Key takeaways

- Around 18% of customers abandon checkout when they don’t see their preferred payment method.

- Paddle data shows that 62% of buyers choose local payment methods over others, driving up to 8% in conversion improvement

- Paddle customers that added just one extra payment method saw their conversions increase by 5.5%.

You’re losing customers at checkout and don’t even know it.

Every time a potential customer visits your payment page and only sees “credit or debit card,” a percentage of them bounce. It could be that their cards declined. Or they don’t want to enter their details again. Or maybe they’re international customers who prefer local payment methods you don’t accept.

The solution is to offer alternative payment methods (APMs).

This article explains what APMs are and how to implement them to improve conversion rates and increase revenue.

What are alternative payment methods?

Alternative payment methods refer to any payment option beyond traditional methods, like cash, credit, and debit cards. They include digital wallets like PayPal and Apple Pay, bank transfers, direct debit systems, and region-specific solutions like Alipay or PIX.

These aren’t just “nice-to-have” extras anymore. In many markets, they’re the primary way people pay online. For instance, Germany’s customers prefer bank transfers. In Brazil, Pix handles over 3 billion transactions per month. And China’s Alipay and WeChat Pay handle more than 90% of mobile payments.

The shift occurred because traditional card payments are not suitable for everyone. Some customers don’t have credit cards. Others worry about sharing card details online. Many people simply prefer the payment methods they already use daily.

For SaaS and app businesses, this creates both a challenge and an opportunity. The challenge is that different markets expect different payment options. The opportunity lies in offering the right alternatives to potential customers.

Popular payment methods for SaaS and apps

The world of payments is way bigger than you might think. Each method serves different customer needs, regional preferences, and business models. Let’s break down the main categories so you can determine which ones are most relevant to your specific audience.

Card-based payment methods

While Visa and Mastercard rule the US, other regions have their own preferred card networks that customers trust more. These networks have deeper market penetration in their respective home countries and often offer better rewards or lower fees.

Prepaid cards and gift cards offer another card-based alternative. They’re popular with younger demographics and customers who want to control their spending on subscriptions.

Key examples of these include Cartes Bancaires (France’s domestic network that processes most French card transactions), UnionPay (China’s national payment network, essential for mainland Chinese customers), and JCB (Japan’s major credit card brand with strong merchant acceptance).

Digital wallets

Remember when paying online meant typing 16 digits, an expiry date, and that little CVV code? Digital or mobile wallets made all that disappear with a single tap.

Customers link their cards or bank accounts once, then use fingerprint, Face ID, or simple login to authorize payments. The wallet handles all the sensitive data transfer behind the scenes.

Some examples of global players at the forefront of this alternative online payment method include PayPal, Apple Pay, Google Pay, and Amazon Pay. Region-specific players include Alipay, GrabPay, and MercadoPago.

Bank transfers

These are direct account-to-account payments that bypass card networks entirely. Money flows straight from the customer’s bank to your business account.

Customers can authorize a bank transfer using their online banking service, a payment app, or by sharing their account details.

This popular payment method often attracts lower fees and works well for high transaction volume.

Examples include Single Euro Payments Area (SEPA) transfers, Automated Clearing House (ACH) payments, and Faster Payments.

Direct debit payments

These are automatic recurring payments that deduct money from customers’ bank accounts on set dates. Like an automatic bill pay, but you control when and how much.

This payment method works well for subscriptions because it reduces payment failures and churn. Also, customers don’t need to remember to pay or update their cards for every payment.

An example is BECs Direct Debit, Australia’s system for automatic payments.

Top alternative payment methods around the world

Payment preferences vary dramatically by region, making local knowledge crucial for global expansion.

North America

Digital wallets, such as PayPal, Apple Pay, and Google Pay, account for the majority of payments in North America.

In 2023, 78% of US consumers used a digital wallet at least once, up from 65% the previous year.

PayPal is particularly important in North America, with Paddle data showing it drives a high percentage of revenue for businesses that enable it.

For B2B SaaS companies, ACH bank transfers are an excellent option for annual subscriptions. They’re cheaper to process than cards, and customers don’t have to worry about expired credit card numbers disrupting their service.

Europe

Europe offers the most diverse payment options, with each country liking different ways to pay.

Consider the Netherlands, Germany, and Belgium as examples. Most Dutch people use iDEAL for online payments. Germans like to use Giropay for their payments. In Belgium, people mostly use Bancontact.

At the same time, digital wallets like PayPal are still popular across Europe. Newer services, such as Klarna (a buy-now, pay-later service), are gaining popularity, especially when people purchase expensive items.

The main thing to note is that European customers often prefer their local payment methods over international ones because they trust them more and are familiar with how they work.

Latin America

Latin America is rapidly adopting instant payment systems. Brazil’s PIX has revolutionized payments with instant, free transfers. Mexico’s SPEI offers similar functionality. Credit cards remain important, but regional networks like Elo (Brazil) and local installment payment options are crucial.

Asia-Pacific

Asia-Pacific presents the most fragmented landscape. China requires Alipay and WeChat Pay for meaningful market penetration.

