Many subscription companies overlook their dunning strategy. A great dunning process can save you potential customers when done correctly. Here's how to get it right.

The term “dunning” sounds less than inviting (potentially why it's an overlooked process for many subscription businesses). That and its reputation as a process that both customers and companies hate to deal with.

Nevertheless, dunning is a process you have to work at. A great dunning process is the best way of finding out why a customer account is not sending you payments. It requires direct, sometimes repeated, communication with your customers and can sometimes turn into a long and unwieldy process. But a dunning process done right saves you potential customers, recovers lost revenue, and drives down delinquent churn.

What is dunning?

Dunning is the process of asking customers for money they owe the company. This usually happens after a credit card has been declined, a payment gate has encountered an error, or the customer has insufficient funds.

Dunning is widely disliked by both business owners and customers. Business owners can find the task of trying to acquire payment from difficult-to-contact or uncooperative customers laborious. On the other hand, customers often find dunning invasive and even intimidating.

However, this bad rep comes more from the way in which many companies choose to approach their dunning as opposed to flaws in the process itself. Companies frequently abandon best practices of customer service when approaching their customers about failed payments and instead play the role of the cold-hearted debt collector.

Look at dunning the same way you’d look at selling — as an opportunity to create (or, in this case, recover lost) revenue.

3 reasons credit card payments are declined

Because the success of your business depends on customers making consistent payments, it’s easy to get frustrated with them when they don’t. Sometimes, it can even seem as though some customers are purposefully attempting to avoid paying you. Most often, however, customers behind late payments don’t even know there’s a problem.

Customers’ credit card information is outdated

Many customers forget to update their cards on different accounts because they have forgotten the card is expiring, or they may have forgotten that the expiring card is the one linked to their account.

This is one route to failed payment - and to delinquent churn - that you can head off by sending reminders to customers in advance of card expiry.

Their card is reported lost or stolen

Things happen: your customer could have lost the card and put a hold on it until they found it again, in which case informing subscription providers is understandably unlikely to be too far up their list of priorities.

Their account has insufficient funds

Likewise, if a customer is struggling to pay their bills, your service may not be a top priority for them. A little flexibility on your part can really pay off here. Reach out and gauge the situation with the customer, and see if there’s any way for you to help.

5 best practices for your dunning process

Repeat the words to yourself, over and over again if you have to: “The dunning process can be a positive customer experience.” As the company and the party making the first move, it’s your responsibility to set the tone and intent very clearly from the start. Follow these best practices and you may even find that dunning enables you to strengthen your relationship with your customers.

1. Make your intentions & next steps CRYSTAL clear

It’s not unusual to get spam emails or false dunning letters from companies asking you for money. When composing a dunning email, choose your language and tone of voice carefully and make sure the following are clearly expressed:

- Who you are: a friendly agent from a trusted company

- The payment type (credit card, automatic account withdrawal, etc.) and suggestions as to why the payment may have been declined

- The amount and nature of the outstanding balance, for instance, “You’re on the $10 per month plan and owe $40 for the last four months”

- When you will process the next payment

- A link back to your payment page and any further payment instructions

2. Get your subject line right

Subject lines are what get customers to open an email. Make sure it is professional and clear, so they know it’s important.

An example of a good subject line is, “Action required: Payment failure due to [EXPIRED CARD].” It’s direct and to the point. You can tailor your approach to your company’s general persona without sacrificing directness. For instance, Spotify, which takes a more informal approach to customer communication, will give a dunning email a subject line that reads, “Oh no, your payment failed.”

Don’t use poorly automated subject lines that look like spam (“Account NO#X9999903 Payment Query .x”), poorly contextualized subject lines (“Payment Due Now”), or subject lines that take an altogether too chummy approach (“There’s a Payment We’d Like to Talk to You About”). Bad dunning emails are not only likely to get your customers reaching for the spam button - they risk damaging the trust your customer has in you.

3. Be empathetic

Now that you have your customer’s attention, be empathetic. View them as a customer, not as a debtor, and approach the correspondence with the same tact and friendliness you would when trying to make any other garden-variety sale. Remember: the dunning process is an opportunity to recover lost revenue.

