Finding the right revenue model for your company and products is an incredibly important part of starting and expanding your business. It's a key part of building a brand. Explore popular revenue models and how to choose the right one.

In one of the most famous lines from the 1941 classic Citizen Kane, Mr. Bernstein proclaims: “It's no trick to make an awful lot of money... if what you want is to do is make a lot of money.” If only that statement were as true as it seemed. It's probably more accurate to say, “There are a lot of ways to make a lot of money.”

That’s particularly true for software businesses, with the rise of the mobile internet stimulating an explosion in the number of viable revenue models. Choosing which revenue model works best for your SaaS business, though, is not easy (even if that's all you want to do is choose a revenue model for your SaaS business).

Your choice will help determine your sales strategy, and from there the growth rates, the amount of money you’ll need to invest initially, and the kind of relationship you’re likely to build with your customers. More than that — the choice determines the future of your business.

Let’s take a look at some of the most popular revenue models used today — why they’re popular, why they work, and why they will (or won’t) work for you.

What is a revenue model?

A revenue model is the income generating framework that is part of a company’s business model. Common revenue models include subscription, licensing and markup. The revenue model helps businesses determine their revenue generation strategies such as: which revenue source to prioritize, understanding target customers, and how to price their products.

Revenue models often get conflated with revenue streams, probably because each is a single revenue generation source. They are also confused with business models, of which revenue models are a part. Revenue models help business owners determine how to manage their revenue streams and are required to complete a business model.

Without a considered revenue model, your business will incur costs it cannot sustain. With a revenue model, you can set, track, and forecast business growth based on specific customer segments.

11 different types of revenue models

There is no such thing as a perfect revenue model, but the popularity of some of the methods below suggests that many of them are well-tailored for the current state of the market. Here we’ll walk through each type of revenue model and when they may be most beneficial and applicable.

1. Subscription

The subscription model is the “vanilla” SaaS revenue model, not that there’s anything boring about a well-worked subscription plan. Businesses charge a customer every month or year for use of a product or service. All revenue is deferred and then fulfilled in installments.

The subscription model is perhaps the most popular among SaaS companies because of its versatility, promise of recurring revenue, and high value:customer lifetime balance. Done right it's a one-way-ticket to sustainable growth.

