Revenue run rate is an important metric to track for any subscription business. Learn how to calculate and use the metric to shape your business strategy.

Also known as the annual run rate, the revenue run rate is a financial performance indicator that helps you predict the annual performance of your SaaS company over the coming year.

The run rate uses your current financial information, such as present sales and revenue, to forecast your company's performance. Although simple, the method extrapolates the company's current financial information and performance without accounting for factors such as revenue expansion and churn.

However, there are certain situations where the annual run rate is beneficial, as we will see. We're also going to look at how to calculate it for your SaaS company, the risks of making decisions based on forecasted data, and practical applications of this performance indicator.

What is revenue run rate?

Revenue run rate (also called annual run rate or sales run rate) is a method of projecting upcoming revenue over a longer time period (usually one year) based on previously earned revenue. For example, if your business reported $15,000 in sales in the last quarter, your annual run rate would be $60,000. Run rate assumes current sales will continue, using that information to create projections for future performance of the annualized recurring revenue of a company.

What run rate tells you and how to make use of it

The run rate uses current data to understand the implications of your company's future financial performance. You can use it to project your annualized revenue by dividing your quarterly or annual revenue by 4 or 12, respectively. The calculation uses your company's current revenue generation capabilities to understand its long-term value better.

Supercharging your growth? Watch our webinar on increasing run-rate in 2023

Of course, this simplistic method assumes nothing will change over the upcoming year. Churn, expansion revenue, upsells, and changes in growth rate are all conveniently excluded. This means run rate isn’t always accurate, but it is handy for predicting the future growth of your business and comparing the relative size of your business to other companies. For example, a SaaS founder might tell you they have a $5M business—they’re probably basing that on their expected annual revenue of $5M.

How to calculate run rate

Run rate is a fairly easy metric to calculate, once you have a few months of revenue data in hand.

To calculate run rate, take your current revenue over a certain time period—let’s say it’s one month. Multiply that by 12 (to get a year’s worth of revenue). If you made $15,000 in revenue for each month, your annual run rate would be $15,000 x 12, or $180,000.

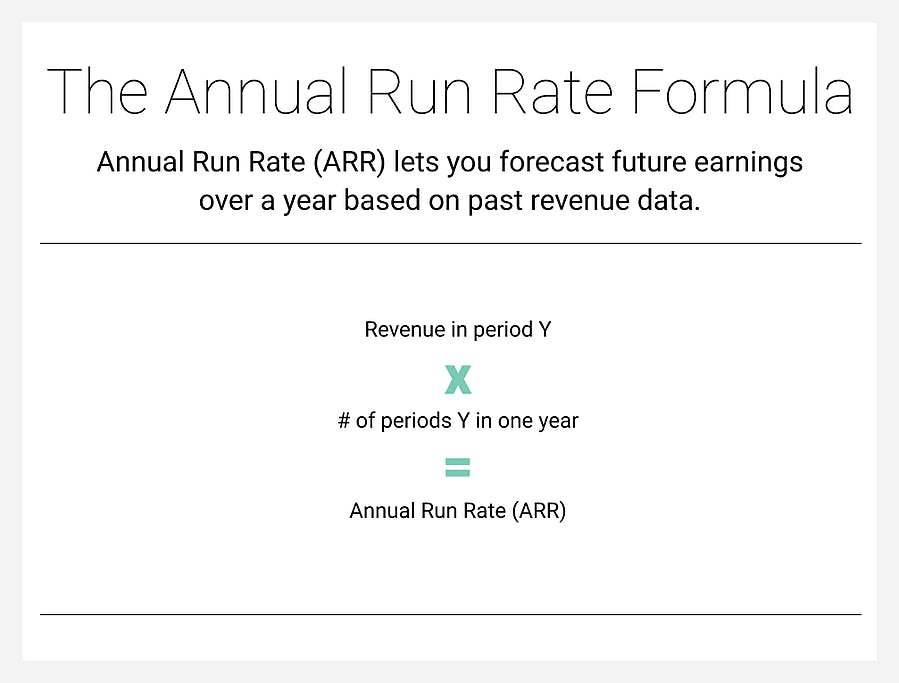

Here’s how the run rate formula looks:

