Customer acquisition is the weakest growth lever. How do we know this? We studied the levers—acquisition, retention, and monetization—of 512 SaaS companies. We found that monetization and retention have much higher revenue impacts than acquisition when considering the same level of impact across each growth lever.

When you break down the data, it makes sense. Retention capitalizes off of customers you already have. Therefore, you make money without having to spend money to acquire that customer base.

Here is a video that explains Net Dollar Retention and important benchmarks, originally created for Paddle Studios:

But, before we go off on a tangent, let’s break it down. First and foremost—what is customer retention?

What is customer retention?

Customer retention is the process and ability of a company to retain its customers over a given period. There are many actions companies can take to reduce churn and increase customer retention. Customer retention is important because it shows whether or not you are delivering value to your customers. By focusing on your retention rate, you can identify critical issues before they take a heavy toll on the health of your business. While you may have the best acquisition process in the business, if your retention is terrible then it’s all worthless.

Why retention is so important

When talking about the difference between customer acquisition and retention, we could say that customer acquisition gets all the love, but the nitty-gritty work of retention is an easier way to generate revenue, and more important for the long-term health of your business. While acquisition guarantees the initial sale, retention brings in additional recurring revenue from repeat customers for an extended period of time (depending on how happy the customer is with your product). Let’s go through some of the main reasons why retention is the foundation of your company’s growth and acquisition.

1. Improve ROI

The Harvard Business Review reports that research shows increasing customer retention rates by 5% increases profits by 25-95%. While that’s a wide range, it shows that even just a small percentage of improved customer retention can make a hugely positive impact on your company’s ROI. On the other side of the table, HBR also reports that it’s five to 25 times more expensive to acquire a new customer than it is to retain an existing one. You can save money and improve your ROI simply by focusing more on customer retention.

2. Convert more sales

It’s easier to sell more to existing customers because the truth is—they already love your product. They already have a rapport with your company and are more likely to spend more on additional features to enhance their already pleasurable experience. An improved customer retention rate results in more sales with a focus on upselling. Your company can offer existing customers additional features or upgrades as an attempt to make a more profitable sale.

3. Spend less on TOFU marketing

From email marketing to social media, a business' marketing team usually focuses on attracting new customers. But, when we add customer retention to the mix, the marketing strategy changes. When you focus on customer retention, you can spend less money on top of funnel marketing and focus more on building stronger customer relationships.

This is not to say you should forgo traditional marketing methods. Instead, supplement these methods with tactics that ensure customer expectations are met on the product level. The bonus? You'll unlock the power of word-of-mouth marketing from happy customer referrals that feed back into your acquisition strategy. All without making a single cold call.

4. Increase customer LTV

The better your retention strategy, the higher your customer lifetime value (LTV). For reference, LTV is the amount of money a customer is expected to spend on your products during their lifetime. If you have a solid retention strategy in place, then your customer LTV will skyrocket. The goal is to spend as little as possible on acquisition and gain more via LTV. This happens when you focus on retention.

5. Earn more referrals

Loyal long-term customers are more likely to refer their friends and acquaintances to your business. Voluntary referrals are the best free acquisition strategies out there. When a customer has been with your company for a while and enjoys the experience, they are more likely to recommend your products to someone else. This social proof does most of the "sales" work for your company. When retention becomes a priority, acquisition happens naturally.

The basic retention rate formula

Hopefully, by now you understand why customer retention is so important. But, you may be wondering, “How is my customer retention?” The good news, you can measure your company’s retention rate. Your customer retention rate is the percentage of customers who continue to use and resubscribe to your service over time. There are a few ways to measure customer retention; however, the simplest formula is to divide the number of active users by the total number of users at the beginning of a time period.

3 other types of retention metrics (and why they’re important)

Retention rate is fairly simple to calculate, but there are other forms of retention that can be just as critical and insightful. You can look at retention on an even smaller scale, which could illuminate specific areas of improvement, or where you are doing well. A good place to start is by looking at your monthly recurring revenue, or MRR.

