SoulCycle kick-started a national spinning craze. Its many imitators and acquisition by Equinox earned it a high-profile status in the fitness world. Newcomer Peloton decided to ditch the studio in favor of streamable spin classes you can do at home.

Which business model will go the distance? In this episode of Pricing Page Teardown, Patrick and Peter dig into data from more than 2,000 SoulCycle and Peloton customers to break down the battle for two-wheeled dominance.

SoulCycle has the brand recognition and the devoted community. Peloton has a tight handle on recurring revenue and appeals to those who prefer to sweat in solitude. Both companies are going after the same group of wealthy fitness fanatics. But just how much are people willing to pay for fancy fitness, and do each of these brands deliver what users want? Watch the video to find out how the spin juggernauts are bringing in revenue, cornering their markets, and spinning up value for their sweaty fans.

SoulCycle Captures the Upper End of the Market

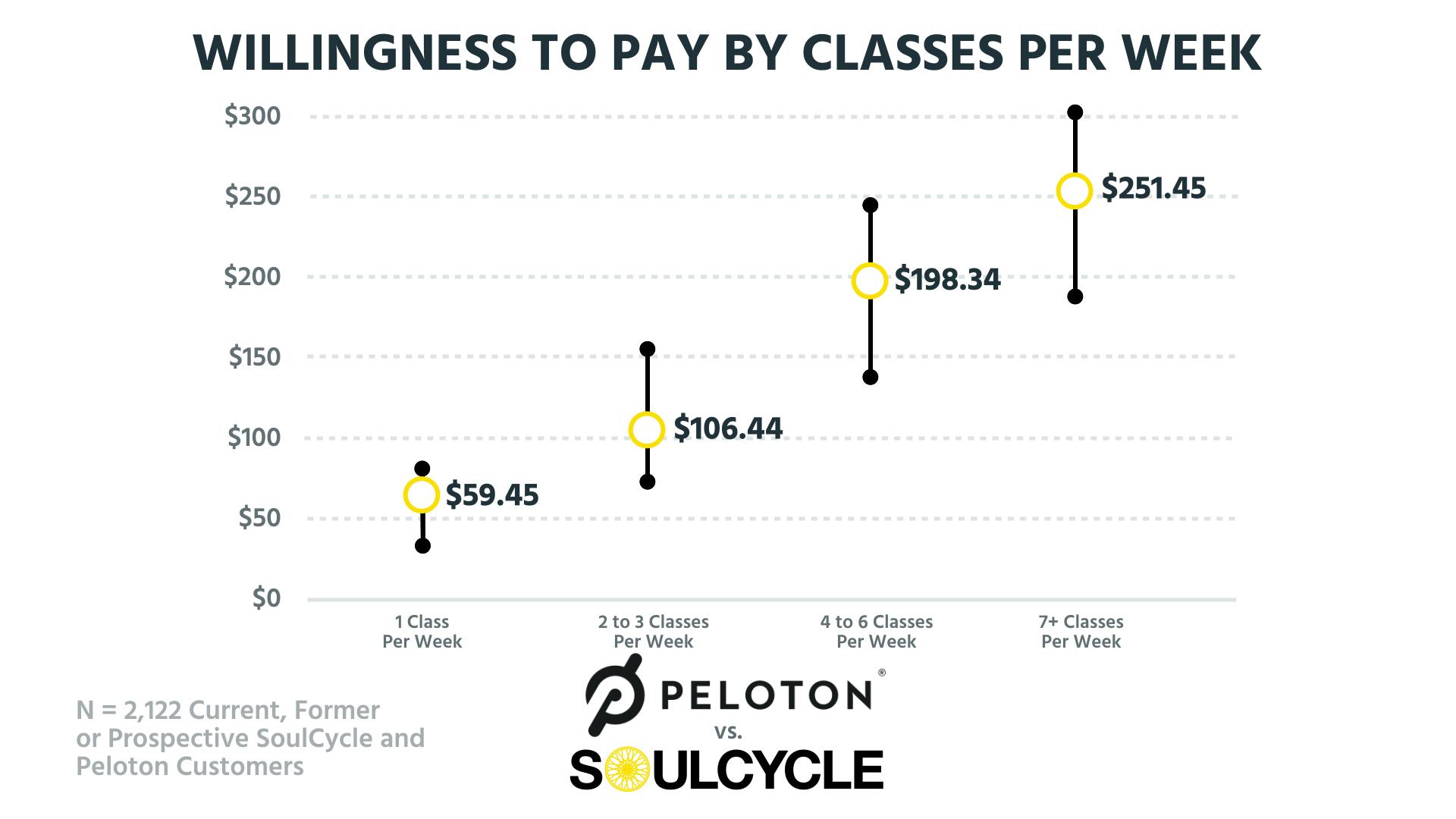

Both SoulCycle and Peloton are tapping into a niche audience for luxury fitness. When we surveyed 2,122 current, former, or prospective SoulCycle and Peloton customers, we found that customers were willing to pay between about $30 to $100 per month for spin subscriptions. The thing is, SoulCycle customers pay that amount.

As Patrick puts it,

"The willingness to pay is about the same for unlimited, and SoulCycle customers are paying so much more for the experience."

