Subscription management that boosts customer satisfaction

From bundles to seat-based plans and add-ons, to letting your customers control their plans, Paddle helps you get more out of every customer

Top subscription companies choose Paddle for growth

Paddle automatically calculates prorated payments, so you always get paid the right amount.

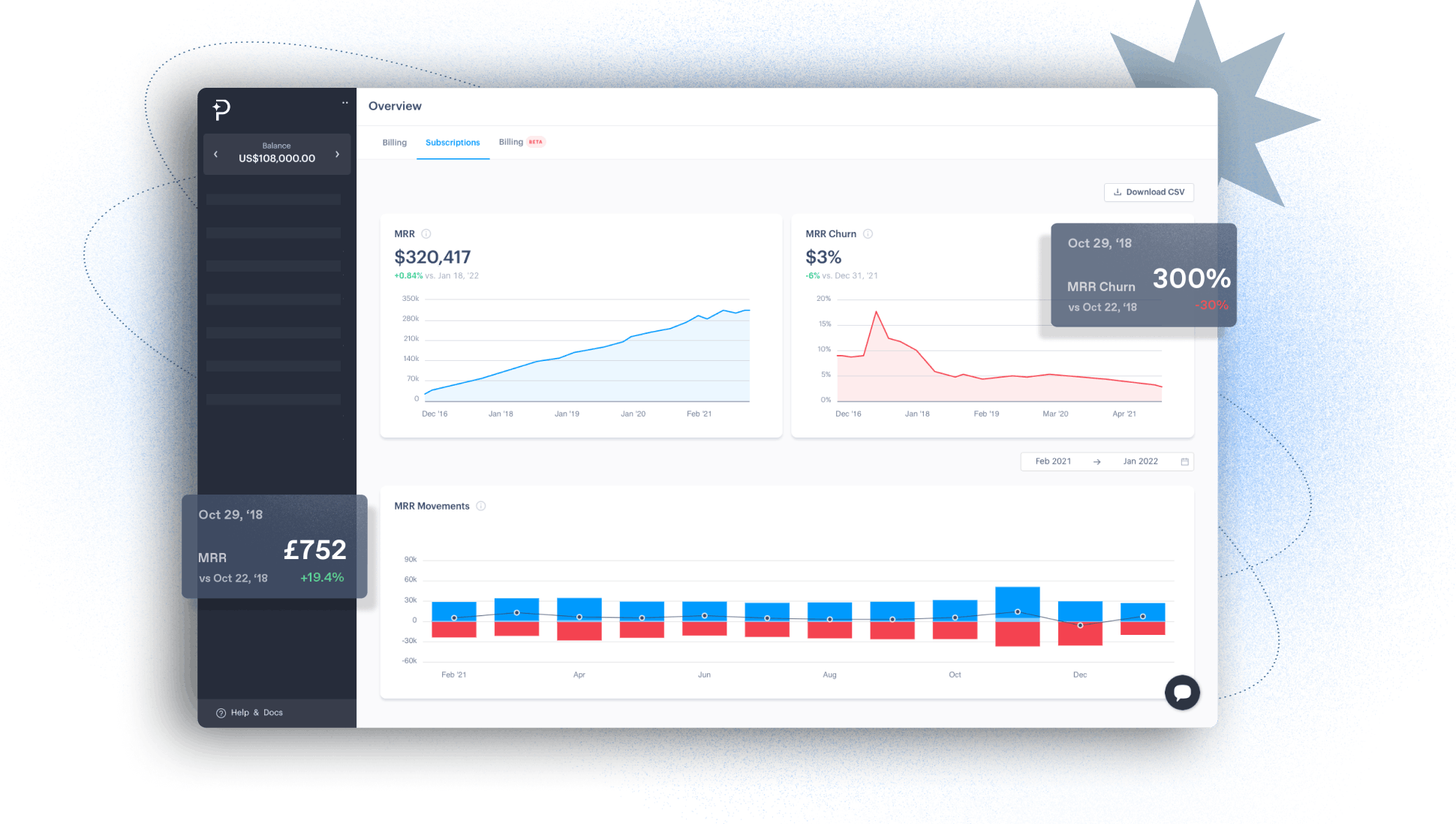

