At the end of the day, your company's real goal isn't more customers--it's more revenue. Will growth hacks get you there? Let's take a look.

What is growth hacking?

Growth hacking was coined by Sean Ellis to describe strategies that singularly and obsessively drive a company's growth. The idea of growth hacking is ambitious, if not vague. Ryan Murphy wrote growth hacking “is more of a mindset than a toolkit,” while Paul Graham acknowledges growth is a “bewilderingly multifarious problem.”

- User retention

- Monetization

- Upgrading and cross-selling

- User on-boarding

- Customer success

- Feature development

Growth does not, and should not, solely focus on aggressive acquisition.

How do you calculate growth?

SaaS growth can be measured in many ways. But calculating revenue growth is one of the best ways to gauge the health and success of your company because:

- More revenue equals more resources to repay customer acquisition costs and get your company out of the red

- More revenue equals more resources to pour back into sales, marketing, product development, and customer success

- More revenue equals more opportunity for profit and success for your team

To calculate revenue growth, most SaaS companies track their monthly recurring revenue (MRR). Monthly recurring revenue measures the total amount of predictable revenue that a company expects on a monthly basis. By measuring MRR each month and tracking the changes over time, you'll be able to understand your company's trajectory.

MRR is calculated by summing all of the subscription values of all active customers in a given month.

Breaking down MRR by acquisition cohort, customer plan, buyer persona, et cetera which customers are contributing most toward MRR growth and which could contribute more. MRR growth for various different segmentations provides feedback on other growth levers such as:

- Upselling and cross-selling: MRR can grow when customers continue on with your product and upgrade to a higher plan

- Retention and customer service: keeping customers happy will prevent customer churn and prevent MRR from decreasing

- Monetization: pricing along a value metric makes MRR growth through plan expansions natural

- Product: MRR growth is a strong sign of customer validation and good market-product fit

Does growth hacking work in SaaS?

“Growth hacking,” i.e. finding one quick trick to supercharge your growth, is a fantasy. However, you can grow your SaaS business by focusing on certain overarching growth levers.

