Welcome back to the ProfitWell SaaS Market Report! After the first few months of 2025 brought economic uncertainty and a sluggish recovery, we're excited to share some genuinely positive news – Q2 has brought a story of resilience, recovery, and the early signs of AI-driven growth that many have been waiting for.

So, what changed? Has uncertainty around tariffs turned into optimism for SaaS? Are we seeing the beginning of an AI-powered growth cycle? Let's jump into the data and figure out what's driving this quarter's promising trends... 👇

This is the latest in our ongoing SaaS Market Reports, which track the movement of the ProfitWell Subscription Index, and its underlying growth and retention trends. This time, we examine Q2 2025 performance.

B2B rebounds, with positive H2 forecast

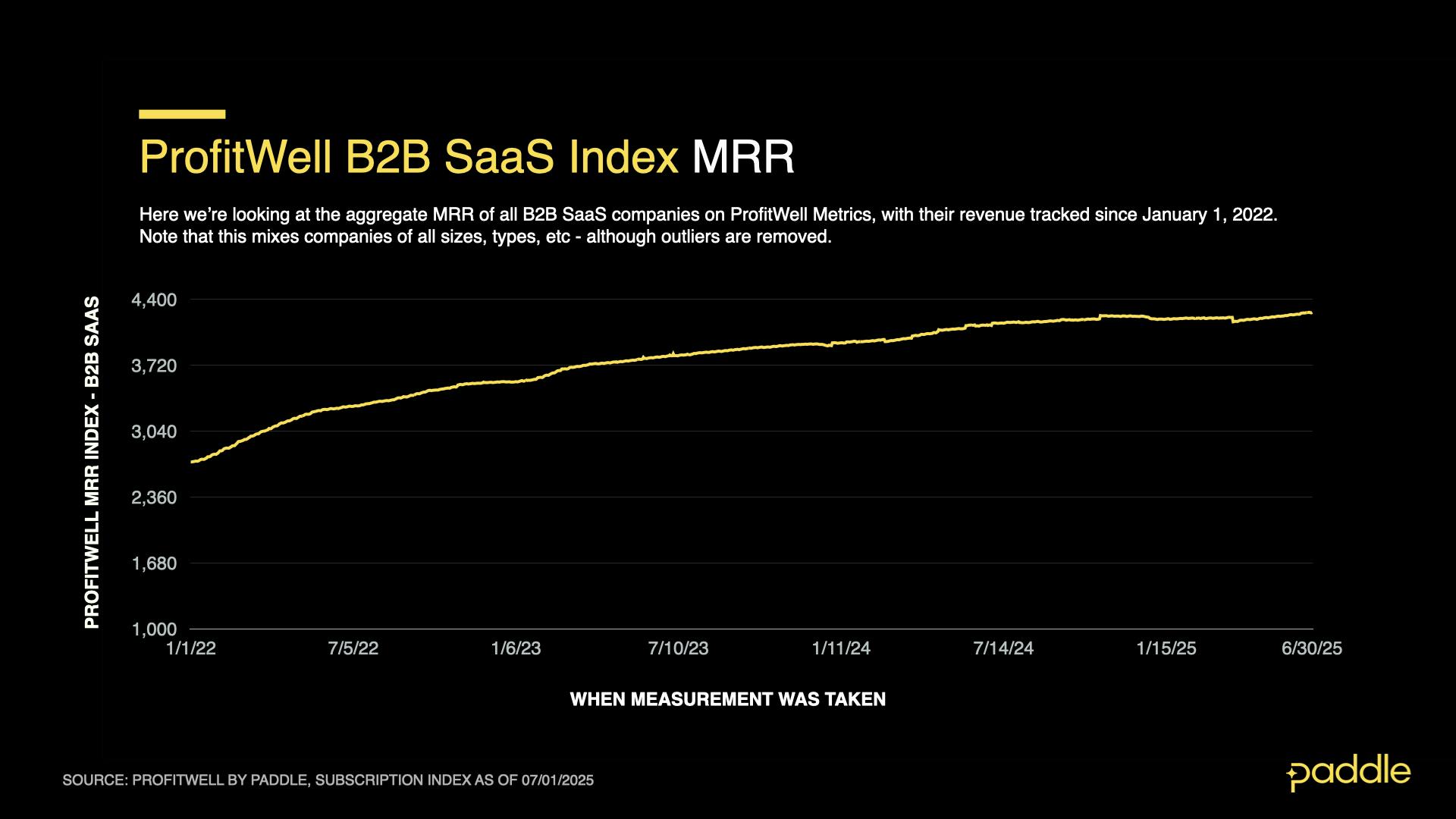

The ProfitWell B2B SaaS Index tracks the cumulative monthly recurring revenue (MRR) from a sample of the 34,000+ companies on ProfitWell Metrics. By measuring the revenue performance of this cross-section of companies over time, we can objectively observe how quickly the sector is growing (or not). The index does not adjust for inflation. Explore the free demo of ProfitWell Metrics here.

Despite a rocky start to Q2, with the weekly average for compound annual growth temporarily dipping into the negatives before rebounding; our B2B MRR Index had a promising quarter as it hit an all-time high of 4265 by the end of June.

