While many established businesses struggle with stagnant growth, AI-native companies are achieving unprecedented scale at remarkable efficiency.

Taking real-life examples from successful SaaS businesses, we look at how you can achieve AI-driven business growth so you don’t get left behind in the current market.

Watch the full talk delivered by Paddle’s CIO, Andrew Davies, at SaaStanak 2025 or scroll on for the full playbook.

The digital growth landscape

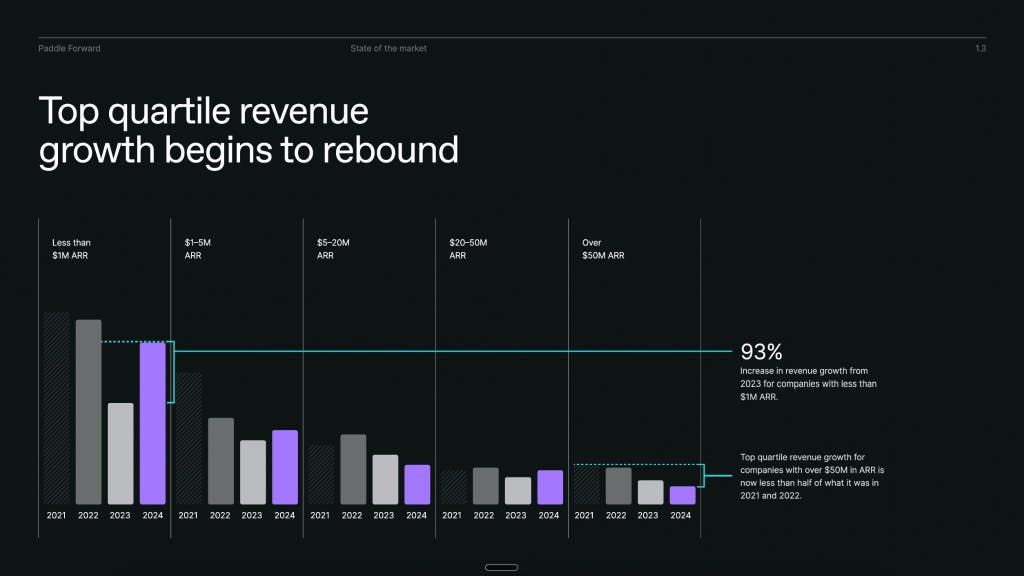

Recent data shows that AI-native businesses with less than $1 million annual recurring revenue (ARR) saw a 93% increase in revenue growth in 2024 than the previous year.

And the operational efficiency of these businesses is just as impressive as their growth rates. For example, Cursor reached $100 million in revenue within 12 months, with just 30 employees.

It used to be the case that you’d need a team of 500 to get to that $100 million revenue mark. The traditional benchmark before AI was around $200,000-$400,000 ARR per employee, but many new-generation SaaS businesses operate at $500,000 to $1 million ARR per employee - at least double the traditional benchmark.

So not only are AI-native businesses growing fast, they’re growing very efficiently.

This transformation reflects more than just technological advancement. It represents a fundamental shift in how software companies build, distribute, and monetize their products.

For SaaS leaders, the challenge is clear: evolve quickly or risk being left behind by more agile competitors. This playbook outlines seven practical SaaS growth strategies that real high-growth companies are using to succeed in today's market.

1. Build distribution into your product's core

Distribution is the battleground

Five years ago, 70% of early-stage venture capital was spent on product development and 30% on go-to-market activities.

Today, those ratios have completely flipped, with 30% on build and 70% of funding directed toward distribution and breaking into the market.

The software industry is relentless and you’re probably facing more competition now than you ever have before. At Paddle, we see firsthand the amount of SaaS businesses in the same categories, solving the same type of problems from different parts of the world.

