Competition-based pricing is a method that, put simply, involves setting your prices in relation to the prices of your competitors.

Welcome to the second post in our series on key pricing methodologies, highlighting their pros and cons. This post concerns competitive pricing (a.k.a. competition-based pricing or price intelligence). Our first post was about cost-plus pricing.

Pricing is the most important aspect of your business. No other lever has a higher impact on improving profits. We elaborated on this assertion in our pricing strategy post, but the key is that a 1% improvement in price optimization results in an average boost of 11.1% in profits - a huge impact!

Competitor-based pricing can help you get there if done correctly. Remember, pricing is a process that eliminates as much doubt as possible for a key stakeholder to make a profit-maximizing decision. Think of pricing as a game of darts where you’re trying to hit a bullseye (the perfect price), but there’s all that extra space on the board. Data eliminates that space as much as possible, with information about your competitor's positions in the market, to get as focused on the target as possible.

To understand this method, let's examine what it entails and uncover the competitive pricing advantages and disadvantages before exploring who should and shouldn't utilize this tactic.

What is competitive pricing?

A simple competitive pricing definition is setting your prices in relation to the prices of your competitors. This is compared to other strategies like value-based pricing or cost-plus pricing, where prices are determined by analyzing other factors like consumer demand or the cost of production. Competition-based pricing focuses solely on public information about competitors’ prices, not customer value.

Imagine stacking all of your competitors on a totem pole, with the most premium or luxury brand on top and the bargain brand on the bottom. You then decide where on the pole you fit and set your price accordingly. Wait, though, isn’t that a bit arbitrary? Of course it is, so we’ll look at the pros and cons of competitor-based pricing next.

Competitive pricing advantages

- Simplicity

- Low risk

- Accuracy

1. It’s fairly simple

If you’re in an industry with even one or two direct competitors, you can implement a reasonable competitor-based pricing strategy. In most industries, marketing and product managers will have to do relatively little research to find a competitive price. It is also possible to make adjustments in prices by following tweaks made by competitors. Remember, this gets much more complicated when there are no congruent goods to price match, which is often what happens in the software space.

2. It’s low risk

It’s rare to royally screw up using this form of pricing, even in a competitive market. If you have a fairly solid grasp on your product’s quality, target audience and cost of production, this method will most likely never lead to bankruptcy. It’s kept your competitors afloat, so similarly, it should do the same for you.

3. It can be accurate

In saturated industries like retail, competitive pricing can be fairly accurate. After all, for most consumer products, there are millions of customers and enough data to move pricing closer towards a methodology based on market price and market share. Unfortunately, software doesn’t tend to have this same luxury.

Disadvantages of competitive pricing

- Missed opportunities

- Following the herd

- Not thinking long term

1. It leads to missed opportunities

The most common ways businesses raise their profits is to increase sales, decrease production costs, or lower overheads. Pricing is often neglected, which is a shame because it’s your customer's main consideration (sometimes an incentive, but more often a barrier) before purchasing your product.

Simply copying your market’s prices could lead to lost profits if you sell your product short. The goal of your business should be to maximize revenue and profits, even if it does take a little bit of extra work on the pricing front.

2. Many companies copy

Competitive pricing assumes that businesses already in the market have the correct answer after a lengthy decision-making process. If a large portion of companies prices their product based purely on price comparisons, then with time the entire industry loses touch with demand. You could keep the same price forever because competitor A hasn’t changed her price, or raise and lower prices in response to trigger-happy competition.

Remember, it’s your business, your product, and your revenue. Every customer a competitor serves is an opportunity lost for you. Why would you let fellows in the other end zone determine the baseline for your price?

3. Short-term thinking

Maintaining a lower price than your competitors isn’t always the best way to attract consumers. Competitive pricing exacerbates that idea by simplifying price as a barrier that constantly must be lowered. Lowering prices (in most industries) leads to doubts about product or service quality and lower revenue from tiny profit margins, even though customers would be willing to pay more.

As we alluded to before, competitor-based pricing also gives you too much of a “set it and forget it” mentality. Pricing is a process that requires data and attention. If you’re not changing your prices and differentiating your product over time, you’re like a shark who’s stopped swimming: dead in the water.

How to build a competition-based pricing strategy

A strong competition-based pricing strategy is built on research. When you understand how the top competitors in your market are pricing their products and how that pricing might impact customers’ expectations, you have a foundation for setting your new product’s or service’s rates.

Identify the competitors in your market

The first step to competitor-based pricing is determining who your competitors are. Which companies are selling similar products or services? This is fairly standard market research you should be performing already.

Then, group them by specific characteristics, such as tenure and market share. Pick out the companies that most closely match your own brand’s profile—these are your top competitors.

