Everything you need to know about Stripe's new Merchant of Record-type feature: Stripe Managed Payments.

- Merchant of Record defined

- What is Stripe Managed Payments

- Where is Stripe Managed payments not supported

- Stripe Managed Payments fees

- Stripe Managed Payments customer sentiment

- Who is Stripe Managed Payments suited for

- What local payment methods does Stripe Managed Payments not support?

- Stripe Managed Payments vs other Merchant of Records

TL;DR: Stripe Managed Payments

- Stripe Managed Payments is a new, Merchant of Record-type feature designed for Stripe Checkout users. It offers partial simplification for tax and compliance, but still requires users to manage much of their payment stack.

- It is not yet a complete Merchant of Record. Stripe continues to act primarily as a payment processor rather than a billing and payments partner, potentially taking 8-10% of each transaction through its modular design

- Stripe Managed Payments is a significant shift and a tangible validation of the Merchant of Record model, but it will take a significant amount of time before the feature can compete with mature solutions when it comes to coverage and platform sophistication.

- In its current iteration, Stripe Managed Payments does not support key established and emerging countries like South Korea, China, India, China, Turkey and Brazil. For 15 years, Stripe has built its reputation as the go-to payments platform for businesses of every shape and size.

From global enterprises to early-stage startups, Stripe offers the tools to accept payments, move money, and build a comprehensive financial stack.

In April 2025, Stripe introduced a beta version of Stripe Managed Payments (SMP), a new Merchant of Record feature aimed at simplifying global selling and compliance. It’s a big shift for Stripe, signaling that even the world’s largest payment infrastructure company sees growing demand for the Merchant of Record model.

Stripe’s Managed Payments raises a key question: Can a feature designed to fit Stripe’s broad customer base truly meet the operational and compliance needs of SaaS, AI and digital product businesses?

This article breaks down what Stripe Managed Payments actually is, how it compares to a mature Merchant of Record like Paddle and what SaaS and digital product sellers should know before making a decision.

Merchant of Record defined

Before focusing on Stripe’s beta release, it’s important to define the Merchant of Record model.

A Merchant of Record (MoR) is the legal entity responsible for selling goods or services to end customers. They manage all payments and take on the associated liabilities, such as collecting sales tax, ensuring Payment Card Industry (PCI) compliance, and honoring refunds and chargebacks.

Businesses can choose to be their own Merchant of Record, setting up the infrastructure and processes necessary to manage payments and liabilities.

When a business acts as its own Merchant of Record, it must:

- Register for and remit tax in every region it sells to.

- Maintain PCI compliance for payments.

- Handle fraud, refunds, and chargebacks.

- Issue compliant invoices and receipts.

By contrast, a Merchant of Record provider becomes the legal seller on your behalf, taking on the tax, compliance, and operational responsibility for each transaction.

In essence, a Merchant of Record doesn’t just process payments; it carries the legal and operational liability of global commerce.

What is Stripe Managed Payments?

Stripe Managed Payments is Stripe’s first attempt to enter the Merchant of Record space. It’s designed to make it easier for businesses using Stripe Checkout to sell internationally by helping with some elements of tax and compliance.

It currently operates as a feature within Stripe’s broader payments stack rather than a standalone operational model.

Businesses using Stripe Managed Payments can rely on Stripe to manage certain aspects of tax collection and settlement, but they still remain responsible for other components, such as:

- Compliance in non-supported territories.

- System configuration.

- Disputes and refunds.

For those already using Stripe Checkout, this may feel like a natural extension. But for SaaS and digital product sellers with multi-currency requirements, custom billing setups, or customers in unsupported regions, Stripe Managed Payments' current limitations may become apparent quickly.

Stripe Managed Payments at a glance

- Available only to Stripe Checkout users.

- In private beta with limited country rollout.

- Merchants are still responsible for compliance in non-supported territories, system configuration, disputes/chargebacks, and refunds.

- No public pricing or detailed roadmap available

Stripe Managed Payments is a bolt-on feature designed to help certain businesses handle their compliance easily.

In its current form, it is not a full-service Merchant of Record, and it will likely take many iterations before it approaches the level of maturity necessary to match more established solutions.

Where is Stripe Managed Payments supported?

Eligibility is determined by where the business is based.

Sellers must be located in one of the following regions:

Europe | North America | Asia |

|---|---|---|

EU | US | Hong Kong |

Switzerland | Canada | Singapore |

UK | Japan | |

Norway |

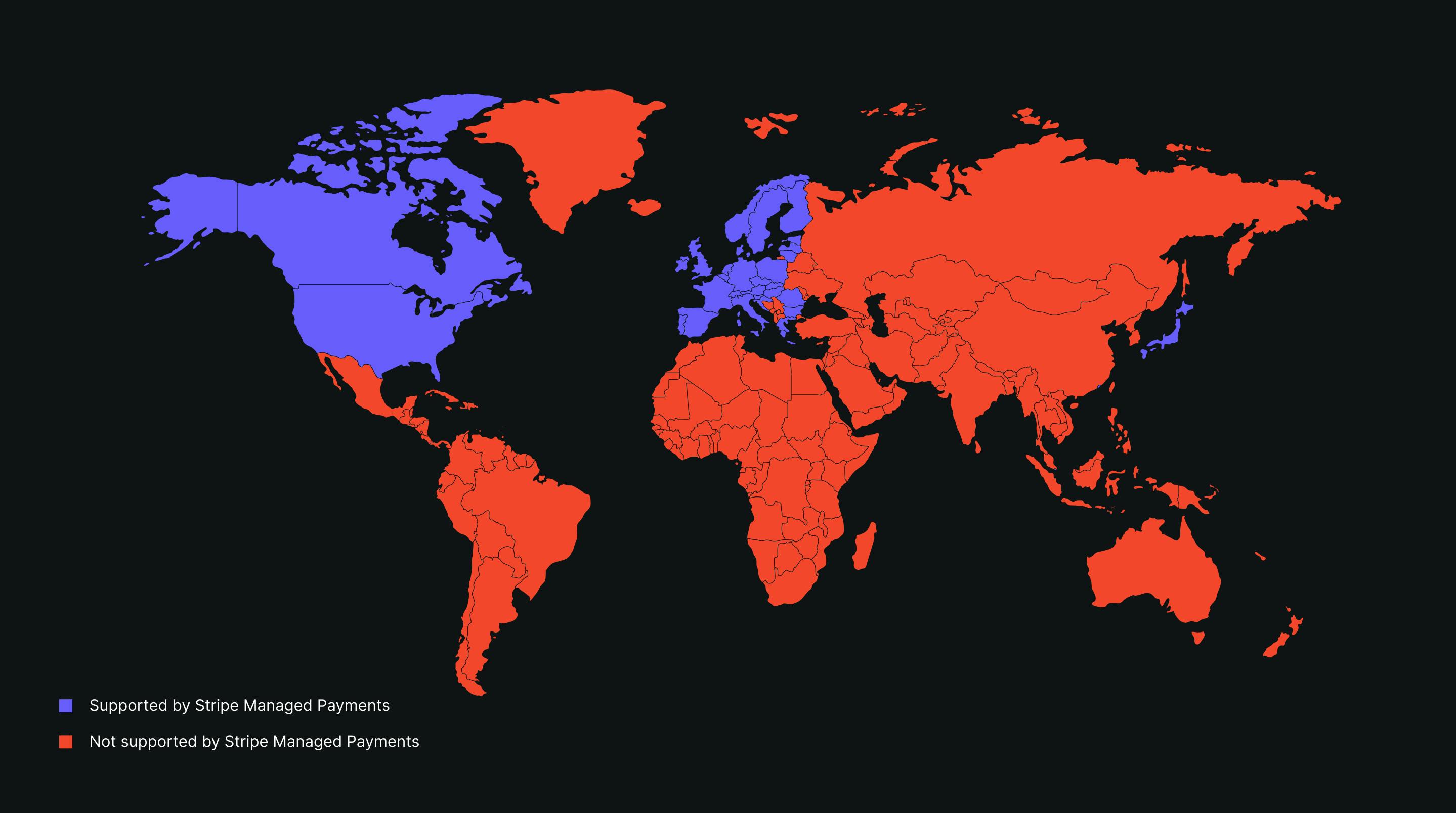

Where is Stripe Managed Payments not supported?

In its current form, Stripe Managed Payments is not supported in key established and emerging territories, such as:

North America | EMEA | South America | Asia | Oceania |

|---|---|---|---|---|

Mexico | Saudi Arabia | Brazil | China | New Zealand |

| Argentina | India | Australia | |

Turkey | Chile | Indonesia | ||

South Africa | Colombia | Vietnam | ||

Egypt | Peru | Thailand | ||

Nigeria | Uruguay | Phillipines | ||

Morocco | Ecuador | Malaysia | ||

Kenya | Paraguay | South Korea |

Sellers are forbidden to sell into the following markets:

- China

- Cuba

- Iran

- North Korea

- Russia

- Syria

Stripe Managed Payments fees

Stripe’s pricing model reflects its modular design.

Users pay transaction fees and then layer on additional costs for features like invoicing, currency conversion, fraud protection, and billing.

Stripe Managed Payments fits within that same structure. Sellers pay their standard transaction fees and any add-ons required for their setup. The total cost of operating on Stripe can vary widely based on the tools used.

For software businesses, this creates uncertainty. What begins as a simple setup often grows into a complex and costly network of Stripe products that can cost 8-10% of each transaction.

Other Stripe fees

SaaS, AI, app, and digital product businesses need a range of other services that cover fraud and at present Stripe Managed Payments is only available for existing Stripe customers who pay for a plethora of add-ons, we detail a sample of those below:

Category | Feature | Fee |

|---|---|---|

Payments | Domestic cards | 2.9% + 30¢/transaction |

Billing | Recurring subscription management | 0.7%/billing volume |

Payments | Link | 2.9% + 30¢/transaction |

Checkout | Post-payment invoice | 0.4%/transaction |

Checkout | custom domain | 10$/month |

Radar | Fraud prevention | 7¢/transaction |

Dispute prevention | Mastercard resolution | 29$/Per res |

Global payouts | Local bank payouts | 1.50$/payout |

Financial accounts | currency conversion | 0.5%/converted amount |

Stripe Sigma | Analytics | 15$/month |

Stripe’s modular approach gives sellers choice, but it also adds complexity and cost. Each new market, product type, or revenue stream brings new challenges and fees.

