Anyone who is involved in startups or SaaS knows the mantra, Startups=Growth. Yet if your unit economics aren't in order, that growth won't be sustainable.

Homejoy is gone. The headlines might be about legal problems, but at the heart of its demise was a fundamental error countless SaaS companies are making every day: it paid too much for its existing customers.

The prevailing wisdom of the startup world has been that you can raise money and spend your way to success, paying high customer acquisition costs (CAC) to achieve high growth rates. After all, startups = growth, right?

Yet, the money will run out eventually, and when it does you need to be in a position of sustainability or you'll end up like Homejoy or Zirtual. To help you get back on the Lifetime value (LTV) train to profitability, let's walk through the three major pieces of how successful SaaS companies get to massive profitability and true revenue growth. But first, let’s define “SaaS profitability.”

What Is SaaS Profitability?

SaaS profitability is achieved when a SaaS company reaches operational efficiency and moves past its break-even point. This means that total revenue is more than the total operational cost. A SaaS company is considered “profitable” when recurring revenue from current customers are able to cover new customers' acquisition costs (CAC).

The situation with SaaS companies is a little different from brick and mortar businesses, as many SaaS businesses struggle to reach profitability even while reporting on big revenue numbers. Many have even gone public and remained unprofitable years after they did their IPO.

SaaS Profit Formula For Successful Business

The best SaaS founders won’t have broken a sweat over what happened to Homejoy. They know that the beauty of SaaS is that it’s just math.

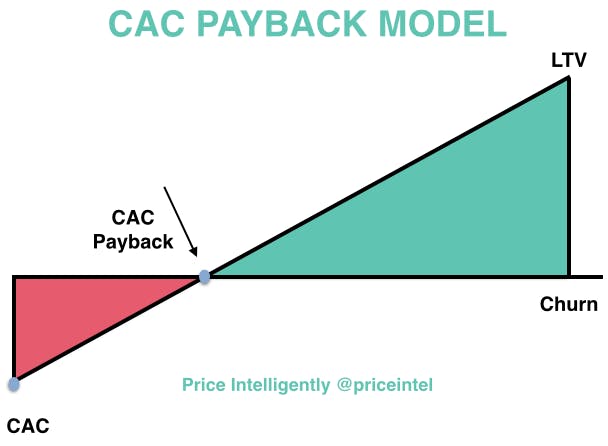

To build a company with long-term growth that lasts, you need to nail down two variables in your SaaS math equation: customer lifetime value (LTV) and cost of customer acquisition (CAC). Based on the current state of the market, these variables should help most SaaS companies, as their customers and companies mature and scale, achieve gross margins in the 75%–80% range.

Here’s how.

1. Achieve an LTV/CAC ratio of 3+

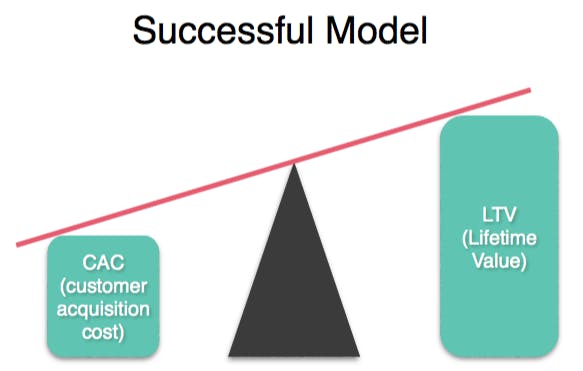

There is a basic ratio for your business that’s absolutely critical that you understand: LTV/CAC.

If this ratio is greater than 1, you’re making money—if it’s not, you’re losing money on each new customer and your churn rate is too high. It is really that simple, but if you don’t nail this down, your business will be unsustainable at its very core and its days will be numbered from the get-go.

We think the optimal LTV/CAC ratio is 3 or higher. Every customer should be paying you $3 for every $1 spent acquiring them. That’s a rule of thumb that has come out of the experience of many a successful and failed SaaS company.