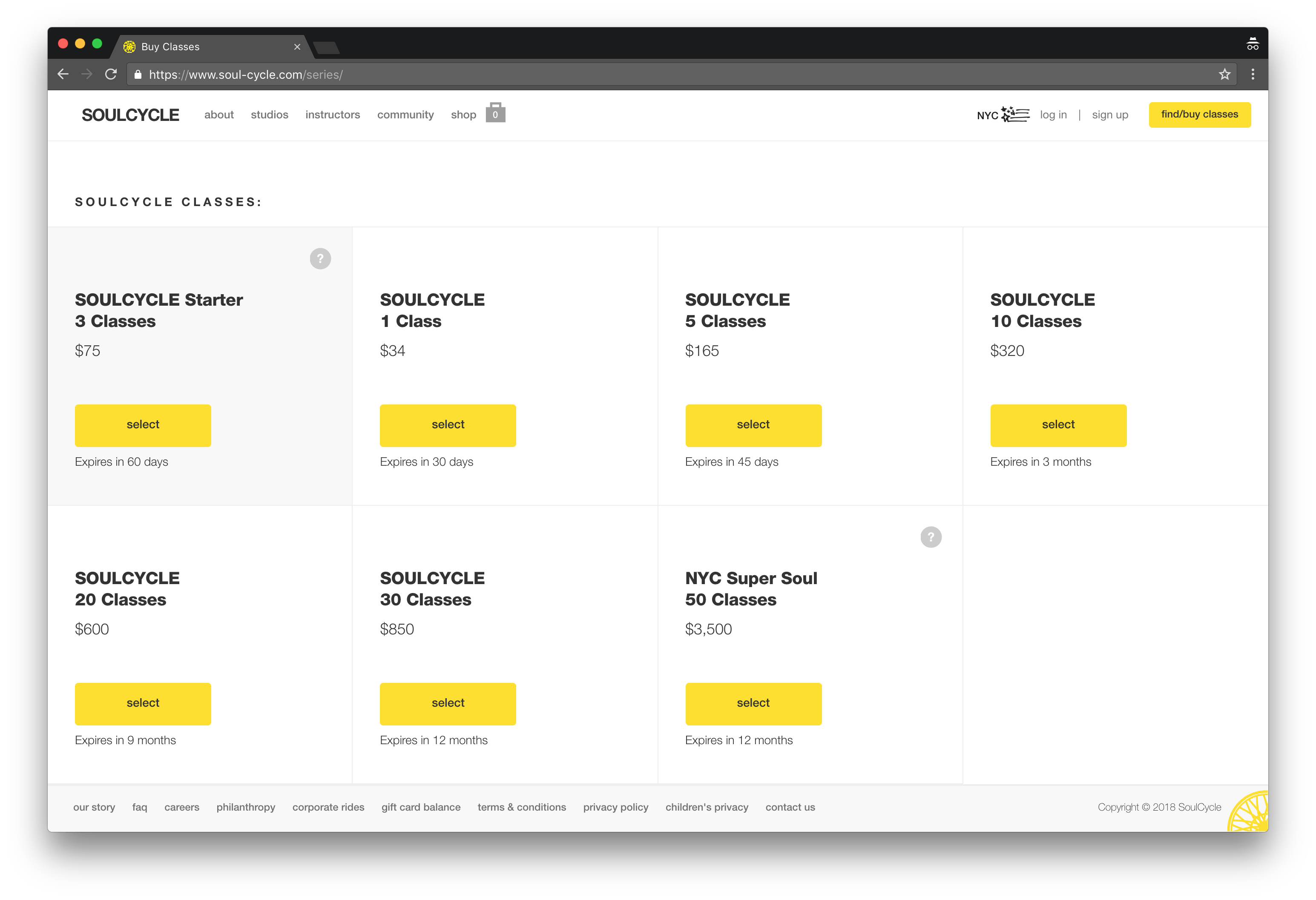

SoulCycle started in 2006 as an alternative to “fitness routines that felt like work.” There are now 80 SoulCycle studios scattered throughout the U.S. and Canada. A SoulCycle subscription requires less commitment than a traditional gym membership. Classes are purchased individually or in bundles, making it easy to work out ad hoc. Bundles offer a slight, but not very significant, discount to the base price of $30–$34 per class (the 30-class pack comes out to about $28 per class). All classes and packages have an expiration date, so customers are faced with a “use it or lose it” deal.

SoulCycle has executed an extremely successful branding strategy that includes wholesome taglines, such as “Find your soul”; uplifting yellow branding; trendy workout apparel; and a robust social media presence. On Instagram, #soulcycle has 316K posts, #findyourSOUL has 36K, and #soulstyle has 26K. Its community-building efforts have paid off: SoulCycle has been called a “cult” by the likes of Harvard, and the did a story about “crazy front-row [people]” who book spin spots like groupies buy concert tickets.

While overall price sensitivity is about the same for Peloton and SoulCycle customers, SoulCycle is able to capture die-hard spinners with deep pockets at a high price point. Our survey showed that SoulCycle customers who spin every day of the week are willing to pay the studio up to $300 per week.

The differentiating factor for SoulCycle is the in-studio, in-crowd experience. SoulCycle customers value the camaraderie and competition that come from proximity to a couple of dozen other exercisers, and the up-close-and-personal motivation from instructors. Customers get to be part of an “in” group that has its own lingo, like “tapping it back.” They leave their phones and cares at the door to enter a dark, candlelit room for 45 minutes.

Though poised to IPO, SoulCycle could face some problems with its business model in the future, especially as Peloton picks up speed. For one, it's simply too expensive, especially when you compare the price of $34 per class to Peloton's $39 per month of unlimited classes.

Secondly, it will become harder and harder for SoulCycle to secure recurring subscribers. Customers who want variety in their workouts may find themselves drifting toward other boutique fitness options in the $40 range, from treadmill runs, to prison-style workouts, to boxing, to bootcamps. True commitment-phobes may choose ClassPass, which has plans that start at $45 per month.

Lastly, it will be tough to draw increasingly connected customers to a brick-and-mortar experience. As fitness hardware and software improve, people will begin to expect workouts that are more personalized and flexible. If SoulCycle fails to keep up with these demands, they may lose their elite customer base.

