The core of marketing is predicting how consumers will respond to different things.

How much will getting Ryan Gosling (or Patrick's hero Hal Varian) to endorse the product raise sales? How would consumers feel about seeing a teddy bear in the marketing email or on the packaging? Businesses can never be certain how consumers will react.

Pricing, and more specifically your company's pricing strategy, is an area of marketing and product that still contains considerable guesswork. Phenomenal marketing and product development can lead to an increase in your prices while maintaining the same level of conversion.

Fortunately, there is a way to guide that process. One of the pillars of pricing strategy and microeconomics is the theory of price elasticity of demand, or simply price elasticity. Below we discuss price elasticity and how to increase demand by making your offering more inelastic through marketing and product development.

What is Price Elasticity of Demand?

Price elasticity of demand is a measurement of how demand for a good will be affected by changes in its price. It is a way to figure out the responsiveness of consumers to fluctuations in price. This is as opposed to price elasticity of supply, which determines the responsiveness of supply to price.

While equations can sometimes be complicated, this one is super simple.

Price Elasticity of Demand Formula

Here’s the basic price elasticity formula you can use:

Price Elasticity of Demand = (% Change in Quantity Demanded)/(% Change in Price)

Since the quantity demanded usually decreases with price, the price elasticity coefficient is almost always negative. Economists, being a lazy bunch, usually express the coefficient as a positive number even when it means the opposite.

However, it’s important to note that a decrease in the quantity demanded does not automatically mean that revenue decreases. The additional profit margin could make up for the slight decrease in purchases.

When the price elasticity of a good is less than 1, it’s considered inelastic. That means a one-unit increase in price resulted in a less than one-unit decrease in demand. On the other hand, if the coefficient (the absolute value) is more than 1, the good is elastic.

That means a unit increase in price will cause an even greater drop in demand. Theoretically, total revenue will be maximized when the price elasticity of a good equals 1 - when demand is unit elastic.

Price elasticity of demand examples

I just threw out a lot of words like "unit", "elastic", "coefficient", "lazy", etc. Economists like to use fancy words, so let's break this down a bit with some examples of price elasticity of demand. Price and demand typically head in the opposite direction. But the demand curve varies greatly based on the product, particularly on how necessary the product is.

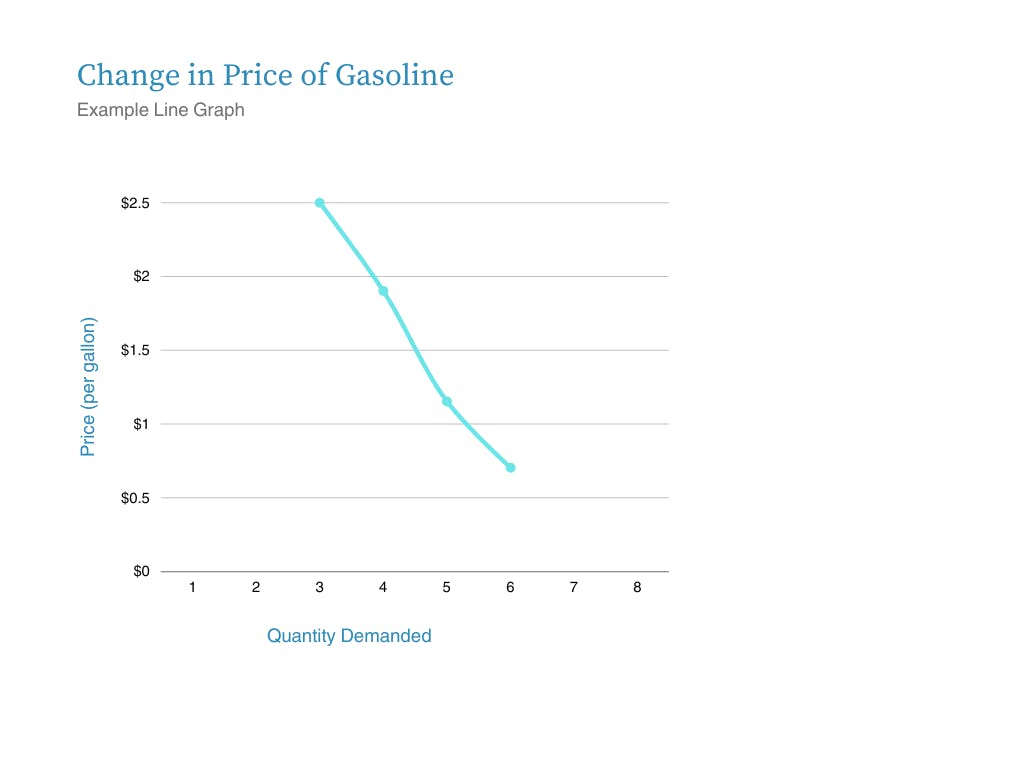

When you consider the gas tank in your car, does a $0.50 increase per gallon affect whether you'll fill up? Typically, other than aggravating you, the answer is no. Many commuters rely on gasoline to get them to or from their jobs, so they will need this product.