And the recoverable revenue is not restricted to the last payment that didn’t go through. Make a point of telling the customer that you want to make sure they keep enjoying your services into the future as well.

What you must absolutely not do is blame your customer. Chances are your customer is completely unaware:

- that their payment has not gone through and

- why their payment wouldn’t have gone through

Explain why their payment wasn’t made with as many details as you can provide. Your customer is smart — they will sniff out your assumptions about them if you signal your doubt in their good intentions to pay what they owe. Doing so will reduce the likelihood of actually receiving that payment (if for no other reason than a customer being harassed by their service provider is highly likely to churn).

4. Keep it concise

No one likes to receive long, depressing emails about making payments. A couple of paragraphs, and sound formatting choices can get the job done in a dunning email.

If you’re including technical information about payment plans or aspects of service, use lists and bullet points to make the information digestible. Make sure that any key metrics or other points (e.g., deadline dates, amounts due) are in bold text to draw the reader’s eye.

And remember, most people read their emails on a mobile device - format accordingly!

5. Know when to stop

The verb “to dun” literally means to harry someone with unwanted information. Perhaps that’s the source of its bad reputation, come to think of it.

While you should see it as an opportunity to recover lost revenue, there’s still a point where you have to let go and accept that a customer may be lost. If you have sent four emails over the last payment period with no response, it might be a good time to stop and terminate the service you’re providing to that customer.

Benefits of a great dunning process

It's never fun to chase people down for the money they owe you — for you or for them. But when you do it well, it pays off (not just financially).

Lower churn

As we’ve seen before, keeping churn low is all-important for any SaaS business. Delinquent churn - where customers do not actively leave your service but are passively churning out through delinquent credit cards - is a particularly serious and easily overlooked churn metric for companies to keep an eye on.

By making sure that their payments stay good-to-go, you’ll keep more of those at-risk-of-churn customers

Positive customer experience

If you have a dunning process that approaches the customer in the correct way and helps the customer recover their account instead of blaming them for not paying, you’ll make it considerably more likely that they’ll trust your methods and stay with your service.

Your approach to dunning should be part of a broader approach to customer experience that sees opportunity in unlikely places. You want your customers to stay put - don’t just say it, show it by helping them come back to using your service. If their payments have stopped because they’ve forgotten your product, then dunning can be a great way of reminding them of it and the great people behind it.

Reduce churn by automating the dunning process

It frankly doesn’t matter how big your company is or how fast you’re growing - losing money to failed payments is just not a loss that you should be accepting. In fact, the bigger your company gets, the larger share of your churn the credit card delinquencies are likely to account for (sometimes up to 40% of it).

