The SaaS business model is unlike the traditional business model in many different ways. Perfecting it can be difficult without the right tools. Explore the fundamentals of how SaaS works, including models, metrics, and tools for SaaS growth.

Ever since John Koenig first coined the term “SaaS” back in 2005, the software-as-a-service industry has been one of the fastest-moving and creative in the world. And with the field having undergone a couple of “knockout expansion years,” with more revenue pouring into SaaS than ever, it has never been a better time for a young SaaS company.

The SaaS business model powering all of this activity is startlingly unique, still young, and inextricably tied to the power of cloud computing. Understanding the fundamentals of how SaaS works is vital when building out a plan for your company’s forward growth.

What is SaaS?

SaaS, or software as a service, is a delivery model in which a centrally hosted software is licensed to customers via a subscription plan. Any company that leases its software through a central, cloud-based system can be said to be a SaaS company.

A SaaS company maintains responsibility for the servers, database (and the data they contain), and other software that allow their product to be accessed and used. The subscription plans offered to customers can vary considerably within separate companies; some SaaS company business models involve offering multiple applications within their product, with different subscription plans giving access to different services.

How does the SaaS business model work

The reason we’re distinguishing between the SaaS business model and the rest is that the SaaS model includes a number of factors peculiar to it, such as:

Recurring payments

In SaaS, clients do not buy hardware. The software-as-a-service business and pricing model involves providing a subscription service to use the app, so you will have to worry about paying the yearly or monthly subscription as opposed to only once.

Recurring payments take the form of monthly recurring revenue, otherwise known as MRR. Because a SaaS company provides a service, not a product, accounting for revenue properly can be difficult. When your customer signs the contract and subscribes, you may get some cash upfront, but that cash cannot be counted as revenue until you've earned it. Until then, it is a liability—money that your customer can ask to be returned at any point if you don’t deliver your service.

As a result, revenue recognition is a fundamental part of the SaaS business model.

Heightened customer retention

All businesses care about customer retention, but in the SaaS revenue models, it is 10 times more important because retention of paying customers is the only thing that keeps you afloat. As we said above, you can’t lay claim to all of your clients’ subscription money until you’ve provided a complete term of service, so if you’re signing customers up for 12 months who are then leaving after 2, then you’ll be without the other 10 months of recurring revenue.

As a result, the SaaS business model puts tremendous value on cultivating customer relationships and upselling. An existing SaaS customer spends more, on average, than a new customer, and are more than seven times more likely to churn (leave your business) to go to a competitor because of poor customer service than they are for a better product.

Consistent updates

While other products may come out with “next-gen” product versions, SaaS consistently provides smaller and more frequent upgrades to their services to keep the end-users happy and have better customer lifetime value.

Part of this comes from the nature of being in the software business: software vulnerabilities can put customer information at risk from hackers, so continually assessing the state of security fixes is a top priority in the SaaS model. Hosting their own products also means SaaS companies can push updates whenever they need to, releasing new features, enhanced versions of old ones, and new product enhancements. By combining this with good customer communication, SaaS companies can be highly responsive to the needs and feedback of their customer base.

SaaS business stages

As we’ll see shortly, highly successful SaaS businesses can boast valuations in the $100 millions, serve a huge number of customers, and completely change the way in which entire industries think about aspects of their business. That, however, is the final and most successful stage of the SaaS business model. Broadly speaking, a SaaS business’s life can be broken down into three stages:

1. Early-stage

In the early stage of your SaaS business, you as the business owner or entrepreneur are still operating at the bare-bones level. You’re unlikely to have many customers, and your product will still be in its early developmental stages. You may be seeking your first round of pre-seed funding, or you may have decided to go for the bootstrapping approach to maintain better control of your operations.

In the early stage, your staff roster will still be small, you will more than likely still have only one product you’re focusing your attention on, and you may not have started to turn real profit yet.

At this stage, you should be asking yourself these main questions: Am I tracking metrics, bringing in new users, and looking to optimize pricing? Have I begun developing my own personal business model that will enable me to seek the right kind of funding and use it well?

2. Growth stage

The growth stage is where things start to get exciting. You’ve built something that’s growing fast, your product is gaining subscribers, and you’re beginning to bring in MRR and possibly positive cash flow.

To kick off your growth stage and to continue powering through it, you will need to begin raising serious funds that will allow your company to grow its team, invest in product development and iteration, and scale. There are a number of funding types that serve the SaaS business model, including:

- Venture Capital: The glamour means of procuring funds for your startup, venture capital is provided by firms or funds that see high growth potential or a strong track record of recent growth in a SaaS company, enough to merit substantial financial assistance.

- Angel Investors: An angel investor is a single operator with substantial financial means who is prepared to make an investment in your company. They can be ideal for startups looking for their first big investment, although, more recently, so-called “super” angels have begun to play a decisive part in later funding rounds too.

