If you're looking to make the switch, we've analyzed seven alternatives to Stripe, ranging from PSPs and payment gateways to more modern payment solutions like a merchant of record.

Find the best Stripe alternatives for your business and customers. Here are some of the best alternative approaches and solutions on the market.

What is Stripe?

Stripe started out and is best known as a payment processing platform, but they do a lot more than that now.

These days, Stripe is considered a payment gateway - a tool that will enable internet businesses of all sizes and product types to take and manage payments online

With Stripe, you can do this without having to set up a merchant account. On top of that, it proves itself as a super powerful payment tool with additional features, including smart retries, auto card updater, and some fraud tooling to lower the risks of churn.

There are alternative solutions for your payments and billing infrastructure. - more on that further below.

Who is Stripe good for?

Stripe is a favorite for many different types of businesses, including:

- Ecommerce

- Marketplaces

- Mobile

- SaaS

Why these business types in particular?

One main reason is that, with their easy-to-use APIs and wide range of integrations (like shopping carts), getting set up and started in the world of online sales is made pretty simple. That’s ideal for companies that want to get up and running as quickly as possible.

Is Stripe the best option for selling SaaS?

So, what makes Stripe a big contender as a payment gateway for SaaS businesses in particular? Let’s take a look at the pros of their capabilities:

Stripe Billing

One big win is how easily Stripe integrates with Stripe Billing, thanks to their shared APIs. This offers recurring subscription and invoicing solutions to businesses — at an extra cost.

Easy-to-use APIs

Stripe has a great set of APIs for businesses that want to move and grow fast. That’s because they’re very much developer-friendly, which lends to a simple and streamlined setting up process. You’ve got to love that.

Extensive integration catalog

By choosing Stripe as your payment gateway, you will have a wide choice of plugins (but, unfortunately, that doesn’t mean it will be easy or quick). Check out this list of revenue tools they integrate with.

On the other hand:

All these benefits are big considerations for SaaS businesses, but there are some areas that Stripe doesn't cover when it comes to scaling a full growth strategy on your payments infrastructure.

This requires:

- Subscriptions and recurring billing (outside of Stripe Billing)

- Localization (eg. covering multiple currencies, payment methods, languages)

- Global sales tax compliance

- Data, reporting, and analytics

- Payment failure

That’s why Stripe does not offer a complete solution to your payment and billing process. This means that SaaS businesses that use Stripe will still need to do extra work to both integrate and correlate information across various tools and systems.

And if they don’t spend time and effort doing that extra work? There is a responsiveness gap.

Let's break it down.

Stripe alternatives at a glance

Name | G2 score (2024) | Piecemeal or all-in-one | Sales tax management? |

|---|---|---|---|

Paddle | 4.5 | All in one | Yes |

Adyen | 3.4 | Piecemeal | No |

Braintree | 3.4 | Piecemeal | No |

Cleverbridge | 4.2 | All in one | Yes |

Fastspring | 4.5 | All in one | Yes |

Checkout.com | 4.6 | All in one | No |

Lemon Squeezy | N/A | All in one | Yes |

Reasons to consider alternatives to Stripe

Between our engineering team's complaints about integrating Stripe and the insights we've gleaned from sales conversations, here's the lowdown on the reasons SaaS companies look for alternatives to Stripe:

Building a piecemeal stack can be complicated

Stripe is only one layer in your payments infrastructure, that being the payment gateway, it’s not a complete solution. Because of this, you’ll need to integrate and maintain supporting tooling for subscriptions, taxes, invoicing and SaaS metrics. Or build your own.

There are two scenarios where this can create too much work for teams. The first is managing reliable SaaS metrics, which requires payments, subscriptions, and reporting all being perfectly in sync. The second is integrating sales tax tooling. This is something that needs deep integration into every transaction with country, product, and customer-level data all together.

Stripe also prevents you from integrating common payment methods like PayPal (as they are direct competitors). To support PayPal with a Stripe stack, you’ll need to replicate all your infrastructure elsewhere.