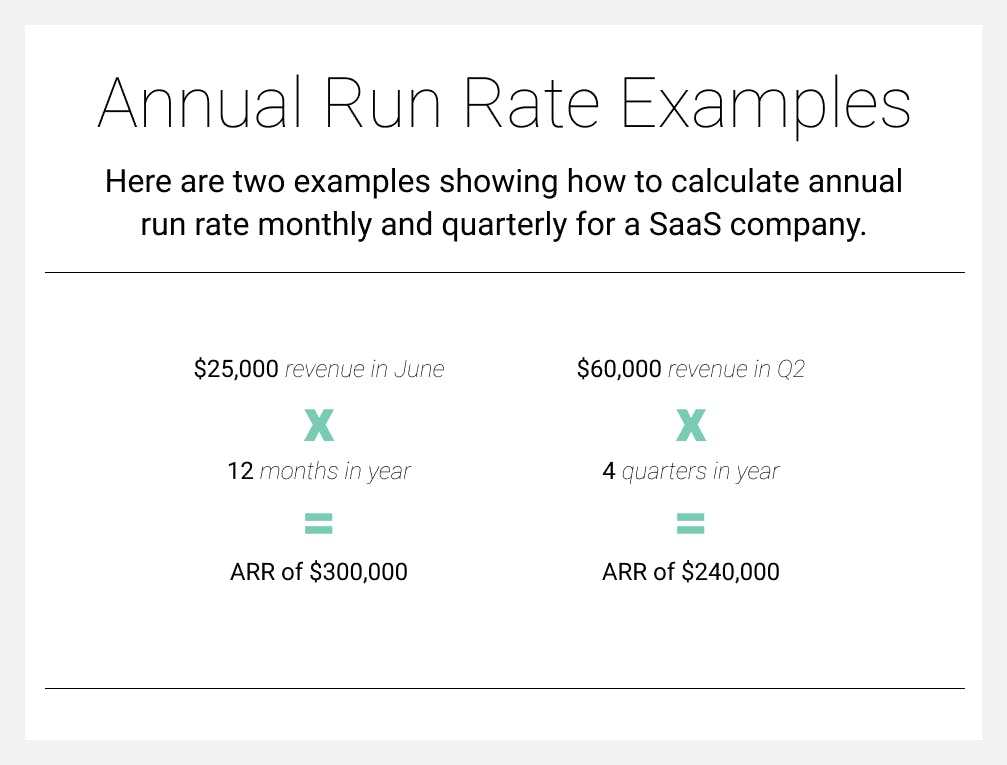

Example of revenue run rate

Meet Company A, a rapidly growing SaaS company. It’s July, and Company A posted revenues of $25,000 in the month of June. To get their annual run rate, Company A multiplies June’s monthly revenue by 12, giving a run rate of $300,000.

Company A could also use data from a longer time period to calculate their run rate. Say they made $15,000 in April and $20,000 in May—that’s a total of $60,000 for the quarter. Multiplying the quarterly revenue by four gives a run rate of only $240,000, significantly lower than what we worked out based on the monthly data.

The benefits of calculating run rate

You can use run-rate revenue to extrapolate your available data to predict future revenue performance. Financial forecasting is helpful for new companies, growing companies, and businesses with recurring revenue. Using it as your company's financial performance indicator offers the following benefits:

Estimated earnings

Run rate calculations are an easy and fast method for gauging your company's current and future financial health, assuming that sales continue along the same trajectory.

Estimate future growth

Having an idea of your company's annual revenue run rate helps you predict your future cash flow needs.

Project future savings

You can use the revenue run rate to predict how well you expect to do for the following year. For instance, you can determine how much you will save and whether you can afford to make capital improvements or purchase new manufacturing equipment.

Make smart budgeting decisions

Understanding your revenue run rate helps you allocate a budget where necessary. For instance, if your revenue run rate predictions fall short of the past years, you can find ways to minimize expenses and boost sales.