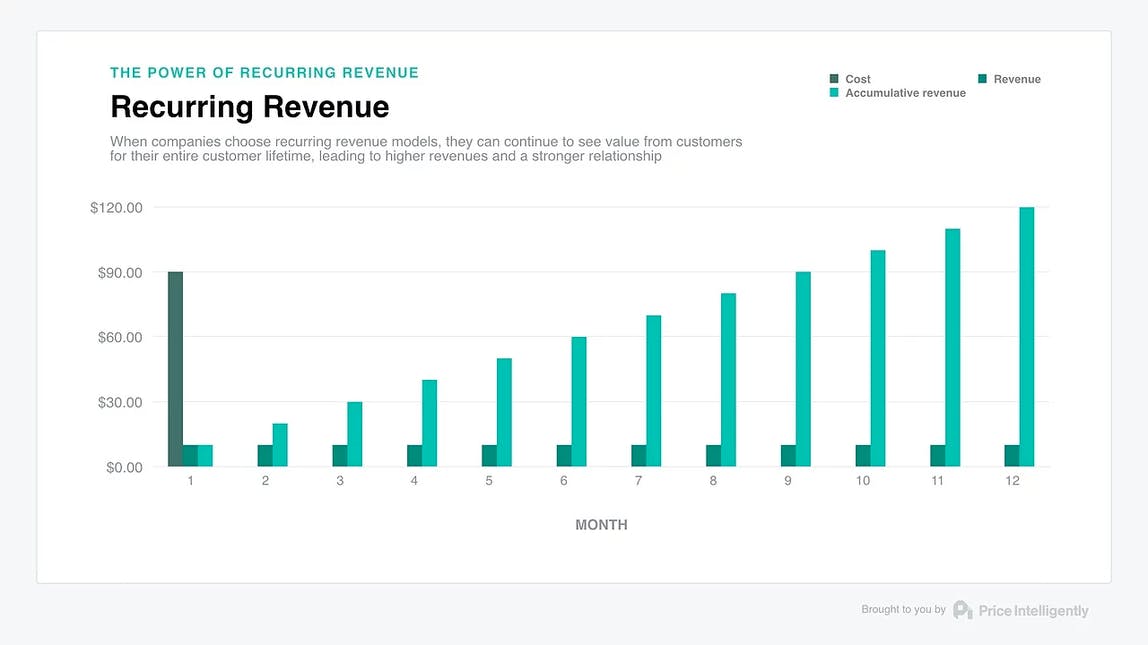

Companies working with recurring revenue models, such as subscription or licensing, see more value from a customer across a given customer lifetime.

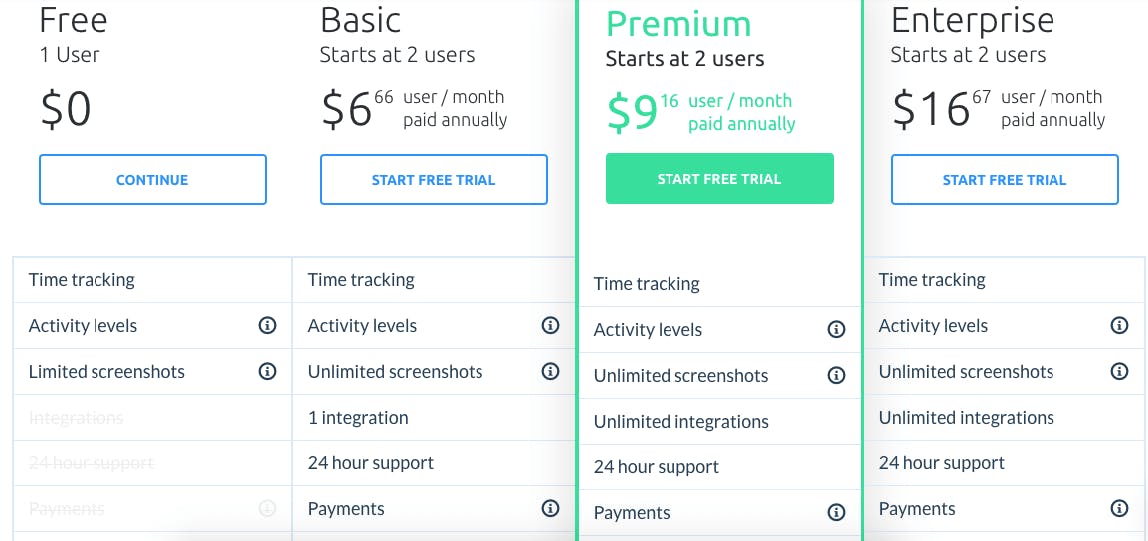

Being able to offer a variety of value options means your company can respond to more than one set of customer needs, expanding your appeal. Hubstaff’s subscription plan, seen below, is a classic of the genre:

Hubstaff’s various plans are distinct from one another in price and feature. This flexibility in the subscription model means that tentative or lower-budgeted customers can still get what they need, all the while maintaining visibility of what extra they could get for a few dollars more a month.

The freemium model is often described as a subscription revenue model, but in fact it’s an acquisition model, not a revenue model. Freemium involves giving users free access to an app and then selling subscriptions for a premium tier that includes more features.

2. Markup

Markup is a very common revenue model for buyer companies (i.e., companies that buy the products they sell). It’s as simple as can be: Take the cost of goods you just bought, mark it up X%, and make a profit margin on the original purchase.

There are various subgenres of the markup model, including the following:

- Wholesale: Sale of goods or merchandise to retailers, business users, or other wholesalers

- Retail: Identification of demand, and satisfaction of it through a supply chain via a number of possible outlets, including physical and ecommercial ones

Markup is particularly used by mediators like ecommerce marketplaces — Amazon, for example. On average, Amazon charges a seller who uses their site 15% of the sale, plus FBA fees (including storage, pick & pack, shipping).

5. Pay-Per-User

One of the most enduring legacies of SaaS in the world of business is the introduction of pay-per-user (PPU). It involves giving a customer potentially unlimited to access to a range of features while charging them only for the services they use. At the dawn of SaaS, as the software required no physical delivery and deployed so quickly and cheaply, PPU appeared to be the most sensible revenue model.