4 ways to distribute your product

- Borrow distribution - use app stores, third-party platforms, integrations, influencers

- Buy distribution - try paid ads, sponsors, affiliates

- Build distribution - create email lists, website users, Substack or YouTube subscribers

- Bake-in distribution - distribution that happens simply through the usage of your product

The most successful companies embed distribution mechanisms directly into their product architecture rather than treating marketing as an afterthought. In a modern SaaS market, where multiple competitors can emerge simultaneously targeting identical problems, the differentiator becomes speed to market and the sophistication of your distribution tactics.

3 pillars of distribution

- Be your customer - The most effective growth strategies emerge when companies achieve genuine market resonance. This goes beyond traditional founder-market fit, adopting a "marketer-market fit" as well. For example, the vast majority of the team at running coaching app, Runna, are runners. Companies thrive when their marketing teams possess deep, authentic connections to their target audience.

- Execute with courage - Mediocrity is the most competitive space we can operate in and the role of a good marketer is to go beyond mediocrity. Successful distribution requires you to pursue strategies that may feel uncomfortable or risky but create genuine differentiation.

- Engineer your alpha - Make sure there are data points underpinning your distribution strategies that can scale as you grow. The rise of the "go-to-market engineer", people who are building with a ‘data-first’ mentality, means you must build scalable systems that can support rapid growth to compete. And be willing to continually test and iterate quickly.

2. Plan for churn from day zero

Churn is inevitable for SaaS businesses

Every subscription is going to lead to a churn at some point for some reason or another. And yet too often, first-time founders don’t plan for churn from day zero. This fundamental truth about subscription businesses requires proactive planning rather than reactive responses.

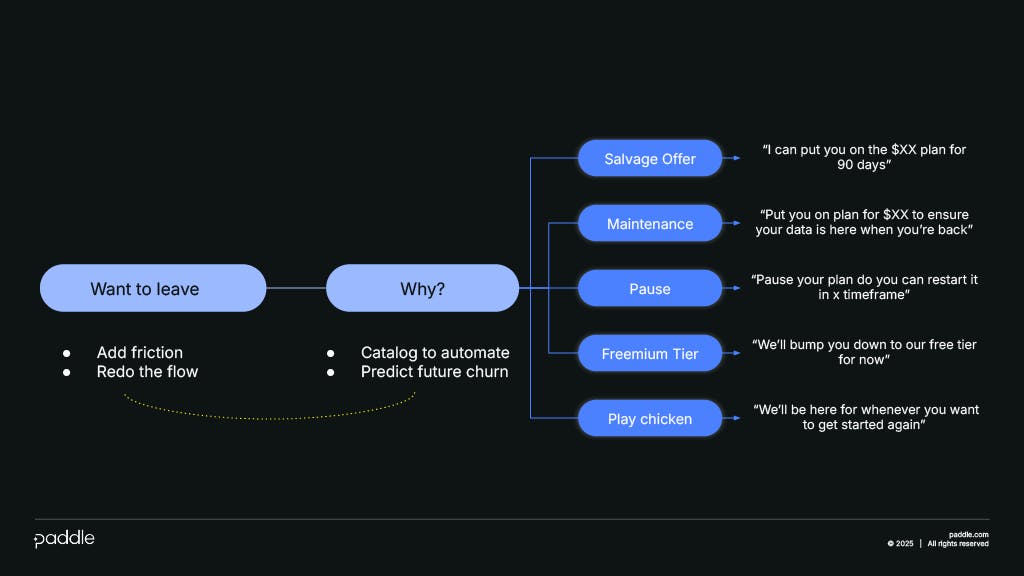

Traditional approaches treat churn as a problem to be solved after it occurs. Forward-thinking companies recognize churn as an inevitable component of their business model and build systems to extract maximum value from these interactions.

How to reduce churn for subscription products

Effective churn management begins with structured exit surveys that you should implement from the very beginning of your product. You should ask two critical questions to transform churn events into learning opportunities:

- Why are you leaving? The key insight is to ensure that price objections don't dominate responses. Instead, dig for issues related to value perception, user experience, or support quality. This data becomes invaluable for product development and preventing future churn across similar customer cohorts.

