SaaS growth is no longer a funnel—it’s a flywheel. The flywheel consists of setting people up, activating them, engaging them, and then referring them to restart the entire process. As a business grows, it becomes harder and at the same time more critical to engineer structures and processes that keep the company working towards the same goals; if one area breaks away, it can quickly get in the way of the effectiveness of the rest. This is where Revenue Operations, or RevOps, comes in.

What is revenue operations?

Revenue operations (RevOps) is typically a business function tasked with combining and aligning sales and revenue goals throughout marketing, sales, and success teams within a business. By delivering visibility across the entire revenue team and across the customer lifecycle, a business is able to optimize its sales and marketing funnel, collect more high-quality leads, and drive revenue growth.

It’s important to note, though, RevOps isn’t some new phenomenon that fell from the sky. RevOps has always existed in some regard, just without the formal title. Now, it’s becoming one of the fastest-growing job titles among SaaS and B2B companies.

The crucial players in RevOps

RevOps is all about alignment, so who’s involved? RevOps typically includes people from marketing, sales, customer success, and a leader. I’ll break down each specialty.

1. The Marketing team

In RevOps, the marketing team focuses on getting advertisements and marketing efforts to potential customers. We have an entire episode of RevOps and Hops dedicated to marketing. The main point we touched upon is authenticity. You can’t have a relationship without authenticity. This comes into play with marketing because a team must market past the conversion. The work doesn’t end once a customer commits.

Honesty and accuracy are essential when building a long-term business. The marketing team must take this into consideration, especially in terms of personalization.

2. Sales and Customer Success

While sales and customer success are totally different specialties, they work extremely close together in revenue operations.

The sales team focuses on closing the deal, but it’s intertwined with customer success. Here’s why: customer success needs to get involved before the sale is complete. Customer success in RevOps needs to be proactive. What’s more proactive than getting involved before a buyer even commits?

Once the sale is made, customer success continues to focus on keeping customers happy and successful while using the product. Delighting the customer is what leads to success and that success is seen via retention and business growth.

3. The leader

Finally, the glue that holds the RevOps team together: revenue operations manager. An up-and-coming job title is Chief Revenue Officer or the CRO. It can also be the CEO and CMO—essentially any higher up who can unite the teams together.

A revenue operations manager is responsible for the entire revenue process and constantly thinks about how to monetize products. This requires a leader to be well-rounded and have the managerial skillset to tackle the challenges of each internal organization. It’s all about ensuring the teams understand applicable metrics and are aligned to achieve a common outcome.

Why invest in RevOps?

RevOps means that revenue does not simply happen by chance, but becomes predictable. According to Boston Consulting Group, B2B companies investing in RevOps have experienced 10-20% increases in sales productivity in the last few years. Tighter alignment between disconnected teams (for example, sales, and marketing), produces even more tangible results:

- 100% to 200% increases in digital marketing ROI

- 10% increase in lead acceptance

- 15% to 20% increases in internal customer satisfaction

- 30% reductions in GTM expenses

Benefits of using RevOps include increased collaboration and more predictable growth and forecasting. The data shows that companies that align their departments and functions outperform those that don’t. Public companies with RevOps functions saw a 71% higher stock performance than those without, according to research by Forrester in 2019. Forrester also concluded that companies using RevOps principles saw a 19% growth increase, and 15% higher profits than those who continued with a more traditional business model.

6 biggest benefits of united RevOps

When you have a strong revenue operations team, you operate like a well-oiled machine. This has a positive domino effect—consistent tech stacks, clear expectations from customers, happier customers, more sales, and predictable growth.

Let’s go through each one.

1. Consistent tech stacks

A tech stack is a set of different tools and platforms to automate your job. With RevOps, since different teams are united, they can use the same tech stack. Tech stacks are more fluid throughout the teams, so the sales team knows how a customer was marketed to, and the success team knows what customers were sold on. Everyone can refer to different platforms within their synchronous tech stacks.