MRR retention

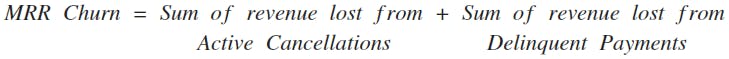

MRR measures the total amount of predictable revenue that a company expects on a monthly basis. MRR retention is the revenue maintained over time from recurring subscription payments. It’s the revenue your company makes on a recurring basis once you deduct MRR from active cancellations and delinquent payments. This number lets you know if your company can sustain profitability. The most practical way to examine MRR retention is to study the inverse—MRR churn.

From there, you can calculate MRR churn rate, which is done by dividing the MRR churn by the total MRR from the previous month.

MRR churn rate for March = MRR churn in March/end of the month MRR for February

Calculating user retention provides feedback on your company’s marketing, product, customer service, and pricing; however, MRR retention communicates the state of your company’s sustainability.

Retention at different stages of the customer lifecycle

The average retention rates across customer lifetime aren’t uniform. If you treat it as though it is, you won't be able to properly improve retention at all stages of customers' lifetimes.

The best way to approach retention is by breaking down customer behaviors based on what stage they are in: short-term, mid-term, and long-term. Depending on the stage a customer is in, they will churn for different reasons. That’s why it’s important to have a retention strategy in place for each stage. Retention and churn reduction is not one-size-fits-all.

One example would be improving user onboarding to combat short-term churn. By implementing a better onboarding experience, retention will improve with customers who churn right after the onboarding process. Mid-term churn can be knocked out by working to constantly improve the customer experience. What bugs/glitches does your product possibly have? Communicate constantly to ensure your customers are happy and want to remain with your product for the long-term. Be easily accessible in case they encounter problems.Finally, combat long-term churn by upgrading current customers. If they want more value, give them that value. Offer larger plans or exclusive options.

Retention for customers on different subscription plans

Just as cohorts of customers who sign up at different times will have different retention rates across the span of their cohort's lifetime, customers on different plans will typically show different rates of user retention.

Enterprise-tier customers—aka those customers on your highest and most expensive plans—most likely have a higher user retention rate. We did a study with 941 SaaS companies and found that customers with four-digit ARPU had almost 50% less churn than customers with one to two-digit ARPU. We also found that higher percentages of annual contracts correlate better with retention. Higher commitment levels and fewer opportunities to renew means more annual contracts leave less room for churn.

One of the reasons why retention is stronger for a high-level customer is because you are spending more resources on them. They are most likely well-acquainted with your customer support team and even further, they might be followers of some of the content you provide.

Understanding the retention rates of different levels of paying customers will reveal important feedback. If you find that customers on low-level plans are more likely to churn, then you need to find out why and either work to upgrade them or fix what’s wrong on your low-level tier.

8 customer retention strategies to improve customer satisfaction

If your retention isn’t so great, don’t panic. Operating a SaaS and subscription business can sometimes feel like a rollercoaster—but we have some retention strategies that can make the journey a little smoother. And it all begins with onboarding.

1. Create a cohesive and thoughtful onboarding plan

First impressions are everything. Onboarding is your customer’s first impression as a paying user with your product. It needs to be close to perfect. The onboarding process is where you build trust with the customer and help them achieve desired outcomes with your product and service. Onboarding shouldn’t feel like a boring, web presentation. It needs to be hands-on and someone from your company should be guiding them through the process.

Sometimes improving onboarding requires adding another tool to your tech stack. You might want to consider finding a platform that specializes in onboarding, or at least chatbots so you can communicate with new users easily.

2. Monitor leading indicators of churn

Identify and monitor metrics associated with future customer churn and take action to address them. Churn is a direct reflection of the value of the product and the features you’re offering to customers. Churn has a direct impact on financial metrics such as MRR, LTV, and CAC. You should constantly be calculating and monitoring your MRR, customer LTV, and CAC to determine the health of your company. If you find that MRR is declining over an extended period of time, then it’s time to figure out why customers are churning and determine a way to combat it before it happens. If your CAC is high but your LTV is low, then customers are churning early on and you need to figure out why that is. Once you identify why customers are churning at certain stages, then you can work to improve it, and retention will increase.