- Why did you choose us in the first place? Guide departing customers toward positive reflection by asking what they valued about the service. This creates an opportunity to see where your alternatives to churn are. This could be a range of different retention strategies, such as discounted plans, feature-limited versions, or temporary pauses.

Retain existing customers before acquiring new customers

Churn prevention tools, such as Paddle’s Retain toolset, work by using billions of data points to win back customers who intend to leave. With Retain working automatically in the background, we’ve seen many SaaS businesses recover thousands in potential lost revenue.

✔ HubX, serving over 200 million users across multiple apps, implemented salvage offers for customers attempting to cancel. They didn’t just retain 63% of customers who initially intended to churn, they also recovered $106,000 within the first three months of implementation.

The goal isn't preventing all churn but maximizing the value extracted from inevitable departures while identifying customers willing to maintain some form of relationship.

Data shows that reactivation revenue (income from previously churned customers who return) can drive meaningful growth during market recovery periods. Develop systematic approaches for maintaining relationships with former customers and create clear pathways for their return. That way, your retention strategies and your growth strategies go hand-in-hand.

Calculate your churn rate to start managing churn effectively.

3. Think global from launch

SaaS and digital product businesses are born global, yet many artificially constrain themselves to market-by-market expansion. A UK-based business may first try to sell in the UK, then market to the US, and so on. But this approach wastes opportunities, delays SaaS revenue growth, and slows down market penetration.

Localize your payments

Localizing your payment methods is a critical step to ensuring your business is set up for global growth.

✔ Aithor, based in Belgrade with sales in over 150 countries, experienced significant international payment processing challenges that limited their global reach. After implementing Paddle, they could localize their payments and support appropriate payment methods and currencies for each region. They saw immediate results - with a 9% uplift in revenue. Their primary markets in the US and UK experienced a 14% revenue growth, but previously ignored markets like Mexico generated unexpected revenue increases too, with a 12% lift.

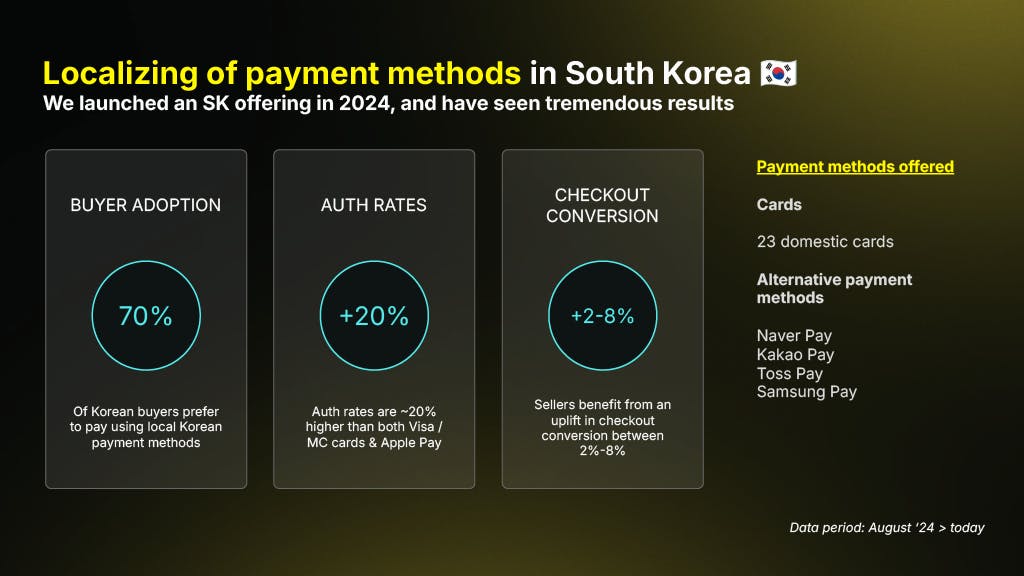

Consider regional payment preferences

Market-specific payment preferences create significant conversion opportunities. In South Korea, 70% of buyers prefer local payment methods over international alternatives. Similar patterns exist across major markets, where local payment options can dramatically improve conversion rates and customer satisfaction.

