Everyone enjoys getting a good discount. But, while offering discounts may make customers feel good about purchases made, it’s not always the best customer acquisition strategy for certain businesses.

“Blindly discounting is one of the worst things you can do, because you’re conditioning your customer into de-valuing your product, and you’re literally throwing money away by putting it back on the table from the initial and future sales with that customer”

Don’t believe us? Don’t worry. We’ve got data to back all this up. Let’s explore this concept a bit more by first looking at the fundamentals of a discount pricing strategy and why it doesn't properly translate to software. We'll then reveal hard evidence into the true impact of a discount price on your bottom line, before finally illuminating solutions to get you on the right track to boosting your value and defending premium pricing.

What is discount pricing?

Discount pricing is a type of promotional pricing strategy where the original price for a product or service is reduced with the aim of increasing traffic, moving inventory, and driving sales.

People are drawn to lower prices because consumers love feeling as if they are scoring a good deal. Discounting strategies also create a sense of urgency that might drive more customers to convert. Companies usually do discounts for holidays, volume purchases, and cash payments..

How to calculate discount prices?

Calculating the discount price is simple. All you need to do is:

- Look for the original price

- Figure out the discount percentage

- Calculate the savings

- Subtract the savings from the original price and you’ll get the sales price

Here is the same calculation in the form of a formula:

Discount price = original price - (original price * discount / 100)

What are the 3 types of discount pricing?

While all discounts strive to take a certain percentage off an original market price, there are different discount pricing techniques. It is critical for businesses to understand that not all strategies are created equal. Which discount pricing technique will work best for you depends on the specifics of your industry, products, overall business strategy, and objectives, to name a few. Let us walk you through some of the most common types of discounts and their benefits—seasonal, clearance, and volume.

1. Seasonal

A seasonal discount is exactly as it states—businesses offer promotional discounts on seasonal goods or during particular seasons. Sometimes seasonal discounts are applied to out-of-season merchandise to sell old inventory. For example, when spring arrives, department stores may place a discount on winter coats since they are no longer needed.

2. Clearance

The word “clearance” is a marketing term businesses use to indicate their products are for sale at unusual discounts, like a buy one get one free offer for a limited time only. Retail stores may offer clearance on discontinued items with the hopes of liquidating what’s left in stock.

3. Volume

A volume discount incentivizes customers to purchase goods in multiple or large quantities. Bundling is a popular form of this type of quantity discount.

Stores will reward people buying in bulk with a reduced price on the group of products. Retailers are able to reduce inventories when people buy in bulk.

A discount pricing example

Amazon has leveraged the power of discount pricing to great effect on its own products. By offering discounts and promotions on a wide range of items, Amazon is able to drive customer loyalty and increase sales volume. This strategy also allows them to remain competitive in the market, as they can offer lower prices than other retailers while still maintaining profitability. In addition, this approach helps Amazon stand out from competitors by providing customers with value-added services such as free shipping or expedited delivery options that are not available elsewhere. Ultimately, this strategy has allowed Amazon to become one of the most successful online retailers today. You will often notice that Amazon has discounted prices on a range of products, every time you visit their site for this very strategic reason. It is important to consider the right time to introduce any adjustments to your prices though, whilst constant discounts may work for Amazon this does not mean it applies to all businesses.

Who does discount pricing work best for?

For retail, discounts can be great for liquidating unneeded products. But for SaaS, the pros of discount pricing are not as obvious as the cons. The idea of scoring a deal makes people feel as though they beat the system; however, your price is the exchange on the value you provide, so you need to tread cautiously when discounting.

Attempting to translate a retail practice to software

As human beings, we've been trained by a century's worth of retail pricing to love discounts. The idea of scoring a deal makes us feel like we’re beating the system, and to a greater extent, makes us feel special. Yet, to understand the discount pricing strategy, we need realize that at its core, a price is your exchange rate on the value you’re creating through your product or service. With that number put down in pixels, you’re saying that whatever you’ve produced is worth $X, because that product or service helps the customer in a manner that fits that equates to their perceived value.