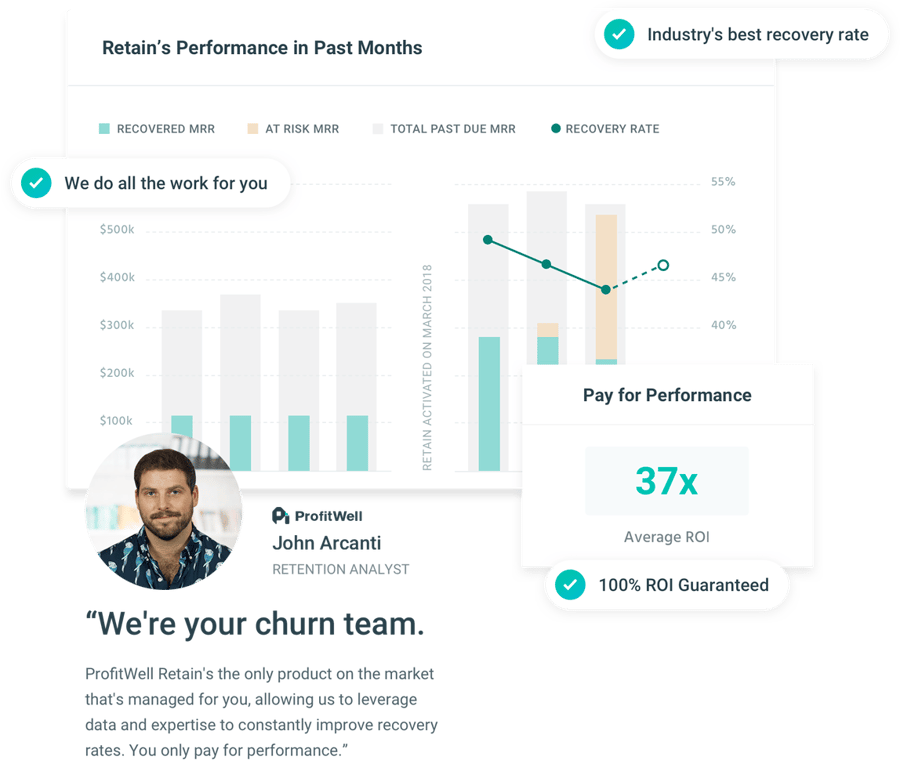

With solutions like ProfitWell Retain, by Paddle, you can drive that churn down. Retain™ combines world-class subscription expertise with algorithms that leverage millions of data points to win back customers.

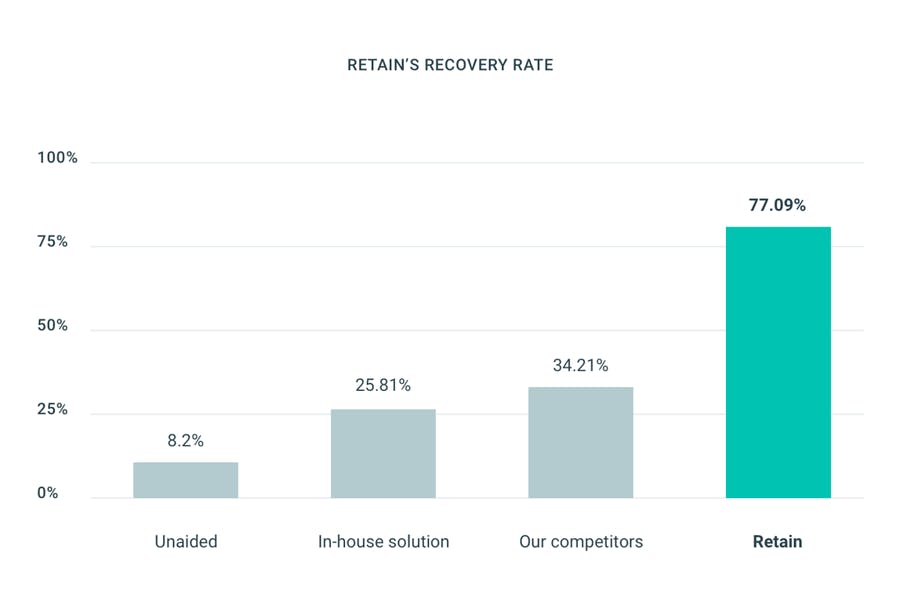

More than double your recovery rate

Thanks to ProfitWell’s in-depth knowledge of customer dynamics in subscription technologies, the strength of Retain’s proprietary technology, and the degree to which the solution is customized for every client, Retain maintains the highest recovery rate in the market.

Get 100% ROI, guaranteed

ProfitWell’s Retain staff augment your churn team. You only pay for performances, not for the software, so 100% return on investment is guaranteed.

Set up in 15 minutes

ProfitWell Retain offers a full service, but onboarding is straightforward. We handle testing and deployment of algorithms and plug right into your existing billing system, so everything is safe and compliant. But your customers won’t even know we’re there — everything is fitted out in your company’s branding. Front-to-back setup takes only 15 minutes.

It's all about the customer

When you’re keeping an eye on fulfillment of payments and another eye on the state of your revenue, it’s easy to forget that customers are people too - things slip their mind and, hey, mistakes happen. Just because it happens to be a payment to your company that wasn’t delivered doesn’t mean that you shouldn’t approach the dunning process like you would any other customer interaction. It’s the customer’s happiness that pays, after all.

Vigilance against fraud is important - and there are solutions out there that can clue you in to who among your customer base might be more likely to commit fraud. But the mistake that many companies make with the dunning process is to be suspect from the start. Be patient, empathize, and educate your customers. You may find that dunning management becomes a notable way of improving your relationships with them.