The Customer Success (CS) team had been tracking prospect 3421 since they signed up for a free trial in October and promptly consumed all their seats. The CS team hit the prospect's website, learned more about their business, and created an in-app suggestion highlighting a relevant new module.

Finally, on the fourteenth day, the CS team launched a targeted offer to convert prospect 3421 into an annual subscription…and they said yes. Well, they tried to say yes. But their credit card was declined – a card they had used 100s of times. What happened?

It turns out your finance department uses a payment processor inexperienced with the banking system in the prospect's home county of Germany. They had improperly encoded the payment authorization request, and it was denied.

All the work that went into converting the prospect to a customer evaporated due to a silly operational flaw. Will the prospect try to find a different way to pay? Maybe, or maybe not. But it's also possible they will get improperly denied again. Even worse, this same issue is happening with some long-term customers attempting to renew their subscriptions.

How often does this happen? More often than you might think. Different payment processors, aka gateway providers, all approach the payment approval process in different ways and with varying levels of success. How well they do their job contributes to the payment authorization rate , which can differ by up to 20%.

Lost revenue compounds over time, so the impact on valuation increases as the situation remains unresolved

What is a “payment authorization rate" and who controls it?

Payment authorization rates, aka approval ratios or payment acceptance rates, are the total number of customer payments that successfully get converted to cash divided by the number of payments submitted by customers. Coming at the very end of the "quote to cash" process, this is an often overlooked area where even minor improvements can lead to significant impacts on valuation.

SaaS payment processing consists of many layers, and each participant in the process has different incentives and access to different information. Simply put, the participants are your company, your gateway provider, the card networks, and the card issuer/bank. Of course, all participants in this process want to eliminate fraud, but only your company bears the brunt of "false positive" denials detailed in the example above.

Because the systems are complex and involve numerous entities, sometimes across several national borders, how a payment is processed can significantly impact whether or not it gets approved. The most impactful participant is the payment processor. Not all processors clean, package, format, re-submit, and route payments the same way. Some providers are more experienced than others, and some are particularly good at cross-border transactions. The payment processor also needs to understand your business and its relative risk for fraud. As we will see below, a good provider vs. an "ok" provider can help drive millions of dollars in incremental value.

How big an impact do payment approval ratios have on my financials?

A few things come into play here. First, business processes that impact revenue disproportionately impact SaaS valuations because valuations are based on multiples of revenue. Lose one dollar of revenue, and your business loses ten dollars in value. Second, as mentioned above, payment approval ratios impact both new sales and renewals, so their impact on revenue is two-fold. Third, lost revenue decreases a business's growth rate, so the multiple of revenue used to value that business will go down. And finally, lost revenue compounds over time, so the impact on valuation increases as the situation remains unresolved.

Approval ratios can vary between 70% and 99%, although much of that difference is driven by the customer's geography, which has an impact on the incidence of fraud. In most cases, rejected payments might very well be fraudulent. However, if we hold constant for fraud and focus solely on falsely rejected payment requests, there can still be significant differences between payment processors. For example, Mercator Advisory Group recently compared payment processor authorization rates and identified an average difference of almost 3% between best-in-class providers and average providers.

A working example

For simplicity, let's assume a high-performing payment processor can deliver a two percentage point improvement in approval rates without noticeably increasing the incidence of fraud. (Plugin whatever percentage you think is appropriate.). As mentioned above, the two percentage point improvement in the approval ratio will increase total revenue and also increase the company's growth rate.

Let's work through an example where the starting MRR is $500,000, net revenue retention (exclusive of approval rates) is 100%, and the company books $25,000 per month in new MRR, growing at 2% per month.

If the approval ratio is 97% vs. 95%, the company will have $545,000 more in ARR after two years and will be growing at 47.5% vs. 45.3%, a 2.2 percentage point increase. These may seem like relatively modest changes; however, they are multiplicative and significantly impact valuation.

How do the financial gains impact valuation?