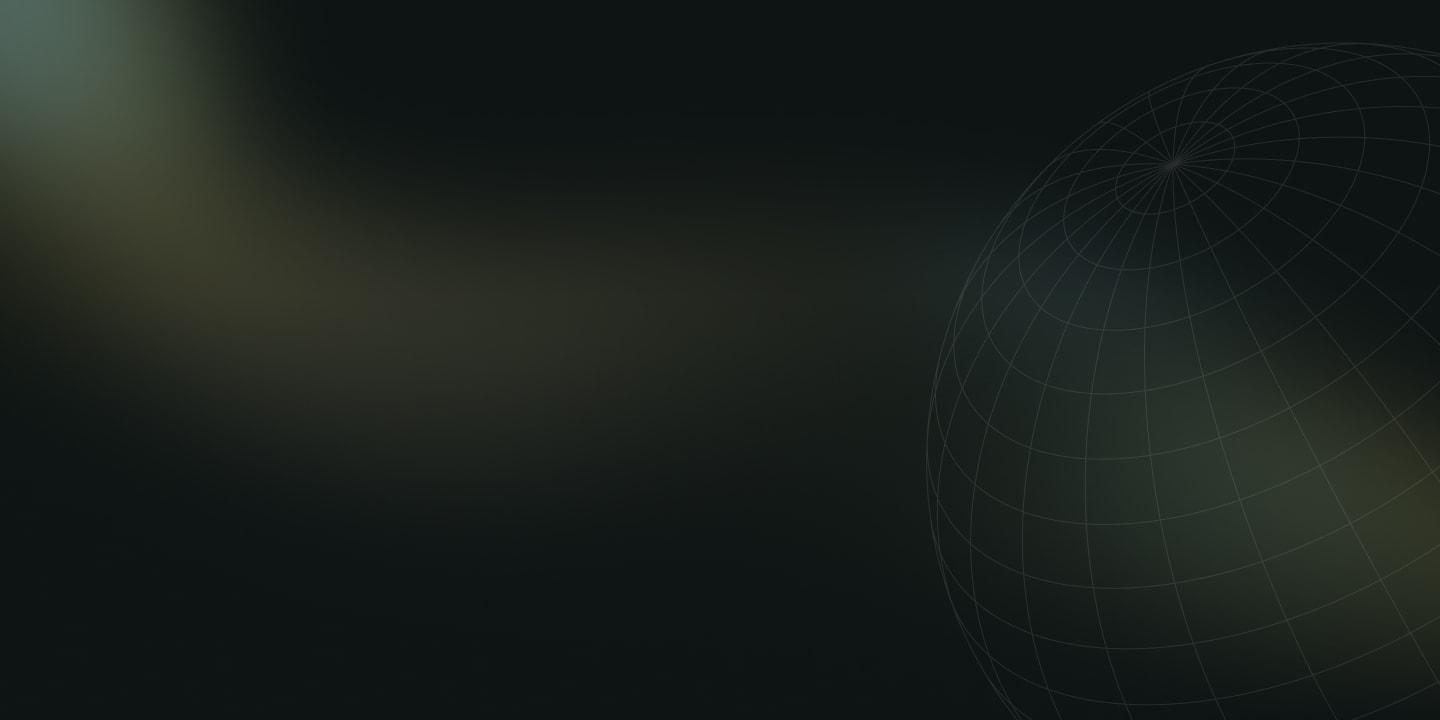

When growth is taken to mean obsessive acquisition, it is extremely short-lived and inefficient. Unfortunately, many SaaS companies rely too heavily on acquisition as a growth lever. Price Intelligently did a study on growth blog posts to analyze the zeitgeist opinions about SaaS growth and found that the community is disproportionately interested in customer acquisition.

The 70% of blog posts on growth cater to a large audience in the SaaS community that is looking for better ways to acquire new customers. They really should be focusing on retention and monetization if they want to grow faster and more efficiently. There are high costs associated with customer acquisition, and as a result, acquisition is nearly half as effective as retention in growing revenue and nearly four times less effective than monetization. So, sound retention analysis can provide a better ROI than acquisition.

The growth strategies that work in SaaS are those that help you better retain customers and better monetize your existing customers. Improvements in these areas drive up your revenue:

- A 1% increase in customer retention results in a 6.71% increase in your bottom line

- A 1% increase in customer monetization results in a 12.70% increase in your bottom line

Better retention and monetization help you to increase a customer's lifetime value without adding more acquisition costs, which helps keep your LTV:CAC ratio high. Simply acquiring a customer will not improve their lifetime value and saddles you with CAC—so acquisition is actually very inefficient for revenue growth.

Read more about retention and monetization as the best SaaS growth strategies here.

What are the best SaaS growth hacks?

The best way to retain and monetize your customers is to understand what features and what value they care about most. Then you can market this value, expand upon it, and create your pricing around it.

This can't be done with hacks—you need to create a framework for understanding customer value and willingness to pay. Important tools for this are:

- Max Diff surveys

- The Van Westendorp willingness to pay surveys

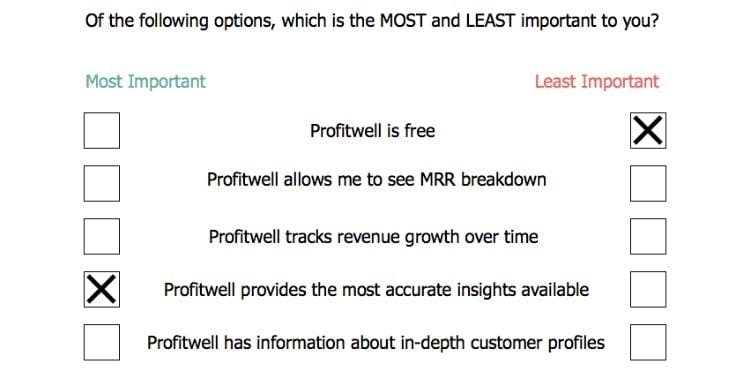

The most effective way to find out what your customers honestly value is to ask them in a Max Diff survey. This asks customers to choose their most and least favorite feature or value proposition.

