You think you know what your board wants to hear: exponential growth, overwhelming booking numbers, and a bulletproof business. But what they actually want to hear is the truth.

Your board members want to see the numbers behind your company's progress laid bare, and they want to see your framework for improvement. They have the same goals as you—to build a successful business—and they have the expertise and perspective to help. But they can only do that if you give them the right numbers to work with.

The metrics you present should speak to your higher-level goals while showing a complete picture of your company's current state. This means being clear, transparent, and forward-thinking. Learn from the decks of real companies and a sample deck we've built for a fictitious SaaS company—then put your own metrics to work to show your board what they really need to see.

Principles of how to communicate with your board

Board meetings present valuable opportunity: they might be the only times some of your board members get to check in and hear updates on your company's progress. It's also a chance to access their learnings from the industry or from building a company. You have to give them good data so they can provide this necessary perspective.

Many early SaaS companies measure metrics every month, so here we're focusing on monthly metrics. Other companies, especially more mature companies, might measure their progress quarterly or annually, in which case they would focus on different metrics.

Your board meetings—beginning with how you craft your board deck—should be guided by principles that facilitate the easiest and cleanest transfer of information for everyone involved. This means building your deck around clarity, transparency, and goals for the future.

1. Lean and clean

Your deck should be concise and well-curated to reflect the most important issues that you want to discuss with your board. Notion Capital, an investment firm that focuses on early-stage B2B companies, recommends keeping your deck to about a dozen slides.

The best way to maintain clarity is to zero in on the issues that are most important to your company at the moment:

- Structure discussion time around very specific questions; vague agenda points will enable distraction. For example, “improving marketing campaigns” isn't a productive agenda point. A better discussion point would be, “Are we prepared to redirect $5,000 in marketing spend from channel x to channel y in the upcoming month?”

- Keep the design of your slides simple. Don't overwhelm the slides with excessive numbers or text, and use graphs where you can show rather than tell.

- Send your deck out to your board members at least one full day before the board meeting, and ask them to review the deck before the meeting. This ensures that everyone knows exactly what you want to talk about and comes prepared with relevant questions.

For example, this slide from a deck by Front shows how clarity helps deliver a powerful message.

[Source]

The design of the slide is clean and uncluttered. There are only a select few metrics presented, and they tell a complete picture of how Front uses their capital. No information is lost, and the metrics take the spotlight.

2. Good, bad, ugly: Be transparent about struggles

When Bill Gates sits on the board at companies, he is reported to require that at least 50% of what CEOs report to be bad news.

That may be extreme, but you shouldn't hide bad metrics or concerning news from your board. No one wants to hear about month-over-month growth if that's not really what your growth looks like. Imagine: you wouldn't want to pretend blood pressure is 120/80 if it's not truly that healthy. That's not beneficial to you. You'd want to measure it, and then get your doctor's advice on how to maintain or improve it.

You should do the same to take care of the health of your company and be honest about your growth metrics. When thinking about what to discuss with your board, consider what “bad news” reflects about your current processes:

- “Where have metrics fallen, and what has changed in the way we operate that might have caused that fall?” Learning these self-reflective processes when you are a small company will establish good business practices for when your company is more mature and your problems exist on a much larger scale.

- “How do our metrics compare to industry standards?” Show that you have a thorough knowledge of the industry you're in. Comparing yourself to other successful businesses in the industry shouldn't put your company down, it should shed light on possible ways to improve.

- “What are we going to do to improve X?” Your metrics aren't always going to be great. What's more important is figuring out how to improve situations and working together with your board to develop solutions.