In this manner, gasoline is considered inelastic, where it would take a drastic price increase to truly drive down demand. Here is a graph to illustrate our price elasticity example:

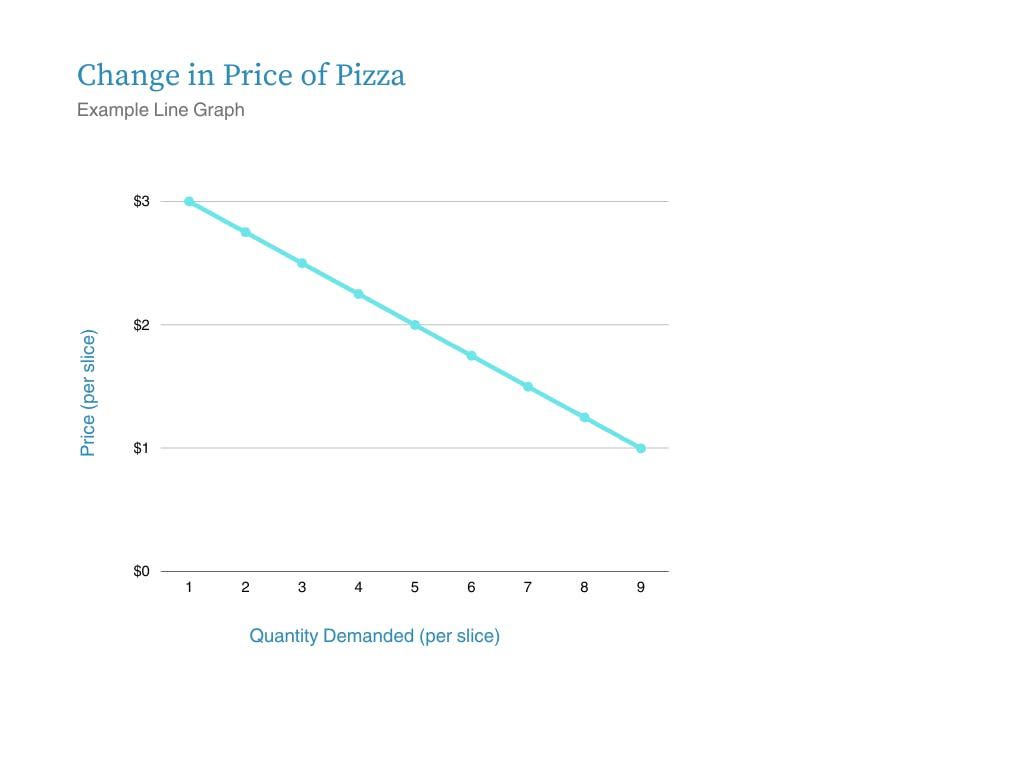

Conversely, if a slice of pizza you purchased every day for lunch went up by $0.50, would it affect your purchase? As long as you weren't super attached to the pizza and had other options (more on this below), you probably would move to another lunch establishment. Pizza, and food in general, tends to be elastic, where even slightly higher prices may cause a change in demand.

How to determine the price elasticity of demand for your product

Most businesses want to capture as much of the cash on the table as possible. To do this, you need to make your product as inelastic as possible, increasing demand, regardless of how expensive you make the product.

You want your customers, whether through particular features, your service, or world-class marketing, to be unable to live without your business. The inputs necessary for this phenomenon to occur will adjust with different customer segments, but the thought process for each segment remains the same.

So, how do you determine your product's elasticity for each segment and use this knowledge to your advantage? Here are a few things to think about:

1. Is the product a necessity or a luxury?

Necessities tend to be inelastic goods (gasoline, electricity, water), while luxury ones are the opposite (chocolate, food, entertainment); they are easier to cut out when the going gets tough. You probably wouldn't stop buying light bulbs if there were a small percentage change in price, but you might not book that cruise to the Bahamas if the cost rose.