The reason why it needs to be greater than 3 is because CAC is paid up front, while LTV accrues over time. Cash flow will become a serious issue with a lower LTV/CAC ratio.

In addition, you need to build in margin for the other expenses in your business—like payroll, rent, operations, and more—so that your company on the whole is profitable. Otherwise, your customer profit won’t be enough to cover your overhead.

2. Optimize Your Pricing to increase your LTV

Your entire sales funnel, your entire marketing campaign, all those emails, ads, posts and tweets are all ultimately pointing to one page: your pricing plan.

This is where you are driving all of your customers. Your whole acquisition spend is to get people to that page, reinforce your pricing strategy, and get them signed up as paying members of your service.

Yet SaaS companies spend only 6 hours on their pricing.

Companies spend all their time thinking about new customer acquisition, but not how they’re monetizing those paying customers that they actually do get. It turns out that that’s a huge misallocation of time.

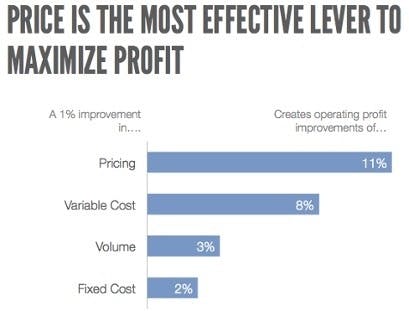

Pricing affects your business more than any other lever, including costs and volume. In fact, a 1% improvement in pricing equates to an 11% boost in profit, compared to only 2.3% and 3.3% boosts from 1% improvements in fixed costs and volume, respectively.

By optimizing your pricing, you’ll see huge gains in your customer LTV. You won’t overcharge your smaller businesses, which causes them to churn in large numbers. And you won’t undercharge your enterprise customers, who are willing to pay 5x-10x what your SMBs are paying.

Plus, your CAC will improve with better pricing, because the pricing page is the key step in your customer acquisition funnel. That’s where prospects decide to give you a chance and actually try your product, or where they drop off never to return.

Your pricing page captures your thinking on your monetization strategy. Invest in it, and you’ll be reinforcing the fundamentals of your business for the long term.

3. Watch Your CAC as you scale

Customer acquisition costs tend to follow the law of diminishing returns as you grow. Your first customers are cheap. They’re your friends, your friend's friends, and the people in greatest need of your solution.

But you get fewer and fewer customers for the same cost as you grow, meaning you have to spend more to feed the growth monster.

At this point, it’s tempting at this point to ramp up your CAC with the vague hope that you’ll be able to find an upsell to increase your LTV and that the next round of funding will be there when you need it.

Or, you can do the hard work of SaaS, and that means putting the screws on your CAC. To reduce CAC, you need to:

- Optimize your funnel

- Increase the efficiency of your sales and marketing

- Use inbound marketing

- Fix your pricing

- Improve your onboarding experience

Unlike acquisition where you might find a “growth hack” to achieve spontaneous, insane growth, there’s no sexy silver bullet here.

Break down your funnel and find where you have the greatest leverage. Are your ad clickthrough rates low? Or are those fine, but then you’re finding that your conversion rate from trial to paid accounts are minuscule?

Once you’ve picked out your weak spots, it’s time to get out of the office and talk to people who went through the flow, test new flows, and find what works.

Don’t Get Caught Up in Short-Term Trends and Fads

Acquisition has become the all-important idea in SaaS startups. Almost every article out there seems to be about acquisition.

But this is only half of the equation of building a great business.

Remember—you are getting those customers in order to monetize them. No one seems to talk about it anymore, but making money from your customers is the undisputed, time-tested path to business success.

Without the proper monetization strategy a high CAC will overwhelm you, and it’s only a matter of time before the cash runs out and there’s no one left to bail you out.

Establish your fundamentals, and you’ll have a company that’s built to last.