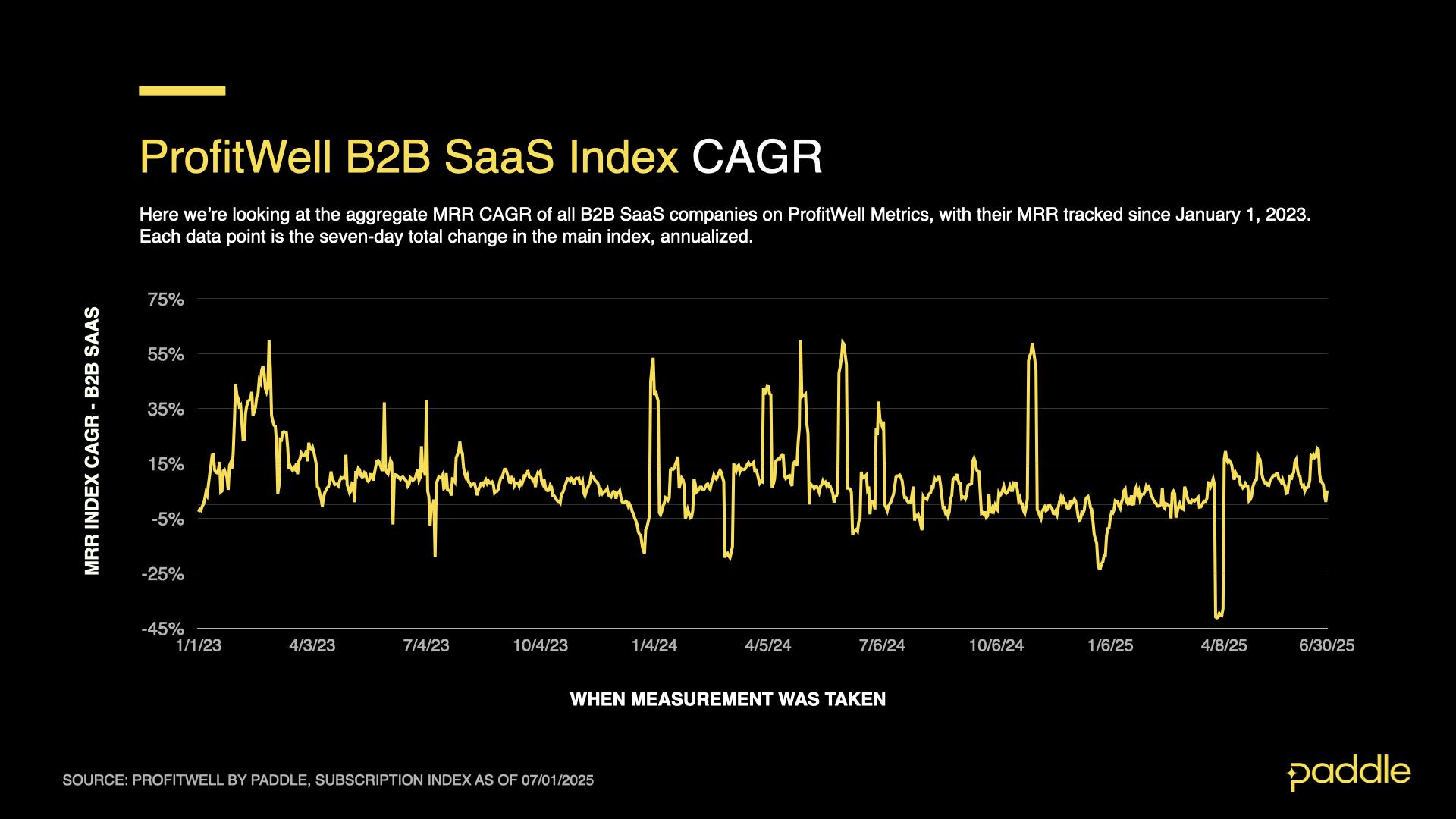

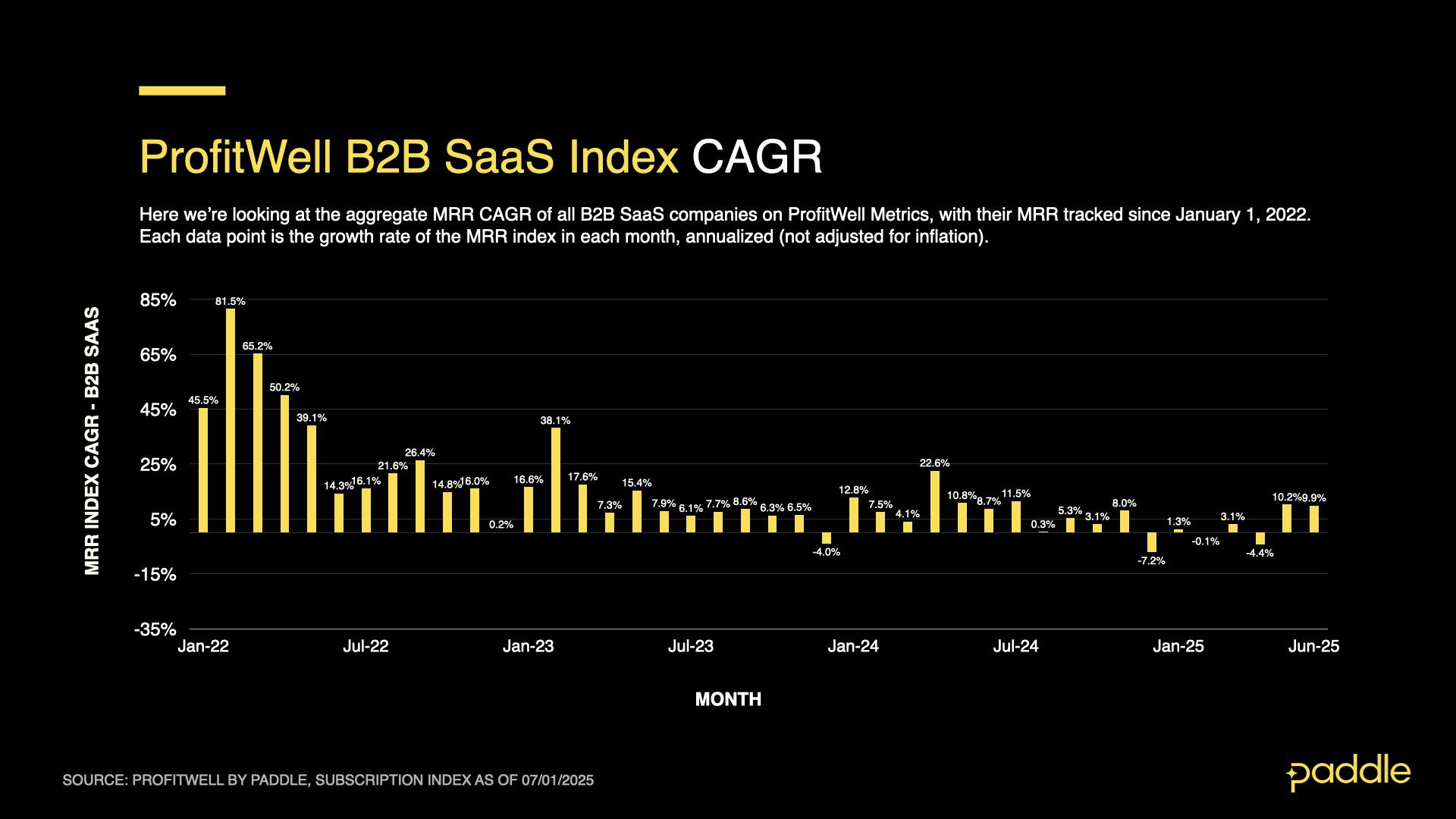

This steady climb in recurring revenue for companies tracked in our B2B MRR index was driven by a strong compound annual growth rate (CAGR) in the last two months of the quarter.

Breaking CAGR down by day, we can see the trend in more detail – growth rates suffered a sharp 1-week drop to -41% CAGR at the beginning of April, dragging April’s overall average down to -4.4%.

This was quickly compensated for by May and June’s performance however, with annual growth rates stabilizing around 10% in late April, where it held steady for the final 10 weeks of the quarter.

This nascent “steady state” for CAGR is noteworthy, as it’s significantly higher than the average growth rates B2B saw over the last 3 quarters, where growth hit a plateau of 3-5%, with frequent dips into the negatives.

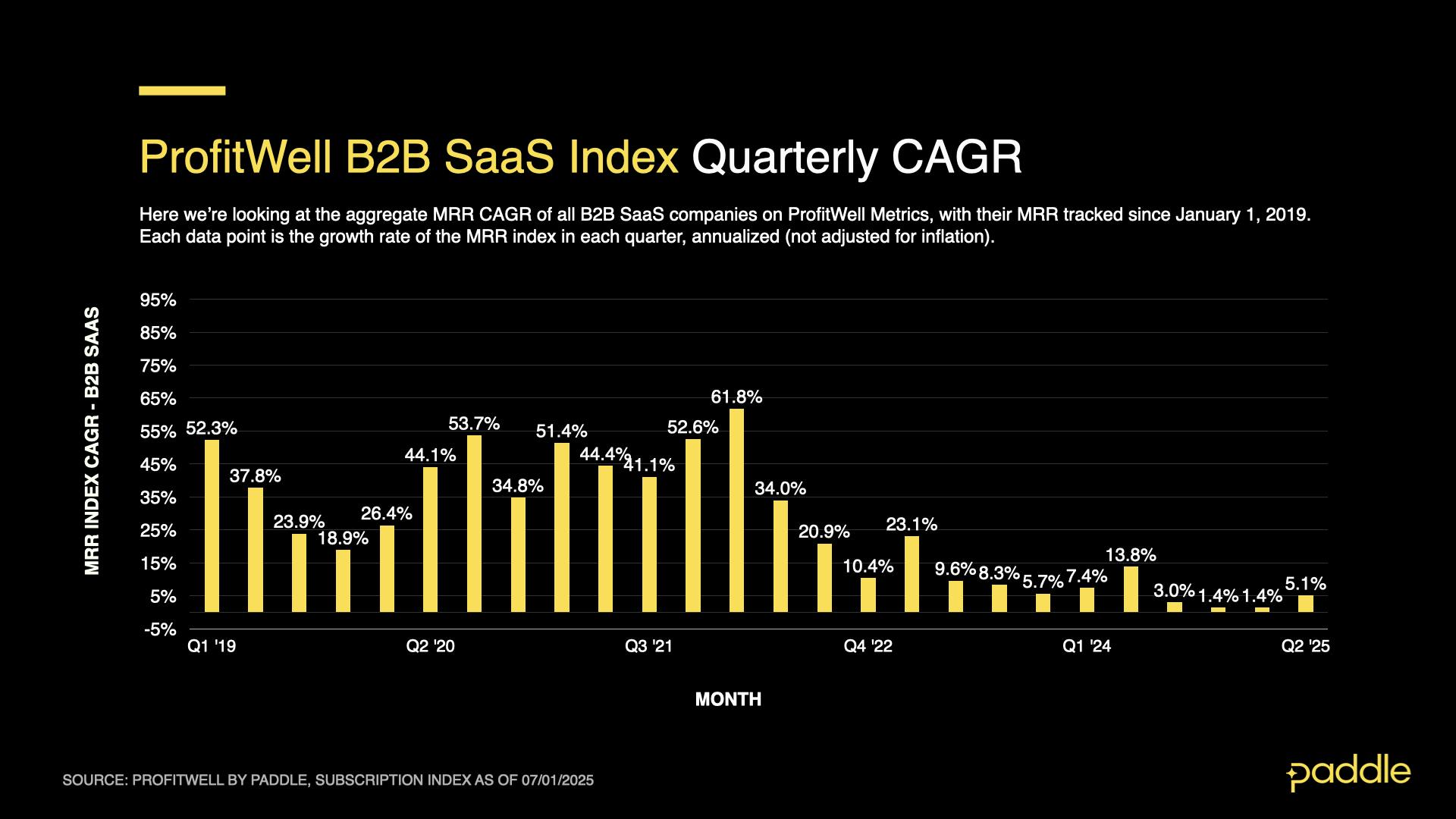

This meant that Q2 saw an overall CAGR of 5.1% – far surpassing Q1’s measly 1.4%, while posting the highest quarterly growth rate seen since Q2 of 2024.

With CAGR remaining stable at 10% for 10 consecutive weeks, we have likely seen B2B growth rates settle at a “new normal”, after 12 months of sluggish growth (averaging 1-3%) punctuated by frequent dips and fluctuations.