However, as natural as it seemed back in the day, pay-per-user is not popular anymore. Ascribing value to your product is one of the key considerations of your revenue model, and that includes demonstrating why it’s worth your target customers’ valuable dollars, not just making everything so cheap and easy that they can’t refuse. The issue with PPU, then, is that it’s rarely where value is ascribed to your product.

Moreover, PPU kills your Monthly Active User metric. The per-user metric is not the most useful to customers in terms of deriving value — its take-it-or-leave-it approach actively works against your Daily Active Users number, and thus contributes to your churn rate.

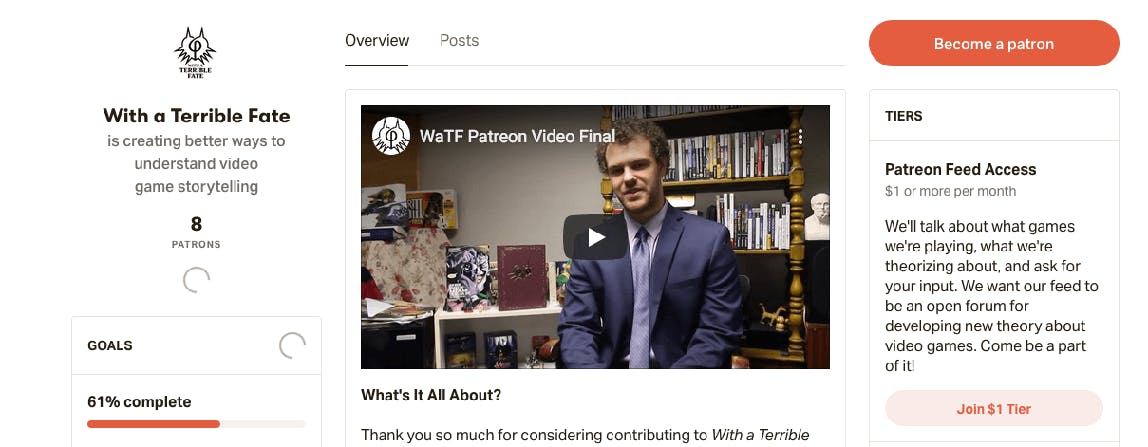

6. Donation

As evidenced by the rise and rise of Kickstarter- and Patreon-based ventures, altruism is, if unpredictable, a pretty effective revenue model by itself. Relying on the donations of regular users is a common revenue model for nonprofits, online media (i.e., YouTubers) and independent news outlets.

7. Affiliate

What is affiliate marketing? This new, popular model works by promoting referral links to relevant products and collecting commission on any subsequent sales of those products. Leverage your product’s synergy with another product in an adjacent space and you both stand to gain.

The affiliate model can be as simple as including in an article an outlink to a book or other product mentioned or offering your customers specialized recommendations relative to purchase history (again, Amazon is a master of this art). Some companies, such as Etsy, even have a specific program for their affiliates, where other companies can earn a commission on qualifying sales that result from featuring links to Etsy products and services.

The affiliate revenue model is increasingly popular, owing to the way it dovetails effectively with other revenue models, particularly ad-based models.