Peloton Cracks the Code on Hardware-to-Subscription

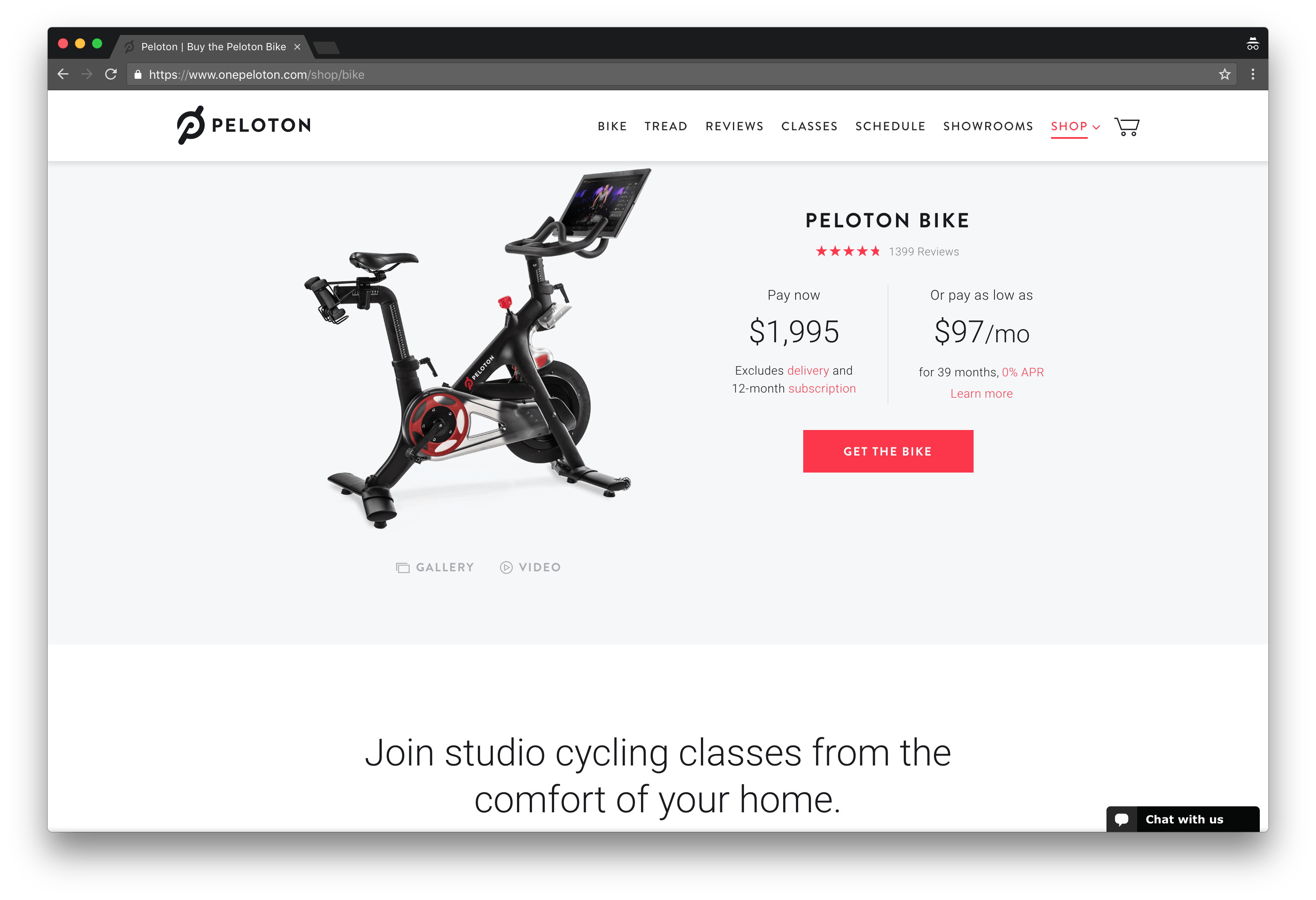

When it arrived on the spin scene in 2012, Peloton presented a novel business model: Customers pay $2K for a stationary bike upfront and then follow up with a $39 monthly subscription for unlimited virtual classes. Classes are streamed via a screen attached to the bike, and the monthly cost applies per bike, not per rider, so an entire household can use it.

Patrick points out the fascinating thing about this is:

"They have kind of cracked the code on the hardware-to subscription model. You have to go through the bike and accessories in order to get to this particular subscription."

Peloton also offers a cheaper option not advertised on its pricing page. If you buy your own bike, you can download the Peloton app for iOS and stream unlimited classes on your iPhone or iPad for $13 per month.