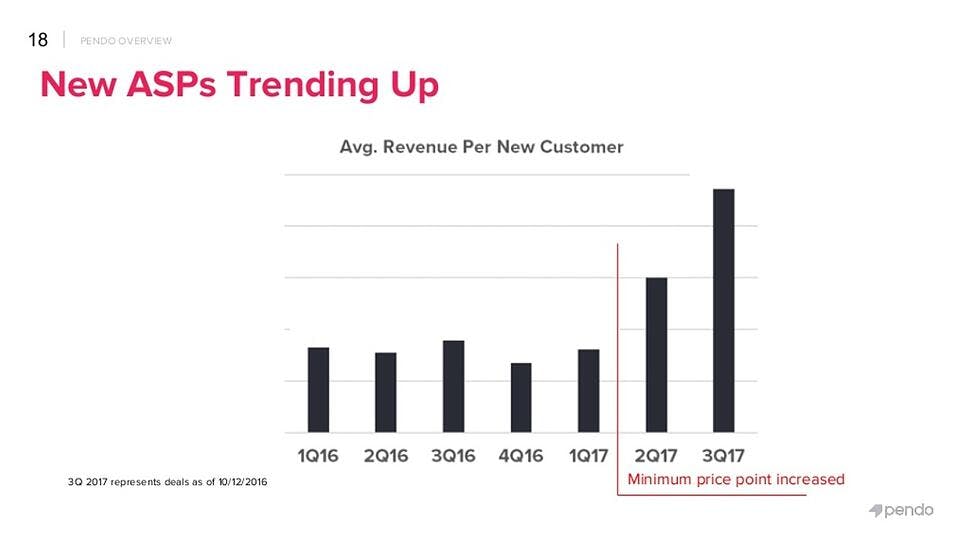

In a slide from Pendo's deck below, they acknowledge that their average revenue per new user in the past has been low.

[Source]

But they show a positive upward trend and pinpoint the action that leads to the improvement. By sharing this with their board, the board has a better understanding of how Pendo will troubleshoot other lagging metrics.

3. The long and the short of it: Show goals for the future

Wistia CEO Chris Savage swears that your company's growth isn't dependent on being a fresh-from-the-accelerator startup. It's about building for long-term success and not being distracted by short-term validation.

Focus on how you can build structures that enable long-term success:

- Determine what customers value most in your product and brainstorm ways to expand out upon that value. This will help you acquire more customers and drive expansion revenue from customers who want more of this value.

- Forecast how the market might evolve given the past trajectory, and understand how this will affect your acquisition channels, your customer acquisition costs, and your market-product fit.

- Create internal feedback systems and work on aligning your team around specific goals. Alignment will make everyone's efforts more productive, and a sense of community and teamwork across your entire team will help make the company a great place to work for all of your team members.

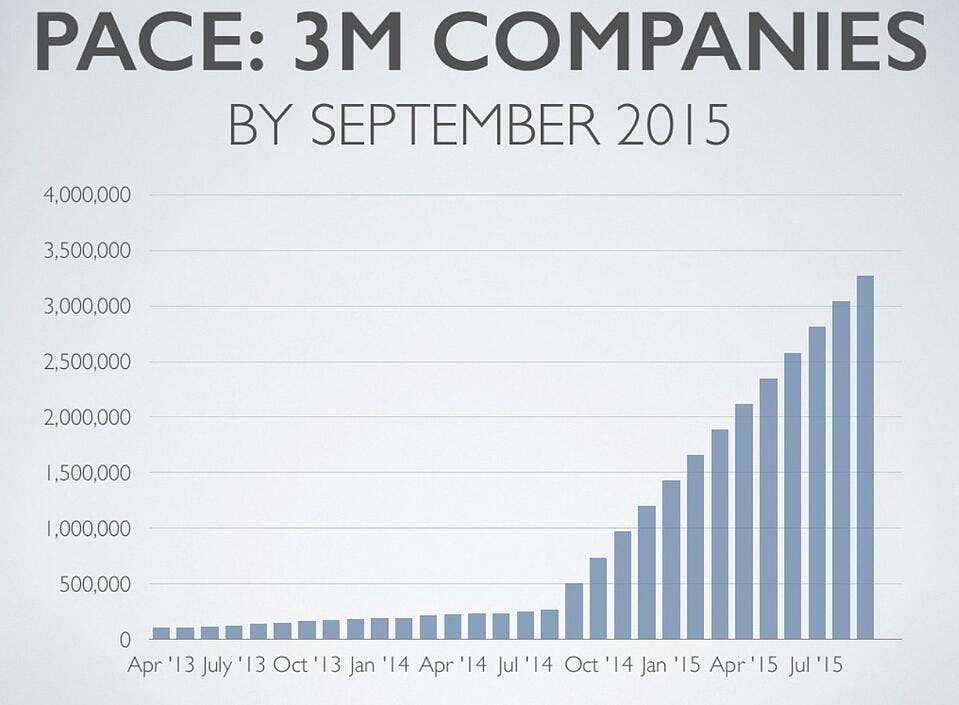

A slide in a 2014 deck from Mattermark puts its goal of 3M companies by September 2015 goal front and center.

