By law, Paddle must apply VAT / Sales Tax to any transaction where it is applicable.

Vendors can choose how they want to handle sales tax on the Sales Tax Settings page in the Paddle dashboard. There are two options available to you as a seller;

- Include VAT in the price (VAT-inclusive pricing)

- Add VAT to the price (VAT-exclusive pricing)

By setting VAT-inclusive prices, the price you’ve input will be the price the customer sees, and the sales tax will come of out this price. Whereas, if you choose to have VAT added on, the % rate of sales tax the customer is due to pay (eg. 20% in the UK, 18% in Spain, etc) will be added on top of the product price you’ve set.

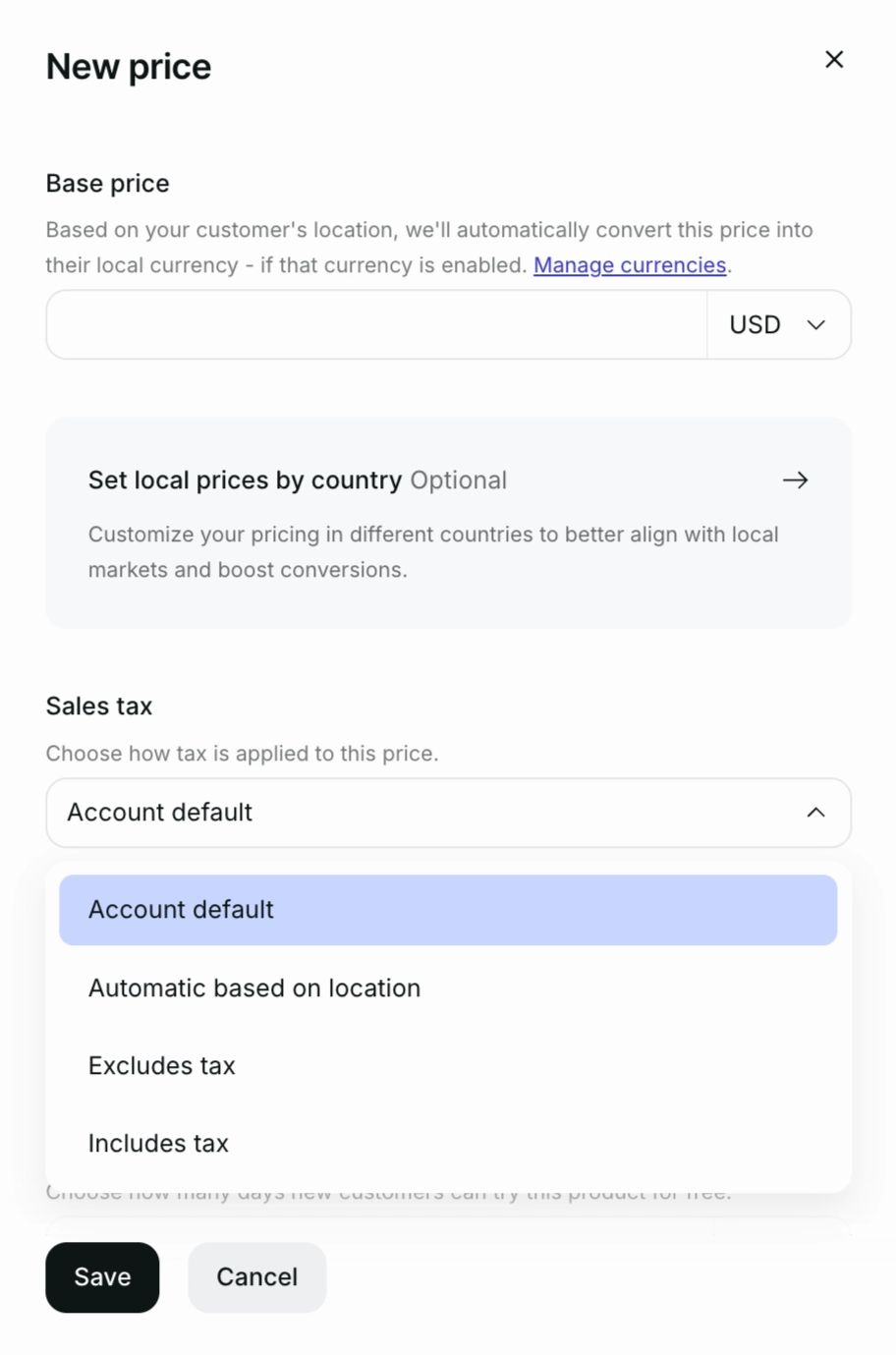

Price Specific Tax Settings in Paddle Billing

When creating a new price for a product in Paddle Billing, you can set a custom tax setting for that specific price by choosing from the "Tax" dropdown. This selection will override the default account tax settings and apply only to this particular price.