Manage inventory

Accurate run rate calculations can help you manage your inventory better by ensuring you don't overstock or run out of merchandise every other month.

Provides a benchmark for your company

You can use the revenue run rate benchmark to track your company's progress and compare it to SaaS averages.

Risks of using revenue run rate

Run rate isn’t always the most accurate metric. Like we saw in the previous example, if the month or quarter you use to estimate run rate is above or below normal, or if your revenue fluctuates over time, your results won’t reflect reality. Run rate also doesn’t account for churn, expansion, contraction, annual versus monthly contracts, or other factors affecting revenue.

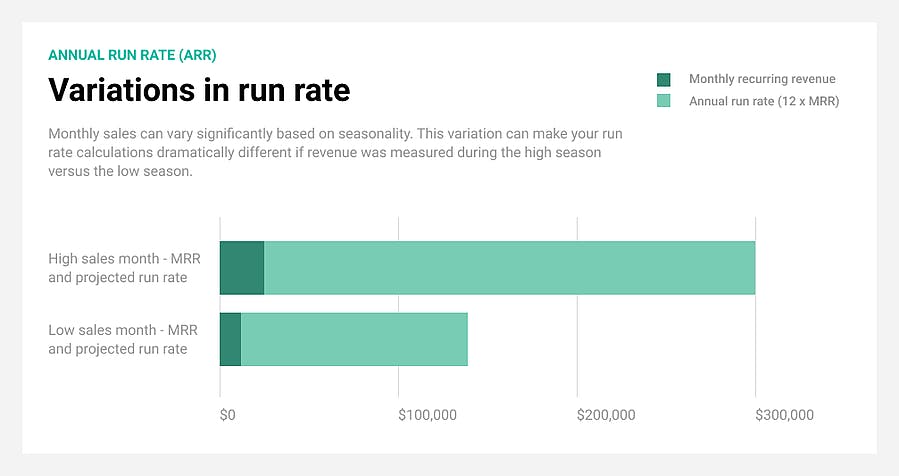

Seasonality

Monthly sales can vary significantly based on seasonality, so a single month’s sales will not always accurately reflect annual sales or profitability. This variation can make your run rate calculations dramatically different if revenue was measured during the high season versus the low season.

Remember Company A? Perhaps, in January, they brought in only $12,000 in sales revenue—this would make their run rate a mere $144,000, less than half of what they estimated based on the data from June. Neither calculation is more or less valid—but one is likely much more accurate than the other.

One-time sales and expiring contracts

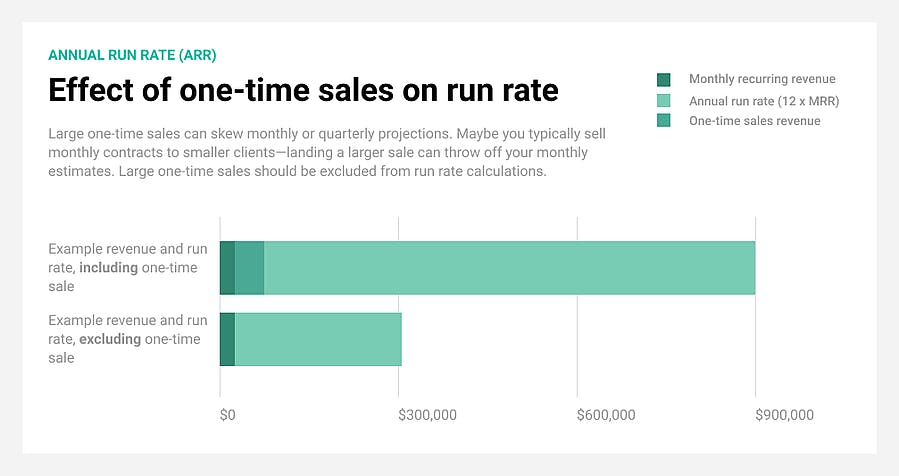

Large one-time sales can skew monthly or quarterly projections. Maybe you typically sell monthly contracts to smaller clients—landing a larger sale can throw off your monthly estimates.