2. Clear expectations from customers

Oftentimes, different departments within a company don’t communicate fluidly. Marketers may say one thing while sales reps outreach to customers saying something contradictory. This is not the case with RevOps. Everyone is on the same page and communication is consistent. When RevOps are put in place properly, there are clear expectations from customers. Which brings me to my next point…

3. Happier customers

When there are clear expectations, customers are happier. When different departments are working harmoniously with one another, they are more attuned to a customer’s needs. This will undoubtedly make for happier customers because they feel that their needs are heard throughout the company.

Happy customers are a strong indicator of customer outcomes. Customer outcomes are the successes your customers are having because your product is having an impact on their business and in turn, providing revenue.

4. Better customer retention

Revenue operations isn’t just about making a sale, it’s also about keeping those customers you worked so hard for. RevOps is as much a retention-based operation as a sales-based operation. Since customer success is involved throughout the entire process, customer success team members know the customers extremely well. This builds rapport and trust with customers, therefore enticing them to stay with your product.

5. More sales and more revenue

Revenue operations turn the sales funnel into a well-oiled machine, getting more customers to convert. Sales operations (which we will dive into a bit) is a siloed process. With RevOps, sales members are not the whole machine, they make up one part. When things go wrong, it’s easier to isolate the issue at the source and make quick fixes. When things run smoothly, customers recognize it and trust the company with their money, ultimately increasing sales and revenue.

6. Predictable growth

With a data-driven, fluid machine, you can predict growth and revenue far easier than before. RevOps results in predictable growth through consistent, accurate measurement, and/or new strategies. Furthermore, since RevOps is a more synchronous process, teams can respond to market changes more efficiently, therefore resulting in predictable growth even in unpredictable situations.

Why have we seen an increase in RevOps?

In the last 18 months, the role ‘Vice President of Revenue Operations’ has experienced a 300% increase on job boards. Business leaders have always wanted to improve growth and profit. So why has RevOps emerged as a distinctive function so recently?

The way customers purchase products has changed dramatically over the last decade, and some businesses have been faster than others to adapt to these new realities. Customers now expect a degree of continuation and personalization in their experience with businesses and brands as they move through their journey. The massive growth of subscription-based models means that what happens after a sale is just as important as the sale itself. As such, marketing, sales, and services need to be looped in on the events and interactions each other's functions have had with the customer prior to a new touchpoint. Luckily, advances in digital transformation and automation have made it possible to measure, share, and merge datasets across the business to get a far deeper understanding of the customer journey and how it is affected by the work done by different teams. This is precisely where RevOps can make a difference.

Tangible shifts have also taken place in the ways companies think about their revenue process, with an increasing emphasis on transparency, accountability, and growth predictability, all the way from the boardroom to the business frontline.

Forbes aptly summarises why RevOps has taken on such an important role in businesses in recent years (and in particularly, B2B and SaaS companies):

RevOps was created as an end-to-end process of driving revenue, from the moment a prospect considers a purchase (marketing), to when you close the deal (sales), to their renewal and upsell (customer success). The result of this orchestration is faster growth and profit.

