The practice of charging users based on age intriguing. Our interest lead us to do the one thing we’re good at - collect some data and analyze if Tinder’s making a smart move.

Last week, famed dating app Tinder swiped right into their first foray into premium plans to much fanfare and hubbub. Now, this haven of legitimate matchmaking and what we at Price Intelligently like to call “intimate pricing sessions”, allows you to swipe left or right on anyone throughout the world and even change your mind down the line—all for a fee.If you have no idea what I’m talking about, it’s ok. Essentially, a free dating app that’s taken the 30 years and younger crowd by storm launched some premium features. But this much anticipated launch was met with some aversion when users found out that Tinder was charging different prices based on age: individuals younger than 30 are charged $9.99/month and those 30 or older paying upwards of $19.99/month.

Critics of the company’s move are crying foul (and swiping left on the idea - ok...we’ll stop the swipe puns), claiming that the company is violating price discrimination laws. Yet, as we wrote in a previous post on price discrimination, the lines are a bit greyer when it comes to price discrimination for online transactions. While we aren’t lawyers, we did find the practice of charging based on age intriguing, especially because our past research definitely shows that older and younger consumers are willing to pay at different levels.

Our interest lead us to do the one thing we’re good at - collect some data and analyze if Tinder’s making a smart move (which we found out they very much are, because they know their buyer personas on a quantifiable level). Let’s walk through the data and illuminate why this is a potential windfall for Tinder, while pulling out lessons for your own pricing strategy.

We created an episode, originally for for Paddle Studios, that broke down the pricing of Tinder and Bumble:

Let's get our Tinder pricing on

Because Tinder is one of the fastest-growing apps out there, finding respondents for our algorithm wasn’t tough. To bring any PriceIntel blog virgins up to speed, our software asks ranged pricing questions, and subsequently crunches those answers across a sample to see the price elasticity of that particular group. We’ve validated this across millions of responses to date, so we know we’re pretty accurate as long as we have enough respondents (more on measuring price sensitivity, in case you're curious).

Here’s the actual survey we sent out to several hundred Tinder users throughout the U.S. where we asked individuals their age, gender, and the pricing questions.

What we found was pretty fascinating. After crunching the data, we discovered that Tinder is absolutely justified in pricing these two user groups differently and could likely add even more differentiation to their pricing structure.

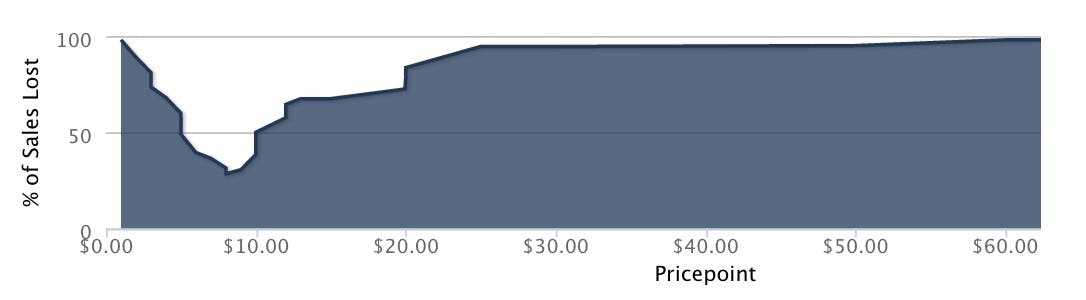

Individuals in the 18 to 29 year old demographic were willing to pay between $8.44 and $10.36 per month with a median price point of close to $10. What’s interesting about these willingness-to-pay numbers though is that some of this demographic was willing to pay much more, up to the $20/month range.

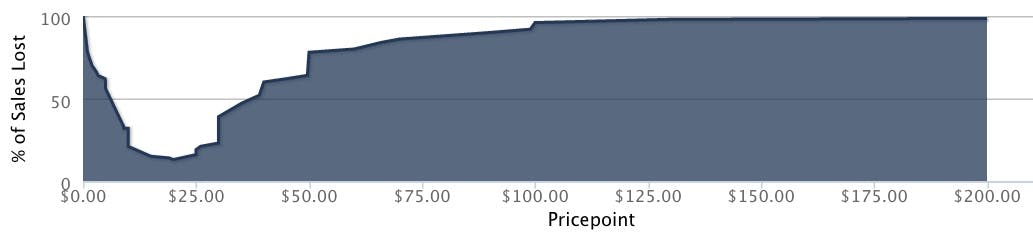

Our older folks were willing to pay a much wider, but higher range that centered around the $25/month range. Especially interesting about this data though is that some folks were willing to pay as much as $50/month for the product.