Japan favors convenience store payments and bank transfers alongside JCB cards. Southeast Asia uses regional e-wallets like GrabPay, while Australia and New Zealand prefer POLi bank transfers and BPAY for bill payments.

Middle East and Africa

The Middle East and Africa are experiencing rapid growth in mobile money solutions. For example, M-Pesa dominates East Africa with remarkable penetration rates, while similar services are emerging across the continent at an accelerating pace.

This growth in Africa stems from a fundamental infrastructure gap in traditional banking and physical cash payment systems, which remain limited across much of the region.

As a result, mobile payments have become essential for market access. Companies that can tap into these mobile money networks often find themselves with a significant competitive advantage in reaching previously underserved customer segments.

Benefits of accepting alternative payment methods

Businesses that offer multiple payment methods experience significant improvements across key metrics, including revenue, customer satisfaction, and conversion rates.

Higher conversion rate and more revenue

In a study by Baymard Institute, 10% of customers cited “not enough payment methods” as their reason for not completing a purchase. Another 8% cited credit card decline as the reason. Combined, that’s 18% of sales left on the table because there were no alternative payment methods.

The adoption of an APM, such as digital wallets, has also resulted in an additional $10 trillion in spending by customers across the United States and Europe, according to McKinsey.

All of this goes to show that your customers are willing to spend as long as you offer a payment method they want.

The impact of offering region-specific payment methods goes beyond just customer preference. It directly affects your bottom line through improved conversion rates.

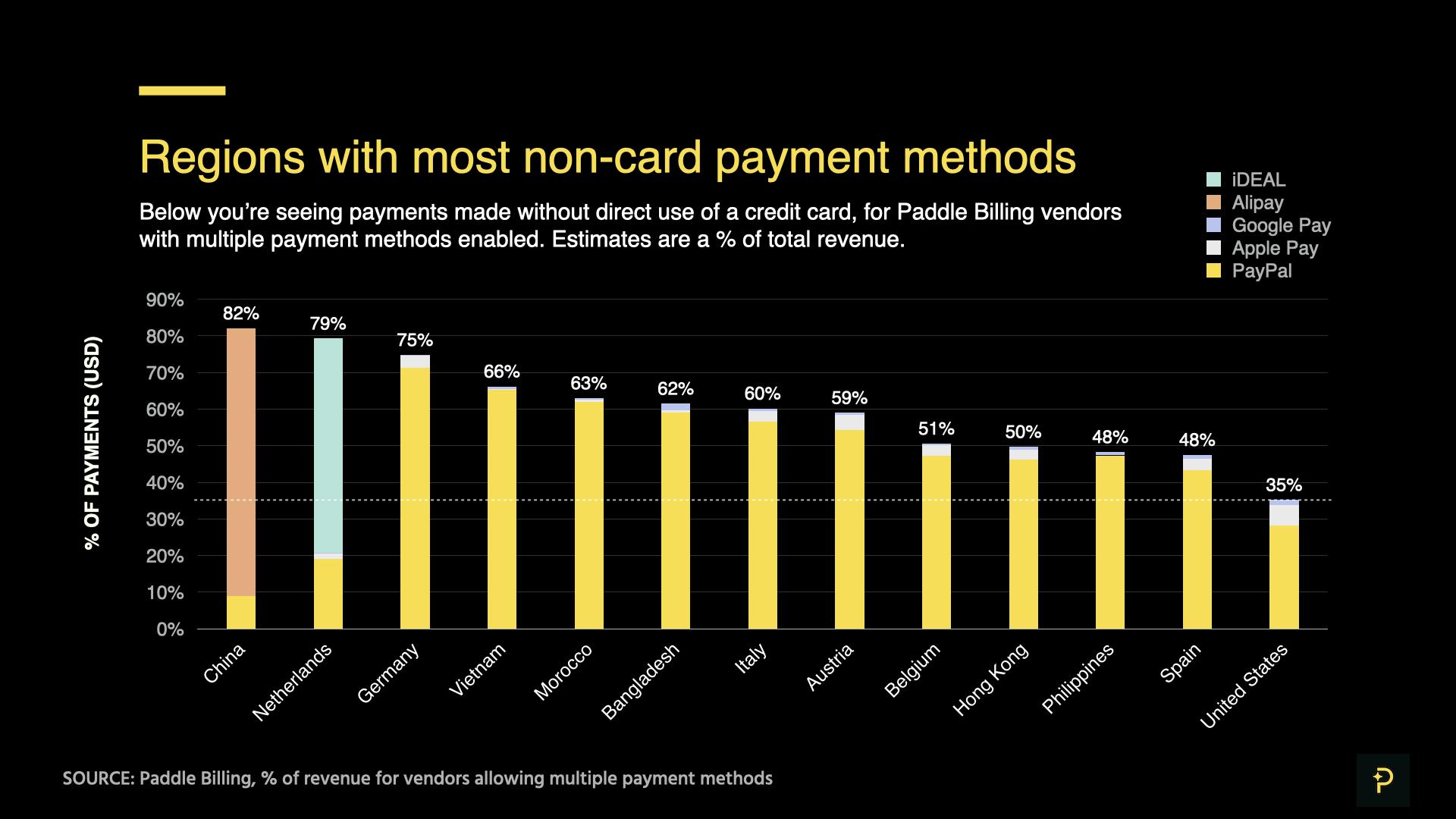

Paddle payment method research

Paddle analyzed businesses using localized payment methods versus those that don’t, and the results are compelling.