[Source]

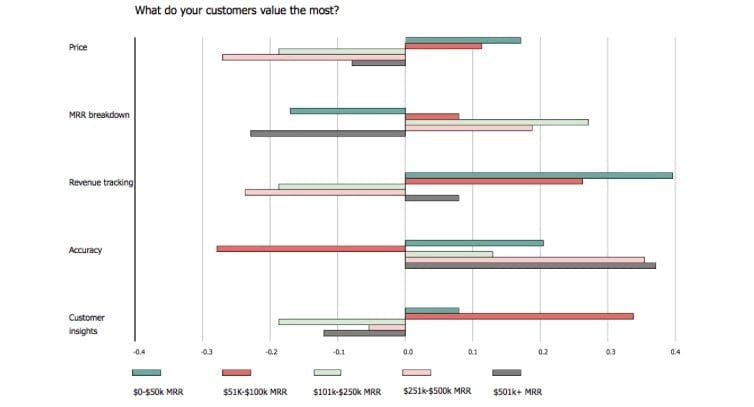

By assigning a “+1” value to the most important features and a “-1” value to the least important features, you can aggregate data of your segmented customer base to learn what specific types of customers value most and least. The following aggregation segments customers by MRR ranges.

[Source]

With this type of data, you can quantitatively identify the aspects of your product you should communicate and expand on. This will help you retain customers by giving them the features that best meet their needs.

A Van Westendorp survey reports customers' willingness to pay by asking:

- At what price would you consider the product to be so expensive that you would not consider buying it? (This tells you a price point that is too expensive for this customer.)

- At what price would you consider the product to be priced so low that you would feel the quality couldn’t be very good? (This tells you a price point that is too cheap for this customer.)

- At what price would you consider the product starting to get expensive, so that it is not out of the question, but you would have to give some thought to buying it? (This tells you a high end of the range of acceptable prices for this customer.)

- At what price would you consider the product to be a bargain—a great buy for the money? (This gives you a low end of the range of acceptable prices for this customer.)

These questions will help you determine the ideal price range for your customers. You can then create tiers at those price ranges, packaged with those customers' preferred features. Monetization like this helps ensure your customer gets the maximum value that they want to pay for, and ensures that you're not leaving any money on the table.

Why is a compass metric important for growth?

Though many companies set targets for growth, not many have systems in place to hold their teams accountable to their goals. Rallying your team around one growth metric makes it easier to develop a strategy in which different team members can play different roles while working toward a common goal.

Focusing on short-term and of-the-moment hacks work against long-term planning. Instead, unify efforts across your team by creating a strategy for focused, efficient growth:

- Choosing one metric: This metric should relate to your revenue growth. Since MRR growth is so fundamental to a SaaS company, this is an ideal compass metric for early stage companies. More mature companies might choose customer lifetime value (the total revenue value of a customer over their lifetime with the company) or MRR churn (the MRR lost each month from customers who deactivate).

- Setting a goal: This depends on the metric you're measuring and the capacities of your company. You should push to grow, but don't set a goal that's unattainable because this will only hurt morale. Steady (as opposed to exponential) growth is actually a very strong way to build an early SaaS company.

- Establishing how frequently you will measure progress: This is what will hold the whole team accountable for checking in with one another and reporting progress. Earlier companies might measure weekly, while more mature companies might measure monthly. This also provides a concrete time to evaluate what's working and what problems that team members are facing.

Communicating about the growth of your compass metric through regularly scheduled emails and meetings will help establish regularity and transparency in your growth process.