3. Get customer feedback

Your customers are the people who are spending money and time with your product—talk to them! Firsthand information on how customers are using your product, and their feelings about it are critical to improving customer experience in the future.

A net promoter score (NPS) is one metric many companies use to measure and index customer loyalty with your brand.

While oftentimes talking to customers is a qualitative process, NPS allows you to quantify it. You calculate NPS by asking the customer to rank one question on a scale of 1-10 (an excellent score being 10 and a poor NPS being one). An example: “How likely are you to recommend this company to a friend or a colleague?”

You can then segment scores.

- A score of 9 or 10 indicates this customer is a promoter. They feel high brand loyalty, enjoy your product, and would recommend it.

- A score of 7 or 8 indicates a passive customer who will probably recommend it but has some hesitations. Perform outreach to this group of respondents and determine what would ease their hesitations to bump them to a 9 or a 10.

- A score of 6 or below means the customer is a detractor. They are the most likely to churn.

When gathering customer feedback, it’s important to have qualitative and quantitative research. Once you have net promoter scores but then do nothing with the data, it’s not very helpful.

4. Have different lifecycle roadmaps for different customers

Different customers will have different desired outcomes with your product. Create several possible “paths” that customers can follow with your product.

5. Have a cohesive CRM system

Using a CRM system only to find leads and close deals is a myth. It can be a powerful tool for customer retention, too. Have sales, marketing, and customer success use a CRM system as a hub for data. When all the customer information is in one place, it’s much easier to stay updated on them.

You can also use past CRM communication as historical records. Read through previous conversations and see what the customer responded best with. What personalization worked? What didn’t? Keep a record of this for future communication. Because when you tailor the conversation based on who you’re talking to, the customer will feel like a human. Additionally, they’ll appreciate communicating with a human as well, and building that rapport is key for retention.

6. Follow up with inactive customers

Do some internal research and find the customers who haven’t logged in to their account in a while. Remind customers who haven’t used your product in a while that you’re there with personal messages. When you outreach, ask why they haven’t used the product for a certain period of time, and work to see if there’s anything you can do to make the experience better. You can use this as an opportunity to upsell with additional features or to a better plan.

7. Have a customer win-back plan

It’s still easier to win back a former customer than to acquire a new one. The first step is reaching out. Why were they unhappy with your product or why did they leave? It could be something as simple as a failed credit card payment. If that’s the case, reach out and prompt the customer to update their credit card information. If you find this is happening frequently, then you need to implement a stronger dunning process. The dunning process is asking customers for money they owe the company. A great dunning process is the best way to find out why a customer is not paying for your product anymore.

However, there’s also the instance where a customer purposefully left your product. Maybe the customer’s company had budget cuts and can no longer afford your product. If that’s the case, find a way to make the situation work. The best way to win back lost customers is communication, flexibility, and expressing that you want the customer to succeed using your service.

8. Create a customer loyalty program

Finally, reward your most loyal customers with deals and opportunities that will keep them coming back. Some customers have been with your company for a long time and have added tremendously to your ARR. Reward them. Offer them something exclusive that lower-tier or newbie customers won’t get.

