Revenue and income are two metrics that are often mixed up. Knowing the difference is crucial for understanding the strength of your business strategy and true health of your business.

It's tempting to think that the relationship between revenue and income is a pretty simple one— that as long as you're keeping one of them healthy, the other will be healthy too. Not quite.

In business, revenue constitutes a business’ top line (total income through goods/services), while income is its bottom line (revenue minus the costs of doing business).

The two terms tell different but equally valuable stories. A blooming total revenue attests to an ultra-efficient sales department excellent at finding and winning new business. Your income, on the other hand, tells you how well you’re able to mesh your ability to sell into a sustainable approach to running your company.

Understanding the difference between revenue and income, and the picture they paint together about a company's financial health, is extremely important for any business, particularly in terms of how total earnings are reported in accounting.

Revenue vs. income: know the difference

The key differences between income and revenue mean that the two cannot be substituted for one another when reporting on a business’s financials. Let’s quickly dive deeper into these two terms before we get started.

What is revenue?

Revenue is the total amount of money generated by the sale of goods or services, or any other use of capital or assets, associated with the main operations of a company, and before any costs or expenses are deducted. Revenue is sometimes referred to as “gross sales” or “top line.” For some businesses, this can include investment gains. As net revenue does not factor in expenses, this value sits at the top of the income statement.

What is income?

Income represents the total amount of money remaining after all operating expenses, taxes, interest, and stock dividends have been deducted from an organization’s total (gross) revenue. Income is also referred to as “net income,” “net profit” or referred to as a company’s “bottom line” as it provides a full picture of cash flow in and out of a business. You may also read how to compute for net profit formula. As income accounts for expenses, this value sits at the bottom of your income statement.

A real-world example of revenue vs income

A well-run company will generally have both high revenue (plenty of success in sales) and well-proportioned income (ability to keep operating costs low). The optimal gross profit margin varies between companies based on the type of goods/service they sell and the cost to produce/provide it.

However, it’s easy to look at soaring revenues and presume that steadily improving net sales or a sales revenue spike alone will take care of the bottom line, without paying due attention to the type and extent of your operating costs. In the early stages of a company, in which keeping new business coming in can seem all-important, this is an easy mistake to make.

Don’t underestimate the dramatic effect that company costs can have on net income. A company that knows how to sell, but that is poorly run, can find itself with an alarming difference between the number at the top of its financial statement and the one at the bottom.

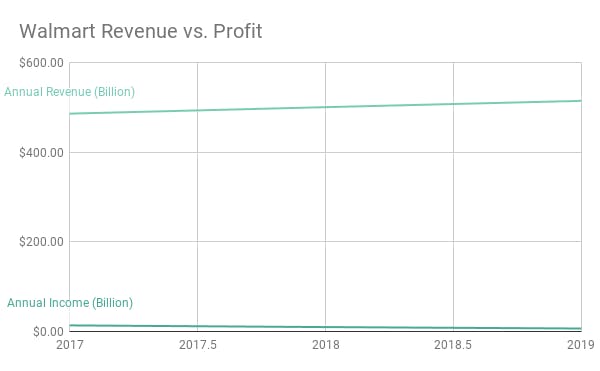

Walmart

Walmart was officially the world’s highest-earning company in terms of revenue in the year 2018, with $515 billion in total revenue.

However their net income, with all costs subtracted, was only $6.67 billion. That’s an income of just over 1% of their total revenue.

Of course, both statistics are, in a wider context, extremely healthy. Nevertheless, the disparity between Walmart’s revenue and its profit demonstrates the potential weight of total expenses on a company’s bottom line. Highest-earning company in the world or not, it would have been disastrous for Walmart to base their forward business planning on revenue without first understanding how it related to their operating income after expenses.

To know how much they have left to invest, and to understand their approach to reducing costs, they have to understand the revenue vs. income relationship in full.

Walmart's revenue and income might be among the very biggest in the world, but the two statistics themselves are absolutely worlds apart from each other. Beware those operating costs!

Why it’s important to understand the difference between revenue and income

Walmart’s profit for the year actually corresponds roughly to their historical revenue vs. income relationship (the year before the company's income was $9.86 billion from $500 billion revenue). Nevertheless, their gap of revenue to income illustrates that, even for huge companies, the two concepts are not easily interchangeable.

Understanding the relationship between your company's revenue and income allows you to gauge progress, build up tools for analyzing where your processes can be improved, and develop a true picture of the health of your operations.

Financial statement

Knowing how to track revenue and income separately is key to producing an accurate financial statement.

For the top line, ensure that all revenue streams have been accounted for, including any direct investment into the company since the release of your last statement.