At a little over five years old, Peloton is already drawing in more revenue than SoulCycle, with much lower overhead — no studio leases or amenities, no cleaning or front-desk staff. Peloton reported $170 million in revenue for 2017, with 250K subscribers and 500 employees, whereas SoulCycle reported $118M with 383K subscribers and 1,200 employees.

Peloton's hardware-to-subscription model is not easy to pull off. It has led to some spectacular failures in Silicon Valley, including, perhaps most famously, Jawbone and Juicero. Peloton customers are able to justify the high cost of the bike with the subscription price: $39 for unlimited classes is incredibly cheap when compared to SoulCycle and its ilk, as well as luxe gyms like Equinox, which cost around $200 per month. Even using the Peloton bike a few times per month compares favorably to boutique studios.

Peloton's product offerings seem to stand in direct contrast to SoulCycle's when it comes to feature/value preferences. With Peloton, “community” is virtual and optional. If you don't want to join the cult, you don't have to. You can view the leaderboard if you want, or you can turn it off. You can join Facebook groups with other enthusiasts or follow instructors, but social media is not necessarily a selling point. Peloton is also more accessible and convenient than a studio class. You get to work out on your schedule, at home, without waiting for popular classes or instructors (with a few exceptions). It's more personalized as well: Your bike tracks your progress and learns your preferences. You can choose from a variety of spin workout styles and get any workout on-demand.