If this is indeed the case, we can expect the rest of 2025 to be excellent for B2B – with recurring revenues climbing steadily, and our B2B MRR Index reaching a record value of 4450 by the end of 2025.

Strong sales and low churn drive B2B results

So what’s driving this new-found B2B growth? Let’s break recurring revenue into its components - new sales, churn, upgrades & downgrades - and explore what’s going on.

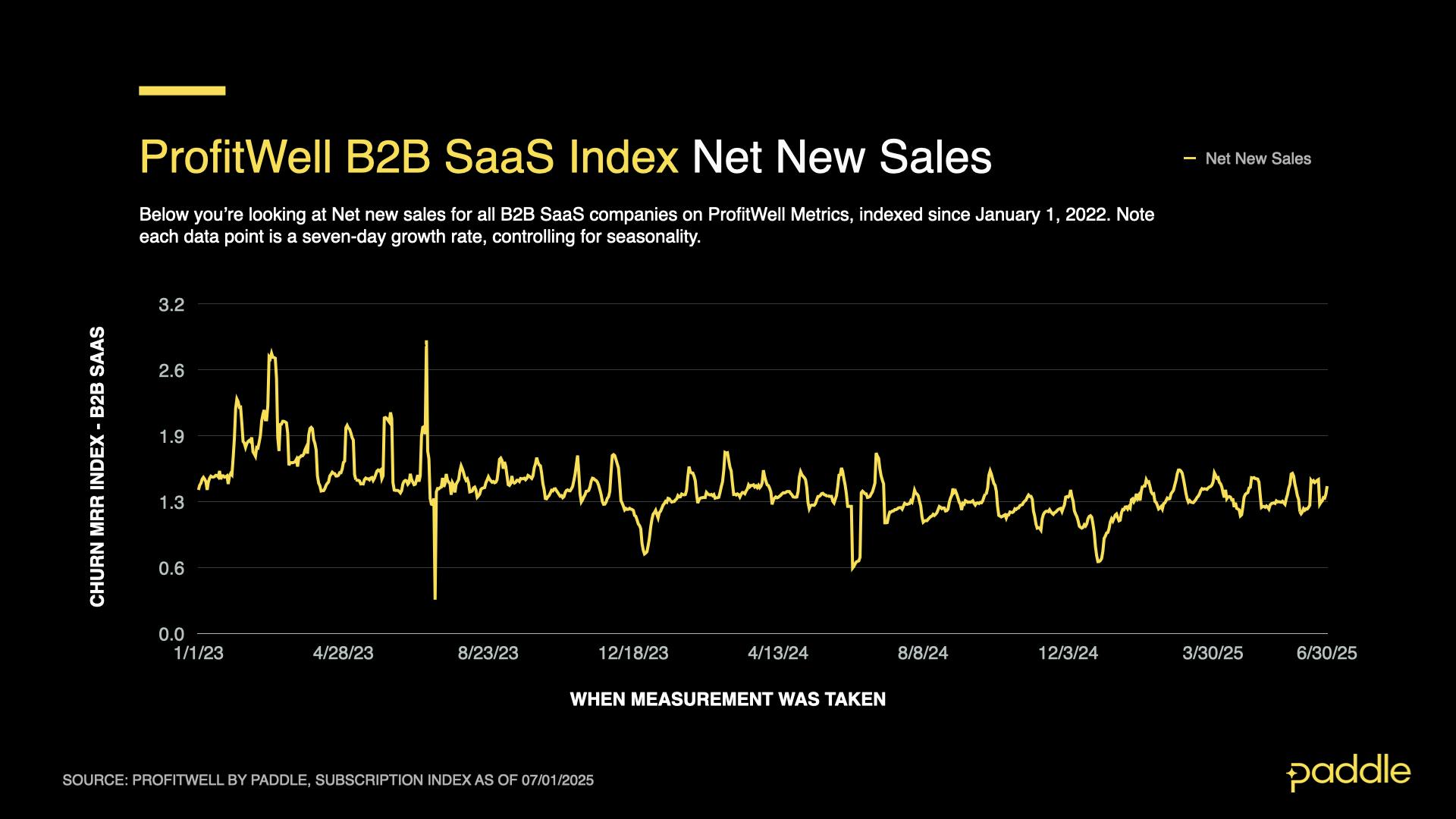

Starting with the Profitwell New Sales Index, we find strong and steady sales throughout the quarter, with the index hovering at a baseline of 1.343 for Q2 – 5.4% higher than last quarter, and showing significant gains compared to New Sales Index values of 1.274, 1.172, and 1.307 for Q3 ‘24, Q4 ‘24, and Q1 ‘25 respectively.

The B2B New Sales Index closely maps to the trajectory of our earlier B2B CAGR graph - 12 months of sluggish growth starting in mid-2024, that then settled at a new, slightly higher “steady state” this quarter - indicating that growing was one of the key factors in this quarter’s B2B rebound.