[Source]

Communicating this goal shows that Mattermark has a long-term growth plan. They also clearly map out the appropriate trajectory for obtaining this goal. At this point Mattermark was looking to raise VC money, so their growth trajectory accounts for an increase in capital.

Above all, the information you present in board decks should be forward-looking. Showcasing short-term wins is gratifying, but developing a sustainable strategy for growing metrics over time is smart.

The nitty-gritty: Show the right metrics that describe your growth

A good board deck hinges on choosing the right metrics to talk about. “The right metrics” should be a combination of numbers that describe your current revenue growth, show current spend, and indicate how customers will contribute to your company in the long term. Make sure you keep the metrics the same from meeting to meeting so that the board can track progress over time.

These are the metrics that you need to include to give your board the true picture of your company's current state:

1. Net MRR Growth

Net MRR Growth is the core of the SaaS business model. The attraction of a subscription business is that you pay customer acquisition costs once to build a base of customers that bring in revenue every month. You need to include this in your deck to show your company's momentum and provide an overview of your month-to-month business activity.

Break down your net MRR into new revenue from acquisitions, expanded revenue from up-sells and cross-sells, and lost revenue from downgrades and churning customers. This is a visual representation of your company's quick ratio, or a comparison of your revenue gains and revenue losses. This is vital to include because it prevents any gains or losses in revenue from slipping through the cracks.

2. Payback period

A SaaS company's payback period is the time it takes to recover the costs of acquiring a customer. You want to aim to shorten your payback period to recover those costs as quickly as possible. Then, incoming revenue from a customer can go toward profit or be put back into the company to fuel growth. Payback period is essential to your deck because it describes a limiting factor, which has a huge impact on how fast your company can grow.

VC at Matrix Partners David Skok recommends that SaaS companies keep their payback period below 12 months so you don't sabotage your own growth with the weight of your customer acquisition costs.

3. Cash Flow

This is a very important slide because cash is the fuel for a bootstrapped company. It's imperative that you keep a close eye on your cash flow and preempt any possible cash issues far in advance. Co-founder and manager at Bigfoot Capital Brian Parks points out that you should never leave yourself in a position where you absolutely need someone else's cash to keep your business running.

If you're a bootstrapped startup, your board isn't going to expect you to have the same type of long runway that venture-backed companies might have. At the same time, if you run out of cash, it's a sure death for your company. Balance your growth and scaling, as well as your customer acquisition costs, with your cash in the bank to make sure you always have a reliable cash flow.

4. Churn rate

A low churn rate indicates happy customers, an effective product, strong marketing, and good retention strategies. Your board will always want to know your churn rate, because it's a huge indicator of how well your product sticks in your market and how likely your company is to have long-term success.

Include user churn and MRR churn in your deck to show your board how customer attrition impacts revenue. You should show both gross MRR churn and net MRR churn—a very low net MRR churn will indicate that you're expanding plans from current customers significantly, which is an excellent growth strategy.

5. LTV:CAC

A SaaS company has to meticulously analyze its LTV:CAC ratio because it is the foundation of your unit economics. A high LTV:CAC ratio means that a customer's lifetime value is much greater than your company's costs to acquire them. Customers with high LTC:CAC ratios are very valuable for steady revenue growth over time. The LTV:CAC ratio needs to be over 3:1 in order for the company to be successful in the long-term.

When you present LTV:CAC ratios to your investors, you should break down your customer base into different buyer personas and different acquisition channels. This will show you and your board where your most valuable customers come from and where you need to focus your marketing to spend efficiently.

Measure and communicate these metrics every month to build a rock-solid foundation for your board meetings. Other information, including hiring information, critical discussion topics, a product roadmap, and key wins and challenges, can be presented in additional slides. But these core metrics are the basis for a strong and productive board deck that ensure you get the most out of your meetings.

How to simplify your board reporting

Spend less time wrangling data for board reporting by using a subscription analytics tool to calculate and visualize your key performance indicators for you. Free tools like ProfitWell Metrics save you time and ensure the metrics you share are accurate and reliable. ProfitWell Metrics integrates easily with your usual revenue tooling. Give it a spin today.

Your board is an extension of your team

Your board members provide important perspective during board meetings because they are removed from the day-to-day struggles and celebrations—so they can view your progress less emotionally and more clinically.

Building a clear, transparent, and forward-looking deck is the best way that you can help your board do their job and set your business up for long-term success. Hit these key metrics to showcase your company's unique personality and growth, and be honest with your board, and yourself, about how you can improve.