This all increases the scope of integration, implementation, and maintenance. The more built integrations you have, the more chances you have for issues to pop up which could lead to increased support tickets from customers who can't change their subscriptions and higher churn due to failing payments.

Additional maintenance work

When using a payment processor like Stripe, your developers will need to integrate and maintain all the necessary tools to support your subscriptions, taxes, invoicing and SaaS metrics - or build your own all-inclusive tool.

Stripe users generally want to get going as quickly as possible with the least effort involved, and/ or drive the highest performance from their payments to maximize revenue.

For those that want a quick and easy job, Stripe APIs make that possible. But those seeking the highest possible performance for their payments will need to do some additional work to their Stripe accounts.

The more tools and integrations you add to your ultra customised payment stack, the more chance it has for something to go wrong. It also leaves you with a gap where your payments infrastructure either completely blocks or slows down your ability to respond to new growth opportunities. This means most Stripe SaaS users could be losing out on revenue. We see this surface in a few areas, including international payment failure and with false fraud flagging.

If you’re based in the US but have customers trying to pay globally, Stripe is sending your company through to your customer’s banks via intermediary banks that have little or no trading history with you. This often leads to declines.

Tax liability can be complicated

The tax burden is one of the most common reasons that we see SaaS businesses migrate from Stripe. Since selling software is borderless, the compliance overhead becomes complicated. In the digital economy, SaaS sales tax is owed where customers are, not where the supplier is. Tax needs to be integrated on every transaction across each customer’s lifecycle, configured for each product and region.

Even with Stripe acquiring TaxJar in 2021 and making it easier to integrate sales tax calculation, users are still required to register, file and remit all tax themselves. While TaxJar does have “Autofile” (a tool which files for taxes automatically on customers’ behalf), it only works in the US currently.

In order to use TaxJar Autofile, businesses who use Stripe still need to set up and integrate a TaxJar account, so there’s no ‘native’ solution.

Alternative approaches to Stripe

So, now we know why SaaS businesses look around for alternatives to Stripe, how are other solutions addressing these problems, and how do you know which is right for your business?

Option #1: A merchant of record

If you are looking for a more unified solution, an MoR is your answer.

A merchant of record (MoR) gives you the resources, support, and technology to improve your revenue across the entire payment process and each customer lifecycle, and ultimately optimize your business growth. 🌳

Let’s break down this model for context:

- It’s more than just a payment gateway: A payments infrastructure rooted in an MoR model gives you a unified solution for taking payments - from checkout and pricing to localization and subscription renewals (and more).

- Say goodbye to dealing with sales tax: With this model, global sales tax is handled for you within the single integration, including full liability for tax compliance too.

- Improve your business’ performance: This infrastructure sits across the journey of your payments which will be maintained for you - not to mention the tooling and support provided to help you easily build an experience specific to your business.

- One single cost: A single cost that covers the $$$ you’d be spending on extra tools, integration processes, and extra employees, and brings in the value of higher performance.

Here are the main MoRs you can consider:

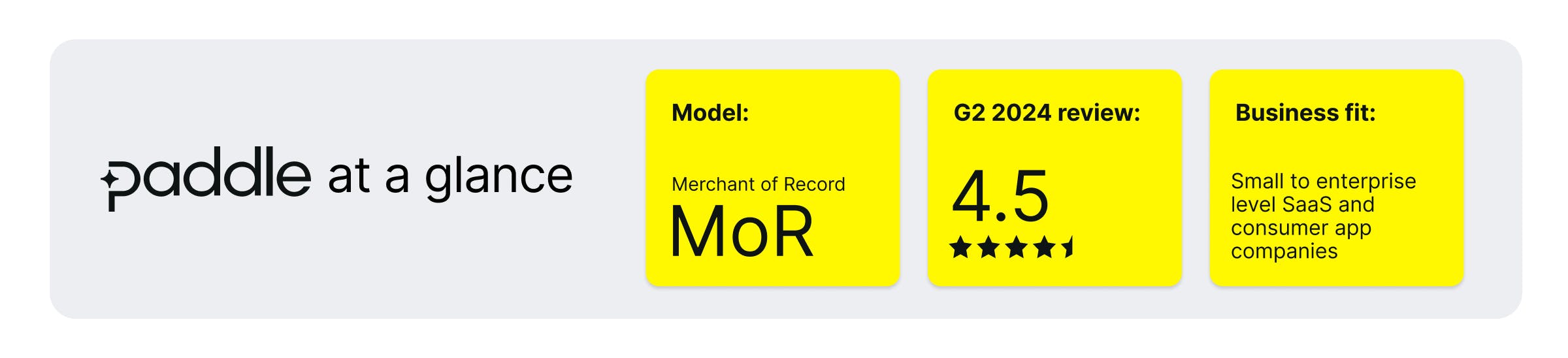

Paddle

Paddle is an excellent Stripe alternative as it is a MoR and provider of payments infrastructure built specifically for SaaS businesses. Managing all aspects of payment infrastructure (aka, ticking all the bullet points above), Paddle covers everything from customer acquisition to renewals and expansions.

The whole aim is to get software businesses ‘growth ready’; ready to expand upmarket, downmarket, and internationally, (and ultimately optimizing their revenue intake).

The key difference between Paddle and other MoRs is that Paddle was developed and designed by SaaS business owners for SaaS business owners. Built specifically for the software industry, Paddle uses the proven MoR business model and applies it to a modern, fast-growing payment infrastructure. You spend less time maintaining a legacy system.

Key features:

- Optimized payments straight out of the box: Instant access to multiple acquiring banks and smart payment routing to give your payments the best chance of success wherever the buyer is based.

- Localization: Turn on local payment methods and currencies with just one click.

- Tax compliance: Paddle takes on the headaches of sales tax and compliance, wherever your customers are based, including all sales tax liabilities.

- Multiple integrations: With multiple integrations (including PayPal), your payments infrastructure is about to be far more streamlined and efficient.

- Dedicated support: Paddle is a partnership - not a provider - for scaling software companies, with SaaS specialist support on hand, as well as advisory for larger businesses.

We speak to thousands of SaaS businesses about their payments infrastructure, and what solution is right for them. Get in touch and speak to an expert today.

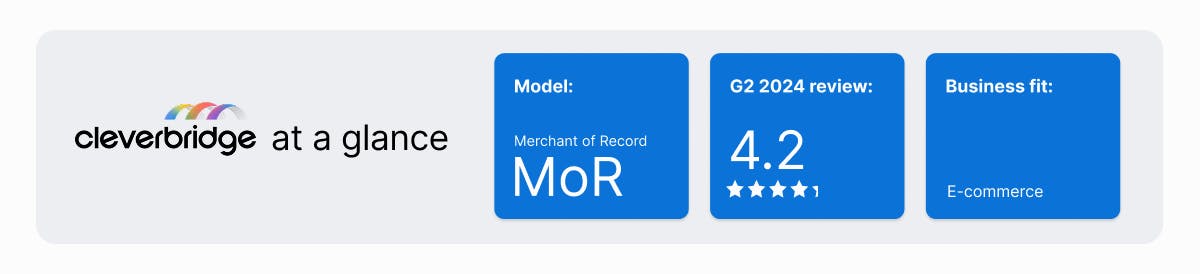

Cleverbridge

Cleverbridge is a cloud-based global ecommerce platform that provides billing solutions for digital goods, online services and SaaS companies in B2C and B2B markets.

As a full-featured MoR platform, Cleverbridge is designed to offer global sales tax compliance and subscription payment capabilities. The platform offers a wide range of billing models and is well-suited to large companies with dedicated engineering teams handling their payments infrastructure.

Cleverbridge is designed for global online businesses that serve customers all over the world and need sales tax compliance solutions.

That said, Cleverbridge is not tailored for SaaS-specific features like key subscription and B2B models. That means there are certain limitations to how well it can support this particular business model.