Venture capitalists and angel investors are not the only routes to growing your business. Some companies go through incubators in their very early days; other, slightly more established SaaS companies find startup accelerators that meet their needs and use them for a different kind of funding experience. Some companies continue to bootstrap for a much longer time, and others are so adept at raising revenue from the start that they find they don’t need external funding until much later.

Now, you should be asking yourself these questions: Have I established key performance indicators (KPIs) to ensure I’m primed for further scaling? Do I have a strong monetization strategy in hand for when I do decide to seek some form of investment?

3. Mature stage

A SaaS company that has reached the mature stage has proved itself and can consider itself established. A company at the mature stage has a well-defined target audience that it’s catering to and has a reliable product that it’s making updates to. The company is bringing in good MRR, and all the other key KPIs (more on those to come) are stable. Mature-stage companies might still seek and receive investment, but it’ll be of a much larger order, aimed at breaking new markets or buying out competitors.

The main question a SaaS company should be asking itself at this stage is: When is the last time we checked our pricing strategies? SaaS companies often reach the mature stage and settle into a sense of complacency, thinking that, because their business is solidly profitable, it must be running at its maximum potential. In fact, mature-stage SaaS companies are often positioned on a pile of potential revenue that they’re wasting with poorly chosen price points.

9 SaaS business examples

The variety of successful SaaS-type businesses is astonishing; there are examples of tremendous success in the B2B and B2C spheres, in AI and video hosting, in e-commerce, in data analytics, and more. To show you just how broad success in SaaS can be, we’ve compiled a list of a few SaaS businesses that have made a serious impact in their fields — or, in some cases, created new ones!

Wistia

Wistia is a company providing video-hosting services for businesses, from uploads to tracking performance to building audiences and brand attention. Brendan Schwartz and Chris Savage founded the company in 2006 and got their first client, a medical devices company, that year.

In 2019, the picture is pretty rosy for Wistia. Despite taking relatively little investment in its early days, it's now the video-hosting service of choice for more than 300,000 businesses across 50 countries that depend on Wistia, bringing them more creative and authentic communications.

Shopify

Shopify is an e-commerce platform for online stores, allowing businesses to create online stores without needing to know how to code. Shopify has completely revolutionized the way businesses think about e-commerce in the process; now, any retailers, big or small, looking to sell online, on social media, or in person have a single integrated solution that can meet their needs.

Shopify has been amply rewarded for its innovations in e-commerce. It made over $1 billion in 2018 and have well-exceeded that total in 2019. Since then, Shopify has grown to 4.4 million active merchants in 2023.

Chorus.ai

Artificial intelligence has been one of the primary growth areas in SaaS during the late 2010s, and no company exemplifies the potential of that field more strongly than Chorus.ai. Chorus is a leading conversation intelligence platform for sales teams. The company’s solution functions as a plug-in to video-calling services, allowing sales teams to record their business calls and extract meaningful data.By recording and analyzing the contents of sales calls, commercial teams are able to refine their approach to selling, curate new training surveys, and regimes for their reps, and come up with new in-depth strategies for better communicating with clients.

Chorus’ solutions are used by world-class revenue teams at other great (SaaS!) companies like Zoom, Adobe, Asana, and Segment.

Lever

Just when you thought recruitment was one of those fields that could never change, a SaaS company came along and changed everything. Lever revolutionized the recruitment sphere with its streamlined processes for sourcing, attracting, and hiring new talent. Its talent software makes it easier for employers to vet candidates, take care of talent marketing, and foster connections between employers and employees through the company’s cloud service.

Much like Chorus, proof of Lever’s success comes with it being used by such seminal companies such as Shopify, Eventbrite, and Netflix to fill their offices with the best employees.

Clearbit

Clearbit creates products and curates data APIs aimed at providing insights throughout the customer life cycle to help businesses grow. There are few industries where clear communication between client and customer is more vital than in SaaS, and Clearbit’s resolution to help those who work with it “understand [their] customers" has made it a vital asset to those they work with.

Clearbit’s ability to do this, as well as their cutting-edge means of identifying future leads and personalizing marketing approaches, has led it to be designated one of the fastest-rising companies in SaaS.

UiPath

UiPath is a platform for robotic process automation. Its use of robotics and sophisticated scripts allows you to automate repetitive or redundant tasks from your schedule, and its innovations in drag-and-drop architecture will bring entirely new possibilities to front-office intelligent automation.

Much like the rest of the companies on our list, they’re not doing badly, either. UiPath has a yearly revenue of over $300 million and was ranked first in the Deloitte Technology Fast 500 on November 6, 2019.