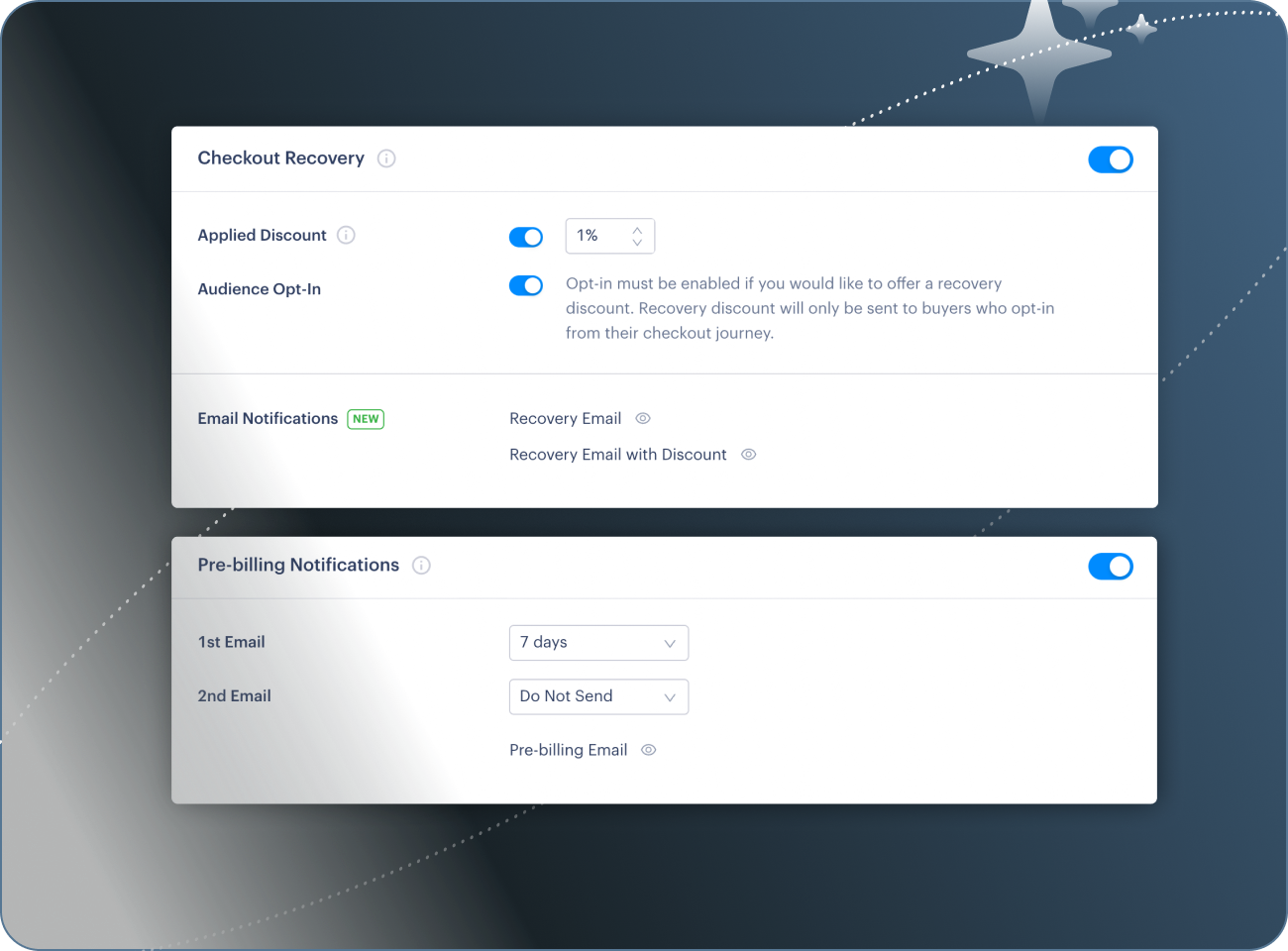

Instead of churning subscribers, pause their accounts and easily reactivate them on their return. Retention reporting tools help you stop churn in its tracks.

Compare your business against 40,000 SaaS subscription companies. Drill into customer segments, cohorts, and pricing plan data to find growth trends.

