TL;DR: Apps running External Payments are seeing significant revenue uplift and are facing no ASO consequences.

Ten months after the Epic v. Apple ruling opened the door to External Payments in the US, most app teams already know the headline: Apps can now route third party payments away from the Apple ecosystem, and avoid Apple’s 15 - 30% commission.

What that means in practice is less clear.

Teams understand the opportunity in theory, but many haven’t moved. Not because they doubt the upside, but because they’re unsure about what actually changes, what risks they take on, and whether the trade-offs are worth it.

In this blog, we’ll show you real world examples, industry data and expert takes - demystifying what has changed and where the real opportunities for app developers lie in 2026.

What’s changed, what’s stayed the same?

For many app-first teams, uncertainty about scope is the biggest blocker. The perceived impact feels larger than the reality.

Here’s how the teams we speak to already using External Payment flows describe the change.

What changes

- Checkout moves to mobile web. Users are routed from an in-app paywall to a browser-based checkout.

- You control pricing and payment methods. Discounts, bundles, refunds, and trials are no longer constrained by App Store rules.

- Some app leaders have hesitated adopting External Payments.

- You take on the responsibility Apple used to handle. Tax, compliance, fraud, billing support.

What doesn’t

- Distribution and discovery. App Store presence, ASO, and Features remain unchanged.

- Core product experience. The app remains the primary place users engage and convert.

- Entitlement logic. Purchases still map cleanly back to in-app access.

- In-app purchases. Most teams continue to offer IAP alongside web checkout.

The shift teams didn’t expect

Some app leaders have hesitated adopting External Payments, concerned that it means fully abandoning Apple’s payments system. From what we’ve seen that’s never the case.

External Payments doesn’t replace the In-App Purchases (IAP) , but complements them. Many of the successful implementations we’ve seen keep IAP alongside External Payments.

iOS External Payments for teams selling in the US often means more choice for the developer and the customer, not more restrictions. In this recent webinar with Paddle, Fernando Rojo, Head of Mobile at Vercel, underscores this critical point.

What does the data say?

After 10 months of real-world adoption, the data tells a story of minor conversion impact and meaningful revenue gains.

Metric | What good looks like | What average looks like |

Net Proceeds | 24% + | 15% (small business program) |

Conversion Rate Change | 0-1% + | 5 - 12% - |

LTV impact | 17% + | 10 % + |

*Aggregate data from Paddle customers and RevenueCat.

Even with a modest dip in conversion, most apps see higher net revenue through a 15 - 24% decrease in platform fees and higher customer LTV.

Providing mobile native payment options and a checkout that matches the UI of your app goes a long way in staving off conversion dips. Ensuring fast web-page load times is absolutely critical here too.

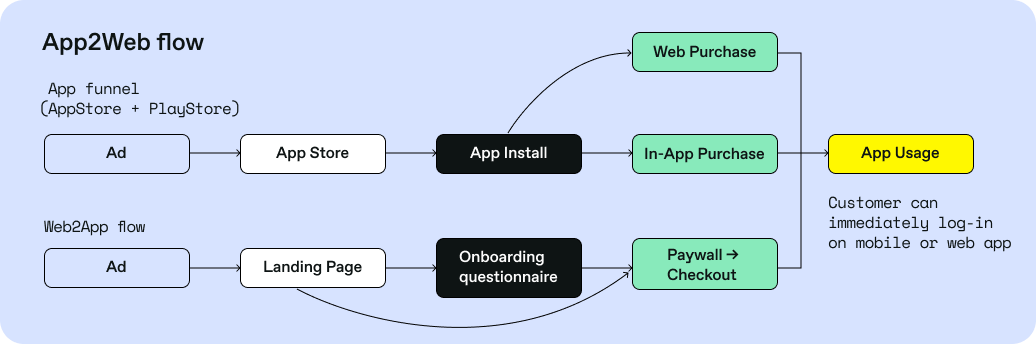

Web2App or External Payments?

There’s still no single right answer 10 months on from the ruling: apps should experiment with every stream they can and find out what works best for their users and their revenue.

Despite this, one benefit of External Payments emerging, outlined by app growth expert Nathan Hudson, derives from ASO and External Payments.

Driving users into the app from your ads first means:

- More installs

- More onboarding engagement

- Stronger ASO signals

Crucially, you can prompt for ratings and reviews during onboarding or immediately after a user passes the paywall.

That’s something you simply can’t do with Web2App. With that in mind, Web2App still brings unique benefits around audience expansion and attribution that are unmatched.

Ultimately both motions can go hand-in-hand and it’s down to the developer to experiment and find that balance.

Have any apps been penalized by Apple?

In short, no and they are unlikely to be.

Paddle customers like Runna (acquired by Strava) regularly rank in Apple’s Featured section while operating External Payment flows.

While comment from Apple is limited, appeals from Apple on the core tenants of the ruling have been rebuffed.

Apple execs are still potentially facing criminal proceedings after violating a 2021 ruling, and could face prison time if the same judge believes they are still acting in bad.

It is still highly unlikely Apple will punish any app making the most out of this newfound opportunity and we’re yet to see a single case of penalization.

How do I get started today?

Start with a single External Payment route: one plan, one paywall, one checkout.

Keep IAP live, then measure and iterate.

1) Design the handoff first.

Before Safari opens, tell users what’s happening, why it benefits them, and what to expect after purchase. Don’t oversell it. The goal is trust and clarity.

2) Treat web speed as conversion infrastructure.

Measure the time from paywall tap to web “Buy” click—not just checkout completion. If that interval is long, you have performance issues, confusion, or both.

3) Keep the web experience familiar.

Match plan naming, benefits language, and pricing. Avoid surprises between paywall and web. Familiarity beats novelty in payments.

4) Keep Apple Pay on the web.

A common misconception is that leaving the app means losing Apple Pay. It doesn’t. And for iOS audiences, Apple Pay can be the difference between marginal gains and real impact.

5) Solve identity and return-to-app.

Where possible, bridge identity so users land on the web already recognized.

Use universal links for return-to-app with a clear fallback for edge cases. Post-purchase confusion is a trust killer.

The “we need to rebuild payments” misconception

A lot of teams assume External Payments means building a payments stack from scratch.

In reality, the hard part often isn’t the checkout UI, it's the operational surface area that comes with web monetization.

When payments move to the web, you inherit what the App Store used to bundle into its commission: tax and invoicing, compliance updates, fraud and disputes, billing support, localization, and keeping payment performance strong across regions.

For many teams, that operational work is the real blocker, not the web flow.

This is also where partner choice starts to matter.

How teams get there faster with Paddle

Rather than redesigning External Payment flows, Paddle focuses on removing the operational and technical drag that makes them hard to execute well.

Teams use Paddle to:

- Increase web-checkout conversions with a fully customizable, localized mobile web-checkout (equipped with Apple Pay, Google Pay and 29+ other payments methods).

- Launch and experiment motions quickly.

- Offload tax, compliance, fraud, and billing as your Merchant of Record.

- Slash churn with longer-term plans, salvage offers and customer win back mechanisms.

What the last 10 months have clarified

External Payments are not a guaranteed win. Poor execution can erase the upside. The teams seeing the best results test carefully, experiment the right balance of motions and remove operational risk before optimizing for scale.