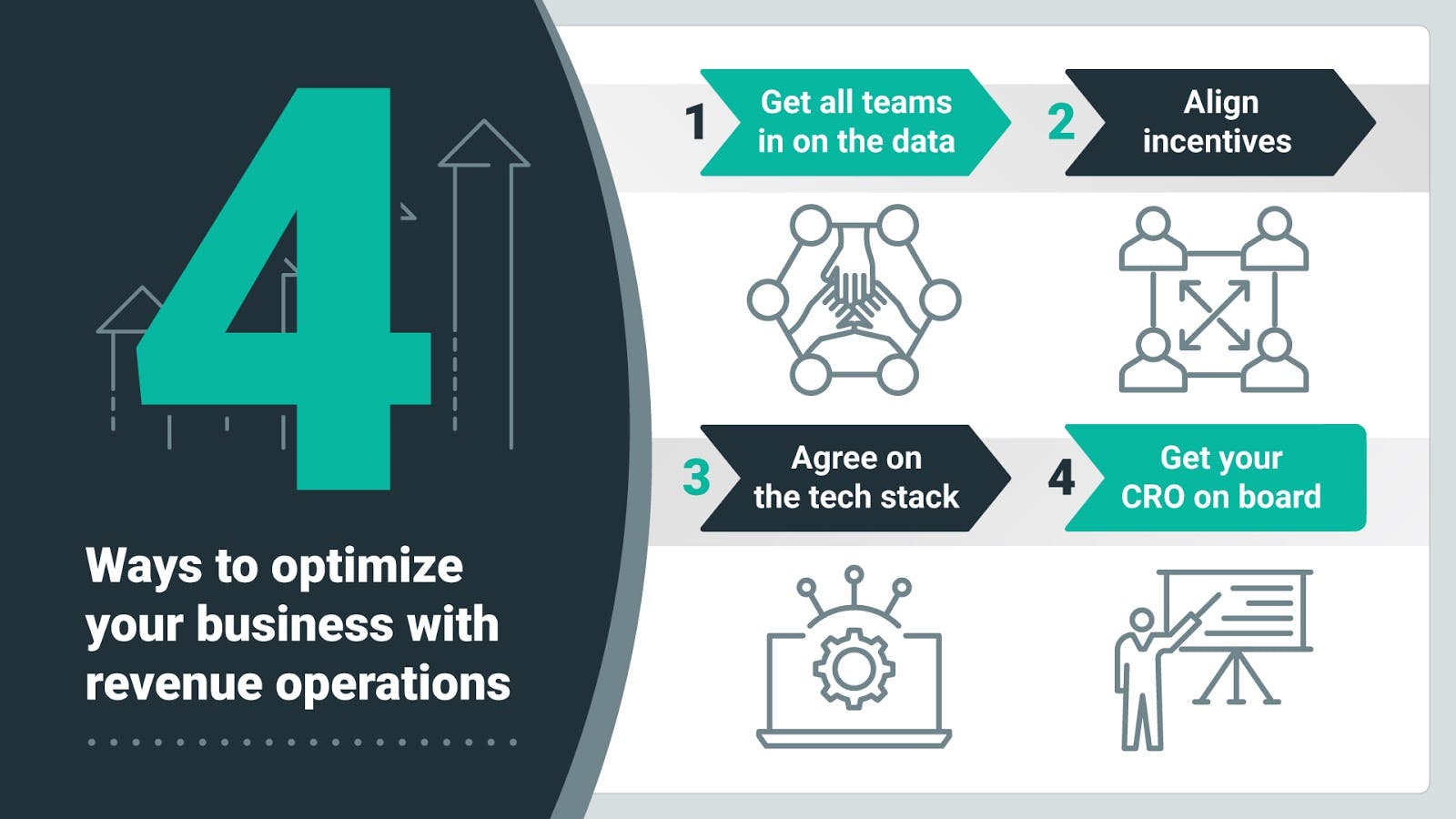

4 ways to optimize your business with revenue operations

It’ll take some adjusting for all parties involved once a RevOps team is in place. To make the transition go smoother, here are four ways you can optimize your RevOps.

1. Get all teams in on the data

You need to be looking into certain metrics and asking the right questions. How long are customers staying on board? How often are they upgrading or downgrading? Which customers have the highest MRR, and which have the highest churn rates. We understand the SaaS world is flooded with metrics, making it hard to know where to start. (We happen to have a free tool—ProfitWell Metrics—to help you out.)

2. Align incentives

Don’t pin the sales team against the marketing, or vice versa. Instead, align incentives for the whole team. The marketing team must bring leads to the sales team. The Sales team must convert good potential customers. The Customer Success team must retain them. Since RevOps works to align different teams, you can sharpen that alignment by mapping out clear incentives.

3. Agree on the tech stack

What tech can Sales, Marketing, and Customer Success use to succeed? RevOps means these teams are relying on the same tech stack. You may have to cut back on tools/platforms that not everyone on RevOps has a use for. Or, you may need to add additional platforms in order to have everyone’s needs met. Either way, having everyone on board with the same tech stack will streamline your operations.