Segment

Segment is a single API tool that allows you to collect, standardize, and activate customer data, providing a data foundation for growth. As the volume of data possessed by companies becomes increasingly sprawling and unmanageable, and as the public desire grows for clarity and integrity in data handling, Segment has slotted seamlessly into an area of need in the SaaS market.

Segment, like Clearbit, is a real up-and-comer and is valued at$1.5 billion—its done it by attending to real practical and ethical needs in the industry.

Truework

Truework’s product automates employment- and income-verification requests for HR teams. In a not totally dissimilar way as Segment, Truework identified a series of pain points at which sensitive personal information tends to be exchanged—for example, when you change banks, buy a house, start a new job, or found a company—and saw a need for greater security in these transactions. Through this, the company has built “a network for verified identity that puts consumers in control of their sensitive personal information,” emphasizing “privacy and ownership.”

Truework is at a considerably earlier stage in their success, but having received their first Series A funding round less than two years after being founded, it's surely destined for great things.

Thrive TRM

Thrive is a software company that develops cutting-edge applications to help recruiters and talent executives make better hiring decisions. Its platform features collaborative, easy-to-use database capabilities that combine the best elements of a CRM and an applicant tracking system in one, seamless, cloud-based solution.

The firm’s clients include several of the most valuable U.S. tech companies, and it has helped place more than 6,000 managers, professionals, and board members since its launch in 2015.

The SaaS business metrics to keep an eye on

SaaS companies are powered by data, and success in the field is predicated on how you maintain awareness of key metrics, how they interact, and how to improve then. The following are five key business metrics that determine the health and potential of a SaaS business.

Lifetime value, (LTV)

LTV is the total amount you’re due to receive from a customer over the life of their account with your product.

The LTV of a user is one of the most important metrics for a SaaS business, and it’s vital that you calculate it the right way. Retention-rate numbers (which we’ll come to shortly) are important but leave gaps in your understanding of how much retained customers are bringing in each month and won’t tell you much about the success you are (or aren’t) having with upselling. LTV brings you this precise understanding.

Customer acquisition cost (CAC)

CAC is the total cost of sales and marketing efforts that are needed to acquire a customer.

The fact of the matter is that bringing on new customers costs—and it’ll be a considerable time after bringing a new customer on board that the additional MRR offsets the cost of winning that new customer. You need to keep tabs on your CAC to ensure that your LTV is able to comfortably outpace it.

Being too conservative with how much you’re willing to spend on CAC can lead to missed opportunities for revenue and growth from new customers; but being too reckless with it can lead to often critically low profitability.

Monthly & annual recurring revenue (MRR & ARR)

MRR and ARR are the lifeblood of a SaaS business. They measure the total amount of predictable revenue that a company expects on a monthly or yearly basis.

Many companies manage to make a mess of their MRR, nevertheless. A survey hosted by ProfitWell showed that one in five SaaS companies were not reporting expenses correctly when accounting for MRR; two in five were incorrectly including trialing or free users in some manner in their MRR; and a majority were making mistakes when differentiating between monthly, quarterly and annual payment timelines.

There is no excuse for slackness with MRR, regardless of the fact that it’s not a figure you need to report to a government entity. It is a key statistic that allows investors to monitor the status of your company and is as important for you when plotting your trajectory.

Churn rate

Churn rate is the percentage of your customers leaving your service over a given period. It’s the nightmare statistic in the SaaS business model; even a little bit can be extremely damaging to a company’s hopes for sustaining the momentum of its growth.

In fact, churn can be ruinous for companies even when all of their other metrics are reasonably healthy. Knowing the foundation of your customer churn rate and the means by which you can reduce it could not be more important in SaaS.

It can be a complex metric to get a full picture of. Breaking down your churn into segments and cohorts will reveal the different drivers behind your churn, while failing to correctly account for trialers or episodic/seasonal customers when plotting churn can muddle the picture. At our last count, there were 43 different ways public SaaS companies were accounting for the metric.

Retention rate

Your ability to retain customers is your foundation for growth in subscription-based services; churn is the flip side of retention, and keeping retention high is as important as keeping churn low.

You may have noticed a pattern emerging in our speculations on key SaaS metrics—and, yes, like all the rest, there’s a serious tendency among SaaS companies to calculate their retention rates incorrectly, too. Both user and MRR retention need to be calculated in tandem, so you can account for both the effects of your product, marketing, customer service, and pricing and the likelihood of sustaining profitability.

You might not be taking care to differentiate between customer life-cycle stages when calculating retention rate, either, or between the plans your customers are on. In short, there’s a lot that can go wrong with your retention-rate calculations.

3 tools that help SaaS businesses grow

Now that we have a pretty solid understanding of the SaaS business model, you might already have started wondering what’s available to allow your business to get the best of the competition and really start to grow. We’ve got a few tools here at Paddle that can really help young SaaS companies grow.