✔ Nexus Mods, operating from rural England with 65-70 million monthly active users, had withdrawn from the Indian market due to tax and regulatory complexity. By choosing a Merchant of Record, they were able to fully localize payments, allowing them to re-enter 205 territories, including India, while their Chinese revenue grew 9x. The gaming mod site achieved dramatic expansion, not through massive marketing investment, but through operational improvements that allowed proper market access.

Companies that solve operational challenges with localization, such as taxes, payments, and regulations, unlock markets that may have been inaccessible or underperforming due to friction rather than lack of demand.

In SaaS, the world is flatter than ever. So set your business up to grow into a global marketplace from the beginning of your journey.

4. Move fast to monetize

Digital companies that see the most growth are often the businesses that test their pricing models often. Data consistently shows that businesses that roll out a pricing or packaging change every 3 months outperform those that don’t on an average revenue per user basis of 103%.

The erosion of SaaS margins

Traditional SaaS companies that add AI features without adjusting pricing models are seeing margin erosion. This happens when a business doesn’t anticipate the power users who consume AI products much more than expected.

OpenAI's acknowledgment that they lose money on Pro subscriptions, because users consume more resources than anticipated, illustrates this challenge across the industry.

SaaS makes sense if you have 80% margins because that's what funds all of your upfront go-to-market activities, and much more. The integration of AI capabilities into traditional SaaS products threatens to reduce that margin continually if your products aren’t priced according to usage as opposed to traditional digital product metrics.

✔ Monica, the all-in-one AI-powered personal assistant, used Paddle to get greater insights into their customers’ purchase behaviour. This led the team to eliminate their free trial, leading to an 80% chargeback rate reduction and a more consistent revenue stream.

Pricing your AI product

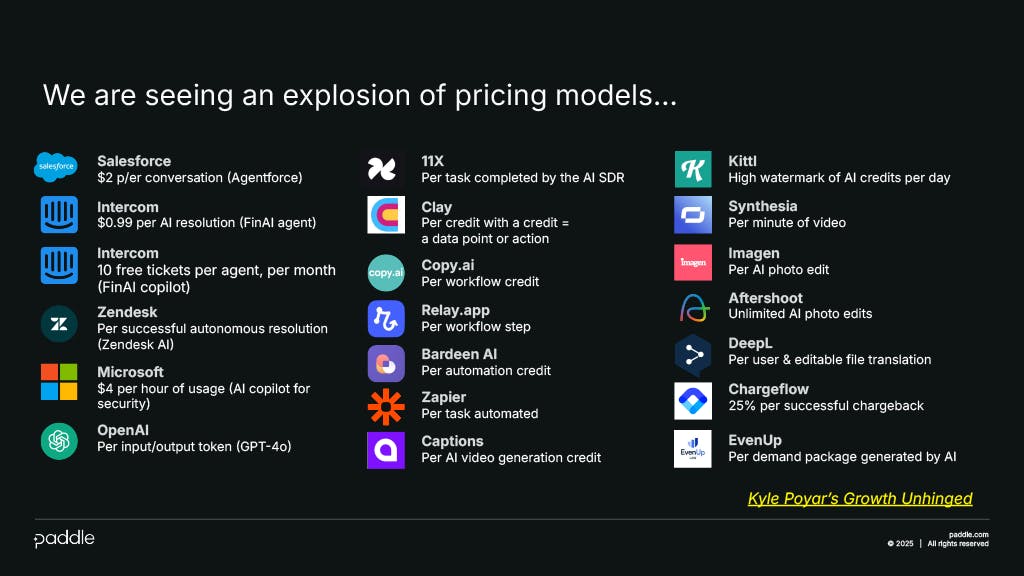

In an AI-driven world, agents and automation reduce headcount rather than increase it. This has resulted in a shift in the SaaS industry from traditional seat-based pricing to usage-based or outcome-based pricing.