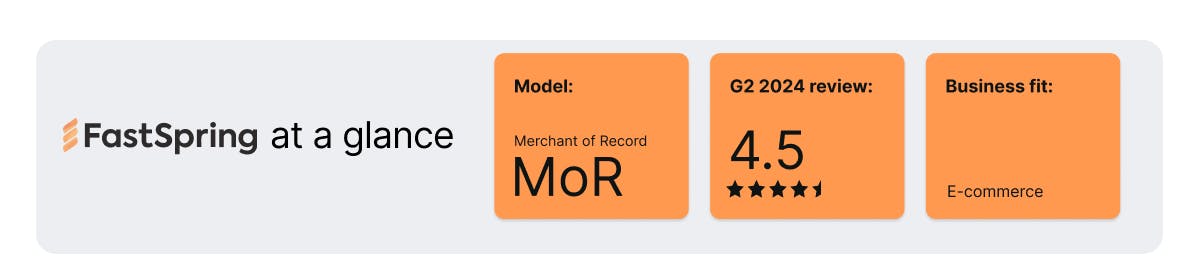

Fastspring

FastSpring is another MoR that handles online payments for businesses who sell both physical and digital goods with core features to support:

- Subscription management

- Sales tax compliance

- Payments and billing

- Fraud protection

- Revenue recovery

- Analytics

Ultimately, FastSpring acts as a reseller, selling goods & services and handling online payments on behalf of its business customers. It can be used by SaaS companies looking for a way to manage payments and subscriptions.

Managing sales tax compliance is also possible with Fastspring, which is of particular use for SaaS companies who operate internationally or domestically in regions like the US where sales tax legislation is particularly complex.

FastSpring doesn’t specialize in SaaS, so you’ll still have work to do to build a payments infrastructure optimized for the SaaS model, including:

- Flexible subscription models and recurring billing

- Simple localization processes including local languages and currencies

- Efficient customer support and growth advisory services to help you execute SaaS strategies

Unified data, reporting and analytics that enables you to respond to new market opportunities, quickly.

Option #2: Payment gateways

You could also consider more direct, ‘like-for-like’ competitors: other payment gateways.

The aim for payment gateways, just like Stripe, is to let businesses be able to take payments online. Inevitably, this means businesses hit the same issues and challenges that you would with Stripe.

That said, between the payment gateway competitors, you’ll see a variety of costs, services, payment methods, integrations, third-party tools, and additional features.

Here are some of the main alternative payment gateways to Stripe:

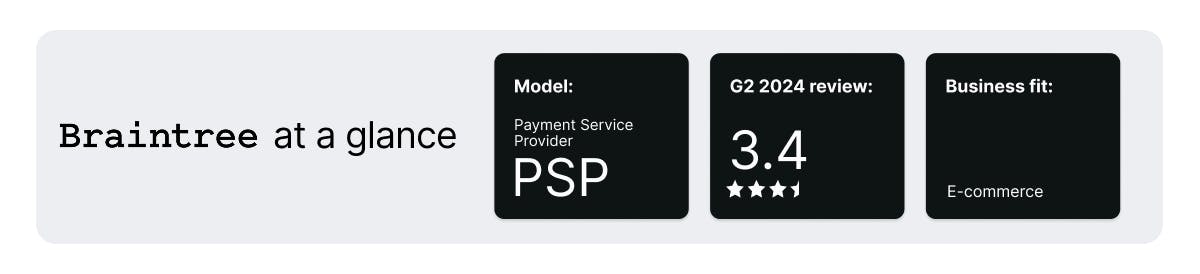

Braintree

Braintree is a good platform to run alongside or instead of Stripe, especially if you are looking for a PayPal integration.

Having been acquired by PayPal, it has native integration which means it’s a great fit for businesses selling B2C or lower price B2B, especially in European markets where PayPal is the preferred digital wallet.

With Braintree, you still need to set up subscription billing, analytics, and localization tools, as well as keeping on top of global sales tax compliance (which can be a job in itself).