Billing software

The SaaS business model is based on recurring billing, so you won't get very far without a decent recurring billing tool. There are a variety of solutions for managing subscriptions and recurring billing out there, but in many cases, you'll need to integrate these tools with a broader payments stack to manage payments and revenue. This can get messy fast. Or you can take an all-in-one approach and use a merchant of record.

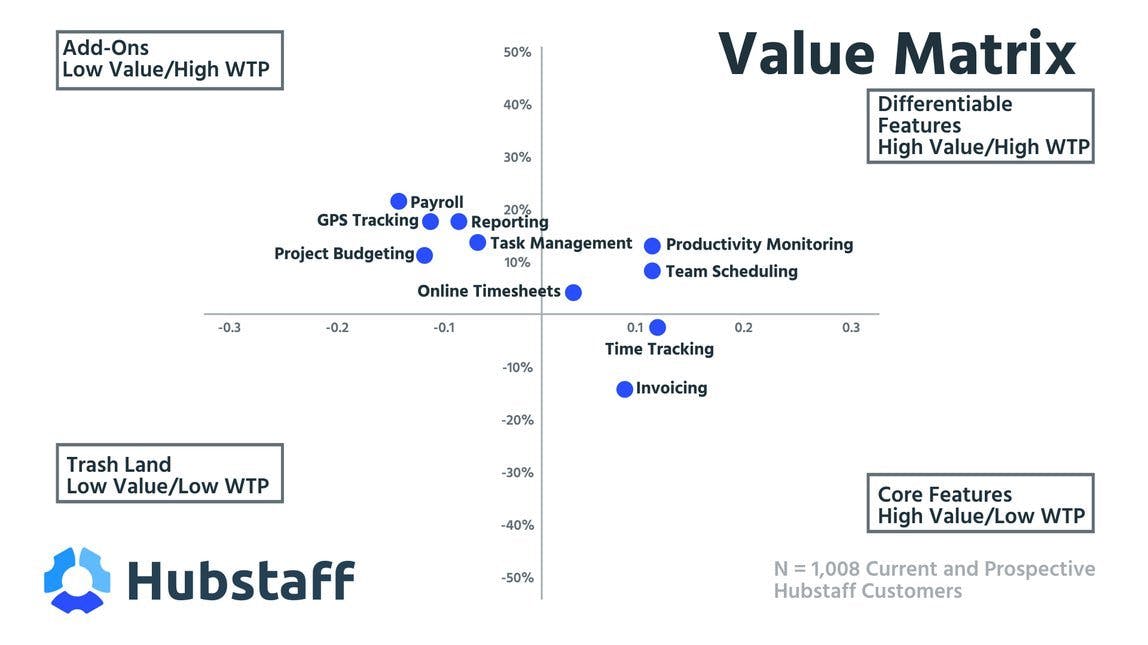

Analytics

As we saw above, your grasp on your data informs your success as a SaaS company: a well-organized, powerful analytics solution can make all the difference. Continued insight into the drivers behind your growth is fundamental for success in the SaaS business model: which customer segments are driving and detracting from subscription growth, which features in your product command the highest willingness to pay among your customer base, which features are leaving customers at more persistent risk of churn.

Retention software

For all their importance when gauging the health of your SaaS business, churn and retention rates are seldom completely understood by young companies. Identifying customer cohorts and tracking revenue retention, MRR churn, and delinquent churn can be difficult to do without resorting to a plethora of spreadsheets. Tools that aid your retention rates and help drive down churn, while minimizing the chances of human error or misreporting, are vital.

What’s next for SaaS businesses?

The range of applications in SaaS is virtually limitless, and with the means of fundraising continuing to diversify, it has never been a better time to join the field.

Still, all of the most successful software-as-a-service companies underpin their success by adhering to a few fundamentals in the SaaS business model: a reliance on good statistics and the use of the right tools and solutions. Apply the same principles to your business and you might find yourself heading in the same direction.

SaaS business model FAQs

What is SaaS business model?

SaaS business model is based on selling cloud-based software for a subscription fee. The cloud-based software is usually accessible via mobile, desktop, and web apps, and the subscription fee is usually monthly or annually.

What is SaaS revenue model?

The SaaS revenue model is based on regular and ongoing payments to use software or a different digital product or tool. The payments have a defined period, and the most common two are monthly and annually.

Is Netflix a SaaS?

It may sound unusual initially, but yes, Netflix is indeed a SaaS. Netflix sells the software to stream movies and TV shows, both licensed through distribution deals and produced by Netflix.

What are the benefits of using Saas?

There are many benefits to SaaS software. The biggest include cost-effectivity, scalability, better security, no licensing management, and more scalability.