One of the most powerful yet overlooked growth levers in SaaS is pricing strategy. Get it right and your revenue can soar. To do so, you need a handle on your target market's willingness to pay.

Anyone whose taken an economics class has heard of supply and demand. Producers want to charge a lot, consumers want to pay a little, and the happy medium that exists is what products are typically priced at. Central to pricing your products at that optimum rate is understanding your target market's willingness to pay.

What is willingness to pay?

Willingness to pay (WTP) is the maximum price that a customer is willing to pay for a product or service. WTP varies depending on the context, different demographics, the specific customer in question, and can fluctuate over time. As a result, willingness to pay is usually represented as a price range, rather than a single dollar figure.

By researching willingness to pay, you can optimize your pricing and packaging to see greater conversions in different regions.

3 reasons why willingness to pay is important

So, we've given the dictionary meaning of willingness to pay: it means exactly what it says. But what does willingness to pay really mean? In other words, how does this simple concept impact your business? In what ways can you use this number to form actionable insights regarding your business? Let's now take a look at how customers' willingness to pay has an actual impact on your business.

1. Willingness to pay reflects market demand

We talked about supply and demand curves earlier. Generally speaking, the more demand there is for something, the more people will be willing to pay for it. This means that tracking the willingness to pay for your product over time also serves as a sort of proxy for tracking the market demand for that product. Company-wide, this can be very helpful because it allows you to see which products, or features of a product, are worth pursuing and which may not be good investments.

2. Willingness to pay drives pricing strategy

Willingness to pay will help you decide the appropriate pricing strategy. But it goes beyond that, particularly for SaaS companies. For example, if you have tiered pricing, which features go in which tier? It might seem obvious, but it's not as simple as placing the features with the lowest willingness to pay in the lowest tier, and the ones with the highest willingness to pay in the highest. There's more to how you decide what and how you charge for new products and certain features. And without the data to make informed decisions, many SaaS companies end up giving away features they should be charging for, or tying their monetization strategy to features that people aren't as likely to break out the wallet for.

3. Willingness to pay drives product development

As you've probably already considered, understanding what features and products people are willing to pay for doesn't just influence where you put a feature into your pricing tier. It also helps you to understand which products and features you should be focusing your time on. As a reflection of market demand, willingness to pay tells you which direction your product development should go in, helping to ensure that you are always driving your product towards growth for your business.

6 factors that influence willingness to pay (WTP)

A number of factors affect consumers’ willingness to pay. Everything from the current market environment to a customer's personal preferences has a direct impact. Take this example from a recent episode of Pricing Page Teardown:

This shows the monthly WTP for current and prospective customers of Envoy based on the size of their company.

The WTP ranges vary significantly depending on the size of the company that is considering a purchase.

Take these factors into account when determining the correct WTP for your target customers.

1. The state of the economy

When the economy is doing well, WTP is likely to increase. A general recession or issues specific to your industry will cause WTP to decrease. Watch for indicators of these general market shifts when thinking about your own subscription pricing.

2. How trendy/in-season a product is

For products and services with a high amount of seasonality, like Halloween costumes or lawn care, WTP will fluctuate with the seasons. Fluctuations like this are generally consistent and easy to track as long as you know how the market has behaved in the past. A great place to do that is on social media.

Trendiness, however, will be much more difficult to monitor. What's trendy is highly variable and highly specific to the market you're working in, so it's important to stay on top of changes as they occur.

3. Consumer’s personal price points

Every customer has a different personal history that informs how they think about price. While it's impossible to account for each and every customer's possible background, you can examine how different aspects of your industry impact the customer directly.

For example, customers with a higher annual income will have a higher WTP and may feel more favorably about a premium or enterprise solution. Segmenting your WTP data based on these data points gives you a great way to create better pricing tiers.