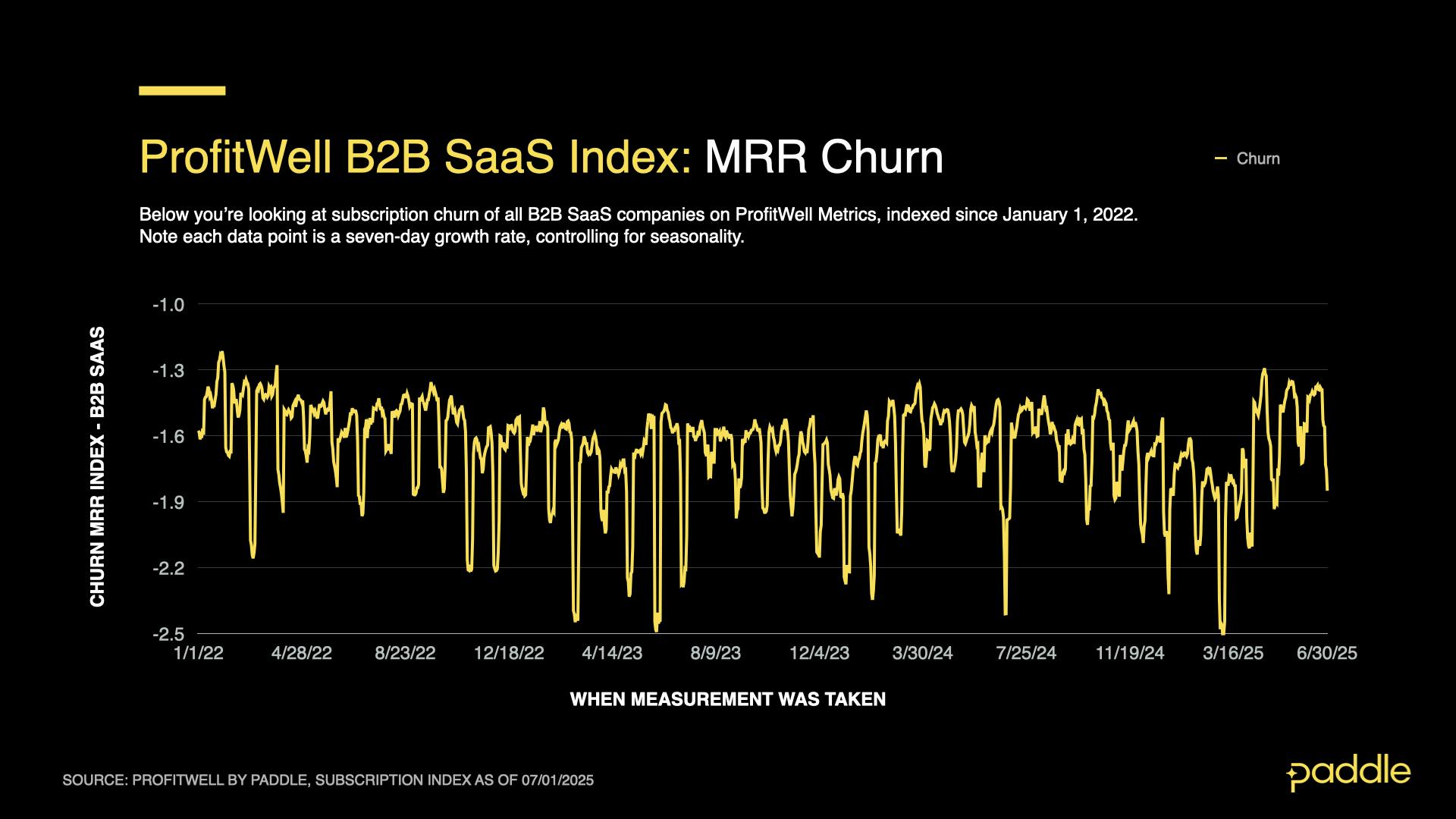

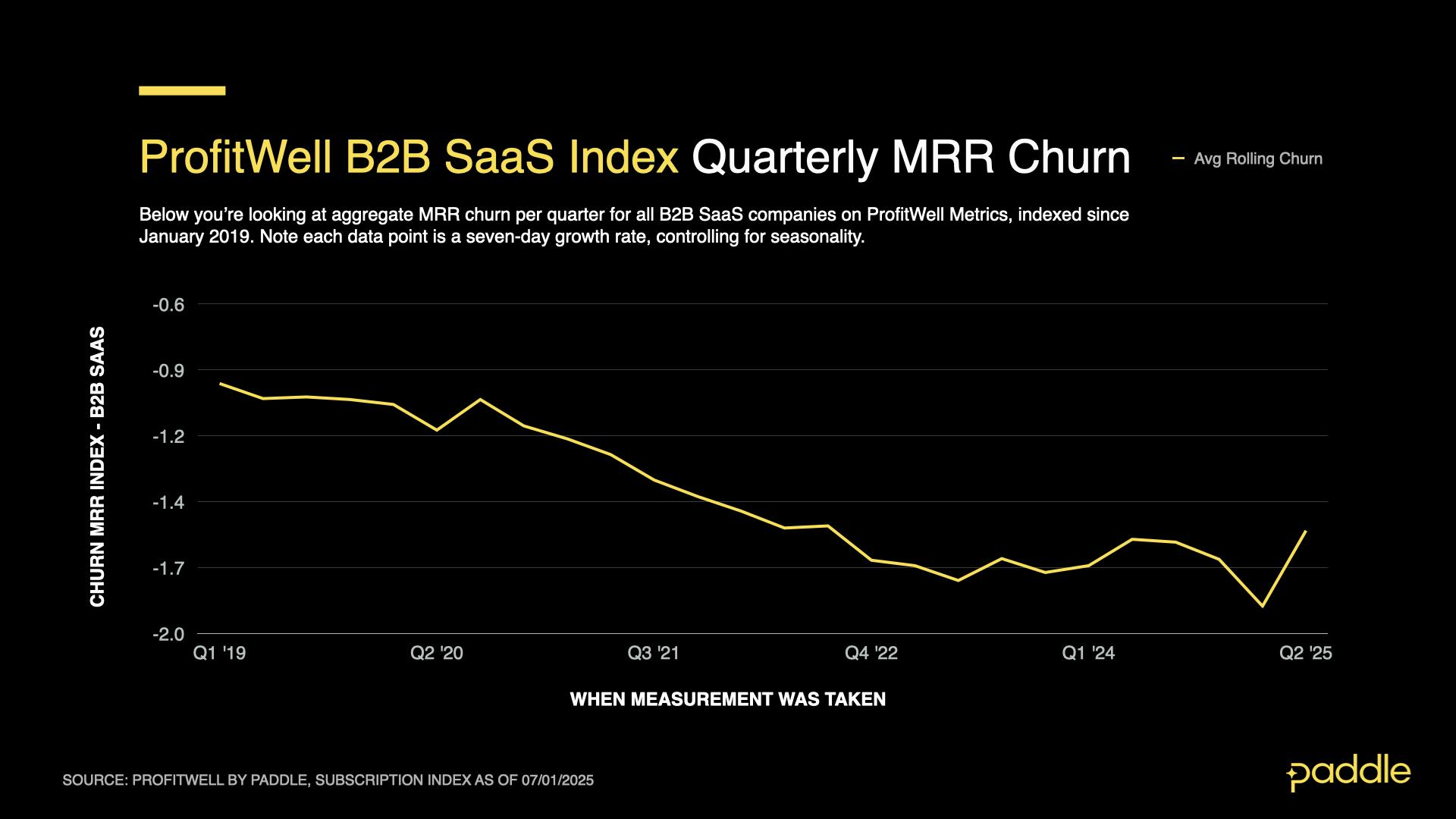

The sustained jump in sales was simultaneously buttressed by a drop in churn rates from May through June, after a rocky start to the quarter. Q2 opened with an average Churn Index value of -1.638 (ie, a churn rate that is 1.638x the churn rate seen when the index was created in 2019), before dropping to -1.545 and -1.507 in May and June.

The good news doesn’t end there either. This quarter's overall average for churn levelled out to -1.563; the lowest we’ve seen since the end of 2022.

While it’s difficult to say whether churn will continue dropping to new lows, or start to level off over the next few quarters, we can safely expect diminished churn to drive further B2B gains for the rest of 2025.

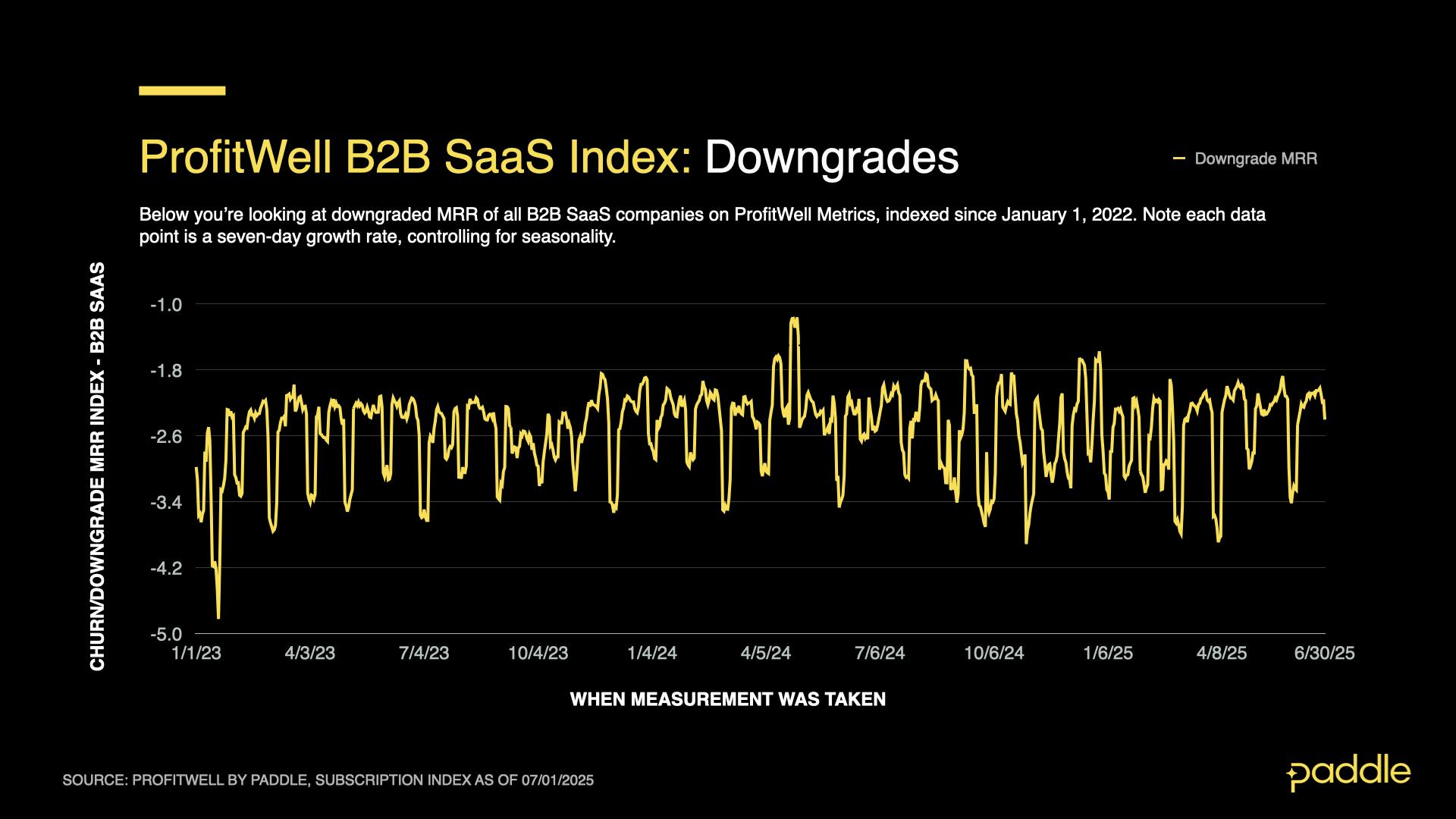

Although downgrades (and upgrades) typically have a much smaller impact on recurring revenue than new sales and churn, the Profitwell Downgrade Index’s performance was also a cause for celebration.

It followed a similar pattern to the New Sales Index, dropping by 13% to a quarterly average value of -2.416 compared to Q1’s average of -2.736. This brings to an end 3 consecutive quarters of elevated downgrades, improving B2B's growth prospects for 2025.