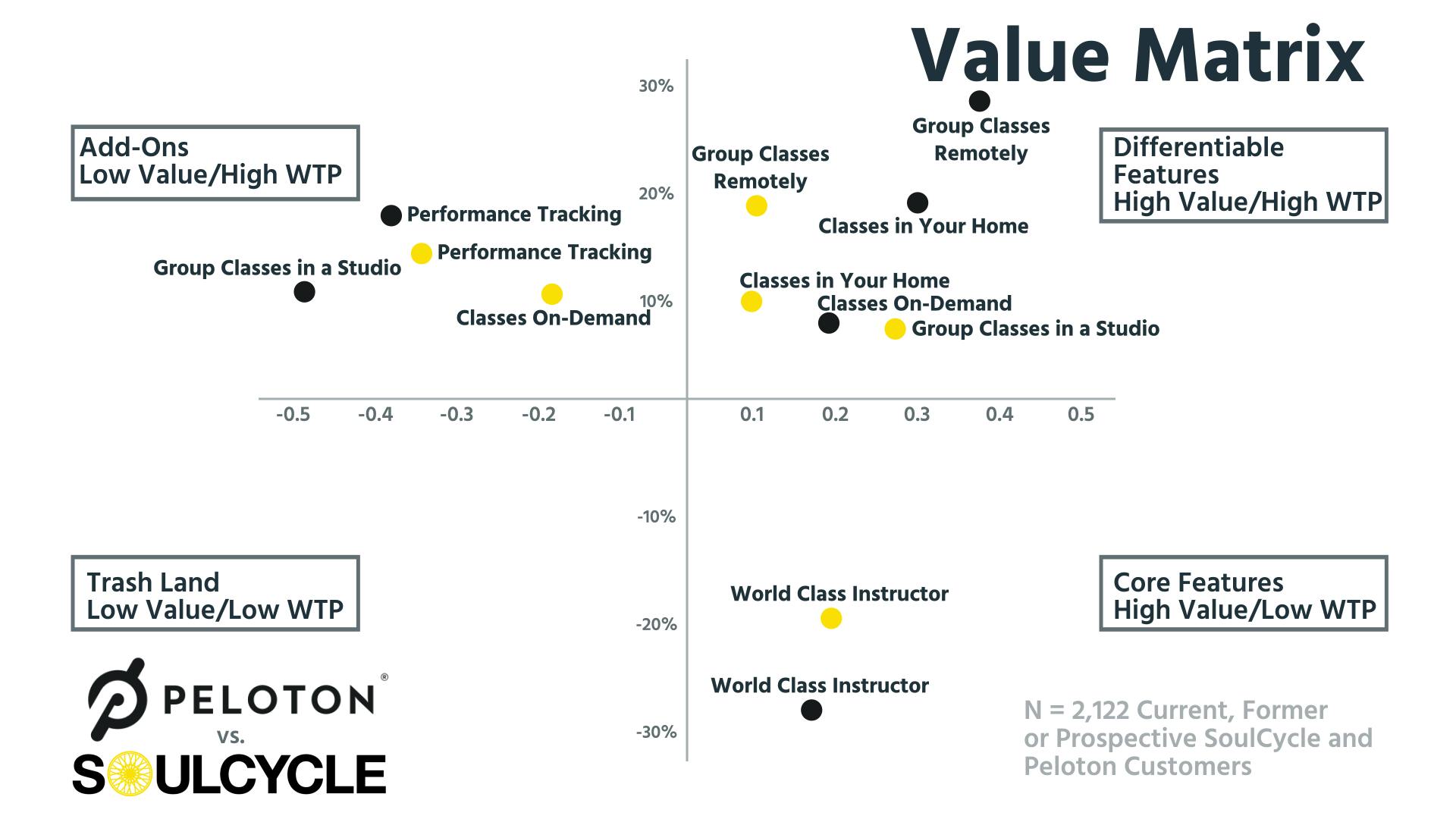

Despite the contrast, the value matrix for SoulCycle and Peloton reveals interesting findings about both:

- In Trash Land is . . . nothing. People really like what both companies have to offer. Must be the cardio high.

- The Core Features are the instructors. Both groups of customers expect world-class instruction at every spin class.

- Some of the Differentiators are direct contrasts, whereas others are not. SoulCycle customers don't value the studio experience quite as much as you might think, even though they're willing to shell out for it. The Peloton audience values remote classes highly and are willing to pay more for them. Predictably, the Peloton audience doesn't care much about the studio experience.

- Add-ons for both include performance tracking — this could go either way in the future as measurement methods improve or people become more protective of their data. SoulCycle customers also seem to think of on-demand as a nice-to-have feature. They're more willing to adhere to a schedule in order to have a collective experience.

To sum up the graph in Patrick's words:

"They do have some inverse functionality, but they're trending more towards Peloton than brick-and-mortar. When you throw in the cost element, I see a future with Peloton."

While trends suggest that Peloton is serving a greater intersection of customer needs and interests, there are a few key things Peloton needs to watch out for in terms of pricing:

- Upfront costs: Right now Peloton benefits from being the first connected-hardware fitness class. What happens when cheaper alternatives come on the market?

- Connected fitness trend could die out: If people become distrustful of tech and generally want to disconnect, they won't be thrilled to hand over their data every time they work out.