4. Get your CRO on board

The CRO is the captain of this ship. It is their job to get the team going. The CRO needs to be clear about the previous three points I just made because they are the ones overseeing the process. The CRO needs to also act as a gatekeeper ensuring everyone is working toward the same common outcome.

SalesOps vs RevOps: What’s the difference?

Let’s not confuse SalesOps with RevOps. While they may look and seem somewhat similar, they are very different. I’ll explain.

SalesOps is siloed

SalesOps brings a system to selling. It refers to the unit, role, activities, and processes that support a sales team. SalesOps members handle a range of tactical and strategic responsibilities, such as compensation/incentive plans, territory structuring and alignment, lead management, process optimization, sales technology, et al.

With SalesOps, the leaders enable sales reps to focus more on selling in order to drive better results. As you can see, SalesOps is a siloed process when compared to RevOps because it is strictly focused on sales process and converting a customer.

RevOps is inclusive

On the other hand, RevOps is more inclusive because you bring in members from sales, customer success, and marketing. Oftentimes, siloed operations cause small issues to spin out of control because they don’t have a clear view of how various systems work harmoniously. When different operations work together, they have a better grip on why an issue surfaced and how to resolve it.

It’s important to note—RevOps is intentionally separated from the teams they serve and RevOps teams report to an organization’s senior leadership. For instance, a RevOps marketer wouldn’t report to the company’s CMO; they would report to the CRO, or whoever other RevOps members are reporting to.

What are the key metrics for RevOps?

The aim of RevOps is to drive, measure, and forecast predictable revenue within and across all levels of a business. How do you measure this? Here are examples of key metrics which RevOps is accountable for and are used to assess the function’s impact here at Paddle:

- Monthly recurring revenue (MRR): The average of the trailing-three-month revenue.

- Annual recurring revenue (ARR): Four times the trailing-three-month cumulative revenue (annualize the MRR).

- Net revenue retention (NRR): The percentage of recurring revenue retained from an existing customer base, accounting for both revenue expansion and churn.

- Customer lifetime value (LTV): An estimate of the average revenue that a customer will generate before they churn.

- Customer acquisition cost (CAC): Cost of Sales and Marketing in a period divided by the number of customers won in the period.

- CAC payback: The number of months it will take to recover the cost of acquiring a customer.

- LTV:CAC: The ratio between average customer lifetime value and customer acquisition cost. It indicates the overall profitability of acquiring customers, whereas CAC payback is the speed at which we get payback from Marketing and Sales costs.

So who needs RevOps?

If you are a business leader, ask yourself these questions:

- Are you struggling with transparency and accountability as you scale?

- Are your sales, marketing, and customer success teams too siloed?

- Do you question the accuracy of your business metrics?

If your answer to any of these questions is yes, then RevOps is for you.

In a complex business world, RevOps represents a business in its entirety: its people, its data, its processes and platforms, and its attempt to focus on one goal: sustainable revenue growth. The cross-functional collaboration that RevOps offers can help shake things up within a business for the better, creating a better understanding of the customer and revenue lifecycle.

Companies can no longer operate as disparate parts passing customers from one place to another in the buying process: businesses must improve processes to power revenue and create a coherent, seamless customer journey.

Revenue Operations FAQs

What does RevOps do?

The role of RevOps is to help B2B companies maximize their revenue potential. A well-established RevOps workflow helps demolish silos between departments to align them all - customer service, marketing, and salespeople. In that way, revenue operations is refining customer journey to ensure that potential leads slide down the funnel and become long-term customers.

What are the benefits of RevOps?

Some of the biggest benefits of revenue ops include forecasting business growth, driving revenue, and adapting to changes in the market as you drive growth.

What do revenue operations managers do?

A revenue operations manager, also called the VP of Business Operations, is responsible for managing the team responsible for executing business strategy and fulfilling the set OKRs.

What is the difference between revenue operations (RevOps) and sales operations (SalesOps)?

Revenue operations focuses on multiple functions in the company, from marketing, sales, and customer service to finance. Sales operations, on the other hand, focuses solely on sales enablement.