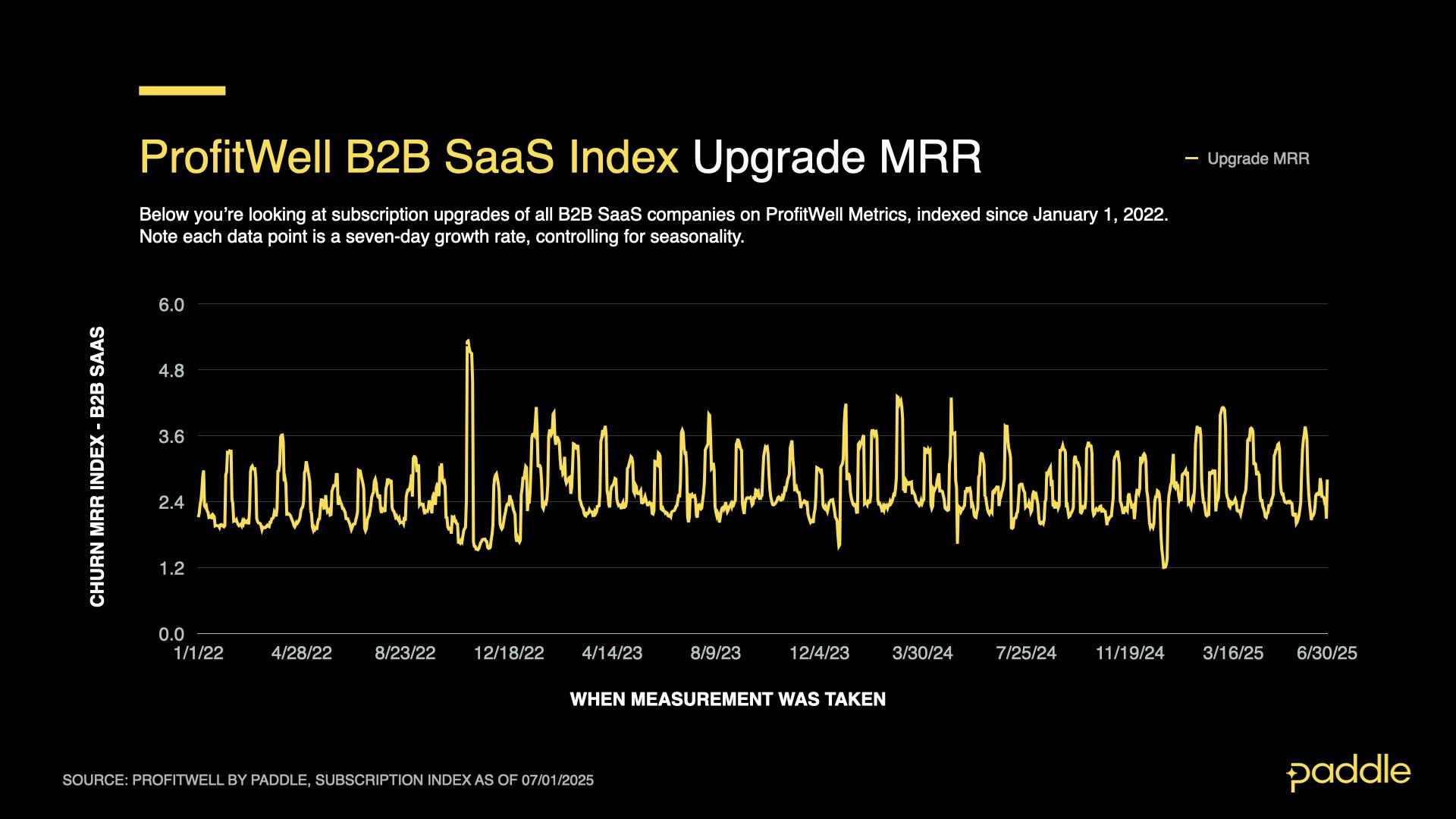

Finally, looking at the Upgrade Index, we find a 2% drop to an average of 2.675 compared to Q1’s average of 2.736. While this has a very minor impact on B2B growth, we’ll be watching closely in Q3 to see if upgrades continue to fall, and start impacting B2B growth.

A return to calm, and early AI wins

While the market comes to terms with the new reality of ~$3T in US tariffs (and the initial panic dissipates), we’re starting to see SaaS businesses “exhale” after holding their collective breaths and bracing for the worst following Q1’s tariff announcements.

This is likely what drove Q2’s rebound in sales and drop in churn, as businesses that had laid off workers, paused purchases, and cut non-critical expenses adjusted to a trade environment that wasn’t as bad as anticipated, and resumed investments in tooling, R&D and growth.

It’s also worth noting that the majority of SaaS businesses aren’t directly impacted by the current tariff regime – instead facing secondary effects as their customers adjust to the impact on their operations and supply chains.

However, this alone cannot explain the 10 consecutive weeks of strong revenue growth we observed this quarter. While we can’t directly confirm this with Profitwell SaaS Index data, we strongly suspect that Q2’s growth is driven by the introduction of AI into existing B2B SaaS products.

We see the recent flurry of acquisitions, and meteoric rise of several nascent, AI-first SaaS companies as the leading indicators of revenue growth and retention improvements at B2B SaaS companies that have integrated AI into their core product offerings.

In our previous report, we spoke about B2B SaaS companies re-configuring their organizations to better integrate AI with their existing product offerings. We are now seeing the early dividends of these changes, as product teams learn to solve customer needs with AI; and sales teams start to sell & price these solutions effectively.

Combining the lift in revenue from early AI wins, and an anticipated interest rate cut by the US Fed in Q3, we forecast that B2B growth will remain strong for the rest of 2025 - maintaining or even surpassing the 10% CAGR that we saw in the last 10 weeks of the quarter.

B2C climbs despite anticipated summer slowdown

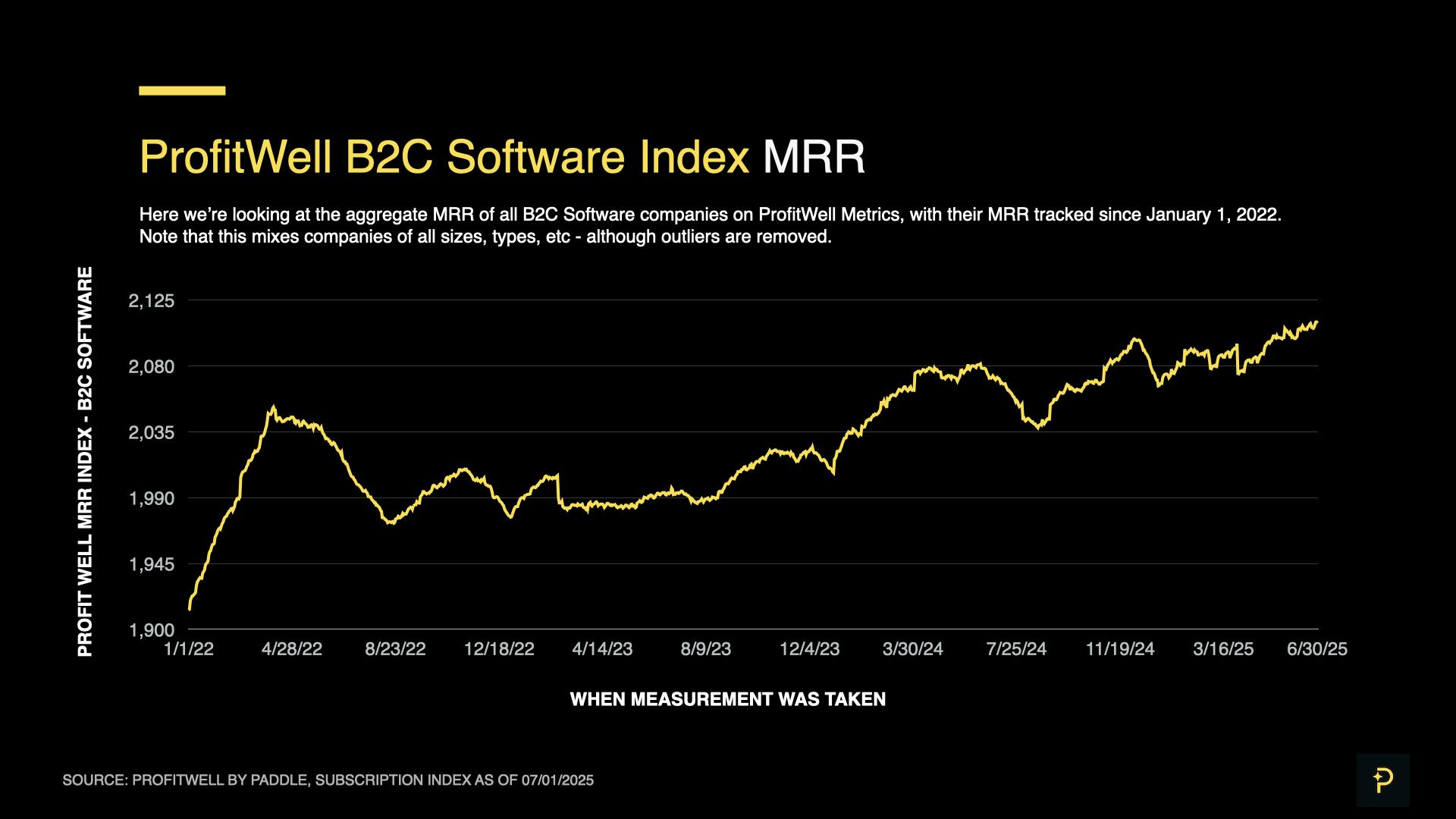

Echoing the trajectory of B2B growth, the companies composing our B2C SaaS Index had a difficult start to Q2. Over the first week of March, growth temporarily plunged to -30% CAGR, dropping recurring revenues (as measured by the Profitwell MRR Index) to a 9-week low of 2074.