Companies that enable iDEAL for Netherlands customers see a 4.21% higher capture rate compared to those without it. The impact is even more dramatic in China, where businesses offering Alipay experience a 14.3% higher capture rate than those relying only on international payment options.

These improvements represent real revenue that competitors without localized payment options are leaving on the table.

Reduced checkout abandonment

Checkout abandonment rates drop significantly when customers see familiar payment options. A customer who’s comfortable with PayPal but suspicious of entering card details will complete the purchase when PayPal is available.

Access to new markets

You get easier access to new markets when you support local payment preferences. Entering Germany without PayPal puts you at a serious disadvantage. The same applies to entering Brazil without Pix or China without Alipay.

Lower processing costs

When you offer a local payment method, you can avoid the expensive processing costs associated with global payments or currency exchanges.

Improved customer satisfaction

This comes from meeting people where they are. When customers can pay using methods they trust and prefer, they’re more likely to remain satisfied subscribers.

Building your alternative payment method strategy

An effective payment strategy requires understanding your customers and markets, rather than simply adding every available option.

Here’s how you can build it:

Start with customer research

The best payment strategies begin with data, not assumptions.

Survey your existing customers about their payment preferences and analyze your data for geographic distribution patterns.

High bounce rates from specific countries often signal gaps in payment methods that are costing you conversions.

Analyze your target markets

Different regions have distinct payment cultures that directly impact buying behavior.

B2B customers typically prefer bank transfers and invoicing for their software purchases, while consumer apps need fast, mobile-friendly options that work seamlessly on smartphones.

Meanwhile, high-value purchases might require installment payments to make annual plans more accessible.

Consider your business model carefully

Your revenue model should guide your payment method priorities.

Subscription businesses benefit most from direct debit and automated payments that reduce churn and failed transactions.

In contrast, one-time purchases require fast, frictionless options that prevent checkout abandonment.

Freemium models with upgrade paths should focus on minimizing payment friction to encourage conversions from free to paid plans.

Choose what works for your business.

Balance coverage with complexity

You don’t need every payment method available, but you do need the right ones for your specific customers. So, start with methods that serve your biggest markets, then expand methodically based on actual usage data rather than theoretical coverage.

Think about the customer journey

Payment preferences often shift as customers mature in their relationship with your product.

A startup founder might use a credit card for a monthly plan but prefers bank transfers when upgrading to annual payments. Enterprise customers may start with cards but switch to purchase orders and invoicing as their usage scales.

Monitor and optimize continuously

Payment preferences evolve faster than most businesses realize. New methods emerge while others decline in popularity, and customer expectations shift with market trends.

Regular analysis of your payment data helps you stay current with these preferences and identify opportunities for improvement.

How to set up alternative payment methods with Paddle

Setting up alternative payment methods doesn’t have to be complicated. Paddle simplifies the entire process by handling multiple payment providers and regional requirements through a single platform, so you can focus on growing your business instead of managing payment infrastructure.

Here’s how to get started.

- On your dashboard, navigate to Paddle > Checkout > Checkout settings.

Here, you can turn specific payment methods on or off with simple toggles. But you can also do a lot more.

Paddle automatically determines which payment methods to display to each customer based on their location, preferred currency, and device type.

A customer in the Netherlands will see iDEAL options, while someone in Brazil gets local payment methods that work best for them. You don’t have to handle any of this yourself.

Customers can also save their payment information for faster purchases later, making it easier for repeat buyers and keeping customers happier.

Unlike traditional payment systems that require extensive coding work, Paddle handles displaying payment methods, processing payments, detecting fraud, and resolving issues automatically. Your team can focus on building your product while Paddle takes care of all the payment headaches.

Paddle also handles PCI compliance, payment rules for different countries, and data protection requirements for all supported payment methods. This works with various financial institutions to ensure secure transactions and eliminates a significant amount of legal and technical work that your team would otherwise have to undertake.

Want to see which specific payment methods Paddle supports and get detailed setup instructions? Check out Paddle’s complete payment methods documentation for step-by-step help on setting up alternative payment methods for your subscription business.

Fight checkout abandonment and improve customer satisfaction with Paddle

Payment friction kills conversions, but the right alternative payment methods eliminate barriers between interested prospects and paying customers.

Every market has payment preferences that feel natural to local customers. When you support these preferences, you’re adding convenience and showing respect for local culture, while also building trust with potential customers.

The technical complexity of managing multiple payment methods across different regions can seem overwhelming. However, platforms like Paddle handle this complexity behind the scenes, allowing you to offer dozens of payment options through a single integration.

Your customers want to pay. The question is whether you’ll make it easy for them to complete that transaction using the payment method they trust and prefer.

Want to benefit from dozens of alternative payment methods for your SaaS, AI, gaming, or mobile app, with just one click? Get started with Paddle today or speak to an expert.