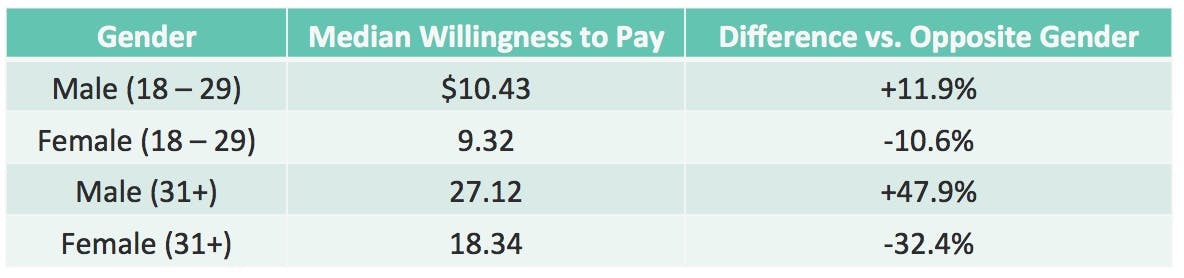

We also split the data based on gender, where we found that men were driving willingness to pay considerably more than women with their median willingness to pay being 11.9% and 47.9% higher for our young and older groups respectively. This shouldn’t come as a huge surprise, as a big persona for Tinder is Hookup Hank, who is potentially looking to find special someones before traveling (you normally only can swipe left/right on people within 50 miles of you).

Cool. Tinder isn’t completely out of control with this differentiated pricing, but why is this important to you and for Tinder’s overall pricing strategy? Well, it comes down to two big things: (1) an opportunity to expand to a multi-price mindset and (2) taking advantage of differences in the same persona.

You have more than one type of customer; you should have more than one type of pricing

We’ve written about the multi-price mindset before, but the basic premise is that if you have only one price, you’re likely losing out on a ton of cash, especially with millions of users like Tinder. This is because what you’ll notice is that on those elasticity curves it’s not as if every single person was only willing to pay one single price. In fact, a good portion of the market was willing to pay more than double the median price point.

Taking advantage of this means Tinder has an opportunity to not only price discriminate based on age, gender, location, etc., but can also add in additional tiers with different features to capture a larger share of wallet from their users, especially those individuals who would pay for anything and everything that Tinder puts out, including probably the basic, free app.

The downside of this is that Tinder wants to make things as simple as possible for its users to upgrade, which is hindered by multiple tiers, which is why potentially breaking the grey price discrimination laws may be their best bet (more on this below).

Long story short—unless every single one of your customers is truly identical, you need to be using multiple tiers to capture as much room under the demand curve as possible.

Even the same persona may have different price sensitivities

Along with providing an array of feature-differentiated options for personas, you’ll find that many of your same customer personas are likely to be willing to pay different amounts. For instance, a very small startup just getting off the ground will have a different willingness to pay than an enterprise corporation that will be using the product at the same level.

This is an extremely frustrating problem to have, because if the only difference between your personas is their budget, then normally you have to choose one or the other to focus on. The alternative is to try to find a feature, value metric, or add-on that you can differentiate for that higher willingness to pay customer (like described above), but this can be extremely difficult.

Tinder cuts through this problem though by just straight up charging these groups differently. Typically when this is found out by the public it turns into really bad PR, which Tinder is getting a bit of over the past week. This is mainly because even if older folks are willing to pay more, they don’t want to know they’re willing to pay more.

Ultimately, the way we’d solve this for most applications is forcing these particular groups into a higher tier for a specific reason, for example, “all our enterprise customers need this SLA. No exceptions” or “the over 30 crowd needs to pay more so we can source more folks over 30.” While not everyone will like these justifications, the transparency is appreciated and avoids the backlash that Amazon, Orbitz, and now Tinder have experience.

The bottom line: Identical personas will be willing to pay different amounts, but you should err on the side of caution by not price discriminating without utilizing feature differentiation.

Tinder's huge, though, so maybe no one will care

No online price discrimination cases have been won by consumers, mainly because proving “discrimination” without a shadow of a doubt is extremely difficult. No cases have been this blatant as Tinder’s though, but I’m sure their corporate attorneys are all ready to go if need be, especially because there’s plenty of multi-country pricing precedent out there.

While there are more fundamental issues to fix in pricing before choosing to price discriminate, always make sure you’re backing up your decisions with data that comes directly from your customers. That’s a decision, we can definitely “swipe right” on (sorry, couldn’t resist #dadjoke).