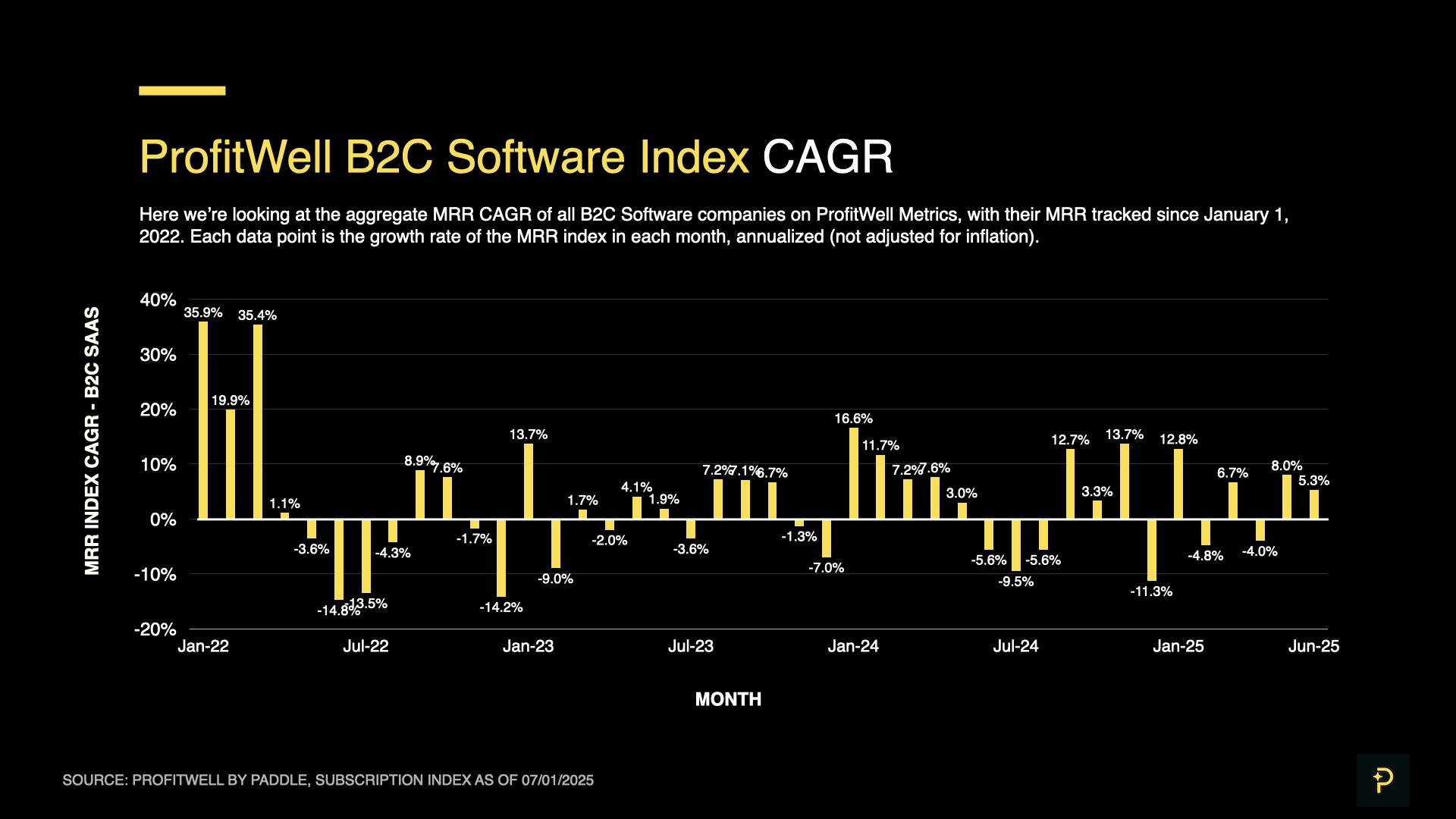

However, before the dip could do serious harm to B2C revenue, CAGR quickly rebounded, stabilising at a higher average than we saw in Q1. In fact, in May and June, B2C CAGR reached 8.0% and 5.3% respectively, propelling our MRR Index to an all-time high of 2115 (ie, 2.115x the index’s recurring revenue in 2019, when it was created).

Like B2B, this indicates that the slump in Q1 - driven by uncertainty and panic about the tariffs - is over. Don’t celebrate too quickly though. With summer starting, we anticipate a seasonal drop in SaaS spending, as consumers prioritize travel and in-person experiences over software spending. The effects of this are already apparent, as evidenced by CAGR’s 33% drop between May and June.

New summer; same slow sales

To explain a bit further, we can again examine the four components of subscription revenue growth - new sales, churn, upgrades and downgrades (the last two typically having a much smaller impact).

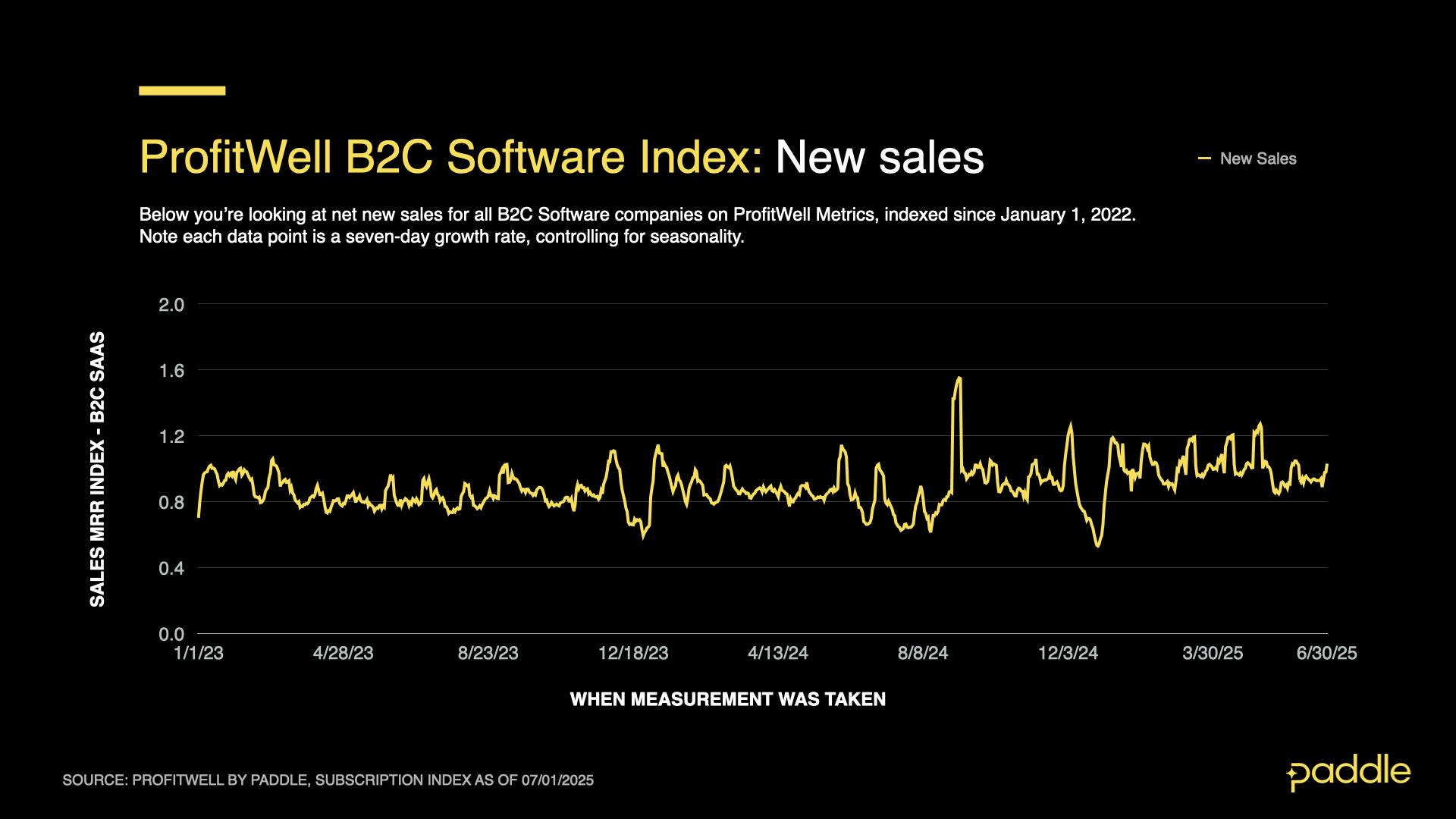

Starting with sales, we see strong and steady growth for the first half of the quarter, with the New Sales Index averaging 1.046, before dropping 10.5% to 0.936 in the last half of the quarter - likely driven by the summer slowdown in consumer spending.

