Merchant of record (MoR) service providers, like software experts Paddle (yes, that’s us!) and general MoRs like Cleverbridge and Fastspring, are growing in popularity among SaaS businesses who are looking to permanently offload the burden of managing payments and the associated liabilities.

In this guide, we’ll look at how this approach works in practice and why the MoR model is helping SaaS companies grow more quickly.

First up, what is a merchant of record?

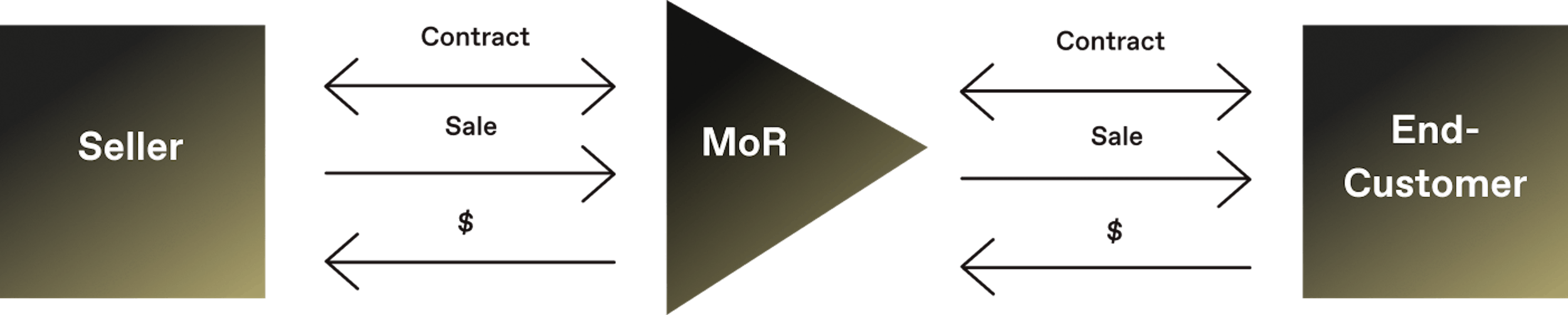

A merchant of record is the legal entity that sells goods or services to an end customer. In a transaction, it’s the MoR who the end customer owes payment to for their purchase.

As a result, the MoR is responsible for handling all payments and holds the liability related to each transaction. This includes collecting sales tax, ensuring payment card industry (PCI) compliance, complying with local consumer law, and honoring refunds and chargebacks.

How does using a merchant of record work?

An MoR functions as a reseller of your software. This means that when your customers visit your website, or go through your sales process to make a purchase, they’re technically transacting with the MoR, who purchases the product from you and sells it to the end customer.

Transactions are routed through the global payments infrastructure already built and maintained by the MoR. It’s then the MoR that takes on the liability for all of the payments and sales tax compliance associated with those transactions.

When the transaction is complete, it’s the merchant of record that is the principal in the transaction and it is their name that appears on the customer’s credit card statement and to whom the cardholder has recourse in case of any dispute. This is how and why the merchant of record becomes the liable party.

Revenue is processed and paid out to you as cash in the bank and as a single stream of data that you can connect to your accounting and business intelligence tools. You also remain in full control of your product and your ongoing relationship with your customers.

What are the alternatives to an MoR?

Businesses that don’t use a merchant of record will need to build this infrastructure themselves. This is usually achieved by implementing multiple tools and connecting them together into a payment and billing stack.

The most common starting point is a payment processor, like Stripe or Braintree. The payment system’s partner integrations then fill in the gaps, forming the rest of the stack. Here are some of the other pieces of the payments infrastructure puzzle:

- Payments: To achieve maximum payment coverage (payment methods and currencies) globally, you’ll need to integrate with additional payment processors as you scale.

- Subscription billing: A system that enables you to charge customers on a recurring basis with flexible subscriptions. This can be built in house, or via a tool that manages that logic for you.

- Financial and data privacy compliance: Processes, tools, and people that will help you stay up to date (and compliant with) the financial and privacy regulations in different markets.

- Sales tax compliance: Software or the internal resource to make sure you correctly calculate the amount of sales tax owed before filing and remitting payments to the authorities.

- Invoicing: Supporting your sales-assisted billing with a scalable solution for creating, sending, and reconciling invoices.

- Disputes and refunds: Handling payment reconciliation, refunds, and chargebacks often requires additional headcount or incurs fees from your payment provider.

- Fraud and chargeback protection: To protect your business and customers from fraud, you’ll need to create logic to flag fraudulent orders, and then manually review those suspicious orders, refining your custom rules.

- Buyer support: Providing best in class support to your growing customer base – regardless of where they are based.

All of the above will likely require additional headcount or see you incur additional fees for tooling. You’ll also need to factor in engineering time to set up and maintain these integrations. So, while doable, it’s a big job that only grows as you grow - and that brings us nicely on to why it’s becoming increasingly popular among growing SaaS businesses.