4. Circumstantial needs in different consumers

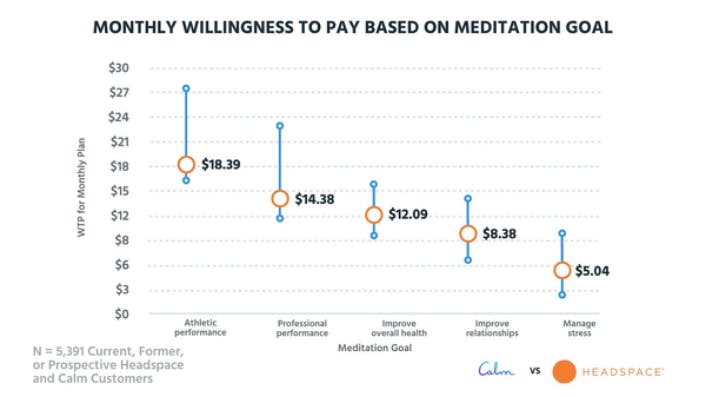

Just as consumers have personal feelings about price points, their individual circumstances directly impact WTP. This can be anything from their geographical location to personal goals, like the following graph of monthly willingness to pay for Headspace or Calm:

The different WTP are based on Calm and Headspace users' medication goals.

If a consumer changes their goals from Athletic performance to Improve relationships, the WTP drops so much that the ranges don't even meet. Your consumers will always base their WTP on their current circumstances.

5. How scarce or rare a product is

The less something is available, the more valuable it will become. The same is true for WTP. If your customers perceive the product or service that you're selling as rare, or scarce, it will raise their willingness to pay.

While this can be used to your advantage, increasing the rareness of a product too much can make it seem unattainable for some customers. Always consider your individual buyer personas to make sure you're not pricing too far outside their grasp.

6. The quality of a brand or product

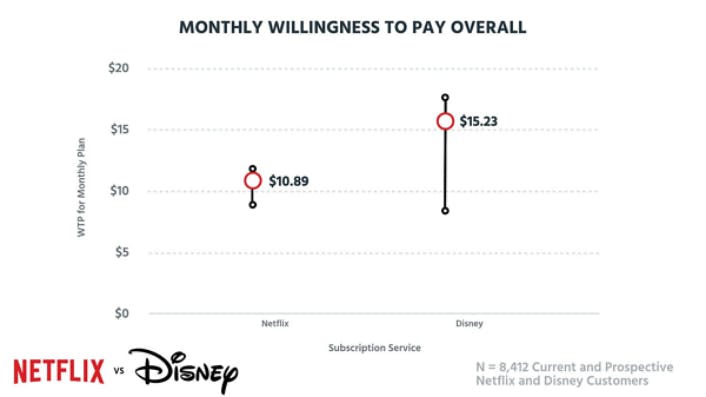

Consumer perception of quality has a direct impact on WTP in much the same way as rareness. The higher the quality, the higher the willingness to pay. We saw this in our Pricing Page Teardown of Disney and Netflix:

Differences in WTP for Netflix and Disney are based solely on the perception of the brand.

Disney is a much more well-known brand with an established track record for quality entertainment. That raised the overall monthly WTP by almost 50%.

How to calculate WTP

A willingness to pay formula doesn’t exist, as one of the big issues with any problem of economics is that humans aren't entirely rational. If you ask 100 people what they'd be willing to pay for a product, you're likely to get 100 different answers from your survey respondents. There's no formula that can be plugged into that will account for that. But although there is no exact willingness to pay formula, that doesn't mean you can't calculate WTP. Three factors to getting an accurate customer's WTP range are described below.

1. Market research

While we're talking about basic economics, we need to discuss the fact that competition tends to drive prices down. If you are the only company in your space selling a product, you can set a higher price (but keep it reasonable). If the market is oversaturated already, you won't be able to charge much higher than competitors of a near equal value. Market research surveys the market that exists for a product, and the competitive landscape that exists around it. This can help give you an idea of how much leeway you have in your pricing.

2. Customer research

The market for a product may be great, but that doesn't mean the market for your product is great. Your product’s features need to line up with the features that those consumers value the most. This is a very important part of willingness to pay because it takes the calculation away from generic product categories and into something with a more measurable value. A product that fits the market better will enjoy a higher willingness to pay than one that doesn't.

3. Direct/indirect surveys

The use of surveys, direct or indirect, is a great way to gather information about what customers want, how much a customer values a given feature, how loyal they are to you or your competitors, and many more data points that can be used to provide an internal baseline when calculating the willingness to pay for your target customer base.

How to increase willingness to pay

Willingness to pay isn't static, and it is tied to your specific product and how it fits into the market. There are a number of ways you can influence your customer’s WTP, but it takes real effort. Here are three approaches:

1. Perfect your value proposition

Take a look at your messaging. If you can’t clearly and simply articulate your value proposition and what sets you apart from your competitors, you cannot expect your target audience to pick up on or understand.