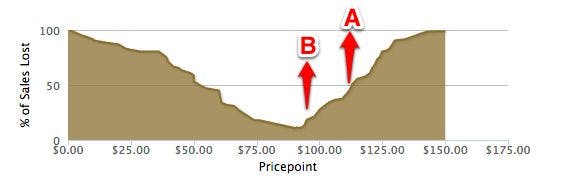

Different types of customers value that product or service at different price points, meaning different segments of customers will have a different exchange rate, or perceived value, of your offering. Take a look at the price elasticity graph below (a screenshot from our software). The profile of the graph shows us that different segments of target customers value the product differently. As such, stakeholders need to decide where on that graph their product resides to spur a sizable profit margin for their business.

Once you’ve decided where on this range you’re going to price, discounting then comes into play in an attempt to move more sensitive customers “up river.” Essentially, discounting works in a similar fashion to a free trial or even a freemium tier. You’re lowering the price point to the level of sensitivity of a new tranche of users. Thus, attempting to convince those users during that initial term that the product is worth the higher price, and when the next term comes up they should pay the regular price.

For instance, imagine that this chart is showing the price sensitivity for a particular SaaS tier for a brand new CRM. Management, taking into account different stakeholders in sales, marketing, finance, and the like decide to put a stake in the ground at point A. Of course, they aren’t capturing all of the market, but that’s fine because they believe for the current state of the business there are plenty of customer at that level. The next quarter comes up and sales aren’t going so well, so the team decides to slash prices 20% for inbound prospects to point B. Immediately, a bunch of users hop on board, helping the sales team meet quota.

A discount pricing strategy has sweeping implications

Everything is rainbows and sunshine now, right? Well, no, not at all actually. By discounting you’ve conditioned the customer to de-value your product. Discounting works in the retail space so well, because brands can limit supply (or at least make it look like supply is limited), and therefore create a sense of urgency in the eyes of the consumer. In the software space, supply is practically unlimited and non-physical, and we’re inundated with so many promotions and discounts every day that we know more are coming down the pipeline, even if you say, “for two days only.”

What’s even worse, is that when that next month or updated product comes, the customer is already using the product at a particular price. Very few companies have the first month user retention strategies in place to boost value to the original price point. Switching costs are so low (especially after only one month of use) that customers churn out, wasting you even more money from marketing, onboarding, and any extraneous costs associated with having that non-ideal customer distract you. You've put in anchor pricing that discounted your selling price and left your business with less profit. As David Skok illustrated, churn is kryptonite to startups, and if you’re growing sales through discounts, problems will only get worse, even if you are retaining a certain percentage of those customers.

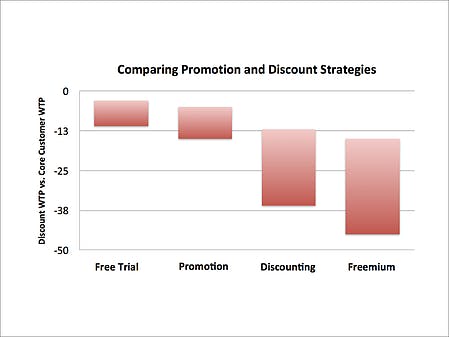

Let’s talk turkey though, because everything has been philosophical up until this point. We’ve run hundreds of price sensitivity campaigns for software companies and one of the segments we always test is the effect of discounting on willingness to pay. Enough results have come in for us to assert that the numbers back up our above analysis. Even though it varies by product, industry, etc., customers receiving a discount on their first month or initial purchase value the product at least 12% lower than the product’s list price. Note that free trials and promotion still reduce perceived value of the main product, but not as much as if you offer discounts or a freemium offering.

Discount pricing strategy pros and cons

To summarize some of the above points, let's take a clearer ook at pros and cons, beginning with the benefits that can come from a discount pricing strategy.

Pros of discount pricing

1. Reduces the activation energy

By offering a discounted price, customers don’t have to think too hard when making the decision to buy your product. Having a discount reduces the activation energy for the user to sign up by allowing them to try the product until they are ready to commit.

2. Can close deals

Deals that are on the fence may be saved by offering the prospective customer a discount, so discount pricing is a simple way to increase sales. This should not become the norm for all sales efforts, but it could be helpful when trying to close that one deal.

Cons of discount pricing

And now, the not-so-good side effects of discount pricing.

