The B2B SaaS industry continued to see historically slow growth in June

Companies saw marginally lower subscription activity volume overall as they entered summer, with both slower sales and less churn being reported. Still, churn remained high compared to previous years, including pandemic-era levels.

This is the latest in our ongoing SaaS market updates, which track the movement of the ProfitWell B2B SaaS Index, and its underlying growth and retention trends. Subscribe to the Paddle newsletter to get these updates in your inbox.

SaaS revenue growth stays close to 11%

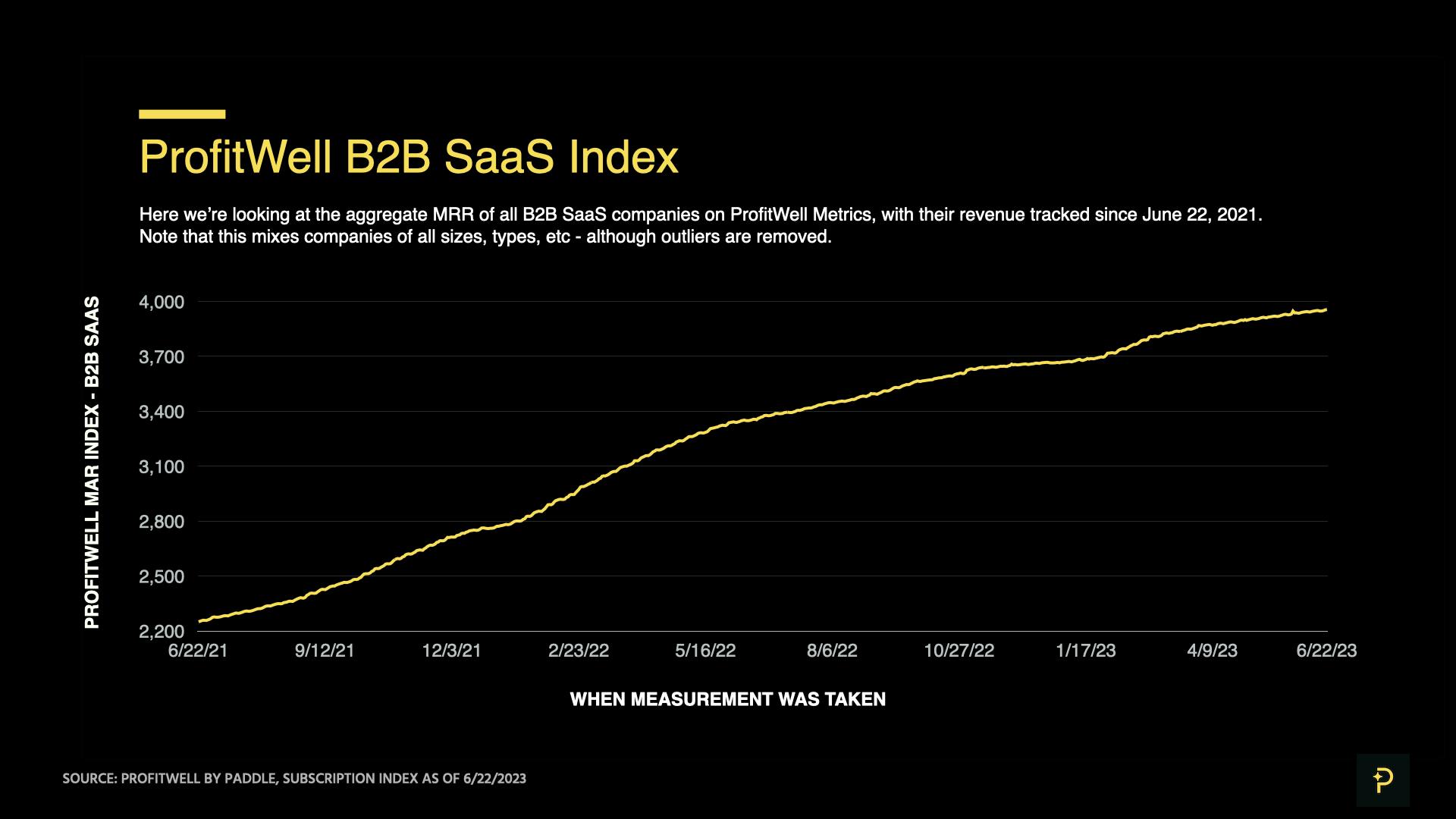

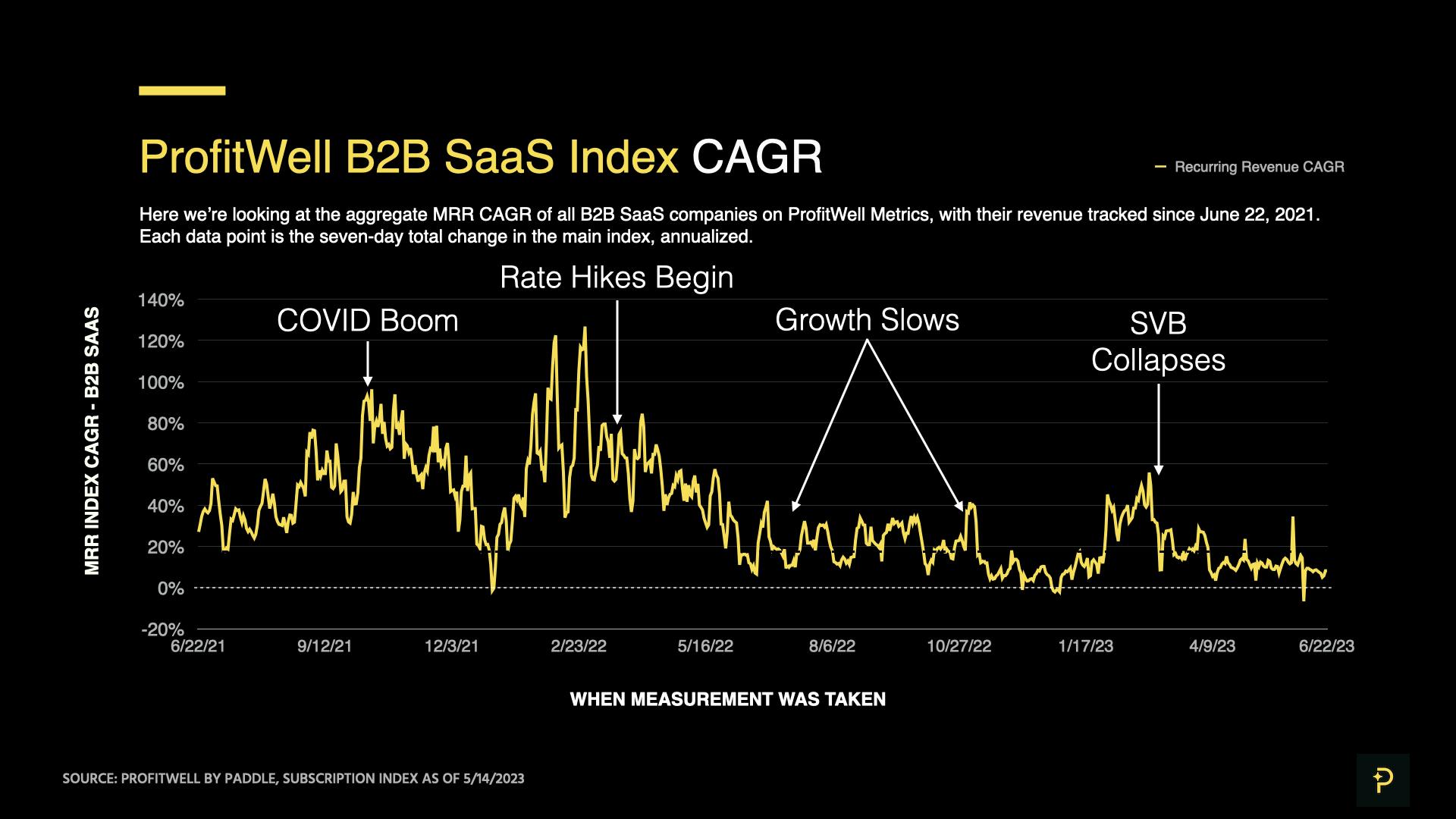

The ProfitWell B2B SaaS Index tracks the cumulative Monthly Recurring Revenue (MRR) from a sample of the 33,600+ companies on ProfitWell Metrics. By measuring the revenue performance of this cross-section of companies over time, we can objectively observe how quickly the sector is growing (or not).

