Explore how our all-in-one solution removes the operational burden of payments, reduces both your exposure to risk and the cost of your payment infrastructure, and increases your revenue.

As CFO, your resources are ideally geared towards financial planning, analyzing performance, and consulting on strategic business decisions.

The most likely scenario is that much of your team's time is spent managing the painstakingly manual efforts of reconciling revenue, reporting on siloed data, and managing sales tax compliance across borders

The SaaS industry is still young, but very much maturing. We're seeing a growing realization across SaaS leadership that operational processes and systems that worked well enough in the early days are now too fragmented. Tools have been added and stitched together as new needs arise, resulting in a messy and brittle infrastructure. This winds up costing businesses unnecessary amounts of resources and holding back revenue growth.

Sound familiar?

In this guide

Review the status quo of SaaS payments and billing systems below, or skip straight to chapters explaining how Paddle helps finance teams thrive

The status quo: Working with fragmented payments infrastructure

This is what your fragmented payments tech stack might look like today:

- Payments: To achieve maximum payment coverage (payment methods and currencies) globally, you’ll be integrating with multiple payment processors.

- Subscription billing: A system that enables you to charge customers on a recurring and automatic basis.

- Financial and data privacy compliance: Processes, tools, and people that will help you stay up to date (and compliant) with financial and privacy regulations in different markets.

- Sales tax compliance: Software or the internal resource to ensure you correctly calculate the amount of sales tax owed before you take on the burden of filing and remitting payments to the authorities.

- Invoicing: Supporting your sales-assisted billing with a scalable solution for creating, sending, and reconciling invoices.

- Disputes and refunds: Handling payment reconciliation, refunds, and chargebacks often requires additional headcount or incurs fees from your payment provider.

- Fraud and chargeback protection: Your team will need to create logic to flag fraudulent orders, and then manually review those suspicious orders, refining your custom rules.

- Buyer support: Providing best-in-class support to your growing customer base, regardless of where they are based.

You might have full teams dedicated to managing this stack of cards, carefully maintaining the integrations, reporting, and often manual workarounds, instead of managing their core competency. This is manual, costly, and time consuming.

And that doesn’t cover the cost of revenue lost to poor payment acceptance rates, involuntary and tactical churn, and poor pricing and payments localization.

You might not even have a full view or control of your infrastructure. Managing the backend of customer payments is engineering’s responsibility, making you implicitly reliant on their resource for changes. You're competing with the product roadmap to make changes to integrations or fix the endless list of bugs within your complex stack of payment and billing systems.