Say Company A lands a single contract in July worth $50,000, in addition to $25,000 in forecasted sales. Based off of July’s revenue data, their run rate would be a whopping $900,000, which, assuming sales return to normal in August, is far too high.

Changes in company performance

The basic run rate calculation assumes company performance will remain the same throughout the forecasted period. Of course, things will no doubt change as the company grows—churn might increase or decrease, customers may be upsold or downgrade, or a new competitor might enter the market, stealing market share.

Let’s look at churn, since that more closely affects subscription businesses. Assume company A had a 5% churn rate as of June, and growth was expected to be flat over the following year. Reducing churn to 4% will increase the expected run rate over the next full year, while increasing churn to 6% will likewise lower the run rate.

Fluctuating demand

Unlike seasonal fluctuation in customer demand, good or bad sales months are hard to predict–although equally capable of skewing your run rate. Landing a huge customer should give you a cause for celebration but not set your expectations.

Cost reduction strategies

If your company applies a cost reduction strategy, possibly after an acquisition, it's likely to focus on the most accessible savings to achieve a significant expense reduction. Suppose it uses this information to create an expense reduction run rate. In that case, it's likely to get an unrealistic amount as it will base future reductions on more difficult areas to compete.

Changes in capacity

The run rate might not be sustainable if the base period you used to derive a run rate applied a very high level of capacity utilization. You require some downtime to maintain the overworked production equipment in such a case.

When is run rate useful for a business?

Despite the inherent problems, run rates do come in handy in certain situations. Here are three examples.

1. Starting a new company

Run rates can be a helpful indicator of financial performance for companies that have only been in business for a short period of time. Since run rate can be calculated based only a few weeks or months of data, executives, investors, and venture capitalists can obtain a somewhat accurate measurement of the company’s expected performance, even if the company has only been in business a short time. Especially if the financial environment around the company isn’t expected to change significantly, run rate can be a valuable metric for early-stage startups.

2.Restructuring a current company

Launching new products or services, restructuring existing ones, or embarking on cost-saving projects can all have a dramatic effect on the performance of a company. Run rates provide a steady benchmark metric that can be used to see whether or not the changes have improved the financial performance of the company. If your run rate is higher after making changes, great—if not, it might be time to go back to the drawing board.

3. General reporting

Run rate isn’t just useful for building your pitch deck. Many startups continue tracking and reporting on run rates regardless of the growth stage they’re in. Run rate is an easy metric to break down—for example, sales reps can quickly track their individual run rate, making it easy to set KPIs. Be careful not to set future budgets based on your run rate, however, since you could end up overspending if your estimates are inaccurate.

Measure run rates with caution using the right tools

Your run rate is a valuable metric for tracking the performance of your subscription company, particularly if you’ve only been in business for a short time. It’s a quick and easy way to get a benchmark on your revenue—but it’s also an easy metric to abuse and an easy metric to miscalculate, sometimes with harmful consequences.

Choosing the right forecasting tools is not a luxury but rather a necessity. ProfitWell Metrics can help you to accurately determine your company's run rate to cope with seasonality, fluctuating demand, cost reduction, strikes, and changes in capacity. In addition, it will help you get a better understanding of the general principles of forecasting.

Run rate FAQs

What is the annual run rate?

The annual run rate is used to roughly estimate a company's annual revenue based on existing monthly or quarterly data. You can use the annual run rate to predict the future of any business, calculate the annual burn rate, and prepare for future demand. Future prediction and annual burn rate calculations can help you determine the amount of inventory you need to hold or how many sales reps to hire for your SaaS company.

What is the difference between run rate vs. burn rate?

While run rate uses available data to estimate a company's annual revenue, burn rate measures negative cash flow. It achieves this by calculating how a new company spends its venture capital on financing overhead before generating profits from operations.

What is run rate EBITDA?

Run rate analysis is highly subjective and requires incorporating disclaimer whenever you produce run-rate calculations within your M&A reports. In some of your M&A reports, you may request the buyer to make a bid based on the EBITDA run rate instead of the adjusted EBITDA figure based on actual results. This happens when the adjusted EBITDA does not incorporate a full year of value for new customer contracts.