The ProfitWell B2B SaaS Index increased by 0.92% — or 11.4% in annualized terms — from May 22 to June 22. This means the total MRR of these B2B SaaS companies was 0.92% higher on June 22 than it was on May 22.

This is similar performance to the previous month (April 22 to May 22), when the index increased by 10.7% in annualized terms. Compare this to the same period last year, when SaaS MRR was on pace for a 44.8% Compound Annual Growth Rate.

While it’s too early to know for certain, it appears that revenue growth is stabilizing after the past year’s interest rate hikes and tumult in the technology sector.

Explore the free demo version of ProfitWell Metrics here.

After a Q1 spike in growth (which likely reflects end-of-year bookings being realized as revenue), B2B SaaS has averaged annualized growth rates of 10-11% this year.

This is a tick down from H2 2022, when SaaS growth was averaging around 18-20%.

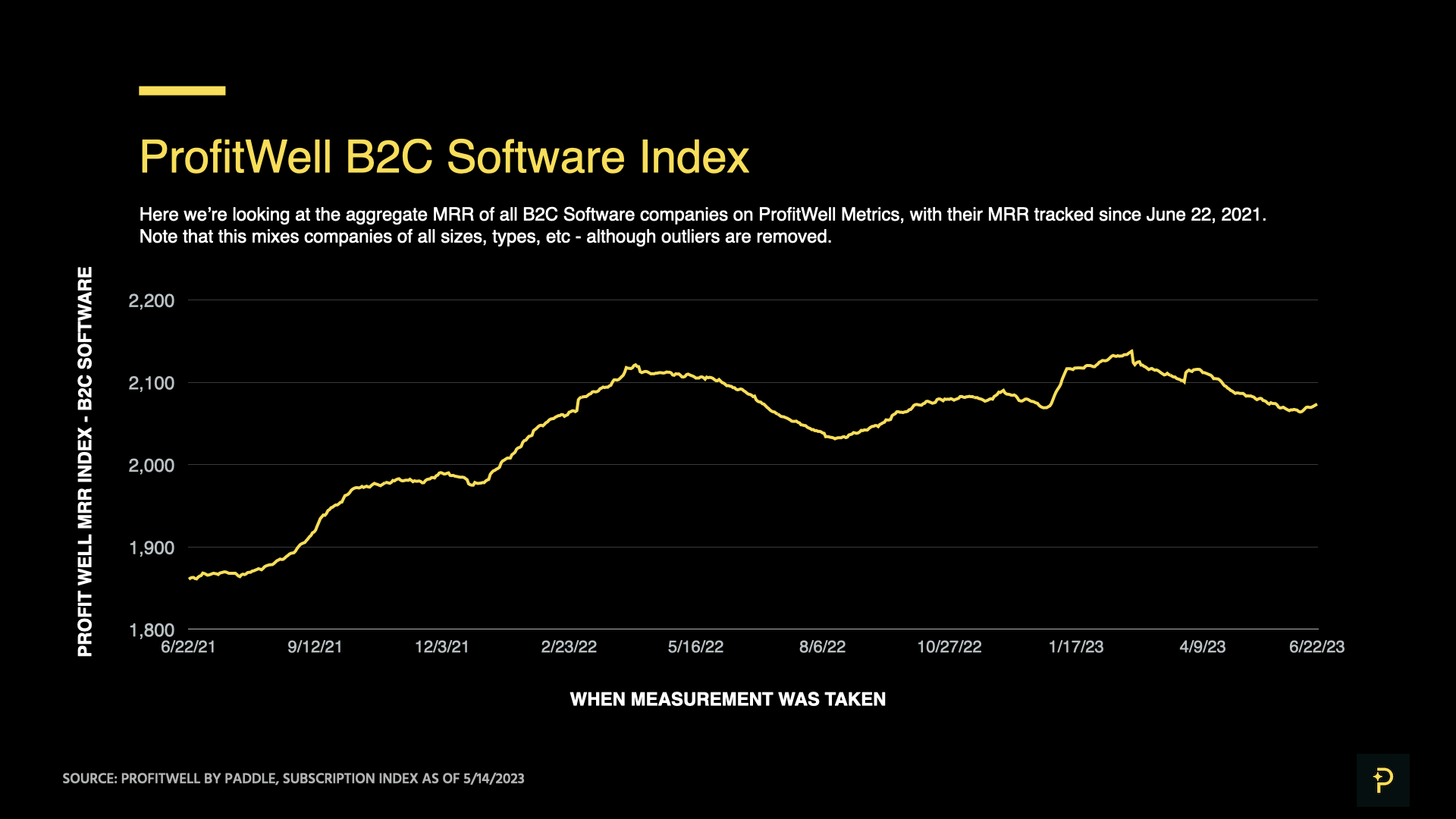

Still, this is still better performance than we’re seeing with the ProfitWell B2C Software Index, which is showing 0% MRR growth in consumer-facing subscription software for 2023 so far.

This indicates that B2C Software companies have taken the brunt of the recent correction in the tech sector, while revenue growth in B2B SaaS continues at a slower pace.