8. Arbitrage

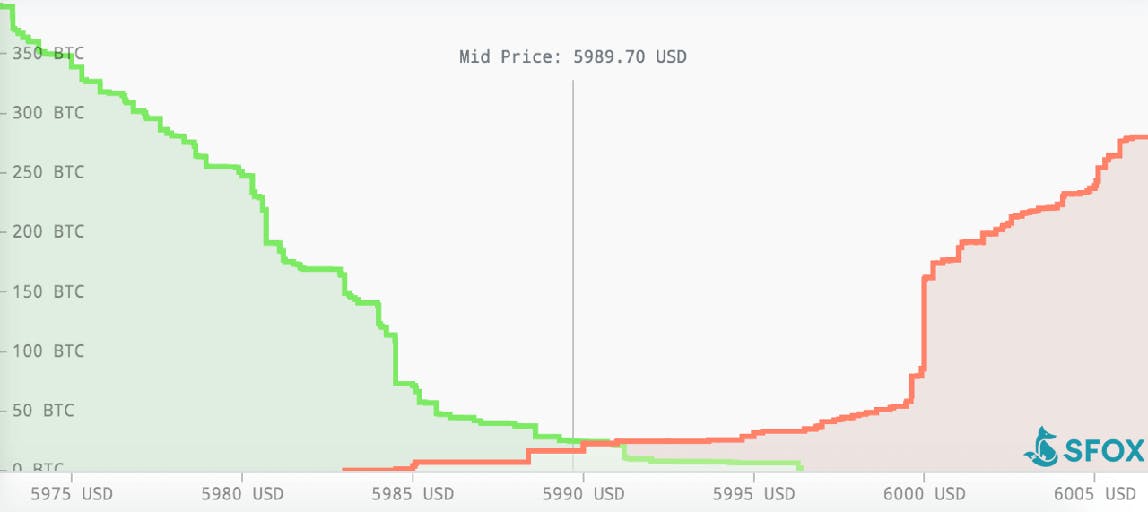

Applicable mainly to sellers or marketplace-oriented companies, the arbitrage revenue model uses the price difference in two different markets of the same good/service to make a profit. You buy in one market (a security/currency/commodity) and simultaneously sell in another market, at a higher price, what you just bought, pocketing the temporary price difference.

Arbitrage is popular with affiliate marketers, as well as with many cryptocurrency firms, SFOX being a prime example.

9. Commission

This transactional revenue model involves a middleman charging commission for each transaction it handles between two parties or for any lead it provides to the other party. It’s particularly popular with online marketplaces and aggregators, as well as businesses like independent music distributors.

It’s particularly easy to get up and running with a commission-based business model because you’re working off of existing products. However, unless your field is well-conditioned for a monopoly, and unless your company is (or can become) that monopoly, you’ll find the commission model very tough to scale.

10. Data Sales

Ever heard the phrase, “If you can’t see how the money’s made, you’re the product”? That’s data-selling in action.

Many companies selling digital goods and services could not exist without core underlying data assets. In the data sale revenue model, this data is sold directly to a consumer or business customer. While certain companies will use data sale as their primary revenue model, the use of data sales to augment another revenue model is virtually ubiquitous.

While some are using it as an entrepreneurial venture, it is also the subject of considerable justified public concern and should be handled with care in the event you decide to go with it as your revenue model.

11. Web/Direct Sales

The old-fashioned revenue model made new, web sales and direct sales involve payment for goods or services through a digital medium.

Web sales involve a customer finding your product via outbound marketing (or a web search) and can used for software, hardware, and subscription-based offerings.

Direct sales revolve around inbound marketing and is good for handling multiple buyers and influencers in big-ticket markets.

Costs associated with revenue models

A good revenue model is not just about squeezing as much revenue possible out of a sales cycle; it’s also about balancing your ambitions in the market with your resourcing requirements. A startup revenue model may be significantly different than one for an established business because their resources are vastly different. When choosing your model, factoring in costs is paramount to ensure profitability.

Cost of revenue

The first cost you’ll be likely to factor in is your cost of goods — how much it costs to produce the goods or service that you then sell. For hardware, this can comprise testing and manufacture; for software, it’ll include the whole development cycle. Regardless of what you produce, administrative overheads will also apply.

You will find cost of goods a considerably less comprehensive metric than cost of revenue, which is the total cost of manufacturing and delivering a product or service to consumers. That includes everything we’ve just covered, plus distribution and marketing costs. Cost of revenue is more often used in SaaS and other service-oriented industries because it makes the many costs incurred outside of production in SaaS easier to track.

Prototyping costs

Prototyping is a fundamental aspect of any production cycle and, unfortunately, is one of the most expensive. While testing prototypes or beta versions of your new product, even the smallest revisions can necessitate costly changes to your production/development process.

This usually comprises a base-level cost, plus iteration costs on top of that. When forecasting prototyping costs, it’s wise to plan for several iterations; it’s highly unlikely you’ll get everything right the first time around, especially if your product is innovative or is composed of a number of features.

Equipment costs

One of the beautiful things about being a SaaS company is that there are no production lines to run. Nevertheless, equipment costs still factor into the bottom line.