Companies that see the most growth are those transitioning toward hybrid models that combine seats with usage-based or outcome-based components.

✔ Intercom launched their Fin AI customer service product, using an outcome-based pricing model. Instead of charging per seat or per interaction, they price based on successful ticket resolutions - directly aligning cost with value delivered. This outcome-based approach ensures that AI capabilities generate revenue proportional to consumption.

Willingness to pay vs adoption

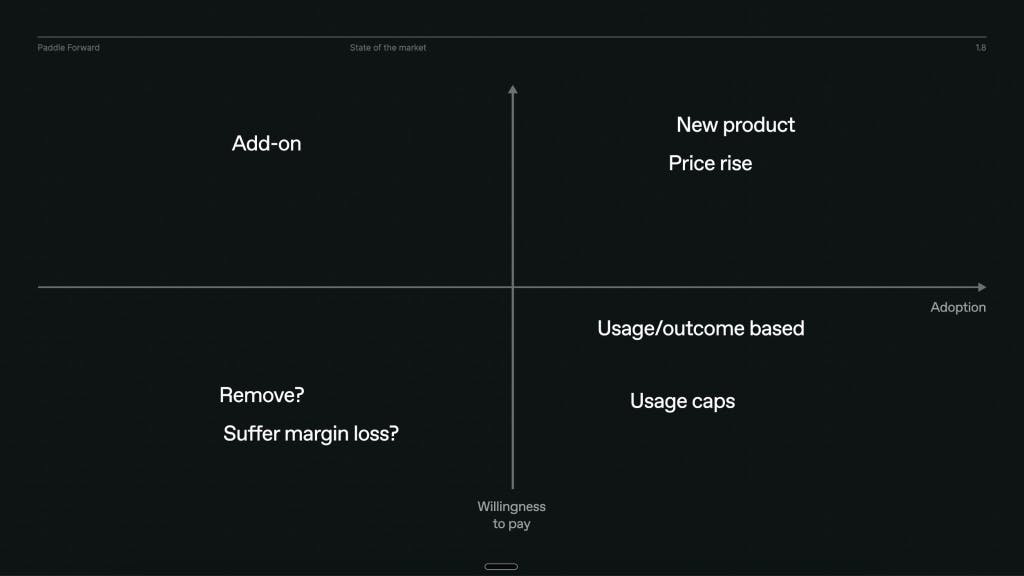

Charging directly for new AI products rather than wrapping the additional cost into existing bundles will lead to more consistent growth, based on the data we have from existing Paddle customers. But it’s important to understand your customers before you set a price.

When considering AI for business growth, you could increase your overall price, charge as an add-on, create a new pricing model, introduce a usage cap, or market as a new product entirely. But which option is the right one for your AI product in your business?

The answer can be determined by where your customers stand on willingness to pay and adoption rates. Here are 3 scenarios and their solutions:

- High willingness to pay + high adoption rates = direct pricing through plan increases or new product offerings.

- Low willingness to pay + high adoption rates = the margin erosion scenario. Usage caps or consumption-based pricing will protect margins while allowing broad access.

- High willingness to pay + low adoption rates = add-on pricing that doesn't burden the entire customer base.