Stripe and Braintree both offer a similar service with similar performance rates, all at a similar price point. Great for businesses looking to get up and running quickly, but the number of manual integrations and extra tools needed may slow them down in the long run.

PayPal

Undoubtedly one of the most popular and trusted payment methods or digital wallets out there, PayPal makes online payments easy (and secure). As mentioned, it’s a solid contender for businesses who sell B2C or into European markets.

As it’s only one type of payment method, PayPal is typically run alongside another payment gateway to offer more payment choices.

In fact, due to its popularity, it’s pretty essential for the majority of businesses to have PayPal as an option.

See how PayPal and Stripe compare in our Stripe vs PayPal article

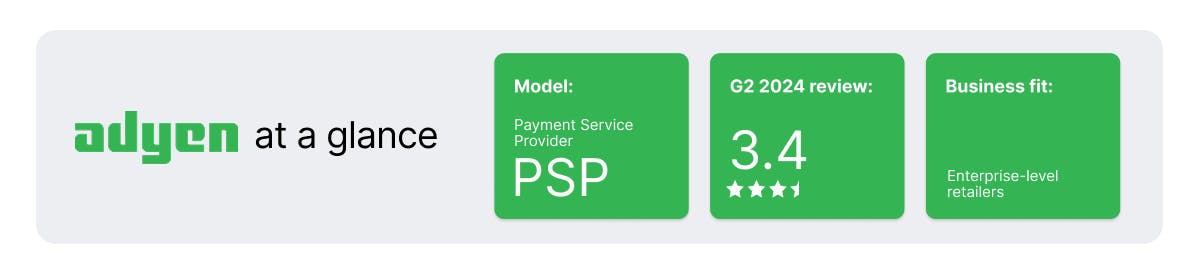

Adyen

Adyen is an enterprise-focused payment company with powerful payment features. Adyen has built out its own acquiring banks in key global markets. It works particularly well for large businesses that have dedicated engineering teams to manage and maintain their revenue infrastructure. Only recently have Adyen opened up to smaller businesses migrating over.

Compared to Stripe, Adyen has fewer turnkey features given their enterprise focus. Many of their features will take more integration effort to build on top of - particularly with subscriptions, taxes, SaaS metrics, and reconciling with invoiced wire transfers.

In terms of cost and value, their transaction fees are adjustable according to your payment volume. With Adyen, this is generally on an Interchange++ model, not a fixed % transaction fee.

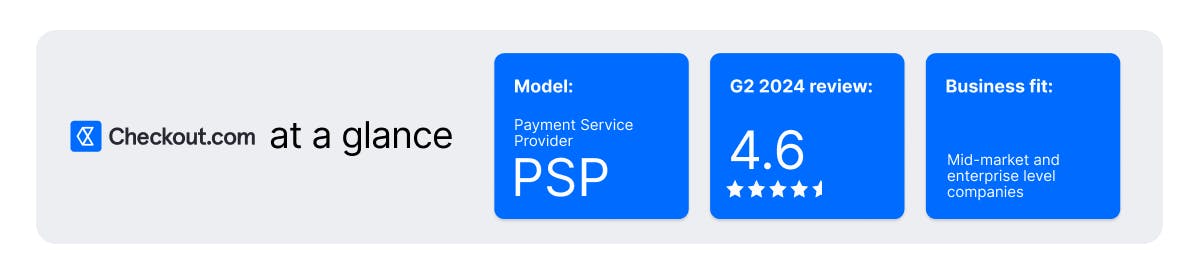

Checkout.com

Checkout.com is a fast-growing payment service and is mostly used by mid-market and enterprise companies.

Pousaz, their CEO had this to say on Stripe vs. Checkout.com: “We only do enterprise. We really only work with the big merchants. There are a few exceptions here and there but it’s mostly enterprise-only and it’s purely online”.

With an extensive choice of payment methods, as well as having the appealing features of transparent pricing and payment routing, you can see why Checkout.com is a favorite among the big businesses.

However, it still faces the challenges of being a single service provider as with other payment gateways.