Transaction volume goes down for the summer, but churn is still elevated

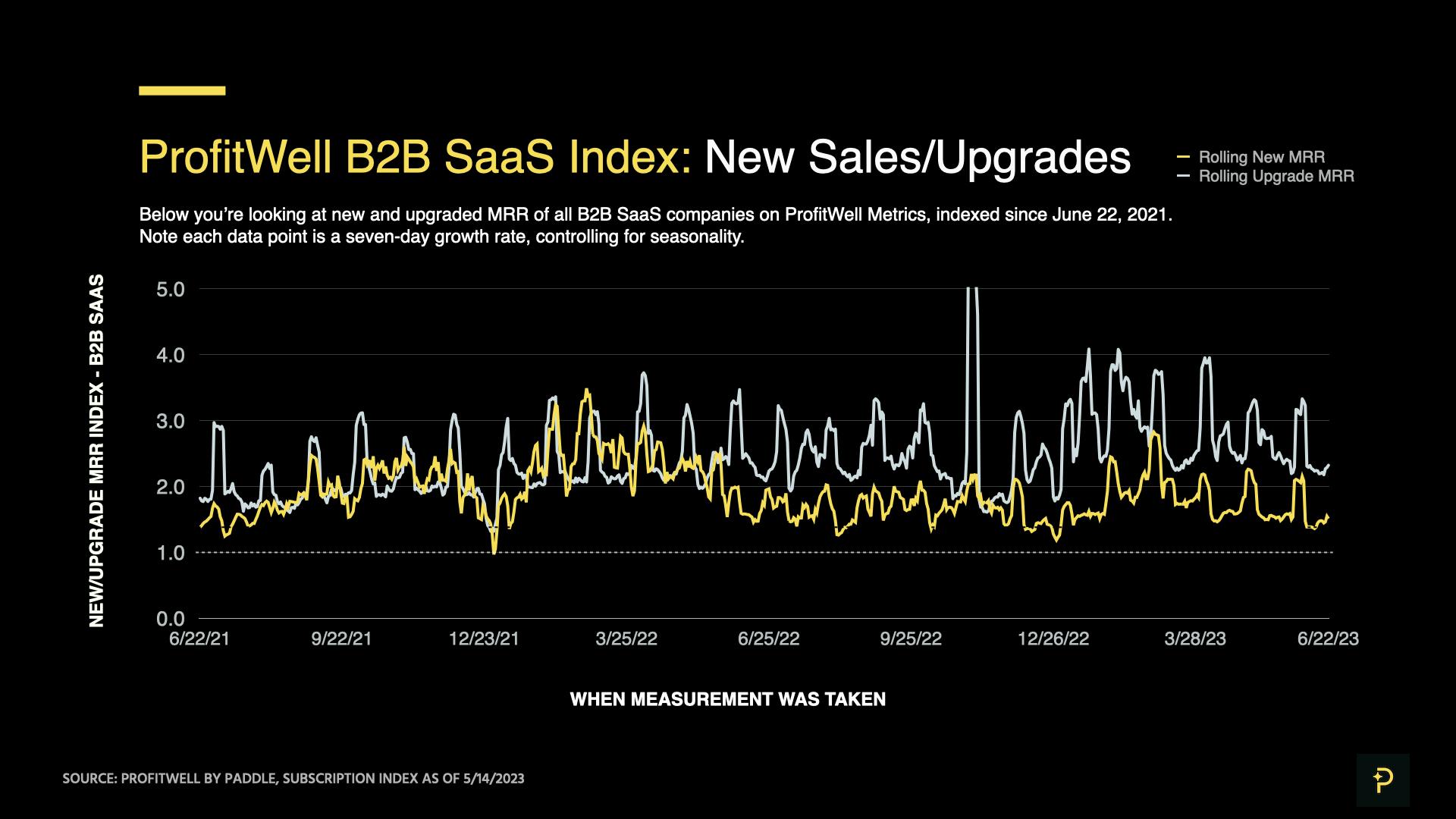

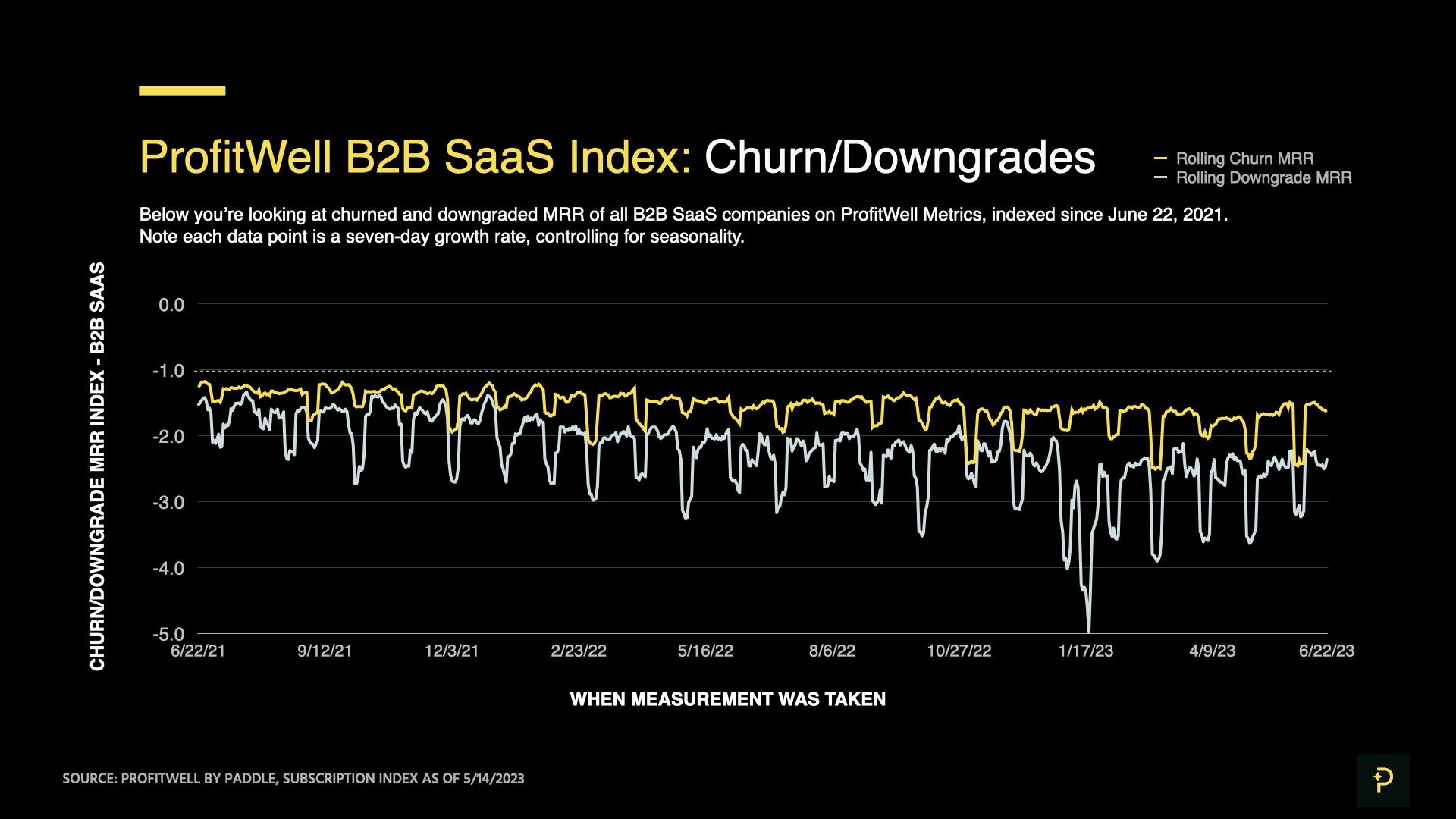

The ProfitWell B2B SaaS New Index is a seven-day rolling average of MRR from net new sales, expressed as a multiple of typical daily sales in 2019. A 1.00 index reading represents sales on an “average” day in 2019, while a 1.10 reading would be 10% higher sales (the ProfitWell B2B SaaS Churn Index is calculated similarly, but will be negative, with -1.00 being an “average” 2019 figure).

Because these indices are seven-day averages, they should be read as directional indicators and not direct inputs into the main SaaS index.

Sales and churn activity both slowed as the northern hemisphere entered summer. The SaaS market often slowed down in summers prior to the pandemic, and evidence suggests this trend has reemerged.

The ProfitWell B2B SaaS New Index averaged 1.62 between May 23 and June 22. This was a 6% decrease from its previous average reading of 1.72 between April 23 and May 22, a shift that is noteworthy but not yet significant enough to signal a possible trend.