Research their pricing and positioning strategies

Once you know the competitors that make up your market, perform a competitive pricing analysis to dig into their pricing models and positioning strategies to build a map of current trends. Make sure to look at not only their pricing but also the way it’s packaged, the types of tiers they use, and the features they differentiate on. This research will help you understand what pricing and positioning customers expect in the market so that you can choose the best price for your product or service.

Average the price of all competitors

Creating a pricing map will help you understand what all of your different competitors are doing individually, but it’s also important to look at all of this pricing data in aggregate as well.

To get the latter view, calculate the average price of your product type across competitors. Knowing this average, you’ll have a benchmark price to compare your own product’s rates to.

Choose higher, lower, or matched prices

After researching competitors’ pricing, you’re ready to determine where your product or service fits into the market.

- Higher-than-average price: When you want the premium price to signal luxury to potential customers

- Lower-than-average price: When you’re trying to undercut the competition with a low price and acquire customers quickly, competitive pricing examples of this include loss leaders

- Matched price: When your pricing strategy will be in line with your competitors

Whether you’re just entering the market or working to solidify your current standing, the price you choose will inform you of the customers' perceived value of your brand. Just remember that competitor-based pricing, like most simple pricing methodologies, doesn’t optimize your company for growth.

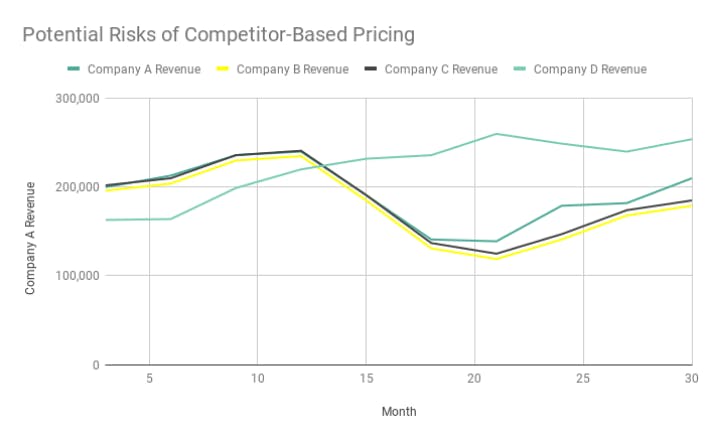

Competition-based pricing risks across four companies

In this example, companies A, B, and C have used competitor-based pricing as a part of their business strategy and gained and lost revenue alongside one another. Company D went with a more well-rounded approach and, while starting lower, grew more effectively over time.

Do we recommend competitor-based pricing?

Yes, but not as “one pricing method to rule them all”. Competitor-based pricing is an excellent tool for understanding the current market and general customer expectations of pricing, but it doesn’t look at the whole picture. SaaS and subscription companies are more successful with a well-rounded strategy that includes competitor analysis, benchmarking, and in-depth research into your company’s metrics. Check out our guide on value metrics for more information.

To summarize, certain businesses need to use competitor-based pricing extensively because their customers price compare and the cost of switching from buying a product at store X or store Y are exceptionally low. Yet, for most businesses, especially in the software or SaaS space, competitive pricing should not be the central tenet of your pricing strategy because there are too many other variables to consider when you’re not comparing congruent products.

Look at the help desk space. Zendesk, Help Scout, Fresh Desk, Salesforce, and dozens of other competitors are all drastically different and geared towards different customer personas. As such, Help Scout shouldn’t peg their prices with Zendesk and vice versa. Of course, the two should keep an eye on one another, but only to guide their market strategies.

Competition-based pricing FAQs

What are the three types of competitive pricing?

The three main types of competitive pricing are:

- Low price - When you set the prices lower than your competitors

- High price - When you set the prices higher than your competitors

- Matched price - When you align your prices with your competitors

What are the most common competitive pricing strategies?

The three main competition-based pricing examples include:

- Penetration pricing - By employing a penetration pricing strategy, you are setting lower prices to penetrate the market by attracting price-sensitive customers looking for better deals.

- Promotional pricing - Setting limited promotional deals helps you double the sales, but know that the final profit will be lower than if you kept the original product prices.

- Captive pricing - This strategy requires you to group some of your accessory products along with your core product and sell them as a bundle, attracting a larger customer volume.

Why do businesses choose competition-based pricing?

Many businesses, especially startups and small businesses, may choose a competitor-based pricing strategy for several reasons. When launching a new product or service, they want to appeal to target customers by offering the price that people are already accustomed to. Competition-based pricing may also help prevent customers from turning to competitors in the search for a low-cost product/service.