1. Decreased willingness to pay

Willingness to pay goes down for users who came on with a discount. When offered a discount right off the bat, upselling them on other products is a lot more complicated. Additionally, customers who started with a discount won’t be too happy when that discount is eventually removed and they are forced to pay full price (which takes us to my next point: churn). This reduces the likelihood of them becoming repeat customers.

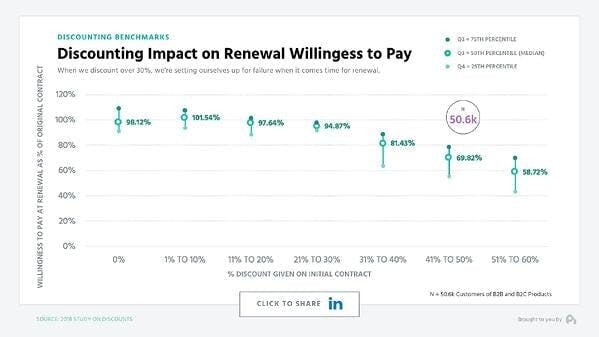

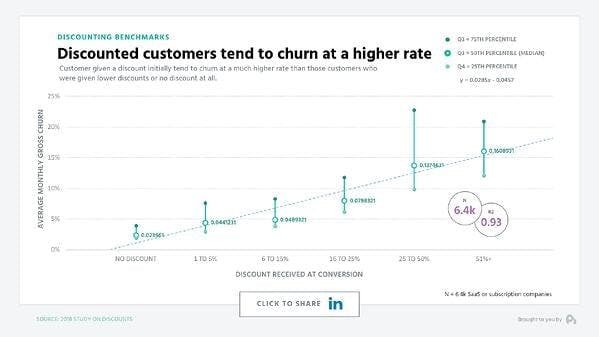

2. Higher churn

Discounted customers have more than double the churn rate than those who weren’t given a discount, so giving a may shorten the average customer lifecycle. Oftentimes, discounts bring in new customers who only make one purchase. If you look at the graph below, which is broken down by the level of discount, you’ll notice a strong correlation of churn increasing as the discount level increases.

3. Impacts growth

Part of the reason we love a recurring revenue model is because we can predict growth. However, once you start discounting, it becomes increasingly complicated to predict as your value proposition is compromised and customer loyalty is not consistent across your customer base. Customers that are acquired with a discount are more likely to churn, but it’s more difficult to know when they will do so, making growth unpredictable.

Are discounts really worth it? Why discounting should be a short-term strategy

You can’t discount yourself into becoming a successful business; discount pricing hurts your bottom line too much and isn't ideal for new products. For SaaS specifically, discounting is a short-term strategy because the cons outweigh the pros. It circles back to everything I mentioned above—higher churn rate, lower willingness to pay, lower profit margin, and unpredictable growth. Additionally, when you discount a product, the perceived value takes a hit. Customers won’t be in for the long-term if they feel your product isn’t of high value.

How to move beyond discounts

There are multiple ways you can appeal to customers without discounting. Here are three different tactics that are more effective than discounting for the long term.

1. Create an entry-level tier

An entry-level tier allows you to drive folks to your main product while also allowing you to capture customers with a lower willingness to pay. For this you will need a value metric, which means as your customer uses your product more (bandwidth, installs, contacts, etc.), that customer should be charged more.

2. Add value instead of providing negative discounts

Part of the reason businesses resorts to discount pricing is that they know people love getting deals and feeling special. But, you can make people feel special without cutting your prices. Instead, add more units (e.g., more user seats or a premium service). Remember, when adding value, a little goes a long way without facing the long-term implications of discounting.

3. Improve your marketing segmentation

You can get more out of your customers by improving your marketing segmentation. With this, you need to understand the trigger features and value propositions of your customers. Furthermore, your marketing messages need to be deeper and more specific. If you’re selling to a niche customer, the value will be different amongst different size companies, locations, and incomes.

Do we recommend discount pricing?

So, the question remains… do we recommend discount pricing? The short answer is no. In general, customers on discounts have worse retention rates so it should not be a core part of your long-term growth strategy. However, selectively using discounts to lower the activation energy of someone signing up for a product can be a good tactic when used with discretion. It is often best to start by considering your pricing objectives and seeing if discount pricing could help you reach any of them.