- Weak community: A virtual-only community is weaker than an in-person community. Without group motivation and identity, people may be more reluctant to renew subscriptions over time.

- Maintenance costs: What will Peloton do over time to help customers keep bikes in good shape? Will they replace old equipment or parts? Any hardware company risks malfunctions and product recalls. Just look at Jawbone.

Since Peloton is still a new company, the future remains to be seen, especially when it comes to customer LTV and the long-term quality of the bikes themselves. For now, Peloton's promising start pushes them to the top of the leaderboard.

Choosing at-home workouts over gym-timidation

While SoulCycle has built a spin empire, right now we believe there's a much larger opportunity in the Peloton model. From the customer perspective, Peloton is a cheaper, more convenient option that removes typical barriers to entry for working out. With Peloton, you don't have to commute to a studio or face gym-timidation from more experienced exercisers.

From an investor perspective, Peloton also wins. Peter and Patrick agree that Peloton is reinventing the at-home gym, and they find it promising that people are actually using the equipment and tuning in to classes.

And there's potential for a more open communal experience online. As Patrick puts it:

"Now we can be in a world where you and I went to that Peloton class this morning, and we're on opposite coasts. That's fascinating."

There will always be a market for luxury gyms like SoulCycle and Equinox. But for people who still want a rigorous workout with top-quality instruction, Peloton offers its customers more freedom and power to build a fitness regimen that works for them at a great price.