The ProfitWell B2B SaaS Churn Index averaged -1.74 between May 23 and June 22, a 5% decrease from its average reading of -1.83 the previous month.

While this is an improvement, these are still historically poor retention levels overall. These recent churn rates are 9.6% higher than the same period last year. The average churn index reading for Q2 2023 is the worst on record going back to 2019, at -1.80 (compared to -1.73 for Q1, and -1.72 for Q4 2022).

Is this a new normal for SaaS after the pandemic?

It’ll take a few months of data to determine if this slower revenue growth constitutes a “new normal”, or if the market will continue to see some major shifts in the coming months.

Still, even adjusting for inflation, it’s notable that a 10-11% annual growth rate is much faster than the US economy’s 2% GDP growth in Q1. So while the macro environment in SaaS feels much cooler than before, it’s certainly still healthier than in many other sectors — and especially in B2C Software.

While many pandemic-era consumer tech trends have been rolled back, changes to the way we work have stuck. SaaS revenue continues to grow even after the 2021-2022 acceleration. The industry is in a period of “normalization”, not so much a correction.

Growth opportunities still abound, but new sales will be tougher to earn than during the pandemic.

Moreover, churn will be much more pervasive than before. Not just because customers are now scrutinizing their pandemic-era purchases before renewal, but also because competition between SaaS companies is increasing.

This period will still reward B2B companies that seek to grow, but strategic and operational discipline are now also critical.

We’ll be publishing monthly updates on the ProfitWell Subscription Index to show you where the market’s headed — and help you form strategies to respond.

Missed our previous market update from June 2023? Read it here.

Subscribe below, and be the first to receive the next SaaS market update.