Google has done a swimmingly good job with their AdWords platform in driving demand because many businesses utilize their advertising to sustain their entire businesses. Of course, competitors are creeping up, but your marketing and actual product make your offering a necessity.

You must figure out if your customers' revenue dried up (B2B) or consumer income was halved (B2C); what about your offering makes it the last thing they cut out of their lives? This is the income elasticity of demand and can be highly elastic or inelastic.

2. How available are close substitutes?

I eat a lot of sandwiches (don't judge me); if the price of Boar’s Head Deli cuts increased, I could easily switch to Sarah Lee Turkey Breast. There are a ton of other brands available, so unless Boar’s Head could convince me its quality was somehow worth the price increase, I will probably buy substitute goods. If your product has a lot of competition that is pretty similar, raising prices will most likely drive consumers away.

I’m just going to make a quick shout-out to product differentiation here. In the SaaS and software space, this is much easier than if you're selling vacuum cleaners. Therefore, build integral features that are essential to the customer and that your competitors don't have in their wheelhouse.

Alternatively, become a part of your customer's backstory, where the switching costs from you would be so high it wouldn't be worth the move. Switching CRM, for example, can be inconvenient from a tactical and procedural standpoint. Of course, a competitor with this in mind could create an easy solution to this exact problem to boost sales.

3. How much does your product actually cost?

You might sell some of the least expensive cars around, but even a cheap vehicle costs a lot compared to other types of products. The higher the price, the more elastic it is due to psychological pricing.

For example, you probably don’t even know how much that pack of Paper Mate pens costs, so when the price rises by 10% (just a few cents), you likely won’t notice. But, if the price decreases by 10% on that new car you want (hundreds or thousands of dollars), you’re sure to notice.

You can take advantage of the actual number on the sticker for your products by providing offers at small, medium, and high levels. You won't offer a car at $50 (unless it's a real clunker), but you may offer a car rental program that allows you to have a smaller price point. Zipcar is great at this with its hourly and daily rates.

4. How long will this price change last?

All goods become more elastic in the long run. With time, it is possible to find substitutes or learn to live without something. The classic example is oil. If the oil price rises in the short run (say, tomorrow), people would grumble over breakfast for a couple of days but still fill their tanks.

However, people might buy hybrids or smaller cars that use less gas in the long run. So even if you determine that your product is inelastic, be careful of what implications a price change (even a small percentage change) could have down the road.

For instance, Rackspace could rock premium prices for a long time because premium hosting solutions weren't available, even for small web applications. With the birth of the cloud, prices have become more competitive, and Rackspace has lost some of its lower-end customers.

Overall, price elasticity should be an important consideration when developing your product and marketing strategies, in addition to being a basic building block behind your pricing. A huge factor that I'll repeat is that the price elasticity for different customer segments will vary. Thus, your marketing, pricing, and bundling must vary.

Pricing is a process that you must integrate into your company's trajectory. For help with your pricing strategy, try our free pricing audit.

Price elasticity of demand FAQs

What are the types of price elasticity?

There are two types of price elasticity of demand: elastic demand and inelastic demand. Elastic demand happens when the demand changes for goods is sensitive to price changes. Inelastic demand is when the demand for goods is not affected much by price changes. Common goods typically have elastic demand, while necessities have inelastic demand.

What is an example of elastic demand?

Elastic demand is used to describe the scenario where the change in demand is sensitive to a small change in price. For example, if we see a large change in the price of Lays chips, consumers are more likely to shift to a different brand, driving the demand down and vice versa. This means that chips have elastic demand due to the availability of close substitutes.

What is an example of inelastic demand?

Inelastic demand describes the scenario where fluctuations in price do not change the demand for a good. For example, gas is required for cars to run, and there are no substitutes for gas. This means that anyone with a car will have to pay for gas regardless of how high the prices are, making demand inelastic.

Why is price elasticity of demand important?

Knowing the price elasticity can offer insight into how a market will react to price changes. This is important for businesses that are making pricing decisions, as raising or lowering prices will directly impact the number of sales. Factoring price elasticity is a key step for companies to determine the right pricing objectives within their niche.

What is Cross Price Elasticity?

This measures the demand for a product based on the price of another product. For example, if the price of Coca-Cola rises, the demand for Pepsi is likely to increase. This price sensitivity can work in the other direction, e.g. if the price of burgers were to rise, the demand for burger buns would drop.