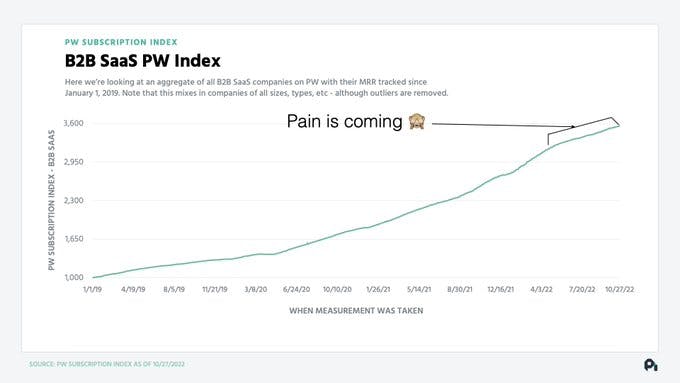

Back in June, we said a recession was looming. We looked at data from more than 20,000 SaaS businesses to look at what was happening in the market and made some predictions about what was to come.

Six months on, the recession is here. It’s time for a follow up.

Our Chief Strategy Officer Patrick Campbell took to Twitter again with a new thread that uses the revenue data from 27.2K companies to forecast how bad the recession will get and explain what businesses can do to make sure they come out on top.

Let’s get into it.

Consumer market decline hits B2B

In a recession, the consumer market takes a hit first – that’s what we’re seeing now. Here's the revenue data for consumer, media, and ecommerce subscription companies.

The next thing that happens in a recession is that businesses lay people off, which worsens consumer markets, causing businesses to make cuts.

It's a cycle.

B2B is usually insulated from this cycle because the market is so much larger - only when it gets really bad in the consumer markets does B2B start to feel the heat.

Unfortunately, we’re seeing the start of this already. In fact, B2B revenue growth is slowing at a rate we haven’t seen since 2008. Looking at the data below, it looks small but it’s just starting.

The TL:DR is that both B2B and B2C markets are getting hit:

- New sales slowing 20%-30%

- Cancellations increasing 15%-20%

This tells us that this recession is a big market problem. It means that all of us are in for a bumpy two years. Here’s what you can do about it:

Six ways businesses survive in a recession

1. Cut costs to get runway to 24 months

You might think you run a tight ship but as Patrick puts it, most leaders have actually been “drunken sailors” over the last two years.

Rather than carrying on as you are, now is the time to look at your Amex bill, load up your profit and loss (P&L) sheet, and open up payroll to find ways to keep costs down.

Common cost-saving opportunities include:

- Recruiting spend.

- Team social budgets.

- Removing duplicate tools that do the same job.

You can also lower procurement review thresholds and cancel cards so that you can start new.

2. Shore up customers

You’re not the only one re-evaluating costs – your customers are too.

Of course, there will be customers in hard hit segments that you will lose. You can’t do anything about that but what you can do is clean up unforced and involuntary retention errors to keep or bring back customers near the point of cancellation.

Here’s how:

- Payment failures account for 20%-40% of your churn. You can halve that by fixing the leaks in your payment processes.

- Introduce salvage offers and save up to 25% of the people who hit cancel (data on the left).

- Convert monthly subscribers to annual and increase lifetime value by 200%-800%.

- Implement reactivation campaigns that send every 60 days to bring back 5% of churn.

3. Clean slate your target segments

Your market has shifted so it’s time to re-evaluate.

Some of the verticals you target are done for a while. They might still take your call, but they aren't buying.

Where other verticals you might be ignoring will get massive tailwinds.

The best thing to do is review your segments and prioritize sales and marketing efforts accordingly.

4. Re-evaluate where you’re selling

The beauty of software is that you can sell anywhere to anyone without really trying. Use this as a strength during a downturn.

Research new regions and determine where there is market demand for a product like yours. We’ve got some more advice on where, when, and how to enter new markets successfully, here.

5. Accelerate your cross-sell strategy

If customers review their expenses and stay with you, that’s a big signal that they value what you offer.

In the past four recessions, expansion revenue stayed consistent. Take advantage of that and sell them more stuff.

Here’s how to cross-sell more effectively:

- Multi-product offerings have +30%-50% growth vs. single product corps (data to the left).

- Value metric pricing: Usage/value-based pricing can double expansion revenue.

If you don’t have time or resources to build new products or overhaul your pricing right now, then look at add-ons instead.

Customers with add-ons have 18%-54% higher CLV.

Add-ons can be the features used by less than 40% of your users. They’re not for everyone but some of your customers will pay for them.

