We love reading stories of SaaS companies that truly get it when it comes to renewal rates.

Companies like Front, the shared inbox service that keeps growing like a weed every month, despite having average user churn rates.

Or Groove, which dug deep into its user data, analyzed retention, and reduced churn by 71% with a single email.

What makes me sad is that even with the obvious benefits of higher renewals, most SaaS companies still lose huge amounts of revenue to customer churn. Yes, some churn might be unavoidable, but you’d be surprised at how much revenue you could save by implementing a few basic strategies to increase renewals.

Before we dive into how you can increase your renewal rate and level up your revenue, though, let’s take a quick refresher on what your renewal rate is and why it’s so important to measure.

What is customer renewal rate?

In a nutshell, your renewal rate measures the percentage of customers who renew their subscriptions at the end of each subscription period. A high renewal rate is a strong indicator of value—it means your company is more likely to maintain customer interest and generate long-term revenue.

Customer renewal rate Your renewal rate measures the percentage of customers who renew their subscriptions at the end of each subscription period. A high renewal rate is a strong indicator of value–it means your company is more likely to maintain customer interest and generate long-term revenue.

It’s important to note that “renewal” can mean different things to different people, depending on the context. SaaS companies calculate renewal rates in different ways: the percentage of customers, recurring revenue, subscriptions, logos, or other metrics are all valid ways of measuring renewals.

Just to be clear, when we refer to “renewal rates” in this post, we’re talking specifically about customer renewal rate—the rate that customers renew their subscriptions—but we’ll go over how to calculate different renewal rates in a few minutes.

Why SaaS businesses should be measuring renewal rate

Having a good handle on your renewal rate is crucial for every SaaS company. Tracking how renewals are changing over time makes it easy to spot trends and potential growth pitfalls early—an increasing renewal rate means happy customers and smooth sailing, while a decreasing renewal rate could be a sign of rough seas ahead.

Determine the health of your business

Maintaining a high renewal rate is a strong indicator of a healthy and profitable SaaS business. Keeping a close eye on your renewal rate over time makes it easier to spot any unexpected changes, giving you an early indication of problems in other areas of the business.

Retain more customers

Your customer renewal rate is the best indicator of overall customer satisfaction, according to tech executive and angel investor Dave Kellogg. Measuring how many customers want to continue doing business with you naturally filters out fluctuations due to customers changing their internal needs, product mix, or contract length.

Tracking individual customer satisfaction (sometimes referred to as customer health) lets you proactively reach out to customers with a higher risk of churning, giving you a better chance of saving those accounts and keeping your renewal rate high.

Accurately predict revenue

Measuring your revenue renewal rate can help you forecast how much revenue you can expect to produce during future weeks, months, and years. More accurate revenue projections mean more accurate sales and marketing budgets and less wasted spend.

The difference between retention and renewal

You’ll often hear the two terms used interchangeably, but customer retention and customer renewal are not one and the same. Yes, for shorter time periods, retention and renewal rates might come out identical, but for longer-term contracts, it’s important to understand the difference between the two terms, and that difference comes down to customer intent.

Customer retention

It’s best to think of retention as the customer not actively canceling when they had the chance. For example, most SaaS companies offer monthly plans—every customer could cancel at any given moment, but most don’t. Your retention rate, then, is a measure of how many customers continue their subscription—whether that decision was automatic, or they had to actively choose to continue the subscription.

Customer renewal

Renewal is a small part of retention. The renewal process is the actions you take to get customers to sign up for another term once their contract is up.

For B2C companies, this is usually as simple as keeping their credit card on file and sending a reminder email or two—but for longer contract lengths and higher-priced products, it might include a sales team member reaching out personally with new offers or discounts, a billing team processing the renewals, and operational staff updating internal systems.

How to calculate your renewal rate

All this might sound overwhelming, but calculating your renewal rate—whether for customers, revenue, or MRR—is a straightforward process.

The first step in calculating your renewal rate is to work out how long of a time period you’re looking at. Renewal rates can (and should) be measured across days, weeks, months, or even years, and each measurement is valuable in different ways. For example, measuring your renewal rate over the first month each customer is subscribed could indicate a problem with onboarding, while a low year-over-year renewal rate for annual accounts could mean the initial signup discount you offered was too high.