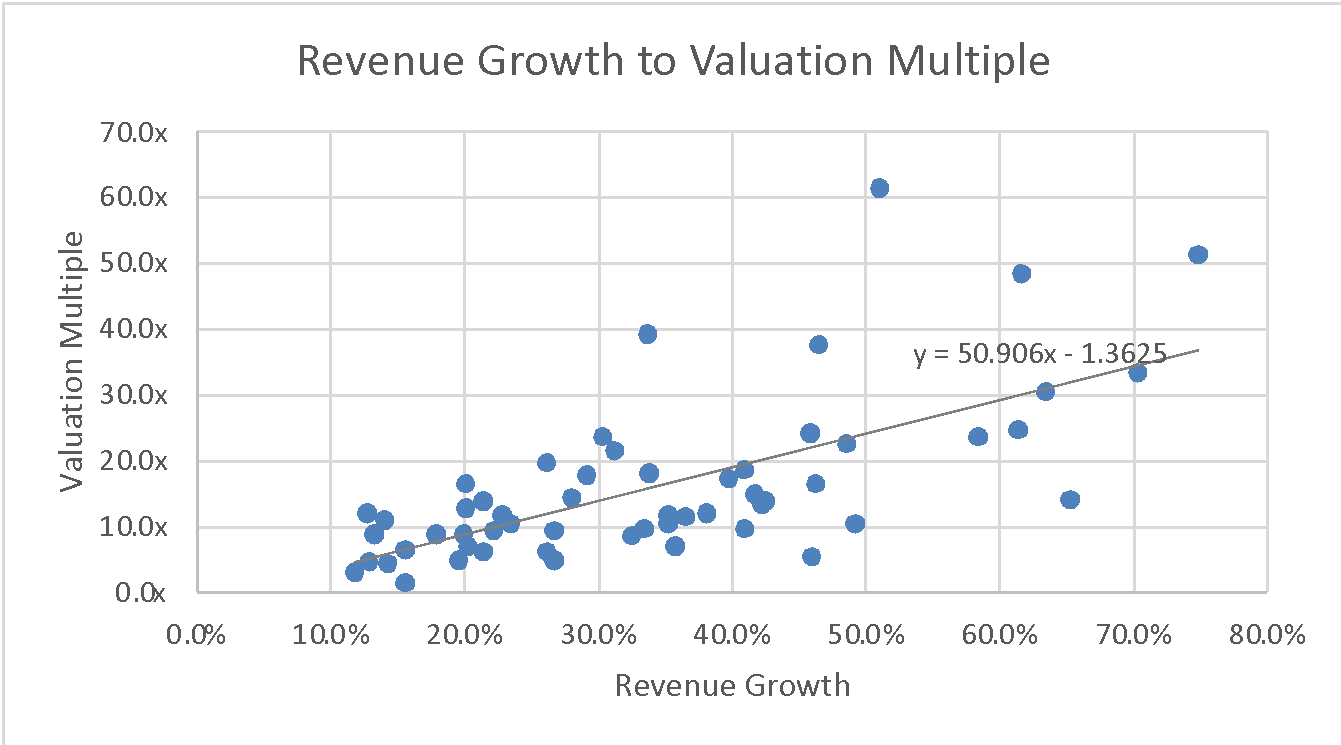

Because revenue growth rate and valuation are closely correlated, we can look to the public markets to quantify the impact a 2.2 percentage point increase in revenue growth will have on a SaaS valuation multiple. Pulling from public market data in early 2022, the graph below shows the relationship between growth rates and valuation multiples. The slope of the line demonstrates that a one percentage point increase in revenue growth translates into a .5 increase in the revenue multiple.

Bessemer Cloud Index, January 2022

This relationship is not set in stone, and many other factors impact valuation multiples. Still, the correlation is very high, and no other factors drive valuation multiples more than revenue growth. In early 2022, a public SaaS company with a 47.5% growth rate is, on average, worth 22.8 times ARR, and if the growth rate is 45.3%, it is worth 21.7 times ARR. However, private SaaS businesses are not as valuable as public SaaS businesses, and for this analysis, we will apply a 33% discount to the public valuation multiples.

Given the SaaS bookings and retention assumptions noted above, the SaaS business with the higher acceptance rate has an ARR of $14.3 million and a 47.5% growth rate after two years. If the lower acceptance rate is applied, the business exits two years with $13.7 million in ARR and a 45.3% growth rate. Applying the adjusted public market valuation multiples to these two scenarios, the higher acceptance rate business would be worth $18.4 million more (9%) than the lower acceptance rate business. The valuation for each business is (ARR*Valuation Multiple*Private Company Discount). Numerically, the valuation difference is ($14.3*22.8*.66)-(13.7*21.7*.66) = $18.4 million.

An additional benefit of the higher acceptance rate not captured in the example is the incremental profitability of the $545,000 in increased revenue. Given an average contribution margin of 75%, the higher acceptance rate company would have about $400,000 more in cash over two years to invest in sales, marketing, or product development.

Take-away.

It's true that many things will impact your SaaS business's valuation in the future more than its payment acceptance rate. That said, this small operational detail may allow you to make a simple, risk-free change that could result in millions of incremental value down the road. It's worth looking into.