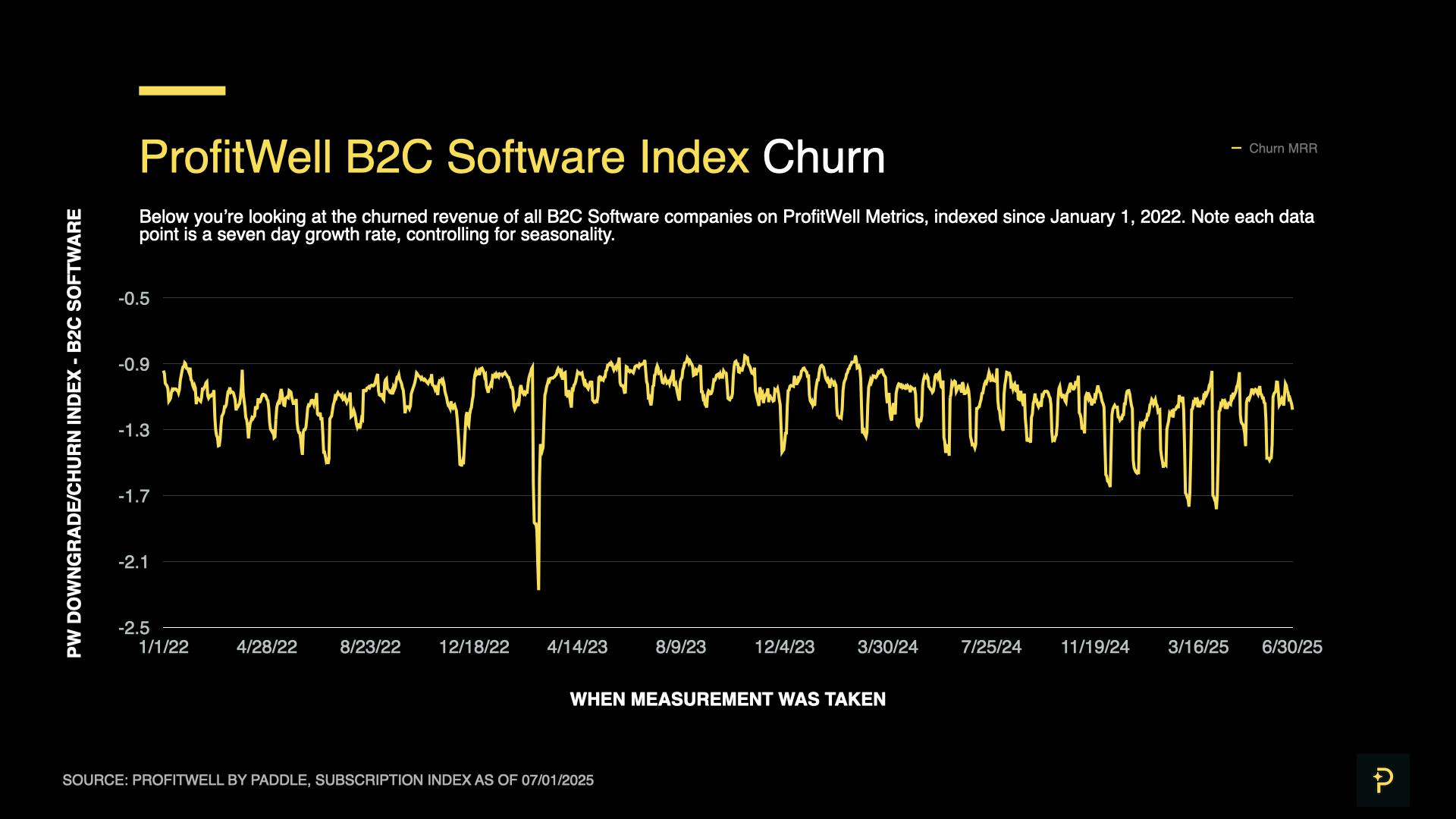

Simultaneously, churn fell consistently throughout the quarter - dropping 4.7%, from -1.241 in April, to -1.183 by June. Additionally, we observed that the periodic churn spikes typical to this index became much smaller - potentially driven by consumers interacting with their software less (and thus forgetting to cancel), as they took time off for the summer.

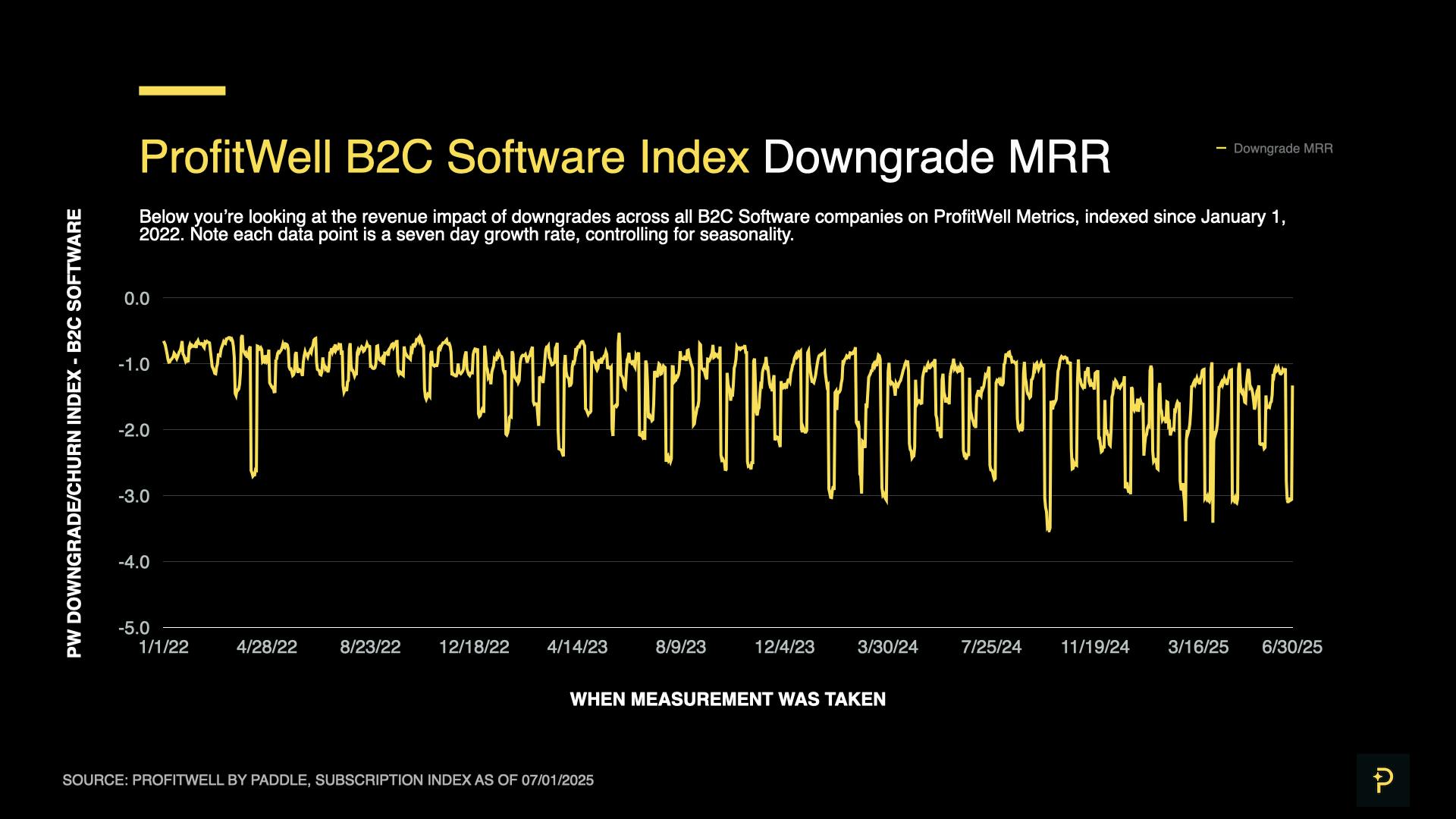

Downgrades also drove Q2’s steady B2C growth, albeit with a much smaller impact than new sales and churn. After months of higher-than-average downgrades (averaging -1.911 in Q1), the Downgrade Index fell to -1.569 and -1.677 in May and June respectively.