Let’s go over how to measure the three main types of renewal rates most SaaS companies deal with starting with customer renewal rates.

Customer renewal rate

The customer renewal rate is easy to calculate. Simply divide the number of customers who renew at the end of the specified time period by the total number of customers who were up for renewal, then multiply by 100 to convert that number to a percentage.

Let’s say you have 50 accounts up for renewal, and three of them decide to cancel—that means 47 customers would continue their subscriptions, giving you a robust customer renewal rate of 94%.

It’s also worth noting that customer renewal rate can’t ever go above 100%—after all, the most customers you’ll ever see renew subscriptions are all of them. Once you start looking at revenue renewal rate, though, that starts to change.

Revenue renewal rate

Measuring customer renewal rate is valuable, but not every customer is worth the same amount. Measuring renewal rate by revenue instead of by customer count can give you a more accurate measure of the financial health of your subscription company—in fact, revenue renewal rate is one of the best predictors of future cashflow, according to Dave Kellogg.

The calculation for revenue renewal rate is very similar to the customer renewal rate formula: divide the sum of renewed revenue during the specified time period by the total amount of revenue up for renewal, then convert to a percentage.

To illustrate the difference between customer renewal and revenue renewal, let’s look at the same example. Say you’re bringing in a total of $100,000 in revenue from your 50 customers each period—the same three customers decide not to renew, but they’re bringing in a combined revenue of $12,000. That makes your revenue renewal rate only 88%, significantly lower than the customer renewal rate of 94%.

Revenue renewal rate can (and should!) be higher than 100% for successful SaaS businesses. This happens due to negative churn stemming from expansion revenue and upselling. In fact, a revenue renewal rate greater than 100% is a very strong sign your SaaS company is healthy and sustainable for the long run.

MRR renewal rate

The final type of renewal rate we’ll look at is the MRR renewal rate. Think of this as your revenue renewal rate, normalized to a period of one month. Normalizing your retention over a single month ensures you’re tracking renewals consistently, even when customers might be on contracts of differing lengths.

You can calculate your gross MRR renewal rate by dividing the renewed MRR by the total renewable MRR each month and multiplying by 100 to get a percentage. Some businesses also choose to include expansion revenue in this calculation, giving the net MRR renewal rate.

Looking back at our example, let’s assume the MRR for all customers is $12,000, and our three customers who canceled were bringing in a combined $1,500 in MRR. That makes the gross MRR renewal rate 87.5%.

If you were to add a single new customer during the same month, bringing in $500 in net new MRR, the net MRR renewal rate would be brought back up to 91.6%.

5 tips to boost your renewal rate

I wish I could give you a silver bullet that will fix all your churn problems, but unfortunately, it just doesn’t exist. Poor renewal rates are the outcome of dozens of possible problems, ranging from poor pricing strategy to shoddy user experience.

I do tend to see a few common problems crop up again and again, though, most of which can be solved with just a little effort. Follow these best practices to keep customers coming back for more, and you’ll be well on your way to a healthy and profitable subscription business.

1. Maintain product stickiness

According to Lincoln Murphy, customers churn for one of two reasons:

- Something happened to or with the customer; or

- The customer did not achieve their desired outcome.

The second reason tends to be far more common. If your product does what the customer needs and helps them achieve their goals, they’re far more likely to stay, and stay longer. On the other hand, if your product is missing critical functionality the customer needs, they’ll leave in search of a competitor that provides what they need.

It sounds simple, but making sure your product is adequately “sticky”—meaning it includes key features that customers simply can't live without—is one of the best ways to improve renewals.

