Explore the metrics that are critical to the SaaS space, why they’re important, and how to generate better results with value-based pricing, positioning, and packaging.

For a SaaS or recurring revenue business, there are a few essential metrics to track if you want to optimize your business for profits and growth. As we found out in the last three posts of this series (see the above note for links), revenue in SaaS is received in smaller increments over a longer period of time, which means customer retention is critical to recovering acquisition costs and monetizing customers effectively. If enough customers are dissatisfied with your product and churn out to look for something else, you’ll lose the money you invested to onboard those customers and the opportunity to generate the cash flow you need to keep your business afloat.

As a result, the metrics that are important to a SaaS business have everything to do with customer lifetime value and the stages of the customer lifecycle. That outcome might seem obvious, but actually finding ways to achieve sweet results when you calculate the metrics surrounding customer acquisition, churn, and recurring revenue is a bit more

Success will come easier if you ensure that your products and pricing are aligned with the value and usage your potential customers seek. This requires a lot of research and data harvesting, but incorporating customer value perceptions and price sensitivity into your pricing process can help mitigate the symptoms of the SaaS realm’s most common ailments. As such, let’s briefly review the metrics that are critical to the SaaS space, why they’re important, and how to generate better results with value based pricing, positioning, and packaging.

Customer Acquisition Cost (CAC)

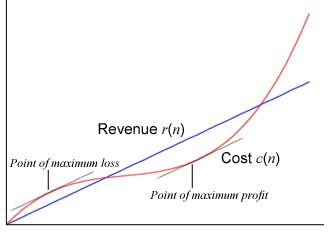

Examining just how many months of revenue from a customer are actually needed to recover the cost of acquisition becomes essential as your business grows, as it may take much longer than you think for your company to recover CAC and actually begin to profit. The key to reducing that timespan is developing a business model that enables you to make more money from your customers than it costs to bring them into the fold, which is easier said than done.

To calculate your customer acquisition cost, you take the sum of all your sales and marketing expenses over a given duration (including human capital costs) and divide it by the number of customers acquired in the same time period. This formula can also be used to assess the effectiveness of specific acquisition methods or new marketing channels, so it’s crucial when you want to test out different growth strategies. According to David Skok in his comprehensive article on SaaS metrics, ideally you should be able to recover the cost of customer acquisition within 12 months.

Achieving this goal can be fairly difficult, but quantifying your customer personas and optimizing the sales funnel will make it easier to turn prospects into paying customers that contribute to your cash flow. We emphasize the importance of positioning almost every week, but it’s only because knowing your customers is essential if you want your SaaS company to survive. Uncover what motivates your customers to buy, their willingness to pay, and the features they value most if you want to decrease the length of the sales cycle and reduce your CAC. Catering the funnel to your ideal prospects is critical, so if you experiment with new sales methods and automation, make sure everything still works to convert the right buyers.

Eliminating Churn

Speaking of moving the right customers through the funnel, let’s discuss what happens when those customers don’t see the value in your product. Customers who churn out potentially waste all the money you spend on customer acquisition, so it’s important to go after the right clients if you want to see a full return on your investment and generate the recurring revenue needed to become profitable. When customers aren’t a great fit and abandon ship, you obviously won’t see the cash flow you need to run a successful SaaS business.

Many companies choose to focus only on their churn rates, but it’s just as critical to determine the profitability of each customer segment through each cohort’s lifetime value (LTV). As we mentioned in the second post of this series (all about churn), LTV and its relationship to CAC are leading indicators of business efficiency, but calculating LTV can get more complicated if you need to account for expansion revenue and changes in the average revenue per account (ARPA). You can find a list of vital LTV formulas in David Skok’s supplement to his SaaS Metrics 2.0 post, but a good rule to follow is the customer LTV should be at least three times the cost of acquisition.

Perhaps it’s too early for your business to collect and calculate LTV data, but churn factors heavily into any lifetime value equation. If your business is in a nascent stage of development, it’s still important to find ways to reduce churn so you can ensure you’re ready for growth.

Aligning the prices customers pay with the value they place in your product is an essential part of value based pricing that can increase customer retention. Pricing along a value metric and assigning each of your customer personas to specific product tiers will enable you to justify the value received at a particular price, and it will also ensure you can upsell customers to premium products and plan upgrades as their own businesses grow. In addition, collecting price sensitivity data will potentially help you determine more profitable prices or whether your product needs further refinement to increase the customer’s loyalty and willingness to pay.

Refining Monetization

Aligning your positioning, packaging, and pricing with your target customers is not only important for reducing CAC and churn, it’s also the key to monetizing customers and generating more monthly cash flow. Simply put, better pricing based on customer value is one of the best ways to boost your monthly recurring revenue (MRR) so you can profit and prepare for the road ahead.

Wistia's pricing page. Simply scrumptious.

To calculate your MRR, you multiply the total number of paying customers by the average amount they pay you every month, otherwise known as the average revenue per account (ARPA). As mentioned in the beginning of this post, MRR is an essential metric to track because SaaS is a business where revenue is usually received through recurring subscriptions.

A proper pricing process will help you convert more potential customers into paying ones, increase upsell opportunities, and ultimately increase your MRR. We’ve already discussed the importance of acquiring the right customers and pricing along a value metric so they see the value in what they’re purchasing, but having an attractive product mix will help you take full advantage of scalable pricing so you can appeal to both high profile clients and price sensitive ones.

In addition, you can use price sensitivity data to determine if your prices are justified by your offerings. Once you collect this valuable input from your customers, you may discover prices are too low and that you can raise prices without significantly increasing your churn rate. As anyone who’s ever read our blog before knows, a 1% improvement in price optimization results in an average boost of 11.1% in profits, and that’s no small boost when it comes to your recurring revenue.

This concludes our first series on SaaS metrics and your pricing strategy. To learn more about pricing specifics, check out our Pricing Strategy ebook, our Pricing Page Bootcamp, or learn more about our price optimization software. We're here to help!