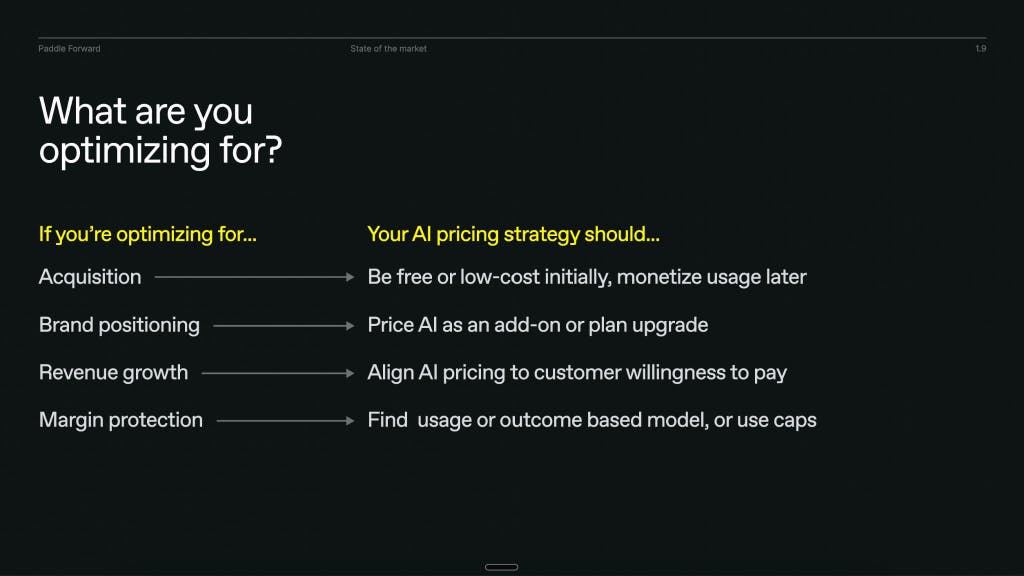

Strategic optimization choices

Companies must decide their primary optimization goal: acquisition growth, brand positioning, revenue growth, or margin protection. Each goal suggests different pricing approaches and trade-offs.

✔ Notion's approach illustrates brand positioning optimization. They offer a flat fee per user and then have clear AI add-ons at fixed prices, creating distinct value tiers that enhance their market position. This strategy prioritizes clarity and brand strength over margin optimization or aggressive growth.

Want to learn more about pricing your AI product? Join Andrew Davies and Kyle Poyar, as they explore how AI is transforming monetization and what you need to do to keep up.

Click the image below to register.

5. Marry the mission, date the model

One growth trend we’ve seen in SaaS is B2B businesses trying to launch a self-serve offering for individuals, and B2C businesses launching a business plan for the teams that they're serving.

Market boundaries continue blurring as companies recognize opportunities to serve both individual users and business customers. The key is to maintain a consistent mission and stick to your company values while adapting your business model to capture different market segments.

B2B to B2C growth

✔ ServiceNow demonstrates this approach by offering individual training subscriptions alongside their enterprise solutions. This self-serve component allows them to capture value from individual professionals while maintaining their core enterprise focus.

This expansion requires different operational capabilities, such as simplified onboarding, automated billing, and self-service support, but leverages existing product development and domain expertise.

B2C to B2B growth

✔ Goodnotes expanded from individual productivity tools to business team solutions. Their transition from an iOS-only consumer app to a multi-platform business solution required new pricing structures, different marketing approaches, and distinct value propositions for organizational buyers. Paddle helped them manage their evolution to offer flexible payment options.

Both directions require careful attention to brand positioning and customer experience. Companies should avoid confusing existing customers while creating clear pathways for new market segments.

6. Focus on your SAM (serviceable addressable market)

The constraint paradox

Successful companies deliberately constrain their serviceable addressable market (SAM) while staying aware of broader opportunities in their total addressable market (TAM).

You should focus intimately, to the point where it feels narrow and constrained, on your SAM in order to build a strong plan for expansion.

Narrow focus enables deeper market understanding, more refined product development, and more effective sales and marketing strategies. This will help you develop specialized expertise and create stronger competitive advantages within your chosen segment.

The constraint creates clarity for team members, investors, and customers about your company’s priorities and capabilities. And by improving internal decision-making speed and allocating resources efficiently, you remove prospective growth blockers.

Market expansion

By staying close to your SAM, you can begin to understand adjacent markets on a detailed level, and know the triggers that would indicate your business is ready for expansion in those markets. Market changes, regulatory shifts, or technological developments can suddenly make previously inaccessible markets viable.