2. Focus on customer success

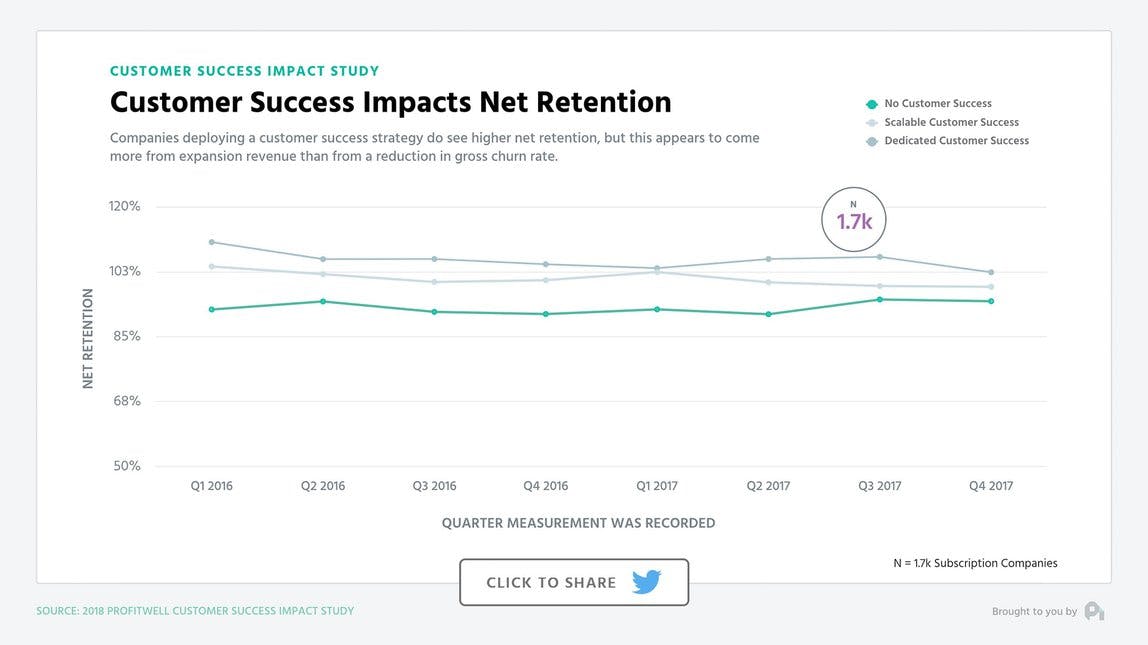

Spending time and energy improving the success of your customers is one of the best investments you can make in your SaaS company. Customer success elevates every part of your SaaS, helping to reduce churn, improve renewals, and increase expansion revenue. In fact, companies with some sort of customer success function see at least a 10% boost in net dollar retention compared to their non-customer success peers.

3. Understand your customers

Getting to know your customers is key to retaining them. And I mean really getting to know them—not just vague personas but a detailed understanding of their needs, their value drivers, and their willingness to pay.

Once you know what your customers actually need from your product, you’ll be able to set your pricing to provide maximum value and match your pricing structure to their specific needs. All of which makes your customers’ lives easy—and the decision to renew even easier.

4. Eliminate payment failures

Credit card failures are one of the largest single buckets of churn for SaaS companies. The vast majority of credit cards expire every 36 months, so roughly 2.8% of your customers' cards will expire every month. If all of those expirations went unaddressed, you could easily lose nearly 33% of your annual subscriptions every year from delinquent churn alone.

The good news? Most of this lost revenue can be recovered. Churn reduction software like ProfitWell Retain can automatically win back lost customers, increasing your recovery rate with very little effort. Most solutions only charge based on how much revenue you save, making it an affordable option even for early-stage companies.

5. Create a customer renewal playbook

Consistency is key when it comes to renewals. Everyone on your team needs to work together to ensure every single customer chooses to continue with your service—and that means you need a standardized process for generating renewals.

Your playbook should include:

- A standardized way to quickly reach out to a customer if there's an unexpected payment issue.

- A method of tracking which customers renew to avoid sending recovery messages to customers who have already renewed (we've seen it happen).

- A mechanism to reward team members who lock in renewals early. Retained customers are just as important as new customers—you can create an incentive to make sure your team views them that way.

Don't wait until it's too late to increase your renewal rate

Annihilating churn and getting more customers to renew needs to be an ongoing process—one that begins as soon as a new customer signs up for your service.

Your renewal rate shouldn’t be a problem you start thinking about once a customer’s contract is nearly up—you need to track renewals right from the start and take the time to eliminate the holes in your renewal process.