A popular add-on that almost all companies can charge for is "priority support" — and it’s one that generates pure profit for answering an email first.

6. Cut your discounts in half

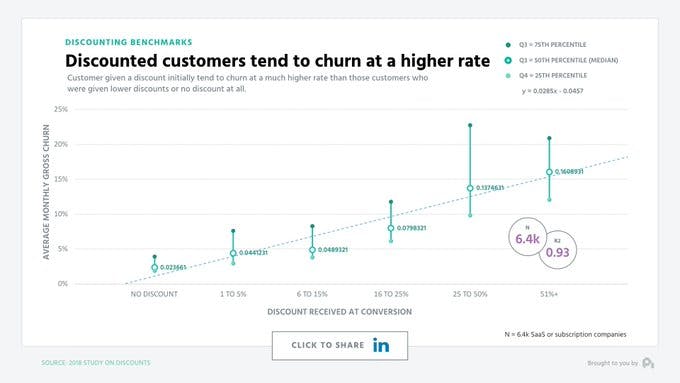

The temptation in a recession is to go all in on discounts to get more people through the door. But here’s the problem: discounts over 20% *double* churn rates.

The data shows that most sales teams think a discount of around 25% is preferable (data to the left) to increase conversion. In reality though, discounts should be small and sparingly used – conversion will remain the same and you’ll make more revenue.

Four ways to win in a recession

1. Increase accounts en masse

Businesses that come out of this with the most customers will win. So, in addition to

stopping your existing base from churning, you need to acquire as many new accounts as possible.

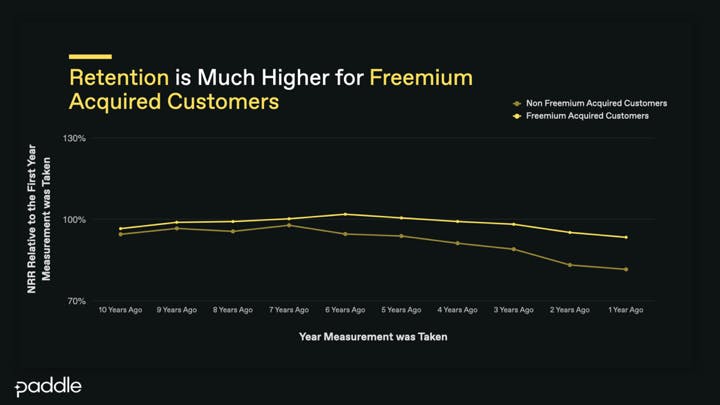

One way to do this is to implement a freemium model as part of your acquisition strategy. This way, you can get more daily active users on your product. Users that you can then nurture into paying customers when they’re ready to buy.

In addition, customers who convert from freemium go on to become the most valuable. In a freemium cohort:

- Customer acquisition cost (CAC) is much lower.

- Net promoter score (NPS) is double.

- Retention is much higher.

2. Relieve customer anxiety

In a downturn, people crave community and answers. Make sure your company is the one that gives it to them.

Some ways to do this are:

- Publish more great content.

- Host more webinars.

- Plan in-person events.

- Build out a community.

Being helpful and adding value in this way will help you to convert customers now and also be the brand your prospects remember when they are ready to buy.

3. Go after competitors

Just like you and your customers, your competitors’ customers are reviewing their own spend and looking at alternative solutions.

Your job is to make sure that it’s you they flock to you by raising your brand awareness and showing where you add value:

- Email them or visit them in person.

- Send them the helpful content you created for step two.

- Update your competitor pages with clear differentiators.

Once you’re through the door, recession position your product — that is tell them how you help them do more with less.

And when you’re hit with the objection "we'd love to switch, but we've got seven months left on our contract" you close the deal by offering to give your product away for free for the rest of your competitor's contract. It might seem like a lot of money but really is seven months free for a 60-month+ partnership too much when the alternative is no customer?

4. Increases prices (at the right time)

If someone doesn't churn in the next three months, it means they've chosen you.

It also means you have pricing power.

Companies who accelerate in recessions always use this pricing power by raising prices at the right time – when customer volume picks up again.

Do your research *now*, so when the time comes three to eight months from now, you're ready. For how to do this in practice, check out our 5 step guide.

Stick to your fundamentals

Fundamentals are rarely in vogue, but they're never wrong. Recessions just make you snap back to them.

If you shore up your flank and make moves to win, you'll be fine.

For more on how SaaS businesses are responding to the market downturn and what leaders are prioritizing in 2023, check out our latest report.