Entering into a market is no easy task, especially when there’s an established brand whose name recognition and customer base are well established. Going after this market with a new product or service, regardless of whether or not it’s better than what’s currently available, is a Herculean task. But, penetration pricing can help.

Based on the idea that everyone loves a good deal, penetration pricing helps you gain footing in a new market by competing on price. Offering a significantly lower price than what people expect helps you acquire customers faster. You’ll also have to work harder to raise prices in the future.

In today’s article, we’ll talk through some of the benefits of penetration pricing and how you can leverage its power to establish your service in a new market.

What is penetration pricing?

Penetration pricing is an acquisition strategy for companies that are trying to gain a foothold in highly competitive markets. These companies “penetrate” the market by offering a lower price than their competitors—enticing customers away from their current provider in an effort to gain market share.

How penetration pricing works

By pricing below what current consumers expect to pay, companies can increase awareness of their product or service early on and attract customers faster. Instead of having to compete with established brands solely on the value their product or service provides, this penetration strategy helps companies acquire new customers through price alone.

Once these companies have grown their customer base, they can start increasing the price to capitalize on willingness to pay. This process of raising prices is the most difficult aspect of a penetration pricing strategy, as customers who jump ship to go for the cheaper offering are more likely to do so again as prices increase.

If you’re considering a penetration pricing strategy, it’s important to start building strong customer relationships immediately to retain customers long-term.

Two examples of penetration pricing

Penetration pricing is a popular tactic in the business-to-consumer (B2C) market. The competitive nature of these products and the sheer number of choices most consumers have make it difficult to gain a footing in a new market without a strong acquisition strategy.

Disney+

The streaming entertainment market is one of the most difficult spaces for new companies to enter. Established brands like Netflix and Hulu have serious brand recognition and a loyal customer base. So, when Disney+ decided to launch its own streaming platform at the end of 2019, it decided that penetration pricing was its best shot.

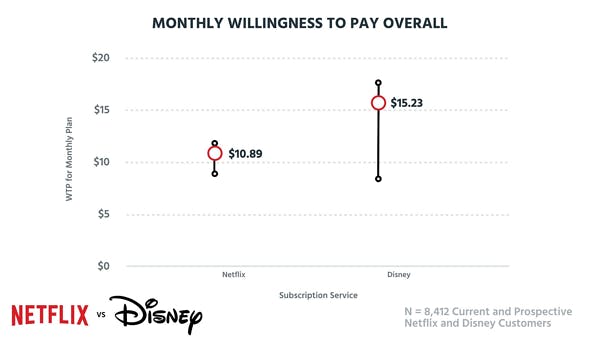

In the episode of Pricing Page Teardown on Netflix and Disney+, Disney’s initial offering of $6.99 is well under its customers’ willingness to pay.

Monthly willingness to pay for Netflix and Disney+.

Instead of making people choose which streaming service to go with, Disney+ priced itself aggressively low to entice new customers to buy their service while also keeping Netflix. If it had priced itself closer to Netflix at launch, it could have increased its average revenue per acquisition (ARPA), but it would not have been able to build its customer base as fast.

It will be interesting to see how this changes in the months to come as Disney+ establishes its place in the market and starts raising prices.

Cable and internet service providers

The ongoing battle between cable companies and ISPs like Comcast and Verizon uses some textbook examples of penetration pricing. Each company goes after their competitions’ customer base by offering an outrageously low introductory price that includes significant discounts or free upgrades (like HBO or Starz) and bundles together phone, internet, and TV packages.

After an initial 6- or 12-month introductory offer, customers will see their upgrades disappear and their subscription fees increase. Companies like Cricket Wireless and T-Mobile are also throwing their hats into the ring to try and upset the balance of power between the two largest providers.

This kind of rampant competition is what can make penetration pricing so attractive to new businesses.

The pros and cons of penetration pricing

Using penetration pricing can help your company establish a foothold in competitive markets, but it definitely comes at a price. Undervaluing your service can signal to customers that you’re not as worthwhile as any competition that enters with a more expected price.

Pros

- Makes it easier to enter new markets with established incumbents

- Helps you build a customer base quickly

Cons

- Makes it difficult to build loyalty with customers

- Recquires you to raise prices sooner to grow the business

When deciding whether to implement a penetration pricing strategy, it’s important to understand when it can help your company and when it can hurt it. Entering markets quickly can be very enticing but will require more work to maintain your place once it’s time to increase the price.

Using penetration pricing successfully

Penetration pricing shares some similarities with freemium pricing as an acquisition method. It’s not sustainable for long-term revenue growth to bring in customers solely based on price.

Let’s say you’re a new SaaS tool for project managers, and you’re entering a market with powerhouses like Atlassian, Trello, and Asana. While you know that your product is amazing and offers more value than your competitors, consumers in the market don’t. So, you decide to go with a penetration pricing strategy to enter the market.

In this situation, it makes sense for your base tier to be free to match up with your competition. But your basic and premium packages will need to be priced differently. Using a penetration pricing strategy, you would structure these tiers so that the per-user price is at the bottom of customer willingness to pay. That helps you get more customers on paid tiers in your service.

Key takeaway: With penetration pricing, building relationships with your customers quickly becomes much more important.

Once you start acquiring these customers, you’ll nurture them through onboarding and educational content until finally, months down the line, they’re fully ensconced in your service. At this point, you can consider raising the per-user price of your basic and premium packages to fit the norm of your competitors.

You’ll also need to consider how to offer upsells and other types of expansion revenue to increase the overall lifetime value (LTV) and average revenue per user (ARPU) of your current customer base. If you’ve built up relationships with your customers, they’ll be more willing to accept these price increases.

Penetration pricing vs. price skimming

Penetration pricing is sometimes confused with price skimming, but the two differ in very clear ways.

- Price skimming: A company enters the market with a higher initial price than their competitors, then lowers it as demand decreases.

- Penetration pricing: A company enters the market with a lower initial price than their competitors, then raises it after their customer base is established.

Price skimming only really works for products that are perceived as innovative or luxury. The model is built on “skimming” — attracting the top layer of potential customers with the highest willingness to pay and slowly going downmarket from there.

Should you use penetration pricing?

Penetration pricing is a tricky strategy for subscription and SaaS businesses. To pull it off, you’ll need to quickly build loyalty in your customer base and establish strong relationships before increasing your price.

If there is an established brand in the market you want to enter, choosing this method can potentially get your metaphorical foot in the door, but the work required to gain back the revenue lost through these lower prices takes a lot more time.