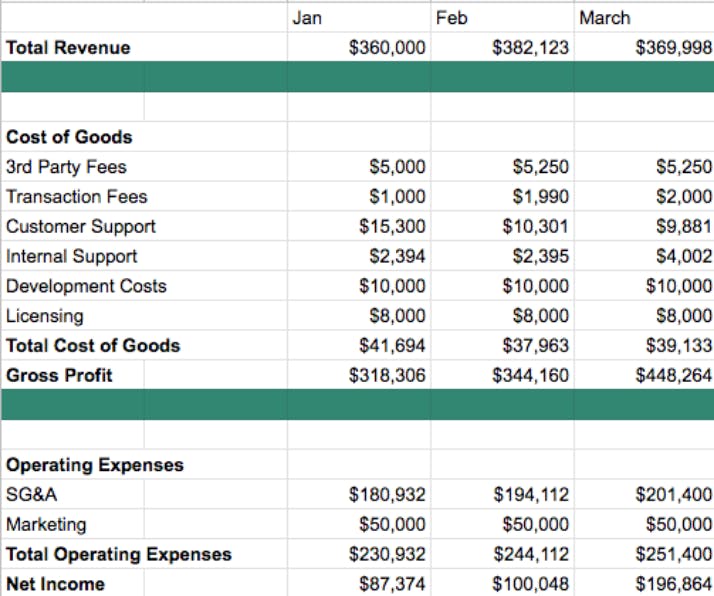

For gross income, ensure your accounting team has a grasp of the different areas of expense. A detailed loss statement can spell out selling, general and administrative (SG&A) costs often form the bulk of the expense for SaaS companies. Cost of goods and vendor fees are likely to play a part too.

It all contributes to the bottom line. If your revenue vs. income relationship is looking particularly unhealthy, you may need to consider expanding your statement reporting to include a line-by-line review of all SG&A expenses to look for ways in which those expenses can be reduced. Making reductions on seemingly marginal expenses (i.e., the expensive, brand-new 20-person office your six-person team just moved into) may not seem like difference makers, but cumulative cutbacks can improve your company’s outlook.

Financial reporting

An accurate understanding of the revenue vs. income dynamic makes representative financial reporting possible. This is fundamental to your ability to analyze processes in your company that could be harming your bottom line.

You cannot possibly make representative month-on-month forecasts of your business without a sound grasp of how revenue breaks down to income on your balance sheet. When doing your own internal reporting, accurate numbers allow you to build estimations of next month’s revenue/income based on the relationship as it stands now and how the relationship will be affected by external factors (increase in demand, improved vendor relationships leading to lower supply costs, future increase in costs of providing service, etc.).

Beyond month-on-month forecasting, a revenue-oriented approach to a company's financial reporting won’t tell you much about your company’s long-term outlook. Basing reporting on net income, incorporating an understanding of the cost of goods sold (COGS), etc., will show you how to adapt your approach to remain competitive in the market and how to use your revenue to drive real growth.

This is what the financial reporting for a SaaS company in good health might look like. Their SG&A is under control (no need to break it out into individual expenses), vendor fees are constant, and the company has a good chance of seeing more improvement in its next month.

Tax documents

Once you’ve subtracted all your business expenses, the income number you’re left with is still only income before tax. Unless you want to get audited, tax documents need to be down to the tee on revenue/profits.

Having an awareness of where your business sits relative to business tax requirements is an important stage in preparing financial documentation. Understanding the difference between federal, state, and local tax requirements for your business is important. Prepare the calculation of your income and then subtract your annual income tax bill. The result will be the final picture of your net income.

Investor meetings

Investors are unlikely to be moved by reports of vast revenue growth; it’s profit that they’ll be getting a portion of and profit they’ll care most about.

Understanding revenue-income dynamics helps demonstrate a broader understanding of operational efficiency to investors. Evidence of sustainable operations may seem like a less sexy thing to give to investors than an off-the-charts sales quarter, but demonstrating that sustainability (minimal overspend on things like rent, salaries, total sales commission, information technology, and accounting costs) is a sign of an income-focused business looking to be profitable, not one that’s simply looking to sell at all costs.

Moreover, an income-focused approach will help you avoid a fatal mistake often made by young companies: neglecting the customers you’ve already won. In SaaS, existing customers are the most profitable ones, the ones who will inflate your bottom line with comparatively little need for new expenditure from your company. Placing priority on retaining business (preserving and upgrading client/customer relationships, etc.) not only steadies the revenue ship by keeping money coming in steadily but vastly improves your long-term prospects for income and profitability. New customers, lest we forget, are more expensive than existing ones.

High revenue and high income are the targets for most businesses; depending on your company type and industry as well as cost reduction and your skill in upselling to existing clients, you might even find yourself turning high income out of relatively small revenue.

It’s ultimately a question of profitability. Whatever your product or service, and whether or not you’re ready to take on Walmart for the title just yet, properly managing the relationship between your revenue and income will result in a model of operations that is profitable.

Revenue vs. income FAQs

What is net revenue vs net income?

A company's net revenue is the money it has earned from performing its core business operations. Net income is the profit that a company has earned after covering the expenses, and taxes, and after accounting for all gains and losses.

What is operating revenue?

Operating revenue refers to the revenue generated from the company's primary business activities. Depending on the type of business, operating revenue can be generated from the provision of services or sales of products.

What is the difference between operating profit and net income?

Operating profit is the company's profit calculated after taking out the expenses but before accounting for the taxes, debt, and costs of certain one-off items. Net income, on the other hand, is the company's profit after accounting for all the expenses.