Stripe Managed Payments customer sentiment

Stripe Managed Payments is only available for a small number of users globally, with the feature still in Beta release.

While there are no specific reviews on the new feature, we can use existing customer sentiment to get a fair idea on overall platform strengths and weaknesses.

Stripe G2 reviews range from 3.8 to 4.5 across its 8 products. Customers enjoy:

- Integrations

- Easy setup

According to the same summary of reviews on G2, Stripe often falls short when it comes to:

- High fees

- Payment issues

- Poor customer support

Who is Stripe Managed Payments best suited for?

As one of the largest payment service providers in the world, Stripe serves a diverse customer base that includes e-commerce brands, marketplaces, retailers, subscription platforms, and B2B software companies, because of their sheer scale, it is unclear who Stripe Managed Payments is for.

As previously mentioned, that breadth is what makes Stripe powerful, but it also makes it difficult to design a solution tailored to the specific operational needs of any one segment.

Stripe Managed Payments seems to follow that same pattern. It’s being developed as a broad feature rather than a focused product, intended to extend Stripe’s existing infrastructure rather than replace it.

At this stage, Stripe has positioned Managed Payments primarily for businesses already using Stripe Checkout. If you’re not currently using Stripe’s hosted checkout, you won’t have access to the feature. That means it’s likely to appeal first to Stripe-native merchants with relatively standard, card-based payment flows rather than complex or multi-channel setups.

Based on its early design, Stripe Managed Payments is best suited for:

- Businesses already using Stripe Checkout who want to simplify parts of their tax and compliance workflow without migrating platforms.

- Ecommerce and D2C sellers running standard checkout flows who need light compliance coverage rather than full operational outsourcing.

Who should avoid Stripe Managed Payments?

While Stripe Managed Payments may simplify life for some existing Stripe Checkout users, it isn’t designed to meet the needs of every type of business.

At this stage, SMP is not well-suited for SaaS and digital product businesses that sell globally and aren’t already using Stripe Checkout. It is also not a good fit for those that rely on sophisticated subscription, metered, or hybrid billing structures.

These companies typically need deep operational coverage that goes far beyond payment processing, including handling tax registration, issuing compliant invoices, and managing chargeback or refund workflows across global markets.

Because SMP is still in private beta and only available through Stripe Checkout, it doesn’t yet fit businesses with custom payment experiences.

In its current form, Stripe Managed Payments isn’t suitable for:

- SaaS and digital product sellers looking for a fully operational Merchant of Record model that handles tax, compliance, and billing globally.

- Companies outside Stripe’s supported regions, or those selling to customers in markets not covered by the beta.

- Teams that need a plug-and-play solution rather than another feature to configure, maintain, and reconcile within a growing stack of Stripe products.

- Product-led growth companies that want unified subscription metrics and retention tools directly in their billing platform.

What local payment methods does Stripe Managed Payments support?

Owing to its immaturity, payment method coverage on Stripe Managed Payments is limited to:

- Cards

- Apple Pay

- Link

What does this mean in practice? A mature Merchant of Record, like Paddle, supports a vast array of local payment methods in key markets like:

- AliPay (China)

- PiX (Brazil)

- UPI (India)

- iDEAL (Netherlands)

- Payco, Samsung Pay, Naver Pay, and Kakao Pay (South Korea)

The consequence of this can seriously stifle growth potential, with local payment methods proven to boost payment acceptance by 91% in countries like China.

Stripe Managed Payments vs a mature Merchant of Record

Building a Merchant of Record that can support global expansion takes time. It’s a regulated and sophisticated solution that requires setting up local entities, correct licenses, compliant invoicing, and buyer support across dozens of jurisdictions.

Approval rates, fraud controls, and treasury operations only strengthen with real-world volume and audits, and these capabilities can’t be shortcut.

Here’s a closer look at Stripe Managed Payments, when compared with a mature Merchant of Record like Paddle.

Feature | Paddle | SMP |

|---|---|---|

Pricing | all-in-one price (5% + 50¢.) | complex add-on structure |

Checkout | customizable | Locked in |

Payment Methods | Broad range | Limited to cards, Apple pay and Link |

Global reach | Extensive | Limited |

Is Stripe Managed Payments right for my business?

Stripe Managed Payments is an important evolution for Stripe and a clear signal of the growing demand for a Merchant of Record solution. It simplifies parts of selling globally but remains an early-stage feature within Stripe’s broader ecosystem.

When compared with a mature Merchant of Record with over a decade in the game, like Paddle, the capabilities simply don’t compare.

Stripe’s strength has always been its breadth, but that same breadth makes it harder to meet the deep operational needs of software companies.

For now, its limited availability, coverage, and flexibility make it best suited to existing Stripe Checkout users rather than SaaS or digital product businesses with global customer bases.