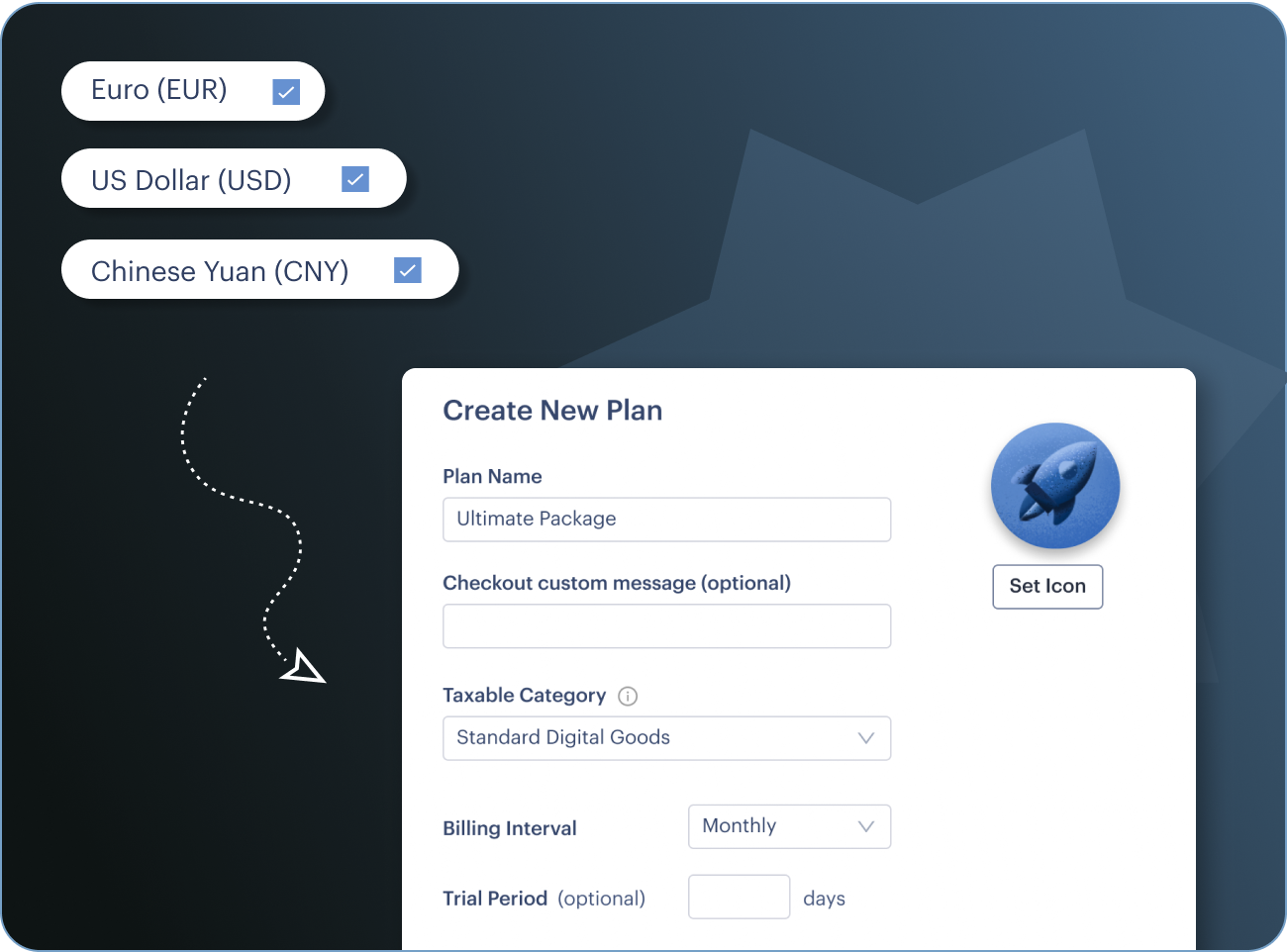

Gone are the days of three core subscription plans, your buyers expect more value from your products. Paddle provides flexible subscription software enabling you to sell multiple products in one plan, with multi-seat + add-ons, providing your buyers more choice.

Our customer portal allows your buyers to cancel or update payment methods, add or remove products, or change quantities with ease. No need to build your own.

Learn about customer portal

By partnering with Paddle, we've offloaded the intricacies of sales tax compliance, so we can focus on developing our product

We manage your payments, tax, subscriptions and more, so you can focus on growing