Your customers want to know what your product is, how it can help them, how much it costs and what exactly they can expect in return - and they want all this information yesterday. The clarity in your messaging is key, anything less is a missed opportunity.

2. Raise brand awareness

It’s not all about presenting the value of your product, though. The brand itself can be just as influential in a customers’ buying decision.

As much as they make a song and dance of new products and features with reveal events and the likes, a lot of the appeal comes from the brand itself. People have a lot of respect for Apple, and apply that to their buying decisions.

Building brand awareness comes down to a powerful marketing strategy; one that ultimately creates a competitive advantage for your business regardless of how exactly your features stack up against a competing product.

Invest in different channels and content types, including SEO and social media, as well as partnerships with larger or better-known brands, to get people to see and talk about you.

3. Get involved with influencer marketing

We know that social media can be an essential tool for a lot of businesses, and we all know that word of mouth is an equally important method of building credibility. So, what do you get if you combine them?

Influencer marketing can be a powerful strategy. Partnering with influencers in your field who then talk about your brand or product on their platform drives awareness but also links their credibility to your name.

One example is Setapp. They created a strong social proof campaign in which Jason Staczek, a film composer, introduces himself, his career, and how he makes the most of Setapp. See the full video here.

Willingness to pay examples

We've done a lot of research on the effects of WTP on different companies. Here are three examples showing how each company could use WTP to improve their pricing strategy.

Spotify

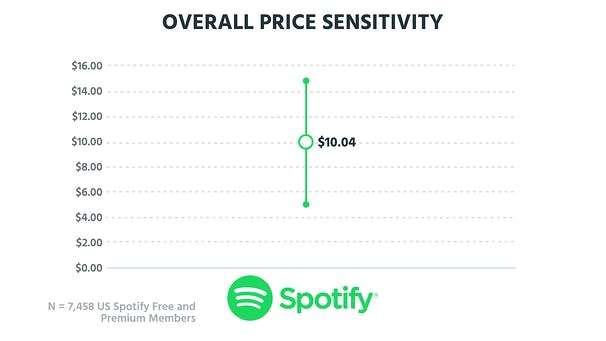

Spotify's standard plan is $9.99 a month, which is right in line with overall WTP in the 7,458 survey respondents we talked to:

Overall WTP for Spotify.

But what is interesting is how big of a range there is. Based on our data, Spotify customers are willing to pay between $5 and $15 for their monthly subscriptions. This indicates that there's an opportunity to differentiate with some additional pricing tiers, which Spotify has done with their Family plan.

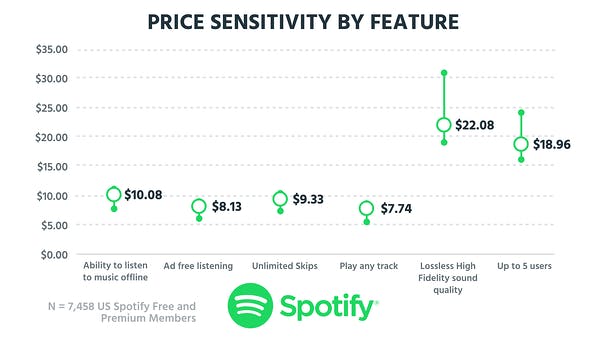

The problem is the plan is only $14.99 a month. Based on our research, that's under the WTP for people who are looking for a plan for up to five users:

Willingness to pay for different features of Spotify.

Using this WTP data, it looks like Spotify could definitely raise that price by at least $3 without an issue, and even up the price to $25 for some consumers.

By researching WTP, we were able to show that Spotify had an opportunity to increase their prices significantly for their Family plan.

Amazon Prime

For Amazon, we found a lot of interesting data based on different customer segments. By surveying 11,089 Prime customers, we found that age and annual salary were two of the biggest factors impacting WTP for their product.

Willingness to pay for different age brackets of Amazon Prime customers.

In 2014, Amazon Prime was only $7.99 a month, which they raised to $9.99 first, then finally $12.99. That took them from $95.88 per year to $119.88, then $155.88. That first jump put Amazon in a great position to capitalize on every age bracket in our graph.