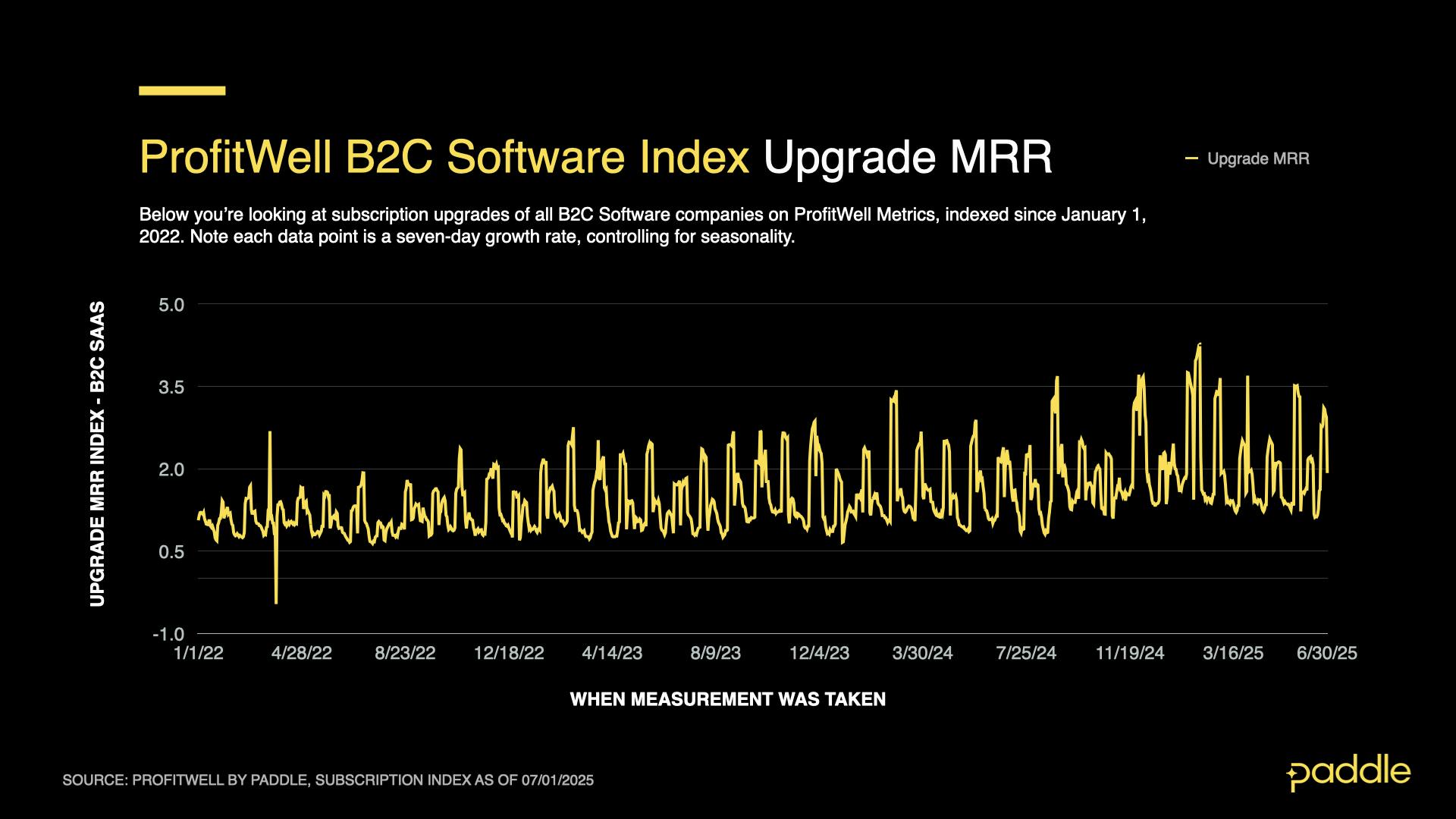

Finally, with the Upgrade Index, we observed a stable average of 1.907 over Q2 - a 13.7% drop from the previous quarter’s average of 2.209. While fairly large, this drop in upgrades likely had a relatively small impact on total B2C CAGR. Nonetheless, the index is worth monitoring through Q3, for signs of a continuing drop in upgrades.

AI bonanza or summer slowdown?

With tailwinds from new AI products and new AI features; and headwinds from summer dips in consumer software spending, what’s the outlook for B2C in 2025?

First, like we’ve seen in B2B, it appears that market uncertainty and consumer confidence have returned to normal (likely driving B2C’s recovery) - as evidenced by external indicators such as the S&P 500’s Q2 rebound from its post-tariff Q1 losses.

With the summer slowdown in consumer SaaS spend typically beginning in May, and the overall decrease in CAGR typically exceeding 80%, this year’s 33% drop in CAGR between May and June is unusually small.

While we may simply be seeing a delayed slowdown in spending, we suspect that an explosion of new AI products, and the implementation of AI in existing consumer products is pushing back against this downward pressure on B2C growth. Like we saw in B2B SaaS, the maturing ability to use AI in consumer products, while pricing and marketing them effectively, appears to be driving new gains in sales and revenue retention.

In the near-term, we can expect the summer dips in consumer software spending to dominate, and depress B2C growth in the first half of Q3. However, as consumers return to their regular spending habits in the fall, we expect the surge in AI products to precipitate a significant rebound, and drive significant growth in B2C through the end of 2025.

Strategies to consider

With a likely rally in the last half of 2025 for B2B and B2C SaaS, what’s the best way to prepare? Here’s a few tips for taking advantage of this AI wave, and coming out ahead of your competitors:

Find the margin to free your AI

It’s no secret that running AI models is expensive. While AI unlocks an untold number of new consumer AI products, if you’re scaling a consumer app, running millions of LLM calls for your user base while handling performance marketing costs, platform fees, and a saturated app market could bring disaster to your finances.

That’s why it’s become critically important for AI consumer apps to grow their margin wherever they can. One recent development (and enormous advantage) for app developers with large US audiences is the ability to re-direct users to external web checkouts for in-app purchases.

Not only does this give developers the power to increase their revenue by up to 25% on every purchase by using a third party payment provider (and avoiding Apple’s 30% commission), it also significantly improves cash flow by improving payout frequency and beating Apple's 30+ day standard.

For those with audiences outside the US - you have options too. Leading consumer apps like Noom and Flo, have perfected the art of web-first acquisition flows - converting users to paying customers before they enter their app, and avoiding Apple’s 30% commission completely. In addition, you gain the benefits of an expanded audience (web and app audiences only have a 15% overlap), and improved attribution, without the restrictions of SKAN and ATT.

These monetization strategies don’t come without additional responsibilities though. While the App Store charges a high commission, it also handles the complexity of international payments - fraud prevention, chargebacks, international tax remittance, and more. Most third-party PSPs leave this burden to you - which is why we advocate for working with a Merchant of Record (MoR) when you start moving payment volume to the web. These providers specialize in handling these payment complexities - giving developers an “app store like” payments experience, for far cheaper.

If you’re interested in moving your in-app payments to the web, or even building your own web-acquisition flow, we’re here to help!

Check out our Web Monetization Guide to learn more, or if you’re ready to jump in, use our no-code Hosted Checkout builder or Web Monetization Kit to create your first web purchasing flow in minutes!

AI isn't just for new products - it's for new processes too

With so many companies scrambling to add new functionality and update their product offerings with AI, it’s easy to miss the opportunity to look inwards, and ask how you can use AI to improve your own processes and drive efficiencies.

AI agents have matured significantly since 2024, and are now capable of automating many of the labour-intensive tasks that are critical to your operations, but outside of your core, strategic competencies. Some of these include white-glove on-boarding, support requests, and external communications.

If you’re a leader, founder, or manager, giving permission to your employees or direct reports to experiment with AI agents is critical to finding hidden efficiencies. Determining which safeguards to put in place - whether for IP protection, hallucination monitoring, or access control, then establishing clear boundaries and policies for usage will give your employees and direct reports the confidence they need to start experimenting.

If you’re interested in learning more, check out our upcoming SaaS Happy Hour webinar with Jacob Bank, the founder of Relay.app, a leading AI agent automation platform. He’ll be speaking with Andrew Davies, Paddle’s Chief Innovation Officer, discussing best practices for AI agent automation, demonstrating novel use cases, and much, much more.

We publish quarterly reports on the ProfitWell Subscription Index to show you where the market is headed — and help you form strategies to respond. All backed by data from the 34,000+ companies on ProfitWell Metrics.

Missed our previous market reports? You can find them here