✔ The recent App Store payment ruling is a great example of this. A court decision instantly opened $160 billion in App Store fees for alternative payment providers to process. This created immediate market expansion opportunities for companies prepared to expand and serve app developers, such as Paddle.

7. Don’t lose focus on your value proposition

The outsourcing evolution

Modern businesses can outsource unprecedented portions of their operations, from infrastructure to core AI capabilities. As we see AI-native businesses grow at such rapid rates, it’s easy to understand how they’ve become so efficient because a huge portion of their business is being done by someone else.

This capability allows founders to focus energy on their unique value proposition rather than building undifferentiated infrastructure. You can achieve remarkable efficiency by leveraging external providers for non-core functions.

The build vs buy decision

Every operational component represents a choice between internal development and external partnerships. You should evaluate not just cost and capability but also founder attention and company focus.

Functions that don't directly contribute to competitive advantage, such as payment processing, tax compliance, and infrastructure management, often provide better return on investment when outsourced to specialized providers.

Preserving innovation capacity

The ultimate goal is preserving founder and team capacity for innovation and differentiation. Companies that get bogged down in operational complexity lose the agility and focus that enabled their initial success.

Strategic outsourcing allows small teams to compete effectively against larger organizations while maintaining the flexibility to adapt quickly to market changes and continue business growth.

Where to start: SaaS growth roadmap

With seven growth strategies, what do you focus on first?

The examples we’ve shared above, such as Monica AI, Aithor, HubX and more, didn’t see success overnight. Success requires systematic implementation across all seven growth strategies. But you should begin with an honest assessment of your current distribution capabilities, churn management tactics, and readiness for market expansion.

Your company may have real strengths in some areas, so finding your weaknesses is your priority.

What are the biggest factors of SaaS company growth?

SaaS growth strategies that are in line with an industry being transformed by AI are important for success, but don’t forget the fundamentals. Your strategies should be applied to these elements for optimum SaaS growth:

- Retention: Your first focus should be on implementing churn management systems to retain existing customers before acquiring new ones. Know why customers leave and implement salvage offers that complement this. Don’t forget to manage involuntary churn, which can be easily avoided by ensuring your payment infrastructure is up to scratch. Tackling churn first allows you to focus that recovered revenue on your other growth strategies.

- Attraction: Look at your business model, pricing, and subscription models, and what deals you're using to entice customers. What does your target market value? And does that translate when expanding into other markets? Establish regular testing cadences to understand customer behaviour and aim for quarterly iterations on pricing and packaging. This will build valuable organizational learning and crucial customer insight.

- Acquisition: Conduct distribution strategy audits regularly to understand customer acquisition. Remember that successful digital businesses are spending 70% of funding on distribution as a way of acquiring more customers in an increasingly competitive industry. Pay attention to customer acquisition costs (CAC) too. If they’re higher than the money you’re making from each customer, reconsider your acquisition tactics.

- Conversion: Make your user experience water-tight by staying true to your mission while being willing to adapt your model to different markets. If you’re capturing a new B2B or B2C segment, or expanding into a new market, don’t lose clarity when explaining what you do and how you can help. And make sure your operational functions, such as taking payments globally, are not a blocker for conversions.

- Tracking: Moving fast to monetize doesn’t mean losing sight of what has worked for your business. Stay close to your SAM to understand what works for your customers, and adapt where they need you to by testing frequently. Try Metrics to gain crucial insights and subscription analytics on your products.

Long-term success comes from building organizational capabilities that support rapid iteration and market responsiveness. The companies thriving in the AI era combine strategic clarity with operational agility. This allows them to capitalize on emerging opportunities while maintaining focus on their core mission.

Rapid transformations in AI create opportunities for SaaS companies willing to embrace these principles. The question isn't whether these changes will continue; it’s whether your company will lead or follow in this transformation of the SaaS industry.

Want to scale your SaaS business smarter? Join our five-part SaaS Happy Hour series for the latest strategies, data, and insights.