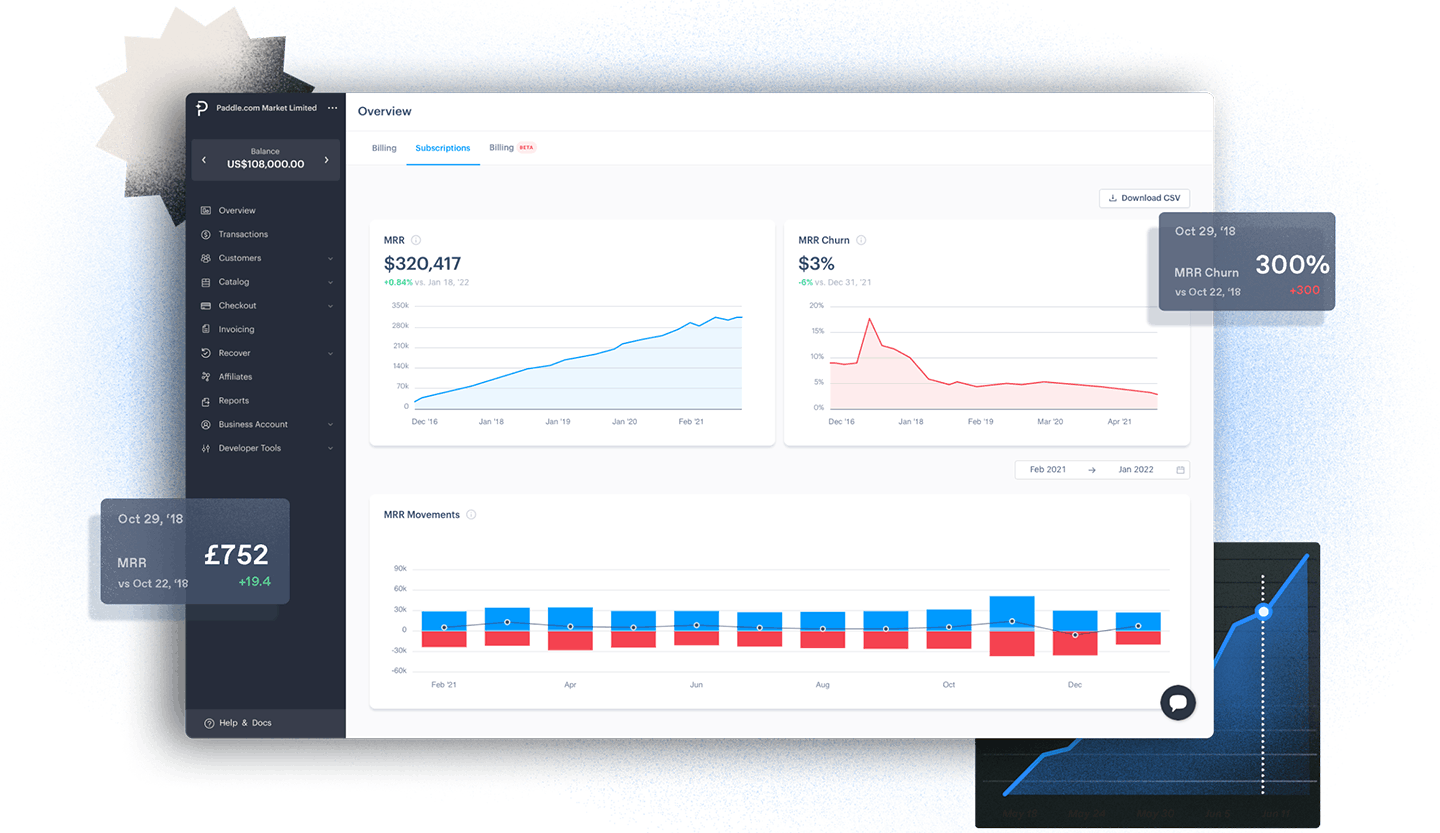

Where Paddle comes in

Paddle can take care of the burden of payments infrastructure and sales tax compliance for you in one platform — paying one fee. That’s right, one fee and all the control.

In 2022, Paddle became the latest fintech unicorn in the UK when we raised $200M led by KKR (with existing investors FTV Capital, 83North, Notion Capital, Kindred Capital, and debt financing from Silicon Valley Bank). We received a valuation of $1.4BN shortly after it was announced that Paddle and ProfitWell were joining forces.

Next up

Dive into how Paddle helps CFOs and their teams be more efficient and effective:

Part 1

How Paddle does the heavy lifting for you

Explore how Paddle absorbs the operational burden of how you get paid, the liability of the sales tax, and the complexities of global compliance from day one. You can focus on the business of running a finance team, rather than on the mechanics of how you get paid

Part 2

Why SaaS businesses (and CFOs) are switching to Paddle

Find out why 6,000+ SaaS businesses have chosen to work with Paddle. With a 35% lower cost to payment infrastructure, 25% higher payment acceptance rate, and 20% improved NRR, the results speak for themselves.

Part 3

The Paddle migration process

A common concern when transitioning to Paddle, like any software change, is the migration of your subscribers. Find out how Paddle’s migration specialists work with you to create the smoothest transition process without putting your subscribers at risk in the process.