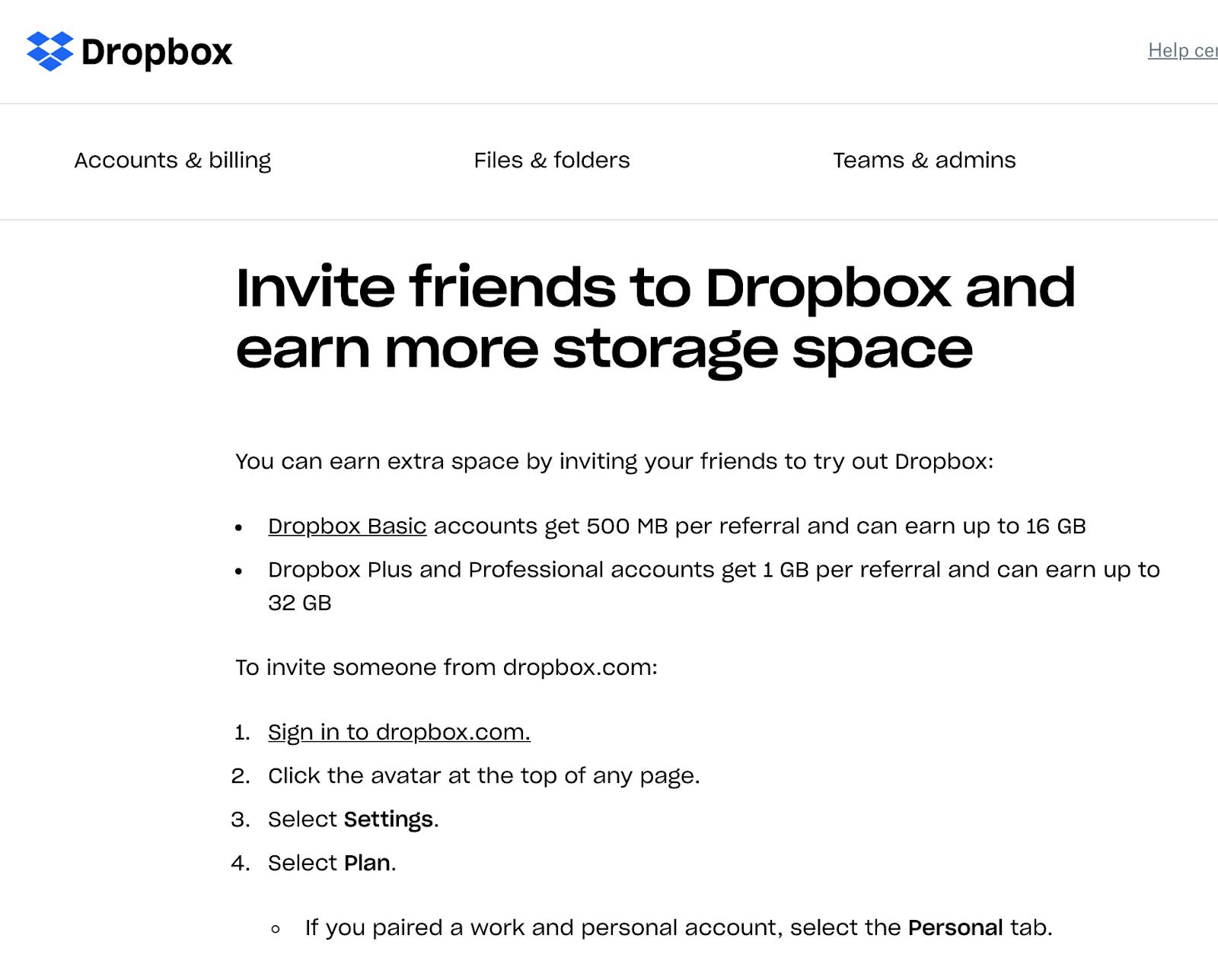

DropBox is taking advantage of customer loyalty and referrals with its program. It’s offering loyal customers the option to earn extra space by inviting friends. It’s a quid pro quo kind of deal. You do something for them, and the customer earns something in return.

Customer retention FAQ

What metrics should I use to track customer retention?

Generally speaking, customer retention rate (CRR) and churn rate are the two key metrics to report on consistently in order to track customer retention. You can use ProfitWell retention reporting for customer success to keep your eye on the key metrics.

How to retain more customers?

Excellent customer service and a reliable feedback loop between your customers and customer success team are key to retaining more customers. Ensuring that customer feedback is taken into consideration when maintaining your product and developing new features is key to long term retention.

What are the benefits of customer retention?

Customer retention is the best way to optimize your revenue machine. Good customer retention leads to more revenue in the long run from repeat purchases, is a lagging indicator that your product is meeting existing market demand, and can lead to better customer acquisition through word of mouth marketing.

What is an acceptable churn rate?

Generally speaking, an average churn rate is 5%, while a good churn rate is under 3% month over month. That said, churn varies by industry and taking industry benchmarks into account is key to understanding what an acceptable churn rate is for your business.

Paddle's subscription billing platform handles payments, tax, churn management and compliance for you, so you can focus on growing your business. Get started today.