (Google Play, Spotify, Pandora, etc.) really act as a fulcrum to discovering new music and making playlists of songs in some manner. This is really because these companies are suffering under the biggest challenge of negotiating insane contracts with record labels and major artists.

Apple as a later mover in the market is doing something fascinating with Connect though in showing us the buds of a blossoming location to “connect” more with an actual artist. There’s a larger uphill battle here to be the location above all others to interact with artists, but the fact that Apple put connect so front and center to the product shows that they’re starting to think about the next generation of streaming in the beautiful way Apple typically does with their innovative selves.

Pricing Takeaway: SaaS and software is so easy to create relative to other products out there. Don’t be lazy and just focus on the commoditized features that anyone else needs or can build. You need to make sure you’re focusing on your personas differentiable tastes and interests to position yourself properly.

Disappointing start, but we're sure they’ll recover

Come hell or high water, Apple is going to make money on Apple music. Subscribers will likely come through unnecessarily high CAC, but fortunately Apple has enough cash to sustain these costs and the product know how to properly wait out the time to recover CAC. All that being said, you’re probably not Apple, so make sure you learn from these takeaways to keep your CAC low and your LTV humming up and to the right.