We’ve seen the MoR model grow in popularity within SaaS over the last few years. The best founders understand the core competence of their business, usually rooted in deep customer and market insight, and they seek to use best-in-class third-party solutions in areas outside of that competence. Using an MoR removes complexity and risk from your payments infrastructure, increases financial efficiency and transparency, and allows for greater focus on your areas of greatest leverage,”

Stephen Chandler, Managing Partner of Notion Capital.

Why are SaaS businesses switching to a merchant of record?

Working with payment infrastructure providers that work off the merchant of record model allows SaaS businesses to grow more quickly. Here’s how:

1. Focus on growth:

Particularly in today’s SaaS climate – where growth and big funding rounds aren’t a given – the MoR model provides you with a scalable solution for payments and billing that will help you to grow sustainably.

Businesses selling through an MoR benefit from access to a global payment network. A good MoR will also be continuously optimizing its payment processes to give you the best conversion, payment acceptance, and renewal rates across the globe.

This also increases your speed to market and gives you the opportunities to maximize on new opportunities more easily. Businesses looking to expand internationally can switch on new payment methods and currencies with ease, without worrying about global sales tax or payment regulations draining your resources. Companies looking to move upmarket and serve enterprise-level businesses can easily start invoicing, without implementing more tools.

The MoR keeps your entire payments infrastructure running in the background, leaving your team to focus on other priorities – safe in the knowledge that revenue is coming in and your data is accurate.

For finance teams, this means telling your business’ story much easier when it comes to raising funds or selling the business.

2. Confidence in your revenue data:

Using an MoR gives you instant access to a ready-built, global payments infrastructure. This allows you to manage payments, and subscriptions from one platform – giving you a single source of revenue and user data.

This is especially beneficial for those running their business on a hybrid billing model, as you can keep both your self-serve and sales-assisted payment data in one platform, with your payments reconciled for you too. This clean, accurate data can then be easily fed into your accounting systems, enterprise resource planning (ERP), and customer relationship management (CRM) software.

3. One set of costs:

A merchant of record is your entire payments infrastructure, in one platform. This makes tracking how much managing payments and billing is costing your business much easier. You’ll have one set of fees, from one provider.

While the fees for an MoR might seem marginally more expensive at first glance, it incorporates everything from payments and subscription management, to tax compliance, to fraud and chargeback protection. – all of which you would otherwise be paying for individually and the cost increases rapidly as you grow and generate more revenue.

Tailwind Labs CEO Adam Wathan was keen to run his business using an MoR to offer him and the team relief from sales tax liabilities and reduce the admin burden of bookkeeping. On costs, he said:

“With our cross-border payments, we were looking at around 3.5% fees with Stripe and 4.5% with PayPal. So, any savings would have been minimal. You just ask yourself, is any saving worth the admin burden and opening yourself up to extra scrutiny from the tax agencies? Absolutely not.”

4. Sales tax and financial compliance:

As a reseller, the MoR is principal in the transaction with the end customer. It is this responsibility that makes them the liable party when it comes to sales tax compliance. It’s on them to register for, file and remit sales tax payments to the local tax authorities. The taxes are then deducted from your sales revenue before you receive your payouts. Not only does this absolve you from any sales tax liability, your bookkeeping becomes much easier too.

Without an MoR, SaaS businesses are faced with increasingly complex sales tax regulations. While there are tools that can help you calculate the sales tax you owe, the majority stop there. This means that it’s still ultimately up to you to register, file and remit sales tax payments, wherever you are liable. What makes it more complex is that sales tax on software is determined by where the customer is based, rather than where the business is located – the regulations also vary from country to county (or in some cases, from state to state) – just to keep you on your toes.

When Resume.io switched from a payment processor to an MoR, the fact that their business was now 100% tax-compliant globally helped increase the business’ appeal as an attractive investment opportunity.

“We just didn’t need to worry about sales tax liabilities surfacing in the due diligence process, that was a huge benefit to us,” Menno Olsthoorn, Managing Director, Resume.io.

Resume went on to receive several offers and accepted an acquisition offer by Talent Inc. in August 2021.

5 FAQs about the MoR model

1. Do I still need to register for sales tax?

The short answer is no. If an MoR is responsible for the transaction, then it holds complete responsibility for any sales tax liability. The payout you receive from the MoR is not subject to sales tax, as this is borne by the transaction with the end customer.

2. Do I need to contract with payment providers and wallets like PayPal?

A merchant of record will usually have its own relationships with payment processors and wallets. This allows you to benefit from a ready-made payment infrastructure, without having to integrate with providers directly.

3. What does the MoR model mean for my relationship with my customers?

The MoR is the principal in the transaction with the end customer but you are still the licensor of the product itself. What this means in practice is that you are still wholly in control of how you present your product and the ongoing relationship with the customer - the MoR steps in only to take responsibility for the transaction and that is where its role starts and ends.

4. What does the reseller relationship mean when it comes to ownership of customer data?

Ownership of customer data has, since GDPR, been placed firmly in the hands and control of the data subject. When you use an MoR, both parties are independent controllers of the data they receive.

5. What happens if I want to move to a new provider?

The Data Privacy legislation doesn’t prohibit the transfer of data to a new provider, provided that the transfer and end location is secure and provides adequate protection for the data subject.