Firmware, app development tools, server rental, plus any other administrative services bought on subscription (e.g. Slack or Hubstaff) will play a part in your equipment costs, but, generally, equipment costs should be the easiest of all to forecast.

Labor costs

An underpaid workforce is an unhappy workforce (if it’s a workforce at all); wage costs come out of your bottom line.

Based on the interaction of salary and commission in your compensation plan, as well as the type of commission you offer (entirely open-ended or capped? Will there be accelerators/decelerators involved?), you will have to plan for your expenditure on labor costs differently.

Advertising & marketing costs

Your advertising and marketing costs will be determined by the following:

- The size of your respective advertising and marketing teams

- The scale of exposure you’re shooting for

- Your method of approach to advertising and marketing:

undefinedundefinedundefined

How to choose your revenue model

With all of those options, how could you possibly be expected to choose? The answer is in your product itself.

Know your market

Where are your customers? How are they accessible to you? If your buyer personas are mainly single customers, address subscription options to them that are expertly targeted to their needs and how your product can fulfill them. On the other hand, if you’re looking to sell to larger companies who need a customized version of your core product, consider a licensing-based option that will allow you to establish a solid, high-return relationship that has the legs to run for the long term.

Knowing your market also means knowing your competitors. Before choosing a revenue model, make sure you have a firm grasp of industry benchmarks: Where is the baseline value for equivalent products to yours in the market? Where does your product sit? Interrogate your product honestly. Not only will a frank assessment of your product’s value save you the mistake of pricing your product too high (or too low), but it will also show you how to capitalize on its value and where your developmental compass should be pointed.

Consider the strength of your connections with compatible peer companies. For instance, if you’re running time-management software and have connections to a neighboring company selling compatible HR software, reach out to them. A strong network connection can be leveraged with an effective affiliate revenue model–based strategy.

Know your product

Knowing your product is every bit as important as knowing your market, if not more so. Sometimes, the nature of a product dictates the best revenue model for it by itself. If you have a suite of products, is it most sensible to have them as a subscription service or as one-off purchased products? The smart money in this case, for the sake of your growth and daily-user figures, would be on the subscription option.

Again, evaluate your product’s performance honestly. How does your product perform compared with its competitors? How wide is your feature array compared with the rest? An awareness of your product enables you to choose a revenue model that hits the value/willingness-to-pay sweet spot.

Consider your options further if your product is not a straightforward software proposition. For example, if your product is platform-based, investigate your advertising prospects to capitalize on your traffic buzz, and think laterally to find possible partners for an affiliate strategy that will give your revenue an added kick.

Pitchfork’s affiliate program with makers of craft beer can be seen on the leftmost tab.

Music blog platform Pitchfork sussed out that the only thing their readers like more than left-field music is craft beer, so they introduced an affiliate feature with brewer’s outlet October. It’s a smart exhibition of affiliate revenue scoring.

Expect the unexpected

As your product line changes and as your company grows, your initial revenue model may change. You may begin with a subscription revenue model that then assimilates aspects from the affiliate, advertising, and data sales models with time and opportunity. You might start off as a fledgling independent blog on donation with a little bit of advertising, then find yourself with an audience big enough that you can shun the advertisers, install a subscription model, and keep the integrity of your writing safeguarded.

Alternatively, you may begin with subscription, see only a fraction of your potential success realized, and move to a licensing revenue model. The important thing is to be willing to shift your revenue model or bring in additional models to complement what you already use, if the situation calls for it.

Your revenue model is unique

So many revenue sources, so many revenue models, so little time.

There are some fundamental differences between revenue models. For instance, if you’re a SaaS company producing your own software product, you’re unlikely to get all that far with an arbitrage model. Likewise, if your product is a medium or if you’re a seller, a subscription-based revenue model won’t do the trick. A product with a high ceiling for potential revenue is not best served by a donation model.

Nevertheless, the choice of a main revenue model out of the batch that do work for your product, and how you then combine them with appropriate aspects of other models, is yours, and yours only. Your product and the market should be in mind at all times while you’re settling on, adding to, and refining your model. After that, bringing in the revenue itself should be as easy as Citizen Kane said.