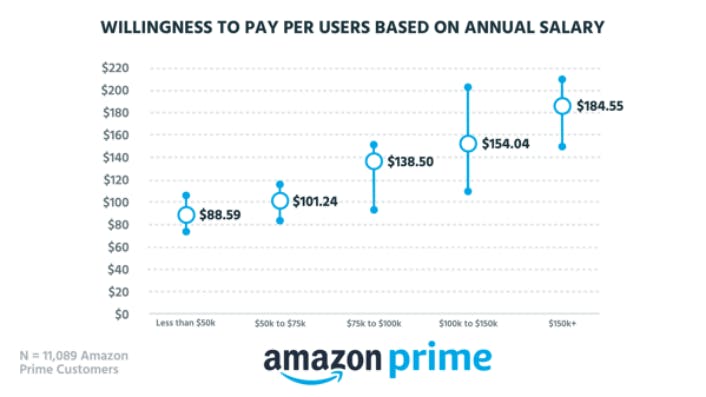

The second jump actually put them above the average WTP based on age but was a great choice for the upper salary brackets shown below:

The effects of annual income on annual willingness to pay.

Amazon is pretty much spot on with the $100K to $150K annual salary bracket, which indicates to us that they're going more upmarket with their positioning to capitalize on the increased WTP.

Shopify

Ecommerce store provider Shopify is one of the companies we found that did the best job of pricing for their customer's WTP. They offer a $29 basic, $79 premium, and $299 enterprise tier for customers. When we break down WTP based on gross merchant volume (the number of sales they made in one year), they're right in line with the data.

Willingness to pay for Shopify customers based on annual shop sales.

Their basic package appeals to people who are just getting started, and their standard plan moves up nicely into the $1.01M to $5M per year range. From there, you would think that $299 was a big leap, but it's actually under the WTP for larger companies doing $15.01M+ per year.

Shopify's pricing tiers grow at approximately the same rate as their customers. The more successful a customer is, the more they're willing to pay and the more features they're likely to need. By structuring their pricing in this way, Shopify makes it easy to grow alongside their customers.

Other metrics to consider

Your customers’ willingness to pay is a metric that reveals a lot about the health of your business, but it doesn’t give you the whole picture.

Here are just a few of the other key metrics you should keep on top of across different functions:

Sales:

- Win rate: The generated leads or opps your sales team closes over a certain period of time.

- Sales qualified leads (SQLs): The number of leads deemed ready to speak to a sales rep.

- Deal velocity: The time it takes a lead to travel through the sales cycle before it is “closed-won”.

- Closed won/lost: The ratio of won Vs. lost deals, either by team or individual sales representative.

Customer success:

- Net promoter score (NPS): A feedback survey with a scoring system that lets you know how likely a customer it to recommend your product or service.

- Customer satisfaction (CSAT) score: Analysing data from feedback surveys to measure how satisfied customers are with their experience of your product or service.

- Response time: Keeping on top of how long your support team take to respond to emails from customers.

Marketing:

- Marketing qualified leads: The number of leads generated by your marketing efforts that fit your ideal customer profile.

- MQL to SQL: The number of marketing qualified leads that go on to be qualified by a sales team.

- Lead to customer: The number of leads that go on to be paying customers.

- Demo requests/talk to sales: The number of people from marketing channels who request either a demo of your product or speak to a sales rep.

General:

- Customer churn: The calculation of the rate at which your customers are cancelling their subscriptions.

- Monthly recurring revenue (MRR): All your recurring revenue on a monthly basis (inclusive of upgrades and downgrades).

- Renewal rate: The percentage of customers that renew after their subscription ends.

- Customer lifetime value (CLV): How much revenue the average customer will bring in during their subscription to your product.

Willingness to pay FAQs

What does willingness to pay mean?

Willingness to pay is the maximum amount a customer is willing to pay for your product or service. It is presented as a range of price values to account for differing opinions among customers and normal market fluctuations.

Is willingness to pay the same as market demand?

Willingness to pay isn't identical to market demand, but they are related concepts. In fact, some people do refer to the demand curve as a willingness to pay curve. The difference is that a curve is going to represent everyone's willingness to pay. As a business setting pricing and determining strategy, you are more interested in the range that represents the average or mean willingness to pay.

What is the difference between willingness to pay (WTP) and willingness to accept (WTA)?

If we can call the demand curve willingness to pay, then we can also call the supply curve willingness to accept. That is to say, the willingness to pay is the maximum price that a customer will pay for a product. The willingness to accept is the lowest amount you can afford to sell it for.